Accounting Assignment Help » Managerial Accounting Assignment Help » Connect Managerial Accounting Homework Chapter 5

Connect Managerial Accounting Homework Chapter 5

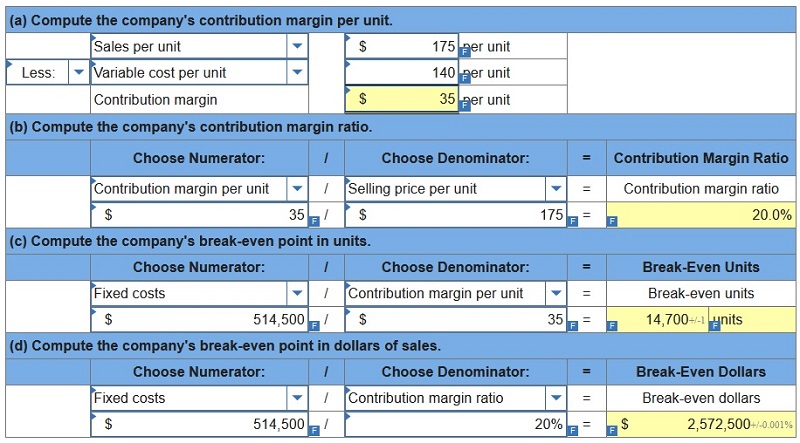

Q1. Blanchard Company manufactures a single product that sells for $175 per unit and whose total variable costs are $140 per unit. The company’s annual fixed costs are $514,500.

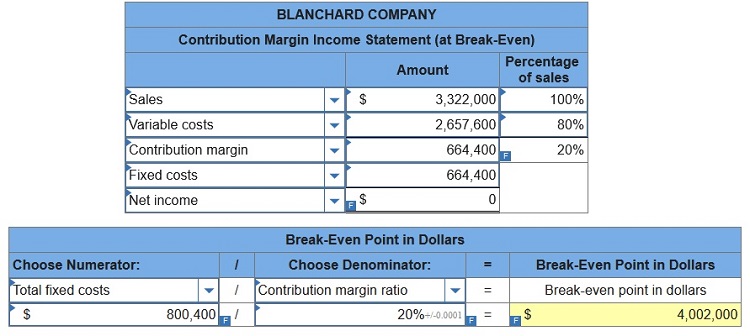

Q2. Blanchard Company manufactures a single product that sells for $220 per unit and whose total variable costs are $176 per unit. The company’s annual fixed costs are $664,400.

(1) Prepare a contribution margin income statement for Blanchard Company showing sales, variable costs, and fixed costs at the break-even point.

(2) Assume the company’s fixed costs increase by $136,000. What amount of sales (in dollars) is needed to break even?

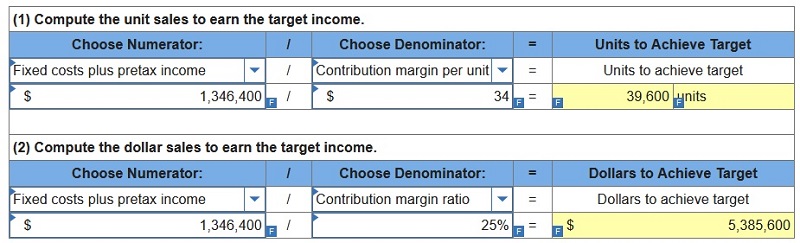

Q3. Blanchard Company manufactures a single product that sells for $136 per unit and whose total variable costs are $102 per unit. The company’s annual fixed costs are $496,400. Management targets an annual pretax income of $850,000. Assume that fixed costs remain at $496,400.

