Home » Online Coursework Help » Online Exam Help » Harvard Finance Introductory Section Final Exam 1

Harvard Finance Introductory Section Final Exam 1

Q1. A firm is considering investing in a project that requires an investment of $40 today. The expected cash flow is $0 for the first year and $50 for the second year. The appropriate discount rate for this project is 9%. What is the Net Present Value (NPV) for this project?

- $2.08

- $42.08

- $50.00

- $100

Q2. When rearranging financial statements, which of the following items is included in financial activities?

- Marketing expense

- Research and development expense

- Interest expense

- Sales revenue

Q3. Assume that a company has a beta of 0.90. The market value of equity is $5,000 and the market value of the company (as determined by its stock price) is $6,000. What is the company’s unlevered beta?

- 0.75

- 0.90

- 1.00

- 1.08

Q4. Assume that a firm has the following data for the year ended 12/31/2019:

Sales: $300

Depreciation expense: $20

Interest expense: $40

Tax expense: $40

Net worth: $150

In addition, the company’s net worth in 2018 was $150.

Assume that in 2020, sales, cost of goods sold, and S, G, & A expenses remain the same, depreciation expense increases, interest expense increases, and tax expense decreases.

Which of the following statements is true?

I. Gross margin will decrease.

II. Operating margin will decrease.

III. Net income will increase.

IV. Return on beginning equity will increase.

- I only

- I and II only

- I, II and III only

- I, II, III and IV only

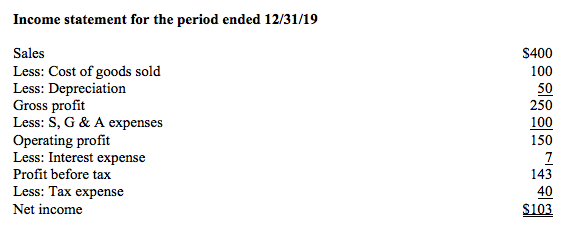

Q5. Presented below is the 2019 income statement for Billie’s Baubles.

Which of the following statements are true?

I. Net margin is less than operating margin.

II. Operating margin is less than gross margin.

III. Gross margin is less than net margin.

- I only

- II only

- I and II but not III

- I, II and III

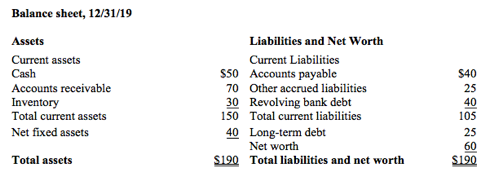

Q6. Presented below is the 2019 balance sheet for Billie’s Baubles.

What was Billie’s Baubles’ current ratio in 2019?

- 0.55

- 1.14

- 1.43

- 2.31

Q7. Assume that a firm has the following data for the year ended 12/31/2019:

Sales: $500

Depreciation expense: $30

Interest expense: $50

Tax expense: $30

Net worth: $100

In addition, the company’s net worth in 2018 was $100.

Assume that in 2020, sales, cost of goods sold, and S, G, & A expenses remain the same, depreciation expense decreases, interest expense decreases, and tax expense decreases.

Which of the following statements are true for the firm in 2020?

I. Gross margin will decrease.

II. Operating margin will increase.

III. Net income will decrease.

IV. Return on beginning equity will increase.

- I only

- I and II only

- II and IV only

- III and IV only

Q8. Choose the option(s) to correctly complete the following sentence.

From the perspective of a potential investor in a firm, investing in the firm’s debt is considered to be less risky than investing in the firm’s equity because:

I. principal and interest payments are debt and are contractually obligated.

II. debtholders are paid back before equity holders in case of bankruptcy.

III. a firm that includes debt in its capital structure has lower fixed costs than an all-equity firm

- I only

- I and II only

- I and III only

- I, II and III

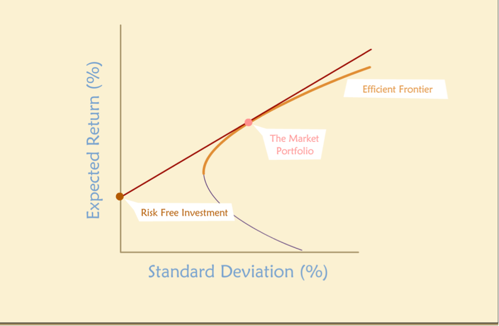

Q9. Choose the option to correctly complete the following sentence.

In the following plot, the line drawn tangent to the efficient frontier is called the:

- Capital allocation line

- Capital market line

- Security characteristic line.

- Security market line.

Q10. It is possible for a firm to be profitable from an accounting perspective even if it has difficulty meeting its financial obligations. True / False

Q11. Choose the option to correctly complete the following sentence.

Consider two projects, A and B. Project B is riskier than Project A. Therefore, project B should have a ________ price, a ________ expected return, and a _________ risk premium than project A.

