Accounting Assignment Help » Managerial Accounting Assignment Help » Connect Managerial Accounting Homework Chapter 2

Connect Managerial Accounting Homework Chapter 2

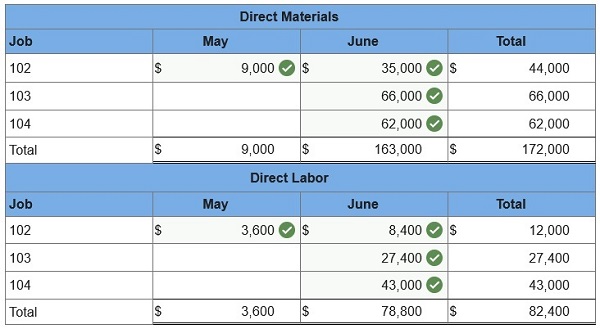

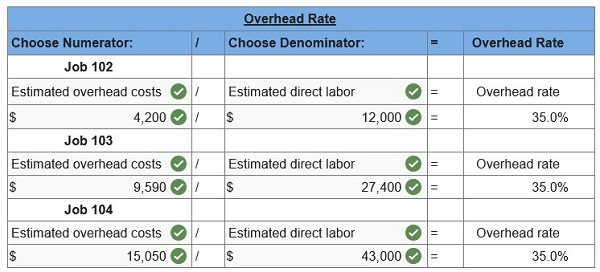

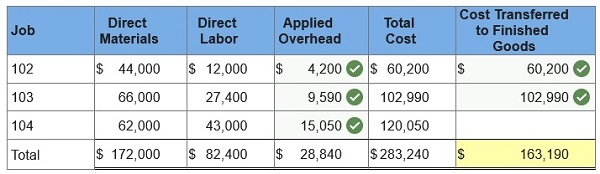

Q1. As of the end of June, the job cost sheets at Racing Wheels, Inc., show the following total costs accumulated on three custom jobs.

| Job 102 | Job 103 | Job 104 | |

| Direct materials | $44,000 | $66,000 | $62,000 |

| Direct labor | 12,000 | 27,400 | 43,000 |

| Overhead applied | 4,200 | 9,590 | 15,050 |

Job 102 was started in production in May, and the following costs were assigned to it in May: direct materials, $9,000; direct labor, $3,600; and overhead, $1,260. Jobs 103 and 104 were started in June. Overhead cost is applied with a predetermined rate based on direct labor cost. Jobs 102 and 103 were finished in June, and Job 104 is expected to be finished in July. No raw materials were used indirectly in June. Using this information, answer the following questions. (Assume this company’s predetermined overhead rate did not change across these months.)

1&2. Complete the table below to calculate the cost of the raw materials requisitioned and direct labor cost incurred during June for each of the three jobs?

3. Using the accumulated costs of the jobs, what predetermined overhead rate is used?

4. How much total cost is transferred to finished goods during June?

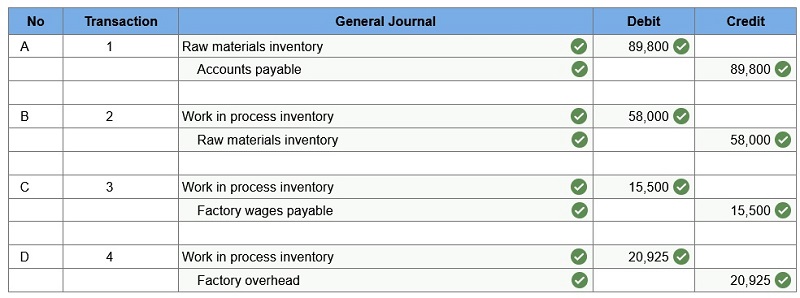

Q2. Starr Company reports the following information for August.

| Raw materials purchased on account | $89,800 | |

| Direct materials used in production | $58,000 | |

| Factory wages earned (direct labor) | $15,500 | |

| Overhead rate | 135 | % of direct labor cost |

Prepare journal entries to record the following events.

- Raw materials purchased.

- Direct materials used in production.

- Direct labor used in production.

- Applied overhead.

