Home » Online Exam Help » Accounting Assignment Help » HBSP Harvard Financial Accounting Final Exam 1

HBSP Harvard Financial Accounting Final Exam 1

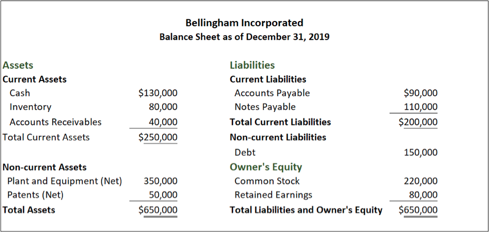

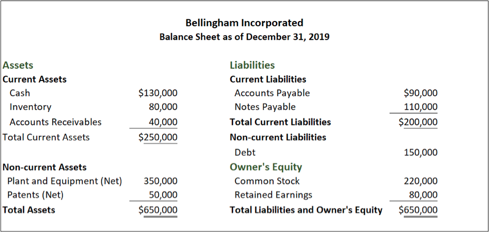

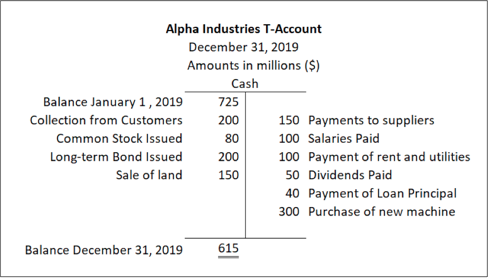

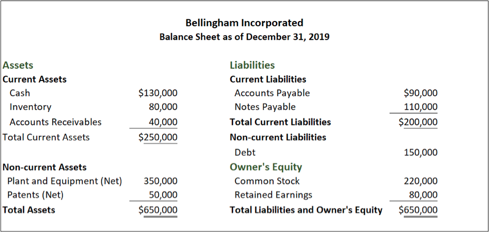

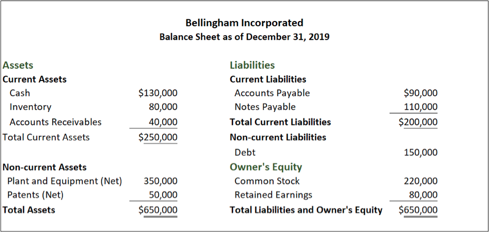

Q1. Refer to Bellingham Incorporated’s December 31, 2019 Balance Sheet shown below.

What is Bellingham’s current ratio on December 31, 2019?

- 0.60

- 0.85

- 1.25

- 2.27

Q2. Choose the option to correctly complete the sentence. Amy Auto Parts has inventory that has been recorded on their balance sheet at $156,000. The fact that Amy’s inventory is not reflected at a value that would be realized if it were required to be sold immediately to pay bills is referred as the ___________.

