Connect Managerial Accounting Chapter 17 Assignment

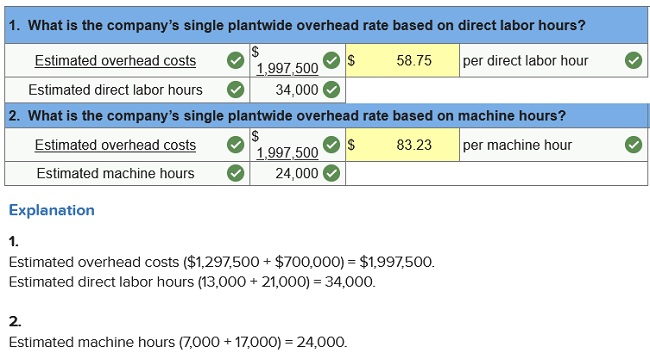

Q1. Rafner Manufacturing identified the following budgeted data in its two production departments

| Assembly | Finishing | |

| Manufacturing overhead costs | $1,297,500 | $700,000 |

| Direct labor hours | 13,000 DLH | 21,000 DLH |

| Machine hours | 7,000 MH | 17,000 MH |

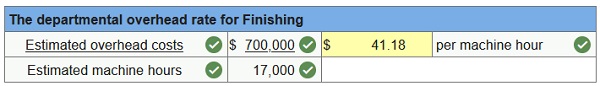

Q2. Rafner Manufacturing identified the following budgeted data in its two production departments.

| Assembly | Finishing | |

| Manufacturing overhead costs | $1,297,500 | $700,000 |

| Direct labor hours | 13,000 DLH | 21,000 DLH |

| Machine hours | 7,000 MH | 17,000 MH |

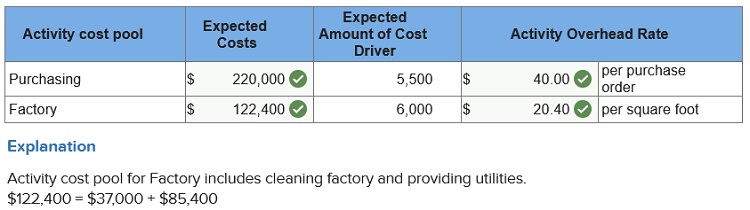

Q3. A manufacturer uses activity-based costing to assign overhead costs to products. Budgeted cost information for selected activities for next year follows.

| Activity | Expected Cost | Cost Driver | Expected Usage of Cost Driver | |

| Purchasing | $220,000 | Purchase orders | 5,500 | purchase orders |

| Cleaning factory | 37,000 | Square feet | 6,000 | square feet |

| Providing utilities | 85,400 | Square feet | 6,000 | square feet |

Compute activity rates for each of the cost pools. (Round your answers to 2 decimal places.)

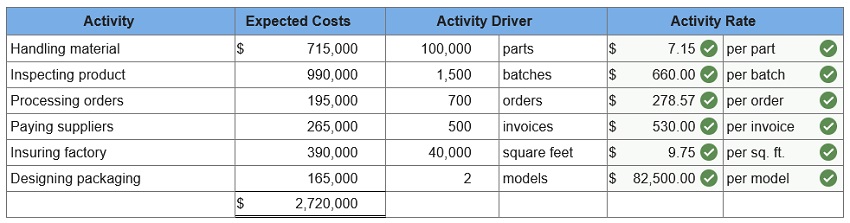

Q4. Xie Company identified the following activities, costs, and activity drivers for this year. The company manufactures two types of go-karts: Deluxe and Basic.

| Activity | Expected Costs | Expected Activity | ||||

| Handling materials | $715,000 | 100,000 | parts | |||

| Inspecting product | 990,000 | 1,500 | batches | |||

| Processing purchase orders | 195,000 | 700 | orders | |||

| Paying suppliers | 265,000 | 500 | invoices | |||

| Insuring the factory | 390,000 | 40,000 | square feet | |||

| Designing packaging | 165,000 | 2 | models | |||

Compute the activity rate for each activity, assuming the company uses activity-based costing. (Round activity rate answers to 2 decimal places.)