Q3. Custom Cabinetry has one job in process (Job 120) as of June 30; at that time, its job cost sheet reports direct materials of $7,600, direct labor of $3,800, and applied overhead of $3,230. Custom Cabinetry applies overhead at the rate of 85% of direct labor cost. During July, Job 120 is sold (on account) for $28,500, Job 121 is started and completed, and Job 122 is started and still in process at the end of the month. Custom Cabinetry incurs the following costs during July.

| July Product Costs | Job 120 | Job 121 | Job 122 | Total |

| Direct materials | $2,400 | $8,400 | $3,300 | $14,100 |

| Direct labor | 3,800 | 3,700 | 3,900 | 11,400 |

| Overhead applied | ? | ? | ? | ? |

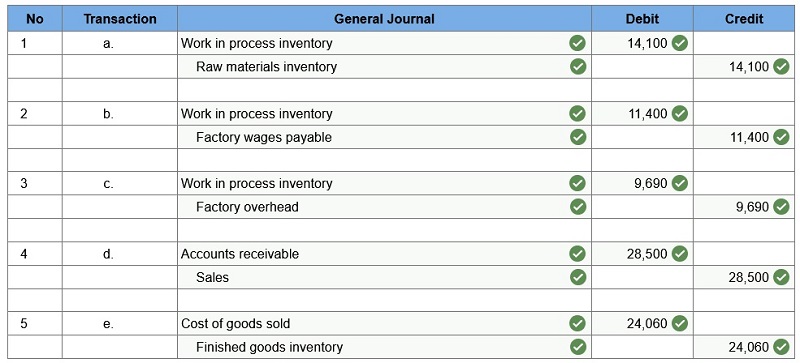

1. Prepare journal entries for the following in July.

- Direct materials used in production.

- Direct labor used in production.

- Overhead applied.

- The sale of Job 120.

- Cost of goods sold for Job 120.

2. Compute the July 31 balances of the Work in Process Inventory and the Finished Goods Inventory accounts. (Assume there are no jobs in Finished Goods Inventory as of June 30.)

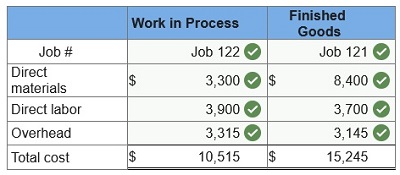

Q4. Prepare summary journal entries to record the following transactions for a company in its first month of operations.

- Raw materials purchased on account, $80,000.

- Direct materials used in production, $37,000. Indirect materials used in production, $12,000.

- Paid cash for factory payroll, $35,000. Of this total, $25,000 is for direct labor and $10,000 is for indirect labor.

- Paid cash for other actual overhead costs, $7,000.

- Applied overhead at the rate of 120% of direct labor cost.

- Transferred cost of jobs completed to finished goods, $50,470.

- Jobs that had a cost of $50,470 were sold.

- Sold jobs on account for $72,100.

Q5. The following information is available for Lock-Tite Company, which produces special-order security products and uses a job order costing system.

