Accounting Assignment Help » Managerial Accounting Assignment Help » Connect Managerial Accounting Homework Chapter 3

Connect Managerial Accounting Homework Chapter 3

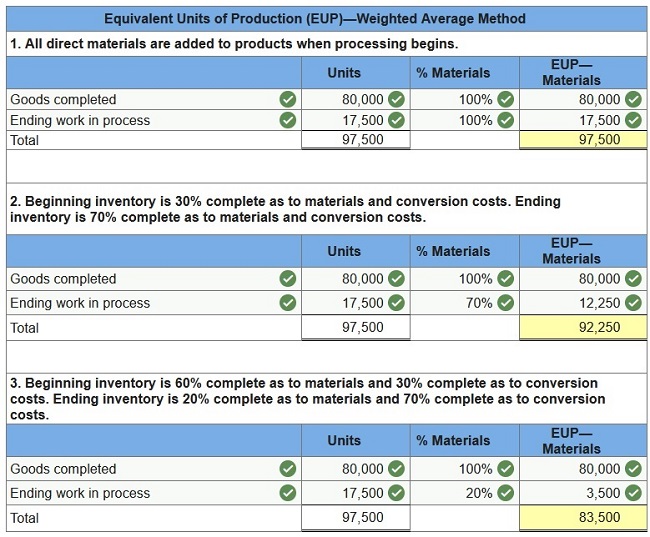

Q1. A production department in a process manufacturing system completed its work on 80,000 units of product and transferred them to the next department during a recent period. Of these units, 32,000 were in process at the beginning of the period. The other 48,000 units were started and completed during the period. At period-end, 17,500 units were in process.

Prepare the production department’s equivalent units of production for direct materials under each of three separate assumptions using the weighted-average method for process costing.

Q2. A production department in a process manufacturing system completed its work on 80,000 units of product and transferred them to the next department during a recent period. Of these units, 32,000 were in process at the beginning of the period. The other 48,000 units were started and completed during the period. At period-end, 17,500 units were in process.

Prepare the department’s equivalent units of production with respect to direct materials under each of the three separate assumptions using the FIFO method for process costing.

Q3. Fields Company has two manufacturing departments, forming and painting. The company uses the weighted-average method of process costing. At the beginning of the month, the forming department has 27,000 units in inventory, 70% complete as to materials and 30% complete as to conversion costs. The beginning inventory cost of $56,100 consisted of $40,000 of direct materials costs and $16,100 of conversion costs.

During the month, the forming department started 320,000 units. At the end of the month, the forming department had 35,000 units in ending inventory, 80% complete as to materials and 40% complete as to conversion. Units completed in the forming department are transferred to the painting department.

Cost information for the forming department follows.

| Beginning work in process inventory | $56,100 |

| Direct materials added during the month | 1,660,000 |

| Conversion added during the month | 929,300 |

1. Calculate the equivalent units of production for the forming department.

2. Calculate the costs per equivalent unit of production for the forming department.

3. Using the weighted-average method, assign costs to the forming department’s output—specifically, its units transferred to painting and its ending work in process inventory.

Q4. Fields Company has two manufacturing departments, forming and painting. The company uses the weighted-average method of process costing. At the beginning of the month, the forming department has 27,000 units in inventory, 70% complete as to materials and 30% complete as to conversion costs. The beginning inventory cost of $56,100 consisted of $40,000 of direct materials costs and $16,100 of conversion costs.

During the month, the forming department started 320,000 units. At the end of the month, the forming department had 35,000 units in ending inventory, 80% complete as to materials and 40% complete as to conversion. Units completed in the forming department are transferred to the painting department.

Cost information for the forming department follows.

| Beginning work in process inventory | $56,100 |

| Direct materials added during the month | 1,660,000 |

| Conversion added during the month | 929,300 |

Assume that Fields uses the FIFO method of process costing.

1. Calculate the equivalent units of production for the forming department.

2. Calculate the costs per equivalent unit of production for the forming department.

Q5. During April, the first production department of a process manufacturing system completed its work on 360,000 units of a product and transferred them to the next department. Of these transferred units, 72,000 were in process in the production department at the beginning of April and 288,000 were started and completed in April. April’s beginning inventory units were 70% complete with respect to materials and 30% complete with respect to conversion. At the end of April, 94,000 additional units were in process in the production department and were 80% complete with respect to materials and 30% complete with respect to conversion.

Compute the number of equivalent units with respect to both materials used and conversion used in the first production department for April using the weighted-average method.