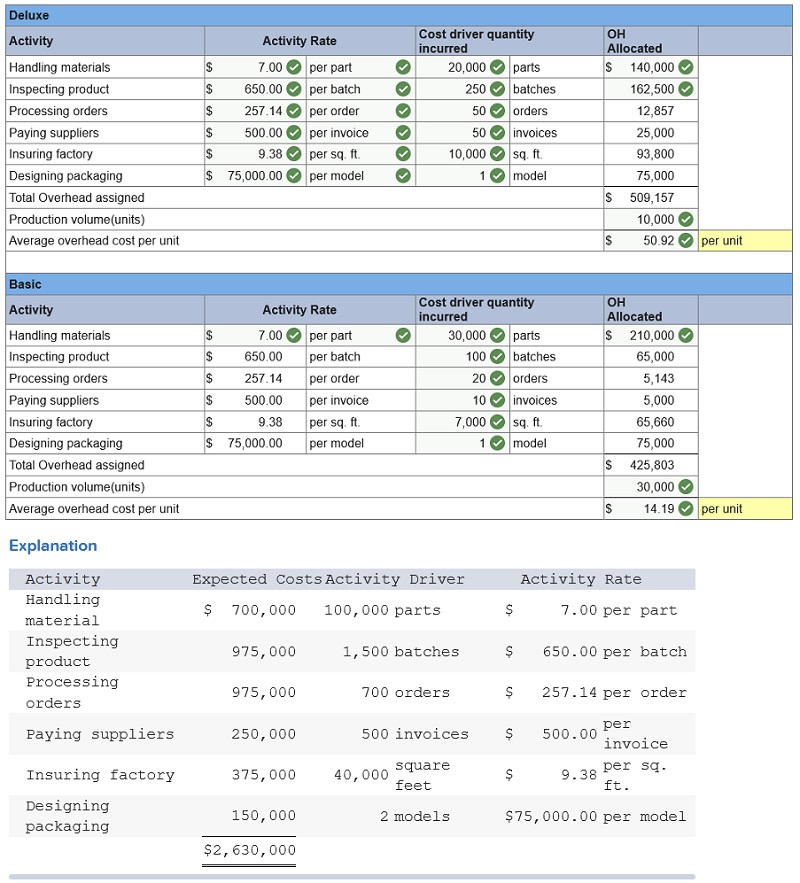

Q5. Xie Company identified the following activities, costs, and activity drivers for this year. The company manufactures two types of go-karts: Deluxe and Basic.

| Activity | Expected Costs | Expected Activity |

| Handling materials | $700,000 | 100,000 parts |

| Inspecting product | 975,000 | 1,500 batches |

| Processing purchase orders | 180,000 | 700 orders |

| Paying suppliers | 250,000 | 500 invoices |

| Insuring the factory | 375,000 | 40,000 square feet |

| Designing packaging | 150,000 | 2 models |

Assume that the following information is available for the company’s two products for the first quarter of this year.

| Deluxe Model | Basic Model | |||

| Production volume | 10,000 | units | 30,000 | units |

| Parts required | 20,000 | parts | 30,000 | parts |

| Batches made | 250 | batches | 100 | batches |

| Purchase orders | 50 | orders | 20 | orders |

| Invoices | 50 | invoices | 10 | invoices |

| Space occupied | 10,000 | sq. ft. | 7,000 | sq. ft |

| Models | 1 | model | 1 | model |

Compute activity rates for each activity and assign overhead costs to each product model using activity-based costing (ABC). What is the overhead cost per unit of each model? (Round activity rate and average OH cost per unit answers to 2 decimal places.)