| April 30 | May 31 | |

| Inventories | ||

| Raw materials | $49,000 | $45,000 |

| Work in process | 9,300 | 19,300 |

| Finished goods | 68,000 | 34,700 |

| Activities and information for May | ||

| Raw materials purchases (paid with cash) | 178,000 | |

| Factory payroll (paid with cash) | 150,000 | |

| Factory overhead | ||

| Indirect materials | 10,000 | |

| Indirect labor | 34,500 | |

| Other overhead costs | 108,000 | |

| Sales (received in cash) | 1,900,000 | |

| Predetermined overhead rate based on direct labor cost | 55% |

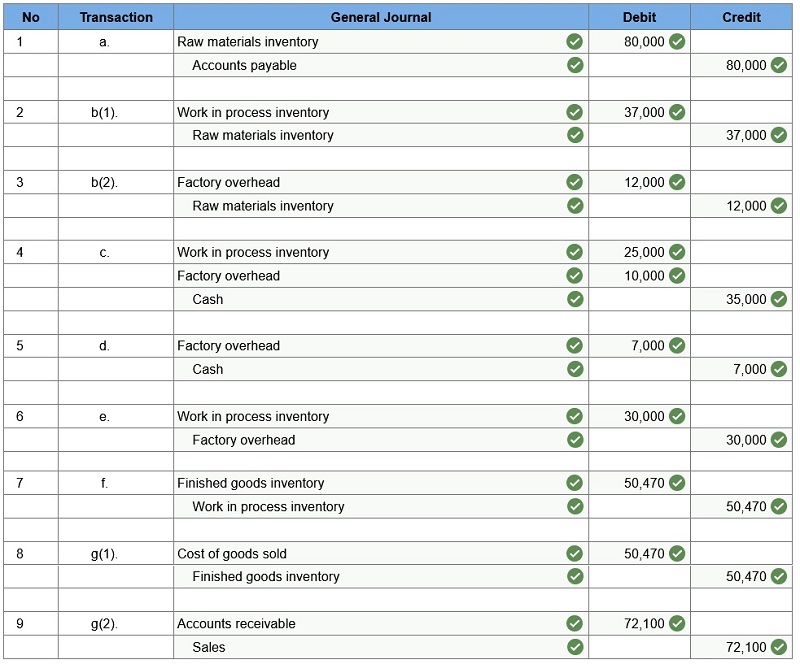

Compute the following amounts for the month of May using T-accounts.

- Cost of direct materials used.

- Cost of direct labor used.

- Cost of goods manufactured.

- Cost of goods sold.*

- Gross profit.

- Overapplied or underapplied overhead.

*Do not consider any underapplied or overapplied overhead.

Q6. The following information is available for Lock-Tite Company, which produces special-order security products and uses a job order costing system.

| April 30 | May 31 | |

| Inventories | ||

| Raw materials | $49,000 | $45,000 |

| Work in process | 9,300 | 19,300 |

| Finished goods | 68,000 | 34,700 |

| Activities and information for May | ||

| Raw materials purchases (paid with cash) | 178,000 | |

| Factory payroll (paid with cash) | 150,000 | |

| Factory overhead | ||

| Indirect materials | 10,000 | |

| Indirect labor | 34,500 | |

| Other overhead costs | 108,000 | |

| Sales (received in cash) | 1,900,000 | |

| Predetermined overhead rate based on direct labor cost | 55% |

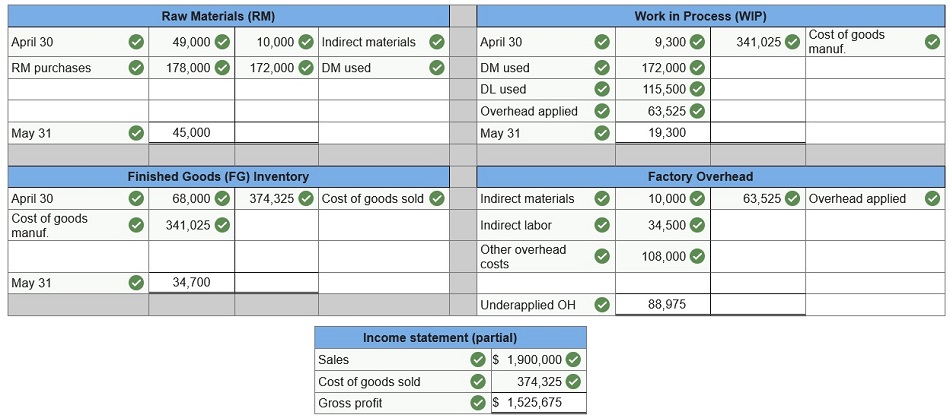

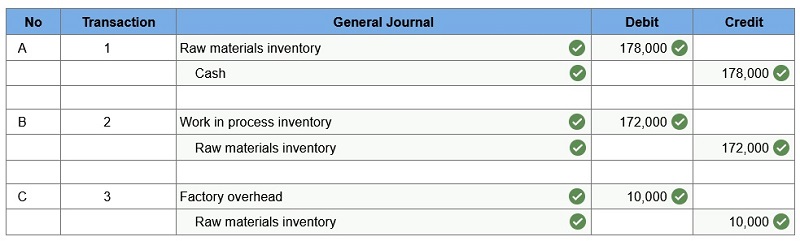

- Raw materials purchases for cash.