Q6. During April, the first production department of a process manufacturing system completed its work on 360,000 units of a product and transferred them to the next department. Of these transferred units, 72,000 were in process in the production department at the beginning of April and 288,000 were started and completed in April. April’s beginning inventory units were 70% complete with respect to materials and 30% complete with respect to conversion. At the end of April, 94,000 additional units were in process in the production department and were 80% complete with respect to materials and 30% complete with respect to conversion.

The production department had $1,115,920 of direct materials and $777,192 of conversion costs charged to it during April. Also, its April beginning inventory of $205,948 consists of $167,920 of direct materials cost and $38,028 of conversion costs.

1. Compute the direct materials cost per equivalent unit for April. (Round “Cost per EUP” to 2 decimal places.)

2. Compute the conversion cost per equivalent unit for April. (Round “Cost per EUP” to 2 decimal places.)

3. Using the weighted-average method, assign April’s costs to the department’s output—specifically, its units transferred to the next department and its ending work in process inventory. (Round “Cost per EUP” to 2 decimal places.)

Q7. During April, the first production department of a process manufacturing system completed its work on 360,000 units of a product and transferred them to the next department. Of these transferred units, 72,000 were in process in the production department at the beginning of April and 288,000 were started and completed in April. April’s beginning inventory units were 70% complete with respect to materials and 30% complete with respect to conversion. At the end of April, 94,000 additional units were in process in the production department and were 80% complete with respect to materials and 30% complete with respect to conversion.

Prepare the number of equivalent units with respect to both materials and conversion costs in the production department for April using the FIFO method.

Q8. During April, the first production department of a process manufacturing system completed its work on 360,000 units of a product and transferred them to the next department. Of these transferred units, 72,000 were in process in the production department at the beginning of April and 288,000 were started and completed in April. April’s beginning inventory units were 70% complete with respect to materials and 30% complete with respect to conversion. At the end of April, 94,000 additional units were in process in the production department and were 80% complete with respect to materials and 30% complete with respect to conversion.

The production department had $1,115,920 of direct materials and $777,192 of conversion costs charged to it during April. Also, its beginning inventory of $205,948 consists of $167,920 of direct materials cost and $38,028 of conversion costs.

1. Compute the direct materials cost per equivalent unit for April. (Round “Cost per EUP” to 2 decimal places.)

2. Compute the conversion cost per equivalent unit for April. (Round “Cost per EUP” to 2 decimal places.)

3. Using the FIFO method, assign April’s costs to the department’s output—specifically, its units transferred to the next department and its ending work in process inventory. (Round “Cost per EUP” to 2 decimal places.)

Q9. The following partially completed process cost summary describes the July production activities of the Molding department at Ashad Company. Its production output is sent to the next department. All direct materials are added to products when processing begins. Beginning work in process inventory is 20% complete with respect to conversion.

| Equivalent Units of Production | Direct Materials | Conversion |

| Units transferred out | 36,000 EUP | 36,000 EUP |

| Units of ending work in process | 3,500 EUP | 2,100 EUP |

| Equivalent units of production | 39,500 EUP | 38,100 EUP |

| Costs per EUP | Direct Materials | Conversion |

| Costs of beginning work in process | $29,950 | $3,540 |

| Costs incurred this period | 412,450 | 221,250 |

| Total costs | $442,400 | $224,790 |

| Units in beginning work in process (all completed during July) | 3,000 |

| Units started this period | 36,500 |

| Units completed and transferred out | 36,000 |

| Units in ending work in process | 3,500 |

Prepare its process cost summary using the weighted-average method. (Round “Cost per EUP” to 2 decimal places.)

Q10. The following partially completed process cost summary describes the July production activities of the Molding department at Ashad Company. Its production output is sent to the next department. All direct materials are added to products when processing begins. Beginning work in process inventory is 20% complete with respect to conversion.

| Equivalent Units of Production | Direct Materials | Conversion |

| Units transferred out | 36,000 EUP | 36,000 EUP |

| Units of ending work in process | 3,500 EUP | 2,100 EUP |

| Equivalent units of production | 39,500 EUP | 38,100 EUP |

| Costs per EUP | Direct Materials | Conversion |

| Costs of beginning work in process | $29,950 | $3,540 |

| Costs incurred this period | 412,450 | 221,250 |

| Total costs | $442,400 | $224,790 |

| Units in beginning work in process (all completed during July) | 3,000 |

| Units started this period | 36,500 |

| Units completed and transferred out | 36,000 |

| Units in ending work in process | 3,500 |

Prepare its process cost summary using the FIFO method. (Round “Cost per EUP” to 2 decimal places.)

