Home » Online Coursework Help » Online Exam Help » Harvard Finance Introductory Section Pretest

Harvard Finance Introductory Section Pretest

Q1. All else equal, companies prefer shorter payback periods to longer payback periods. True / False

Q2. Assume that the risk-free rate is 5%, stock A has a beta of 1.2, and the expected return on the market is 12%. What is the expected return of stock A?

- 8.4%

- 13.4%

- 17.0%

- 19.4%

Q3. A firm has receivables turnover of 8. Sales are $600. What is the value of average receivables?

- $75

- $480

- $750

- $4800

Q4. Choose the options to correctly complete the following sentence

The static tradeoff model relaxes two conditions of Modigliani-Miller Proposition I; these conditions are:

I. Taxes

II. Costs of financial distress

III. Symmetric information

IV. Complete markets

- I and III

- I and II

- II and III

- III and IV

Q5. In the capital allocation decision process, what is the definition of cost of capital?

- 0%

- the return you can receive on an investment with similar risk

- the current risk-free rate

- the return on a risky bond

Q6. Holding all other components constant, which of the following changes will increase the interval measure?

I. Cash increases

II. Receivables increase

III. Operating costs increase

- I

- I and II

- I and III

- I, II and III

Q7. Which of the following choices represents a real activity that generates cash by producing goods and services for customers?

- Debt issuance

- Equity issuance

- Research and development expense

- Interest expense

Q8. Choose the option to correctly complete the following sentence.

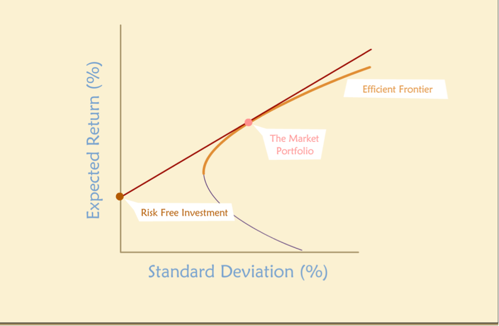

On the tangent line in the plot below, investors in portfolios to the left of the market portfolio are __________ of riskless Treasury securities, while investors in portfolios to the right of the market portfolio are _____________ of riskless Treasury securities

- borrowers; borrowers

- borrowers; lenders

- lenders; borrowers

- lenders; lenders

Q9. Assume that a company plans to invest $500 per year in an investment that promises 5% a year in perpetuity. What is the present value of this investment?

- $100

- $2,500

- $10,000

- $1,000,000

Q10. All else equal, a firm with higher days in inventory will have a shorter cash cycle. True / False

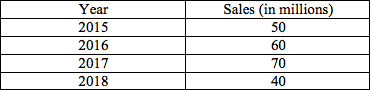

Q11. Firm XYZ has the following sales data.

What is the compound average growth rate (CAGR) for the full period (stated as a percent)?

- 5.43%

- -7.17%

- -5.43%

- 7.17%

Q12. Which of the following investment decision criteria does not require estimating the expected cost of capital?

- Net present value

- Payback period

- Discounted payback period

- Internal rate of return

Q13. Firm BCD has an average collection period of 93 days. If accounts receivable are $242, what are the firm’s sales? (round to the nearest dollar).

- $62

- $140

- $950

- $1433

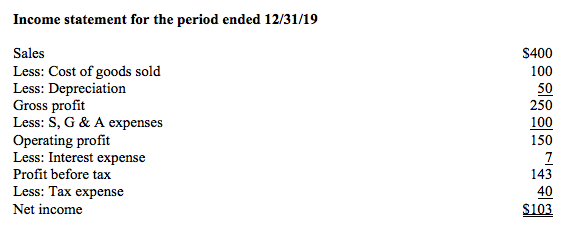

Q14. Presented below is the 2019 income statement for Billie’s Baubles.

The tax rate was 35% in 2019. Assume that the change in capital expenditures for 2019 was $30 and the change in net working capital was $25. What was Billie’s Baubles’ Free Cash Flow (FCF) for 2019?

- $31.05

- $61.95

- $87.95

- $92.50

Q15. A concern with the Net Present Value (NPV) investment decision criterion is that under certain circumstances, it is possible to have more than one NPV for a single project. True / False

Q16. Which of the following common ratios measures efficiency?

- Return on assets

- Times interest earned

- Days in inventory

- Contribution margin

Q17. In 2007, Joe’s shoes had accounts receivable of $40 and accounts payable of $30. In 2008, Joe’s shoes had accounts receivable of $25 and accounts payable of $45.