Q6. Way Cool produces two different models of air conditioners. The company produces the mechanical systems in its components department. The mechanical systems are combined with the housing assembly in its finishing department. The activities, costs, and drivers associated with these two manufacturing processes and the production support process follow. (Loss amounts should be indicated with a minus sign. Round your intermediate calculations and round “Cost per unit and OH rate” answers to 2 decimal places.)

| Process | Activity | Overhead Cost | Driver | Quantity | ||||

| Components | Changeover | $ | 500,000 | Number of batches | 800 | |||

| Machining | 279,000 | Machine hours | 6,000 | |||||

| Setups | 225,000 | Number of setups | 120 | |||||

| $ | 1,004,000 | |||||||

| Finishing | Welding | $ | 180,300 | Welding hours | 3,000 | |||

| Inspecting | 210,000 | Number of inspections | 700 | |||||

| Rework | 75,000 | Rework orders | 300 | |||||

| $ | 465,300 | |||||||

| Support | Purchasing | $ | 135,000 | Purchase orders | 450 | |||

| Providing space | 32,000 | Number of units | 5,000 | |||||

| Providing utilities | 65,000 | Number of units | 5,000 | |||||

| $ | 232,000 | |||||||

Additional production information concerning its two product lines follows.

| Model 145 | Model 212 | |||||

| Units produced | 1,500 | 3,500 | ||||

| Welding hours | 800 | 2,200 | ||||

| Batches | 400 | 400 | ||||

| Number of inspections | 400 | 300 | ||||

| Machine hours | 1,800 | 4,200 | ||||

| Setups | 60 | 60 | ||||

| Rework orders | 160 | 140 | ||||

| Purchase orders | 300 | 150 | ||||

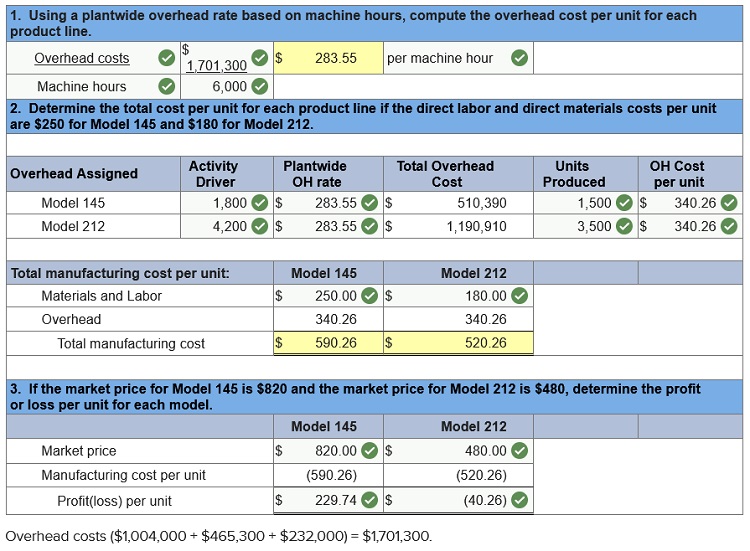

Q7. Way Cool produces two different models of air conditioners. The company produces the mechanical systems in its components department. The mechanical systems are combined with the housing assembly in its finishing department. The activities, costs, and drivers associated with these two manufacturing processes and the production support process follow.

| Process | Activity | Overhead Cost | Driver | Quantity | ||||

| Components | Changeover | $ | 500,000 | Number of batches | 800 | |||

| Machining | 279,000 | Machine hours | 6,000 | |||||

| Setups | 225,000 | Number of setups | 120 | |||||

| $ | 1,004,000 | |||||||

| Finishing | Welding | $ | 180,300 | Welding hours | 3,000 | |||

| Inspecting | 210,000 | Number of inspections | 700 | |||||

| Rework | 75,000 | Rework orders | 300 | |||||

| $ | 465,300 | |||||||

| Support | Purchasing | $ | 135,000 | Purchase orders | 450 | |||

| Providing space | 32,000 | Number of units | 5,000 | |||||

| Providing utilities | 65,000 | Number of units | 5,000 | |||||

| $ | 232,000 | |||||||

Additional production information concerning its two product lines follows.