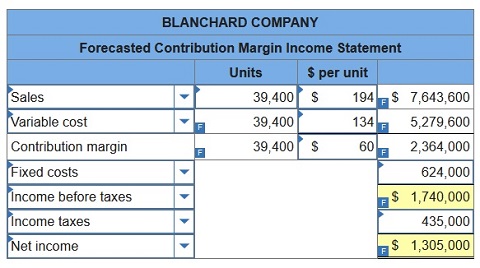

Q4. Blanchard Company manufactures a single product that sells for $120 per unit and whose total variable costs are $90 per unit. The company’s annual fixed costs are $624,000. The sales manager predicts that annual sales of the company’s product will soon reach 39,400 units and its price will increase to $194 per unit. According to the production manager, variable costs are expected to increase to $134 per unit, but fixed costs will remain at $624,000. The income tax rate is 25%. What amounts of pretax and after-tax income can the company expect to earn from these predicted changes?

Prepare a forecasted contribution margin income statement.

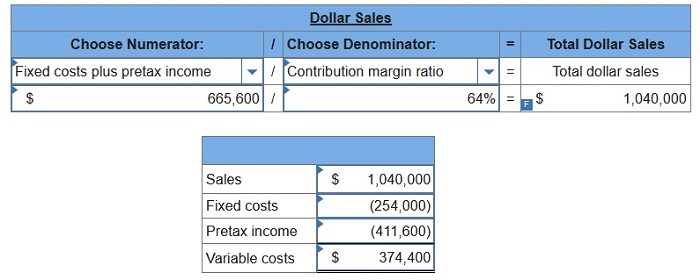

Q5. Bloom Company management predicts that it will incur fixed costs of $254,000 and earn pretax income of $411,600 in the next period. Its expected contribution margin ratio is 64%.

Required:

1. Compute the amount of total dollar sales.

2. Compute the amount of total variable costs.

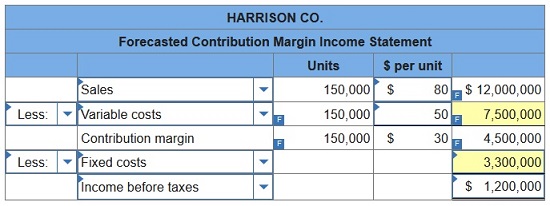

Q6. Harrison Co. expects to sell 150,000 units of its product next year, which would generate total sales of $12,000,000. Management predicts that pretax net income for next year will be $1,200,000 and that the contribution margin per unit will be $30.

Complete the below table to calculate the next year’s total expected variable costs and fixed costs.

Q7. Hudson Co. reports the contribution margin income statement for 2019.

| HUDSON CO. | |||

| Contribution Margin Income Statement | |||

| For Year Ended December 31, 2019 | |||

| Sales (10,100 units at $300 each) | $ | 3,030,000 | |

| Variable costs (10,100 units at $240 each) | 2,424,000 | ||

| Contribution margin | 606,000 | ||

| Fixed costs | 468,000 | ||

| Pretax income | $ | 138,000 | |

|

|

|||

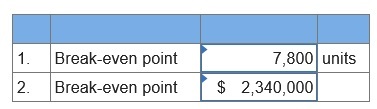

1. Compute Hudson Co.’s break-even point in units.

2. Compute Hudson Co.’s break-even point in sales dollars.

Q8. Hudson Co. reports the contribution margin income statement for 2019.

| HUDSON CO. | |||

| Contribution Margin Income Statement | |||

| For Year Ended December 31, 2019 | |||

| Sales (10,100 units at $300 each) | $ | 3,030,000 | |

| Variable costs (10,100 units at $240 each) | 2,424,000 | ||

| Contribution margin | 606,000 | ||

| Fixed costs | 468,000 | ||

| Pretax income | $ | 138,000 | |

|

|

|||

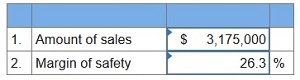

1. Assume Hudson Co. has a target pretax income of $167,000 for 2020. What amount of sales (in dollars) is needed to produce this target income?

2. If Hudson achieves its target pretax income for 2020, what is its margin of safety (in percent)? (Round your answer to 1 decimal place.)