- materiality concept

- liquidity concept

- going concern concept

- consistency concept

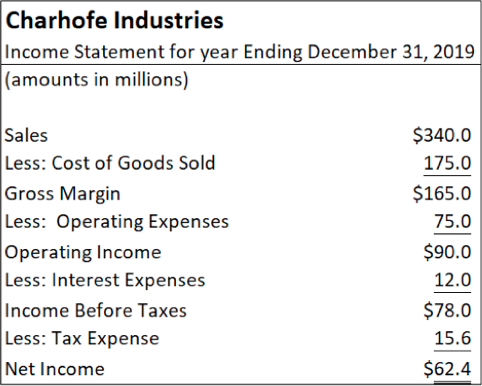

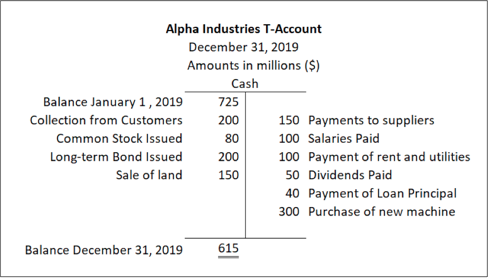

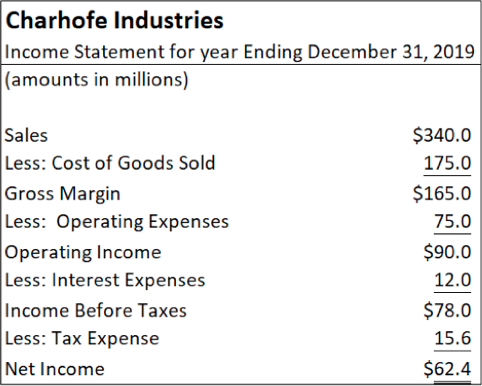

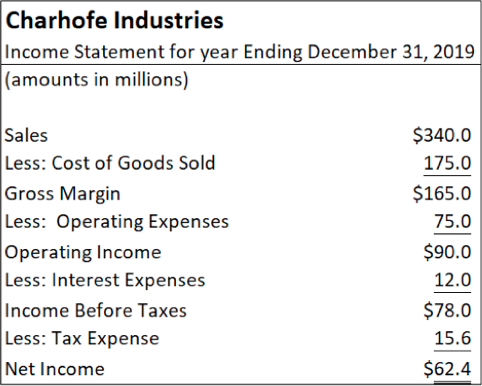

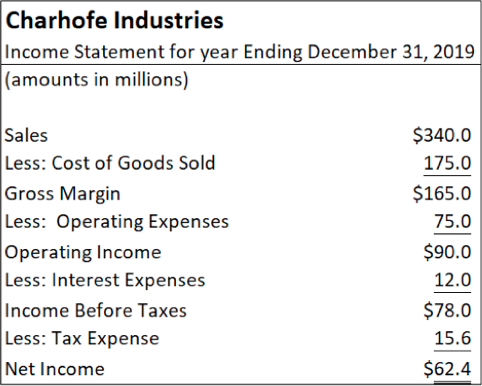

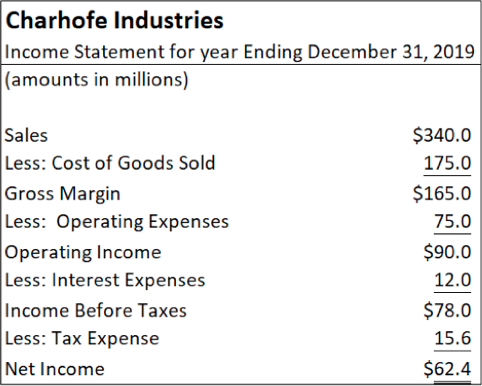

Q3. The next question refers to Charhofe’s December 31, 2019 Income Statement.

What is the 2019 gross margin percentage for Charhofe Industries?