Choose the option to correctly complete the statement.

The decrease in accounts receivable from 2007 to 2008 represents a _________ of cash while the increase in accounts payable from 2007 to 2008 represents a _________ of cash.

- use; use

- use; source

- source; source

- source; use

Q18. The concept of “Conservation of Business Risk” implies that a change in the capital structure of a company also changes the amount of business risk per dollar of equity, but not the total amount of risk. True / False

Q19. Choose the option to correctly complete the following sentence.

The portfolio that offers the highest level of return for a given level of risk is called the _____________.

- Efficient frontier

- Minimum variance portfolio

- Optimal portfolio

- Maximum variance portfolio

Q20. Assume that you wish to save $25,000 in 5 years to remodel your kitchen. Assume that you can earn an annual compound interest of 8% from your savings account.

How much do you need to invest today to have $25,000 in 5 years?

- $5,000.00

- $17,014.58

- $18,375.75

- $23,148.15

Q21. The standard deviation of a portfolio of two risky assets is the weighted average of each asset’s standard deviation. True / False

Q22. Yannie’s Yoga Clothing has 60 stores in malls across the United States. Its main competitor, Tina’s Threads has stores in the same malls.

Choose the option to correctly complete the following statement.

If Tina’s Threads encounters financial difficulty and closes half its stores, the potential impact on Yannie’s Yoga’s financial statements (consistent with scenario analysis and assuming that the aggregate market for yoga attire does not change), would be:

- Decrease in sales; decrease in cost of goods sold

- Increase in sales; increase in cost of goods sold

- Increase in sales; no change in cost of goods sold

- No change to sales; no change to cost of goods sold

Q23. In a world with no taxes, shareholders are indifferent between dividend payouts and share repurchases. True / False

Q24. Which of the following statements are true?

I. It is legally permissible for a firm with cash flow problems to skip a planned interest payment to its creditor.

II. It is legally permissible for a firm with cash flow problems to skip a planned dividend payment to its shareholders.

- I only

- II only

- Both I and II

- Neither I nor II

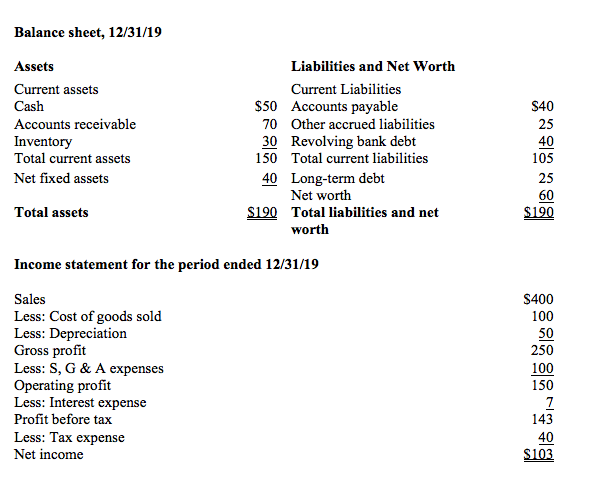

Q25. Presented below are the 2019 balance sheet and income statement for Billie’s Baubles.

In 2018, Billie’s Baubles had net worth of $150.

What was Billie’s Baubles’ return on beginning equity in 2019?

- 54.2%

- 68.7%

- 98.1%

- 171.7%

Q26. Which of the following choices is an example of a use of funds?

- Increase in inventory

- Increase in long-term debt

- Reduction in cash

- Sale of fixed assets

Q27. Last year, an investor purchased Billie’s Baubles stock for $47 per share. Today, the stock price for Billie’s Baubles is $53 per share.

Choose the option to correctly complete the following sentence.

If Billie’s Baubles pays a $2 dividend per share right now, today’s stock price per share will be ________, the investor’s dividend income per share will be _______, and the investor’s unrealized capital gain per share will be ____.

- $45; $2; $4

- $51; $0; $6

- $51; $2; $4

- $53; $2; $4

Q28. Which of the following statements about a pro-forma balance sheet is true?

- It does not need to follow the usual accounting rules

- It is a projection of a company’s assets, liabilities, and equity

- Its main focus is on the method by which a firm might raise additional funding

- It is a projection of a company’s revenues, costs, and profit

To get all correct answers, please click on Pay Now to make a payment of $30. We accept payments via PayPal only. In description, please write the exam name – Harvard Finance Introductory Section Pretest. We will email the answers at your email id within 30 minutes.