Q9. Hudson Co. reports the contribution margin income statement for 2019.

| HUDSON CO. | |||

| Contribution Margin Income Statement | |||

| For Year Ended December 31, 2019 | |||

| Sales (10,100 units at $300 each) | $ | 3,030,000 | |

| Variable costs (10,100 units at $240 each) | 2,424,000 | ||

| Contribution margin | 606,000 | ||

| Fixed costs | 468,000 | ||

| Pretax income | $ | 138,000 | |

|

|

|||

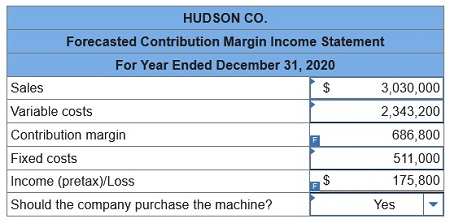

Assume the company is considering investing in a new machine that will increase its fixed costs by $43,000 per year and decrease its variable costs by $8 per unit. Prepare a forecasted contribution margin income statement for 2020 assuming the company purchases this machine.

Q10. Hudson Co. reports the contribution margin income statement for 2019.

| HUDSON CO. | |||

| Contribution Margin Income Statement | |||

| For Year Ended December 31, 2019 | |||

| Sales (10,100 units at $300 each) | $ | 3,030,000 | |

| Variable costs (10,100 units at $240 each) | 2,424,000 | ||

| Contribution margin | 606,000 | ||

| Fixed costs | 468,000 | ||

| Pretax income | $ | 138,000 | |

|

|

|||

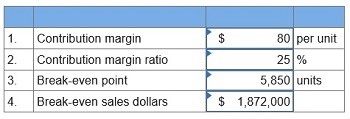

If the company raises its selling price to $320 per unit.

1. Compute Hudson Co.’s contribution margin per unit.

2. Compute Hudson Co.’s contribution margin ratio.

3. Compute Hudson Co.’s break-even point in units.

4. Compute Hudson Co.’s break-even point in sales dollars.

Q11. Hudson Co. reports the contribution margin income statement for 2019.

| HUDSON CO. | |||

| Contribution Margin Income Statement | |||

| For Year Ended December 31, 2019 | |||

| Sales (10,100 units at $300 each) | $ | 3,030,000 | |

| Variable costs (10,100 units at $240 each) | 2,424,000 | ||

| Contribution margin | 606,000 | ||

| Fixed costs | 468,000 | ||

| Pretax income | $ | 138,000 | |

|

|

|||

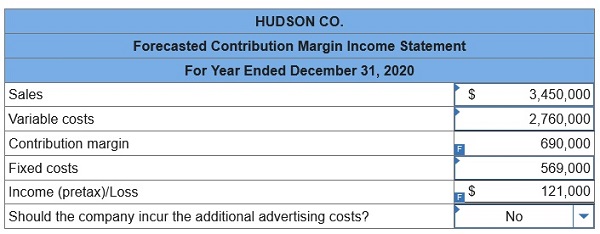

The marketing manager believes that increasing advertising costs by $101,000 in 2020 will increase the company’s sales volume to 11,500 units. Prepare a forecasted contribution margin income statement for 2020 assuming the company incurs the additional advertising costs.

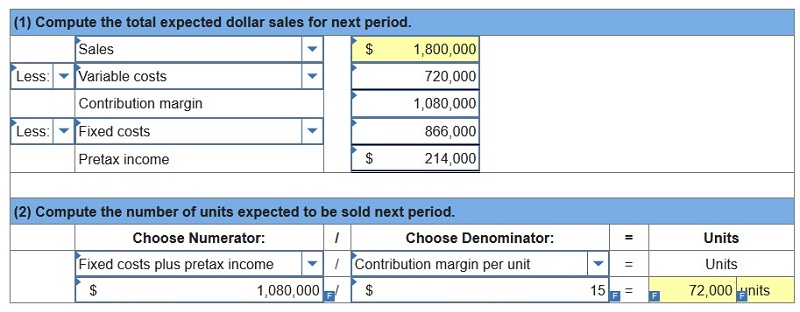

Q12. Nombre Company management predicts $720,000 of variable costs, $866,000 of fixed costs, and a pretax income of $214,000 in the next period. Management also predicts that the contribution margin per unit will be $15.