| Model 145 | Model 212 | |||||

| Units produced | 1,500 | 3,500 | ||||

| Welding hours | 800 | 2,200 | ||||

| Batches | 400 | 400 | ||||

| Number of inspections | 400 | 300 | ||||

| Machine hours | 1,800 | 4,200 | ||||

| Setups | 60 | 60 | ||||

| Rework orders | 160 | 140 | ||||

| Purchase orders | 300 | 150 | ||||

Determine departmental overhead rates and compute the overhead cost per unit for each product line. Base your overhead assignment for the components department on machine hours. Use welding hours to assign overhead costs to the finishing department. Assign costs to the support department based on number of purchase orders.

Determine the total cost per unit for each product line if the direct labor and direct materials costs per unit are $250 for Model 145 and $180 for Model 212.

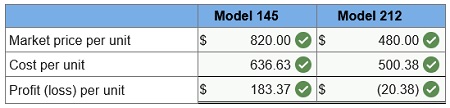

If the market price for Model 145 is $820 and the market price for Model 212 is $480, determine the profit or loss per unit for each model.

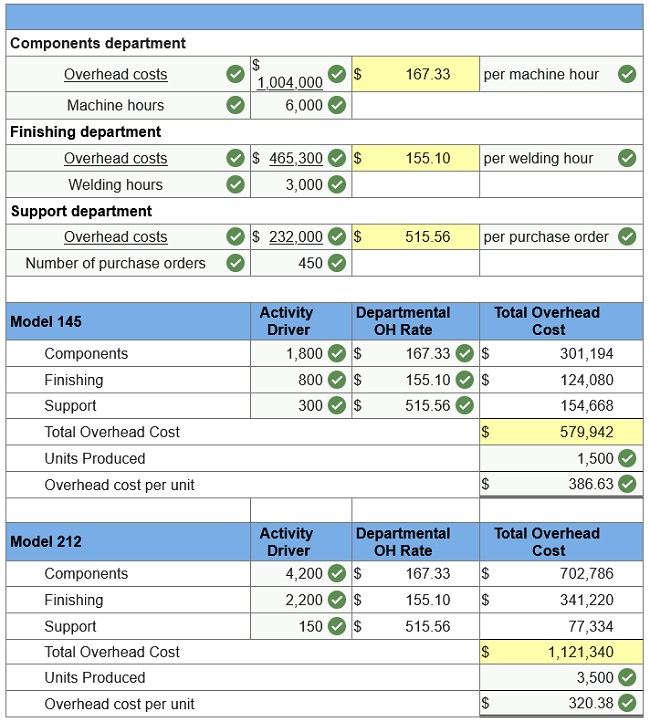

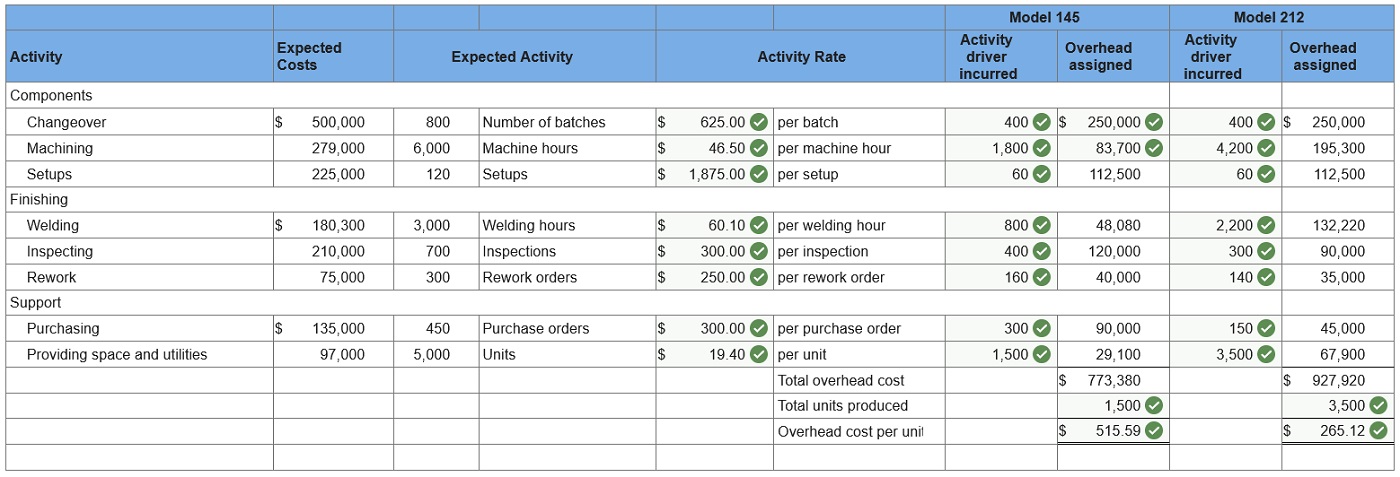

Q8. Way Cool produces two different models of air conditioners. The company produces the mechanical systems in its components department. The mechanical systems are combined with the housing assembly in its finishing department. The activities, costs, and drivers associated with these two manufacturing processes and the production support process follow.

| Process | Activity | Overhead Cost | Driver | Quantity | ||||

| Components | Changeover | $ | 500,000 | Number of batches | 800 | |||

| Machining | 279,000 | Machine hours | 6,000 | |||||

| Setups | 225,000 | Number of setups | 120 | |||||

| $ | 1,004,000 | |||||||