Q11. Pro-Weave manufactures stadium blankets by passing the products through a weaving department and a sewing department. The following information is available regarding its June inventories:

| Beginning Inventory | Ending Inventory | |

| Raw materials inventory | $172,000 | $249,000 |

| Work in process inventory—Weaving | 320,000 | 385,000 |

| Work in process inventory—Sewing | 725,000 | 715,000 |

| Finished goods inventory | 1,346,000 | 1,436,000 |

The following additional information describes the company’s manufacturing activities for June:

| Raw materials purchases (on credit) | $520,000 |

| Factory payroll cost (paid in cash) | 3,345,000 |

| Other factory overhead cost (Other Accounts credited) | 208,000 |

| Materials used | |

| Direct—Weaving | $244,000 |

| Direct—Sewing | 114,000 |

| Indirect | 142,000 |

| Labor used | |

| Direct—Weaving | $1,225,000 |

| Direct—Sewing | 545,000 |

| Indirect | 1,575,000 |

| Overhead rates as a percent of direct labor | |

| Weaving | 90% |

| Sewing | 160% |

| Sales (on credit) | 5,250,000 |

1. Compute the (a) cost of products transferred from weaving to sewing, (b) cost of products transferred from sewing to finished goods, and (c) cost of goods sold.

2. Prepare journal entries dated June 30 to record (a) goods transferred from weaving to sewing, (b) goods transferred from sewing to finished goods, (c) sale of finished goods, and (d) cost of goods sold.

Q12. Pro-Weave manufactures stadium blankets by passing the products through a weaving department and a sewing department. The following information is available regarding its June inventories:

| Beginning Inventory | Ending Inventory | |

| Raw materials inventory | $172,000 | $249,000 |

| Work in process inventory—Weaving | 320,000 | 385,000 |

| Work in process inventory—Sewing | 725,000 | 715,000 |

| Finished goods inventory | 1,346,000 | 1,436,000 |

The following additional information describes the company’s manufacturing activities for June:

| Raw materials purchases (on credit) | $520,000 |

| Factory payroll cost (paid in cash) | 3,345,000 |

| Other factory overhead cost (Other Accounts credited) | 208,000 |

| Materials used | |

| Direct—Weaving | $244,000 |

| Direct—Sewing | 114,000 |

| Indirect | 142,000 |

| Labor used | |

| Direct—Weaving | $1,225,000 |

| Direct—Sewing | 545,000 |

| Indirect | 1,575,000 |

| Overhead rates as a percent of direct labor | |

| Weaving | 90% |

| Sewing | 160% |

| Sales (on credit) | 5,250,000 |

1. Prepare journal entries dated June 30 to record: (a) raw materials purchases, (b) direct materials usage, (c) indirect materials usage, (d) direct labor usage, (e) indirect labor usage, (f) other overhead costs, (g) overhead applied, and (h) payment of total payroll costs.

Q13. Victory Company uses weighted-average process costing to account for its production costs. Conversion cost is added evenly throughout the process. Direct materials are added at the beginning of the first process. During November, the first process transferred 785,000 units of product to the second process. Additional information for the first process follows.

At the end of November, work in process inventory consists of 196,000 units that are 80% complete with respect to conversion. Beginning work in process inventory had $446,355 of direct materials and $188,360 of conversion cost. The direct material cost added in November is $2,987,145, and the conversion cost added is $3,578,840. Beginning work in process consisted of 72,000 units that were 100% complete with respect to direct materials and 80% complete with respect to conversion. Of the units completed, 72,000 were from beginning work in process and 713,000 units were started and completed during the period.

Required:

For the first process:

1. Determine the equivalent units of production with respect to direct materials and conversion.

Q14. Victory Company uses weighted-average process costing to account for its production costs. Conversion cost is added evenly throughout the process. Direct materials are added at the beginning of the first process. During November, the first process transferred 785,000 units of product to the second process. Additional information for the first process follows.

At the end of November, work in process inventory consists of 196,000 units that are 80% complete with respect to conversion. Beginning work in process inventory had $446,355 of direct materials and $188,360 of conversion cost. The direct material cost added in November is $2,987,145, and the conversion cost added is $3,578,840. Beginning work in process consisted of 72,000 units that were 100% complete with respect to direct materials and 80% complete with respect to conversion. Of the units completed, 72,000 were from beginning work in process and 713,000 units were started and completed during the period.

2. Compute both the direct material cost and the conversion cost per equivalent unit.

Q15. Victory Company uses weighted-average process costing to account for its production costs. Conversion cost is added evenly throughout the process. Direct materials are added at the beginning of the first process. During November, the first process transferred 785,000 units of product to the second process. Additional information for the first process follows.