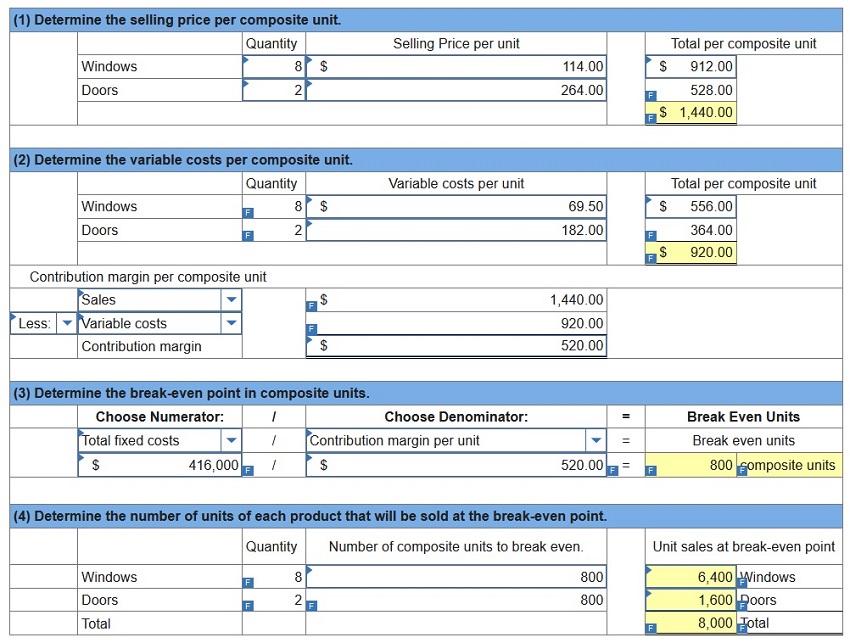

Q13. Handy Home sells windows and doors in the ratio of 8:2 (windows:doors). The selling price of each window is $114 and of each door is $264. The variable cost of a window is $69.50 and of a door is $182.00. Fixed costs are $416,000. (Enter your “per unit” values in two decimal places.)

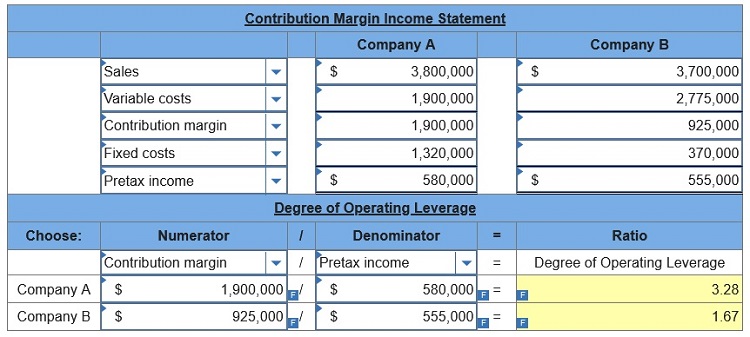

Q14. Company A is a manufacturer with sales of $3,800,000 and a 50% contribution margin. Its fixed costs equal $1,320,000. Company B is a consulting firm with service revenues of $3,700,000 and a 25% contribution margin. Its fixed costs equal $370,000.

Compute the degree of operating leverage (DOL) for each company. Which company benefits more from a 20% increase in sales.