| Finishing | Welding | $ | 180,300 | Welding hours | 3,000 | |||

| Inspecting | 210,000 | Number of inspections | 700 | |||||

| Rework | 75,000 | Rework orders | 300 | |||||

| $ | 465,300 | |||||||

| Support | Purchasing | $ | 135,000 | Purchase orders | 450 | |||

| Providing space | 32,000 | Number of units | 5,000 | |||||

| Providing utilities | 65,000 | Number of units | 5,000 | |||||

| $ | 232,000 | |||||||

Additional production information concerning its two product lines follows.

| Model 145 | Model 212 | |||||

| Units produced | 1,500 | 3,500 | ||||

| Welding hours | 800 | 2,200 | ||||

| Batches | 400 | 400 | ||||

| Number of inspections | 400 | 300 | ||||

| Machine hours | 1,800 | 4,200 | ||||

| Setups | 60 | 60 | ||||

| Rework orders | 160 | 140 | ||||

| Purchase orders | 300 | 150 | ||||

|

|

||||||

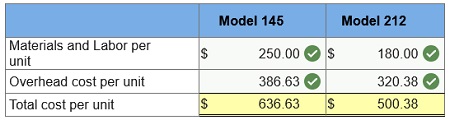

Using ABC, compute the overhead cost per unit for each product line.

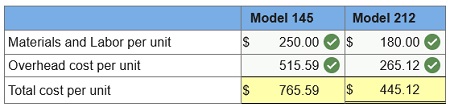

Determine the total cost per unit for each product line if the direct labor and direct materials costs per unit are $250 for Model 145 and $180 for Model 212.

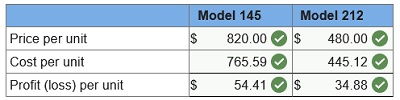

If the market price for Model 145 is $820 and the market price for Model 212 is $480, determine the profit or loss per unit for each model.

To get high quality and accurate accounting assignment help or accounting coursework help. Connect with us via whatsapp at +44 7448-027841

Author: Ask Assignment Help

Connect with Ask Assignment Help for urgent assignment help, online exam help, dissertation writing service & online coursework help for all subjects. Order now to get 25% off on all assignments now.