- higher; higher; higher

- higher; higher; lower

- lower; higher; higher

- lower; lower; higher

Q12. To maintain a certain degree of family control over voting shares, a family-controlled business may avoid issuing equity even if it would otherwise make sense to do so. True / False

Q13. According to the Pecking Order theory of capital structure, which of the following orders is preferred by a firm in accessing its funding sources?

- Debt, equity, internal funds

- Equity, debt, internal funds

- Internal funds, debt, equity

- Internal funds, equity, debt

Q14. Choose the option to correctly complete the following sentence.

In the real world (that is, if we relax the assumptions of Modigliani and Miller’s Proposition I), optimal capital structure is:

- 0% debt/100% equity.

- 50% debt/50% equity.

- 100% debt/0% equity.

- dependent on firm and general economic conditions

Q15. A firm is considering a project to begin producing a new product. Which of the following items represent potential incremental costs of the project?

I. Sales of the new product

II. Raw materials needed as input for the product

III. Commissions to the sales team to sell the new product

- I only

- I and II only

- II and III only

- I, II and III

Q16. It is possible for the Payback Period criterion to accept a project while the Net Present Value (NPV) criterion rejects the same project. True / False

Q17. Company A’s only current asset is accounts receivable and its only current liability is accounts payable.

Company A has common size accounts receivable of 25% and common size accounts payable of 40%.

Choose the option to correctly complete the following sentence.

Company A’s current ratio ____________.

- is less than 1.

- is equal to 1.

- is greater than 1

- cannot be determined from the information given

Q18. You wish to have $5,000 at the end of 15 years. How much do you need to invest today, if you can earn 12%, compounded annually, on your investment?

- $333.33

- $913.48

- $4,464.29

- $26,751.25

Q19. Which of the following decision criteria is (are) true for Net Present Value (NPV)?

I . Accept projects for which NPV > 0.

II. Projects for which NPV < 0 are marginal.

III. Reject projects for which NPV = 0.

- I only

- II only

- II and III only

- I, II and III

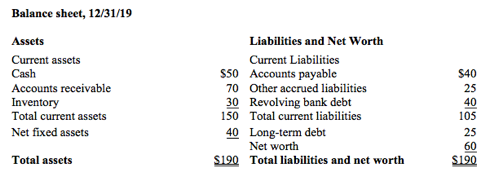

Q20. Presented below is the 2019 balance sheet for Billie’s Baubles.

Choose the option that correctly completes the following sentence.

For Billie’s Baubles, common size accounts receivable is equal to _____________ and common size revolving credit is equal to __________.

- 21.0%; 36.8%

- 21.0%; 34.2%

- 34.2%; 21.0%

- 36.8%; 21.0%

Q21. If a firm defaults on its debt, it is required to file bankruptcy. True / False

Q22. Which options correctly complete the following sentence?

A firm can improve its cash conversion cycle by:

I. increasing its collection period.

II. increasing its payables period.

III. increasing days in inventory.

- I only

- II only

- I and III only

- I, II and III

Q23. In general, a decrease in an asset is considered a use of funds. True / False

Q24. Choose the option to correctly complete the following sentence.

In most countries:

- corporate interest expenses are not tax-deductible while corporate dividend payments are tax-deductible

- corporate interest expenses are tax-deductible while corporate dividend payments are not tax-deductible

- both corporate interest expenses and corporate dividend payments are tax deductible

- neither corporate interest expenses nor corporate dividend payments are tax deductible.

Q25. According to the course materials, which of the following is the single largest contributor to the probability that a firm will end up in financial distress?

- Broad economic conditions

- The firm’s industry

- The amount of leverage in the firm’s capital structure

- The competence of the firm’s management

Q26. Choose the option to correctly complete the following sentence.

A company that issues debt as part of its capital structure is agreeing to _____________ money and ___________ interest on the debt.

- borrow; pay

- borrow; receive

- lend; receive

- lend; pay

Q27. Which options correctly complete the following sentence?

A firm’s retention rate:

I. is the fraction of earnings that is retained by the company.

II. is sometimes referred to as the plowback ratio.

III. is equal to 1 minus the payout ratio.

- I only

- II only

- I and II only

- I, II and III

Q28. Imagine a situation in which a firm owes its creditors $50,000 but the firm’s assets are only worth $40,000. Equity holders have an incentive to take on very risky projects because if they do nothing, they are certain to be wiped out, while debt holders have incentive to avoid risky projects. Which of the following theories is appropriate to represent this situation?

- The static tradeoff theory

- An agency cost

- A product market model

- The asymmetric information of debt holders and equity holders

To get all correct answers, please click on Pay Now to make a payment of $30. We accept payments via PayPal only. In description, please write the exam name – Harvard Finance Introductory Section Final Exam 1. We will email the answers at your email id within 30 minutes.