- 18.4%

- 22.1%

- 48.5%

- 51.5%

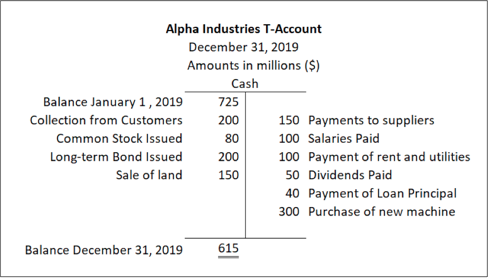

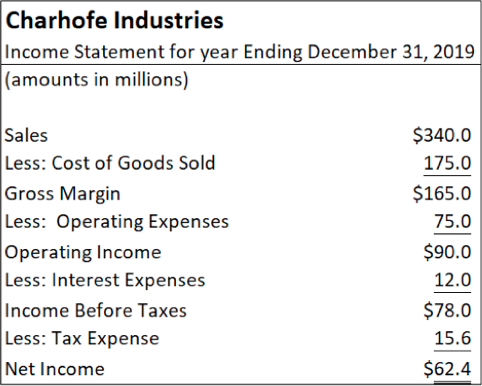

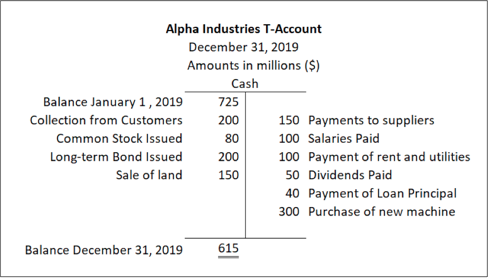

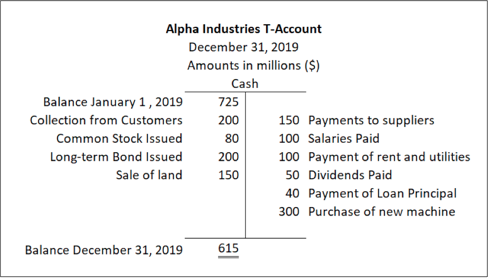

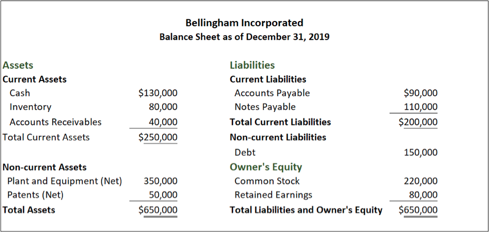

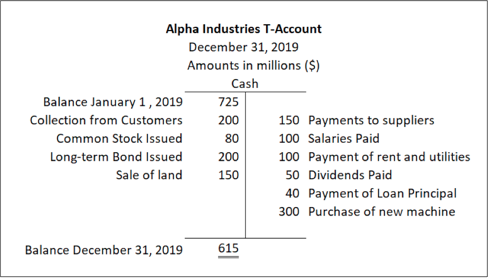

Q4. Refer to Alpha’s cash T-Account for 2019 shown below

Alpha ended 2019 with a balance of $20 million in their salaries payable account. If their salary expense in 2019 was $90 million, what was their ending balance for salaries payable on December 31, 2018?

- $10 million

- $20 million

- $30 million

- $110 million

Q5. Choose the option to correctly complete the following sentence. Schmidt Industries received cash from a customer for a product to be delivered next month. According to the realization concept this revenue has been

- earned but not realized

- realized but not earned

- earned and realized

- neither earned nor realized

Q6. Refer to Bellingham Incorporated’s December 31, 2019 Balance Sheet shown below.

Bellingham began 2019 with the following non-current asset balances: Plant and Equipment (net) $360,000; Patents (net) $55,000. No long-term assets were purchased or sold during the year. What is the depreciation and amortization expense for 2019?

- $5,000

- $10,000

- $15,000

- $20,000

Q7. On December 31, 2018, William Jackson Industries has current assets of $100,000, non-current assets of $400,000 and total liabilities of $200,000. What is the amount of owner’s equity as of December 31, 2018?

- $100,000

- $200,000

- $300,000

- $400,000

Q8, Refer to Alpha’s cash T-Account for 2019 shown below

For 2019, what was Alpha’s cash flow from investing?

- A net inflow of $80 million

- A net outflow of $80 million

- A net inflow of $150 million

- A net outflow of $150 million

Q9. A snapshot at a point in time of an entity’s assets, liabilities and owner’s equity is referred to as what?

- statement of net worth

- statement of solvency

- balance sheet

- income statement

Q10. Refer to Charhofe’s December 31, 2019 Income Statement shown below.

Charhofe began 2019 with $70 million in retained earnings. In 2019, they paid out a special dividend totaling $90 million. What is the retained earnings balance as of December 31, 2019?

- -$20 million

- $42.4 million

- $97.6 million

- $132.4 million

Q11. In determining when revenue is recognized, what two conditions must be satisfied according to the realization concept?

- Revenue must be collected and credited

- Revenue must be earned and realized

- Revenue must be credited and paid for.

- Revenue must be earned and collected

Q12. Refer to Charhofe’s December 31, 2019 Income Statement shown below.

For 2019, what was Charhofe’s return on sales (also referred to as their net profit margin)?

- 18.4%

- 26.5%

- 48.5%

- 80.0%

Q13. Refer to Alpha’s cash T-Account for 2019 shown below.

For 2019, what was Alpha’s cash flow from financing?

- A net inflow of $160 million

- A net inflow of $190 million

- A net inflow of $240 million

- A net outflow of $90 million

Q14. Woodridge Companies purchased a new machine that was on sale for $100,000. The CEO’s brother installed the machine and charged Woodridge $10,000. If the regular price of the machine is $110,000 and the cost to install it should have been $20,000, how should Woodridge record the value of the asset on their balance sheet?