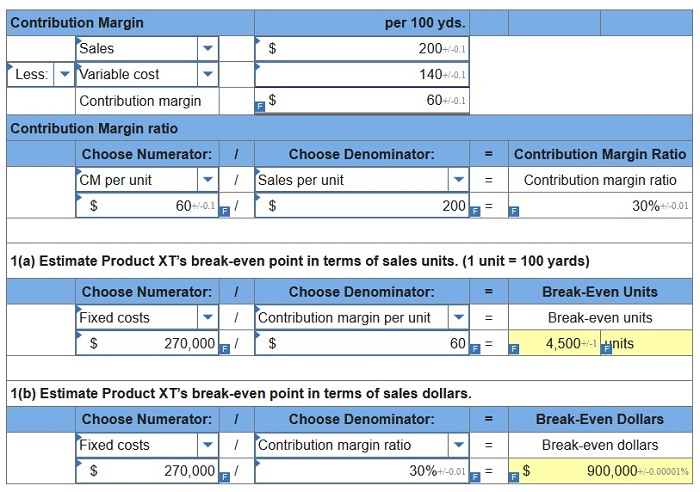

Q15. Praveen Co. manufactures and markets a number of rope products. Management is considering the future of Product XT, a special rope for hang gliding, that has not been as profitable as planned. Since Product XT is manufactured and marketed independently of the other products, its total costs can be precisely measured. Next year’s plans call for a $200 selling price per 100 yards of XT rope. Its fixed costs for the year are expected to be $270,000, up to a maximum capacity of 550,000 yards of rope. Forecasted variable costs are $140 per 100 yards of XT rope.

1. Estimate Product XT’s break-even point in terms of sales units and sales dollars. (1 unit = 100 yards) (Do not round intermediate calculations.)

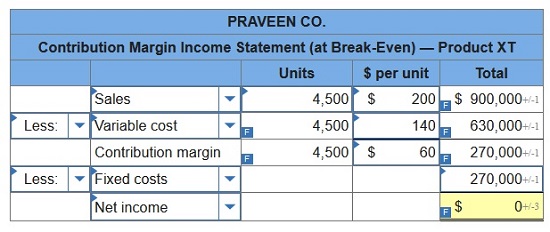

Q16. Praveen Co. manufactures and markets a number of rope products. Management is considering the future of Product XT, a special rope for hang gliding, that has not been as profitable as planned. Since Product XT is manufactured and marketed independently of the other products, its total costs can be precisely measured. Next year’s plans call for a $200 selling price per 100 yards of XT rope. Its fixed costs for the year are expected to be $270,000, up to a maximum capacity of 550,000 yards of rope. Forecasted variable costs are $140 per 100 yards of XT rope.

2. Prepare a contribution margin income statement showing sales, variable costs, and fixed costs for Product XT at the break-even point.

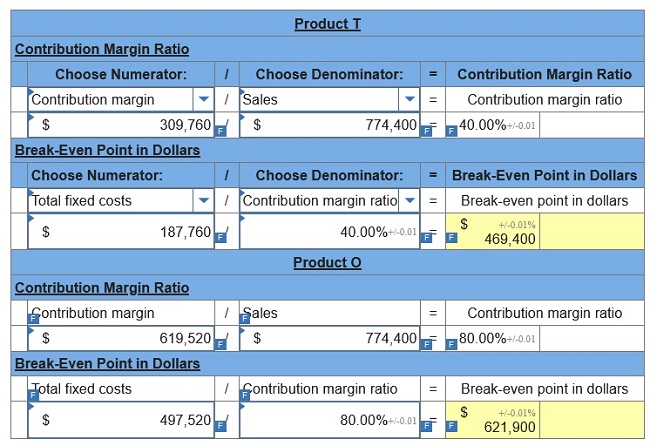

Q17. Henna Co. produces and sells two products, T and O. It manufactures these products in separate factories and markets them through different channels. They have no shared costs. This year, the company sold 44,000 units of each product. Sales and costs for each product follow.