At the end of November, work in process inventory consists of 196,000 units that are 80% complete with respect to conversion. Beginning work in process inventory had $446,355 of direct materials and $188,360 of conversion cost. The direct material cost added in November is $2,987,145, and the conversion cost added is $3,578,840. Beginning work in process consisted of 72,000 units that were 100% complete with respect to direct materials and 80% complete with respect to conversion. Of the units completed, 72,000 were from beginning work in process and 713,000 units were started and completed during the period.

3. Compute the direct material cost and the conversion cost assigned to units completed and transferred out and ending work in process inventory. (Round “Cost per EUP” to 2 decimal places.)

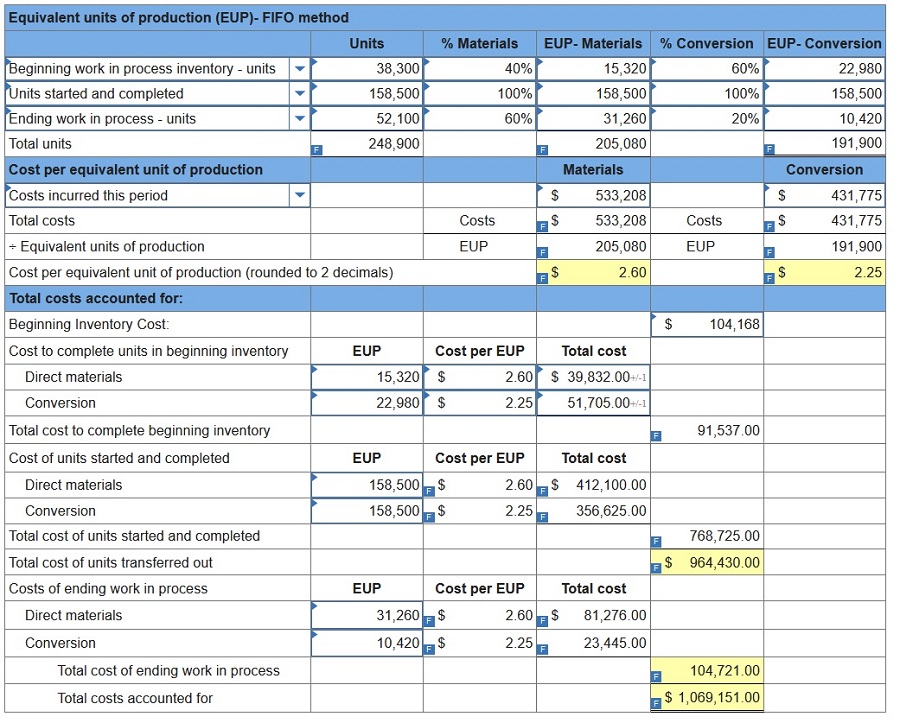

Q16. QualCo manufactures a single product in two departments: Cutting and Assembly. During May, the Cutting department completed a number of units of a product and transferred them to Assembly. Of these transferred units, 38,300 were in process in the Cutting department at the beginning of May and 158,500 were started and completed in May. May’s Cutting department beginning inventory units were 60% complete with respect to materials and 40% complete with respect to conversion. At the end of May, 52,100 additional units were in process in the Cutting department and were 60% complete with respect to materials and 20% complete with respect to conversion. The Cutting department had $533,208 of direct materials and $431,775 of conversion cost charged to it during May. Its beginning inventory included $74,875 of direct materials cost and $29,293 of conversion cost.

1. Compute the number of units transferred to Assembly.

![]()

Q17. QualCo manufactures a single product in two departments: Cutting and Assembly. During May, the Cutting department completed a number of units of a product and transferred them to Assembly. Of these transferred units, 38,300 were in process in the Cutting department at the beginning of May and 158,500 were started and completed in May. May’s Cutting department beginning inventory units were 60% complete with respect to materials and 40% complete with respect to conversion. At the end of May, 52,100 additional units were in process in the Cutting department and were 60% complete with respect to materials and 20% complete with respect to conversion. The Cutting department had $533,208 of direct materials and $431,775 of conversion cost charged to it during May. Its beginning inventory included $74,875 of direct materials cost and $29,293 of conversion cost.

2-4. Using the FIFO method, assign May’s costs to the units transferred out and assign costs to its ending work in process inventory. (Round “Cost per EUP” to 2 decimal places.)

Please click on Pay Now to get explanations to all answers at $40 (No Hidden Charges or any Sign Up Fee). In description, please don’t forget to mention the exam name – Connect Managerial Accounting Homework Chapter 3. We will send the explanation at your email id instantly. If you are looking for accounting coursework help for other fields then also you can connect with us anytime. We will provide high quality and accurate accounting assignment help for all questions…