- $130,000

- $120,000

- $110,000

- $100,000

Q15. Sanford and Son sells athletic equipment. The following events, related to a special customer order, occur as described below:

- September 1, 2019: Sanford receives the special order for 300 football helmets at a selling price of $100 each, including delivery at a future convenient time and location. The customer, with whom Sanford has had a long-term, trouble-free relationship, pays $5,000 as a deposit, and agrees to pay the rest on delivery. Sanford immediately orders $20,000 worth of helmets from its supplier and pays a $5,000 deposit for them.

- September 20, 2019: Sanford pays a $15,000 balance due to the supplier upon delivery of the helmets to its warehouse.

- October 1, 2019: The customer calls for delivery of the helmets and pays the balance of $25,000 when they arrive at the customer site.

On September 20, 2019, upon delivery of the helmets from the supplier and the payment of the balance due, how should the transaction be recorded in Sanford’s financial accounting system?

- debit accounts payable $15,000; credit cash $15,000

- debit inventory $15,000; credit cash $15,000

- debit inventory $20,000; credit cash $15,000; credit advance to suppliers $5,000

- debit inventory $20,000; credit cash $5,000; credit accounts payable $15,000

Q16. On January 1, 2019, Flip-Flop Inc. purchased a trademark from Cool Shoe Inc. for $200,000. They paid for the purchase with $100,000 in cash and $100,000 in Flip-Flop common stock. If Flip-Flop has long-term debt on their balance sheet, which of the following describes the effect of the transaction on Flip-Flop Inc.?

- The current ratio will decrease and total debt to equity ratio will increase

- The current ratio will be unaffected and total debt to equity ratio will decrease.

- The current ratio will decrease and total debt to equity ratio will decrease

- The current ratio will increase and the total debt to equity ratio will increase.

Q17. Refer to Alpha’s cash T-Account for 2019 shown below

For 2019, what was Alpha’s cash flow from operations?

- A net outflow of $150 million

- A net inflow of $150 million

- A net outflow of $110 million

- A net inflow of $110 million

Q18. Which of the following is not a requirement for an asset to be recorded on the balance sheet?

- The asset arises from a past transaction or event.

- The asset is expected to produce a future economic benefit.

- The asset was obtained or is controlled by the entity.

- The asset was acquired at fair market value

Q19. Xylem Technologies purchased a trademark from Phloem Semiconductor for $5 million. How should this new purchase be classified on the balance sheet for Xylem?

- A non-current intangible liability

- A non-current intangible asset

- A current intangible asset

- It should not be recognized as the trademark has no tangible value

Q20. Choose the option to correctly complete the following sentence. If the entity is uncertain whether to recognize an expense or about the amount of an expense, the _________ concept encourages it to pro-actively estimate the cost and record the expense.

- realization

- matching

- consistency

- conservatism

Q21. Sanford and Son sells athletic equipment. The following events, related to a special customer order, occur as described below:

- September 1, 2019: Sanford receives the special order for 300 football helmets at a selling price of $100 each, including delivery at a future convenient time and location. The customer, with whom Sanford has had a long-term, trouble-free relationship, pays $5,000 as a deposit, and agrees to pay the rest on delivery. Sanford immediately orders $20,000 worth of helmets from its supplier and pays a $5,000 deposit for them.

- September 20, 2019: Sanford pays a $15,000 balance due to the supplier upon delivery of the helmets to its warehouse.

- October 1, 2019: The customer calls for delivery of the helmets and pays the balance of $25,000 when they arrive at the customer site

What is the gross margin that Sanford earned on the order?

- $10,000

- $20,000

- $25,000

- $30,000

Q22. Manning Inc. owes $200,000 to one of its creditors. Since it has limited resources, Manning agrees to issue $100,000 worth of common stock and to pay $100,000 in cash to make payment. How would this repayment be recorded in Manning’s financial statements?

- debit cash $100,000; debit common stock $100,000; credit accounts payable $200,000

- debit accounts payable $200,000; credit cash $100,000; credit stock expense $100,000

- debit common stock $200,000; credit cash $100,000; credit additional paid in capital $100,000

- debit accounts payable $200,000; credit cash $100,000; credit common stock $100,000

Q23. On October 1, Jordyn Solutions pays 3 months of rent in advance to its landlord. Which of the following statements regarding this transaction and its impact on Jordyn’s financial statements is true?