| Product T | Product O | ||||||||

| Sales | $ | 774,400 | $ | 774,400 | |||||

| Variable costs | 464,640 | 154,880 | |||||||

| Contribution margin | 309,760 | 619,520 | |||||||

| Fixed costs | 187,760 | 497,520 | |||||||

| Income before taxes | 122,000 | 122,000 | |||||||

| Income taxes (32% rate) | 39,040 | 39,040 | |||||||

| Net income | $ | 82,960 | $ | 82,960 | |||||

|

|

|||||||||

Required:

1. Compute the break-even point in dollar sales for each product. (Enter CM ratio as percentage rounded to 2 decimal places.)

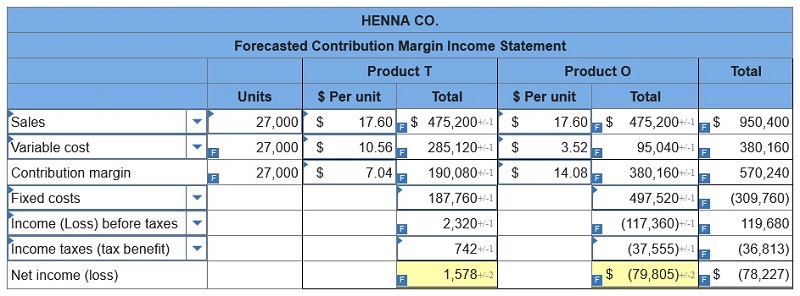

Q18. Henna Co. produces and sells two products, T and O. It manufactures these products in separate factories and markets them through different channels. They have no shared costs. This year, the company sold 44,000 units of each product. Sales and costs for each product follow.

| Product T | Product O | ||||||||

| Sales | $ | 774,400 | $ | 774,400 | |||||

| Variable costs | 464,640 | 154,880 | |||||||

| Contribution margin | 309,760 | 619,520 | |||||||

| Fixed costs | 187,760 | 497,520 | |||||||

| Income before taxes | 122,000 | 122,000 | |||||||

| Income taxes (32% rate) | 39,040 | 39,040 | |||||||

| Net income | $ | 82,960 | $ | 82,960 | |||||

|

|

|||||||||

2. Assume that the company expects sales of each product to decline to 27,000 units next year with no change in unit selling price. Prepare forecasted financial results for next year following the format of the contribution margin income statement as just shown with columns for each of the two products (assume a 32% tax rate). Also, assume that any loss before taxes yields a 32% tax benefit. (Round “per unit” answers to 2 decimal places. Enter losses and tax benefits, if any, as negative values.)

Q19. Henna Co. produces and sells two products, T and O. It manufactures these products in separate factories and markets them through different channels. They have no shared costs. This year, the company sold 44,000 units of each product. Sales and costs for each product follow.

| Product T | Product O | ||||||||

| Sales | $ | 774,400 | $ | 774,400 | |||||

| Variable costs | 464,640 | 154,880 | |||||||

| Contribution margin | 309,760 | 619,520 | |||||||

| Fixed costs | 187,760 | 497,520 | |||||||

| Income before taxes | 122,000 | 122,000 | |||||||

| Income taxes (32% rate) | 39,040 | 39,040 | |||||||

| Net income | $ | 82,960 | $ | 82,960 | |||||

|

|

|||||||||

3. Assume that the company expects sales of each product to increase to 58,000 units next year with no change in unit selling price. Prepare forecasted financial results for next year following the format of the contribution margin income statement shown with columns for each of the two products (assume a 32% tax rate). (Round “per unit” answers to 2 decimal places.)

Please click on Pay Now to get explanations to all answers at $40 (No Hidden Charges or any Sign Up Fee). In description, please don’t forget to mention the exam name – Connect Managerial Accounting Homework Chapter 4. We will send the explanation at your email id instantly. If you are looking for accounting class help for other fields then also you can connect with us anytime. We will provide high quality and accurate accounting assignment help for all questions…