- Rent expense will be debited; cash will be credited

- Cash will be debited; rent expense will be credited.

- Cash will be debited; prepaid rent will be credited.

- Prepaid rent will be debited; cash will be credited

Q24. Refer to Charhofe’s December 31, 2019 Income Statement shown below.

Charhofe began 2019 with a taxes payable account balance of $7 million. If it ended 2019 with a taxes payable account balance of $10 million, how much did it pay in taxes in 2019?

- $12.6 million

- $18.6 million

- $22.6 million

- $25.6 million

Q25. Refer to Alpha’s cash T-Account for 2019 shown below.

Alpha recorded rent and utility expense in 2019 of $70 million. Which one of the following line items would be included in the operating section of Alpha’s 2019 indirect method statement of cash flows?

- Add increase in rent and utilities payable of $30 million

- Subtract increase in rent and utilities payable of $30 million

- Add increase in rent and utilities payable of $70 million

- Subtract increase in rent and utilities payable of $70 million.

Q26. On December 31, 2018, Blais Industries had long-term debt totaling $120,000 on their balance sheet. During 2019, they paid $10,000 in interest on that debt and $50,000 in principal. During the year they also issued new long-term debt totaling $20,000. What is the balance in their long-term debt account at the end of 2019?

- $80,000

- $90,000

- $100,000

- $140,000

Q27. Sanford and Son sells athletic equipment. The following events, related to a special customer order, occur as described below:

- September 1, 2019: Sanford receives the special order for 300 football helmets at a selling price of $100 each, including delivery at a future convenient time and location. The customer, with whom Sanford has had a long-term, trouble-free relationship, pays $5,000 as a deposit, and agrees to pay the rest on delivery. Sanford immediately orders $20,000 worth of helmets from its supplier and pays a $5,000 deposit for them.

- September 20, 2019: Sanford pays a $15,000 balance due to the supplier upon delivery of the helmets to its warehouse.

- October 1, 2019: The customer calls for delivery of the helmets and pays the balance of $25,000 when they arrive at the customer site.

On October 1, 2019, upon delivery of the helmets to the customer and the payment of the balance due, how should the transaction be recorded in Sanford’s financial accounting system?

- debit cash $25,000; debit advance from customer $5,000; credit sales $30,000; and debit cost of goods sold $20,000; credit inventory $20,000

- debit cash $25,000; credit sales $25,000

- debit cash $25,000; credit account receivable $25,000; and debit cost of goods sold $20,000; credit inventory $20,000

- debit cash $25,000; credit accounts receivable $25,000; and debit cost of goods sold $30,000; credit sales $30,000

Q28. Which of the following describes the fundamental accounting equation?

- Assets + Liabilities = Owner’s Equity

- Current Assets = Owner’s Equity – Current Liabilities

- Assets = Liabilities – Owner’s Equity

- Assets = Liabilities + Owner’s Equity

Q29. Which of the following is generally not considered a current liability?

- accounts payable

- taxes payable

- current portion of long-term debt

- mortgage payable

Q30. Refer to Bellingham Incorporated’s December 31, 2019 Balance Sheet shown below.

Bellingham’s inventory balance on December 31, 2018 was $70,000. They purchased $40,000 worth of inventory in 2019 and during the year there were no inventory related write-downs or losses. What was the cost of goods sold in 2019?

- $10,000

- $20,000

- $30,000

- $40,000

Q31. Sanford and Son sells athletic equipment. The following events, related to a special customer order, occur as described below:

- September 1, 2019: Sanford receives the special order for 300 football helmets at a selling price of $100 each, including delivery at a future convenient time and location. The customer, with whom Sanford has had a long-term, trouble-free relationship, pays $5,000 as a deposit, and agrees to pay the rest on delivery. Sanford immediately orders $20,000 worth of helmets from its supplier and pays a $5,000 deposit for them.

- September 20, 2019: Sanford pays a $15,000 balance due to the supplier upon delivery of the helmets to its warehouse.

- October 1, 2019: The customer calls for delivery of the helmets and pays the balance of $25,000 when they arrive at the customer site.

On September 1, 2019, which one of the following accounting entries, related to the $20,000 order placed with the supplier, should be recorded in Sanford’s financial accounting system?

- debit inventory $5,000; credit cash $5,000

- debit inventory $20,000; credit cash $5,000; credit accounts payable $15,000

- debit advance to suppliers $5,000; credit cash $5,000

- debit advance to suppliers $20,000; credit cash $5,000; credit accounts payable $15,000

Q32. Refer to Alpha’s cash T-Account for 2019 shown below.

Based on the cash T-account for 2019, which of the following statements is true?

- The company repurchased their stock

- The company did not record any tax expense in 2019

- The company sold land for $150 million

- The company issued debt totaling $160 million

Q33. Choose the option to correctly complete the following sentence. The __________ concept says that every accounting transaction has two sides that must be recorded.

- accounting

- dual-aspect

- money measurement

- journal entry

Q34. Quinlan Electric purchases machinery for $220,000 that is to be depreciated at straight-line depreciation for 5 years. The estimated residual value of the machine after 5 years is estimated at $20,000. What is the book value of the asset after 2 years?

- $80,000

- $120,000

- $140,000

- $160,000

Q35. Sanford and Son sells athletic equipment. The following events, related to a special customer order, occur as described below:

- September 1, 2019: Sanford receives the special order for 300 football helmets at a selling price of $100 each, including delivery at a future convenient time and location. The customer, with whom Sanford has had a long-term, trouble-free relationship, pays $5,000 as a deposit, and agrees to pay the rest on delivery. Sanford immediately orders $20,000 worth of helmets from its supplier and pays a $5,000 deposit for them.

- September 20, 2019: Sanford pays a $15,000 balance due to the supplier upon delivery of the helmets to its warehouse.

- October 1, 2019: The customer calls for delivery of the helmets and pays the balance of $25,000 when they arrive at the customer site.

On September 1, 2019, which one of the following accounting entries, related to the $30,000 special order, should be recorded in Sanford’s financial accounting system?

- debit cash $5,000; debit accounts receivable $25,000; credit sales $30,000

- debit cash $5,000; credit sales $5,000

- debit cash $5,000; debit accounts receivable $25,000; credit advance from customers $30,000

- debit cash $5,000; credit advance from customers $5,000

Q36. Refer to Bellingham Incorporated’s December 31, 2019 Balance Sheet shown below

Bellingham began 2019 with $240,000 in owner’s equity. During the year they issued $30,000 in new common stock and paid $10,000 in dividends. If their net income for 2019 was $40,000, what was their retained earnings balance on December 31, 2018?

- $30,000

- $50,000

- $60,000

- $70,000

Q37. Refer to Charhofe’s December 31, 2019 Income Statement shown below.

If Charhofe was able to increase sales at a greater rate than cost of goods sold, how would gross margin percentage be impacted?

- It would increase.

- It would decrease.

- It would not be impacted.

- It cannot be determined with the information given

Q38. Refer to Bellingham Incorporated’s December 31, 2019 Balance Sheet shown below.

What is Bellingham’s total debt to equity ratio on December 31, 2019?

- 0.50

- 0.87

- 1.09

- 1.17

Q39. On January 1, 2019, Flip-Flop Inc. purchased a trademark from Cool Shoe Inc. for $200,000. They paid for the purchase with $100,000 in cash and $100,000 in Flip-Flop common stock. How would the transaction be recorded by Flip-Flop?

- debit cash $100,000; debit common stock $100,000; credit trademark $200,000

- debit trademark $200,000; credit cash $100,000; credit common stock $100,000

- debit trademark expense $200,000; credit cash $100,000; common stock $100,000

- debit trademark $200,000; credit cash $100,000; credit retained earnings $100,000

Q40. Refer to Charhofe’s December 31, 2019 Income Statement shown below.

Charhofe ended 2019 with a balance in their interest payable account of $14 million. During 2019 it paid $9 million in interest to its creditors. What was the balance of the interest payable account at the end of 2018?

- $11 million

- $23 million

- $26 million

- $35 million

Please click on Make Payment to get all correct answers at $40 (No Hidden Charges or any Sign Up Fee). In description, please don’t forget to mention the exam name – HBSP Harvard Financial Accounting Final Exam 1. You will receive the answers at your email id within an hour