- Direct materials usage.

- Indirect materials usage.

Prepare journal entries for the above transactions for the month of May.

Q7. The following information is available for Lock-Tite Company, which produces special-order security products and uses a job order costing system.

| April 30 | May 31 | |

| Inventories | ||

| Raw materials | $49,000 | $45,000 |

| Work in process | 9,300 | 19,300 |

| Finished goods | 68,000 | 34,700 |

| Activities and information for May | ||

| Raw materials purchases (paid with cash) | 178,000 | |

| Factory payroll (paid with cash) | 150,000 | |

| Factory overhead | ||

| Indirect materials | 10,000 | |

| Indirect labor | 34,500 | |

| Other overhead costs | 108,000 | |

| Sales (received in cash) | 1,900,000 | |

| Predetermined overhead rate based on direct labor cost | 55% |

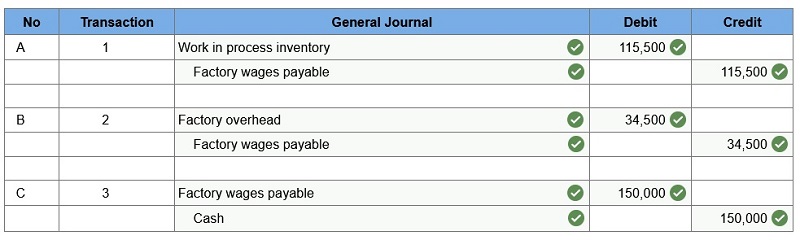

- Direct labor usage.

- Indirect labor usage.

- Total payroll paid in cash.

Prepare journal entries for the above transactions for the month of May.

Q8. The following information is available for Lock-Tite Company, which produces special-order security products and uses a job order costing system.

| April 30 | May 31 | |

| Inventories | ||

| Raw materials | $49,000 | $45,000 |

| Work in process | 9,300 | 19,300 |

| Finished goods | 68,000 | 34,700 |

| Activities and information for May | ||

| Raw materials purchases (paid with cash) | 178,000 | |

| Factory payroll (paid with cash) | 150,000 | |

| Factory overhead | ||

| Indirect materials | 10,000 | |

| Indirect labor | 34,500 | |

| Other overhead costs | 108,000 | |

| Sales (received in cash) | 1,900,000 | |

| Predetermined overhead rate based on direct labor cost | 55% |

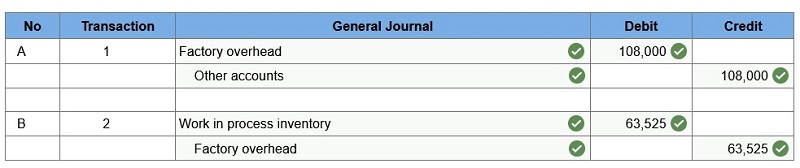

- Incurred other overhead costs (record credit to Other Accounts).

- Applied overhead to work in process.

Prepare journal entries for the above transactions for the month of May.

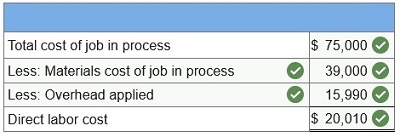

Q9. Lorenzo Company applies overhead to jobs on the basis of direct materials cost. At year-end, the Work in Process Inventory account shows the following.

| Work in Process Inventory | |||||

| Date | Explanation | Debit | Credit | Balance | |

| Dec. | 31 | Direct materials cost | 1,900,000 | 1,900,000 | |

| 31 | Direct labor cost | 240,000 | 2,140,000 | ||

| 31 | Overhead applied | 779,000 | 2,919,000 | ||

| 31 | To finished goods | 2,844,000 | 75,000 | ||

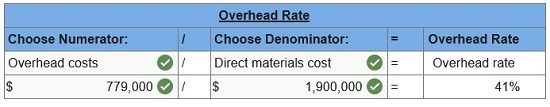

1. Determine the predetermined overhead rate used (based on direct materials cost).

2. Only one job remained in work in process inventory at December 31. Its direct materials cost is $39,000. How much direct labor cost and overhead cost are assigned to this job?

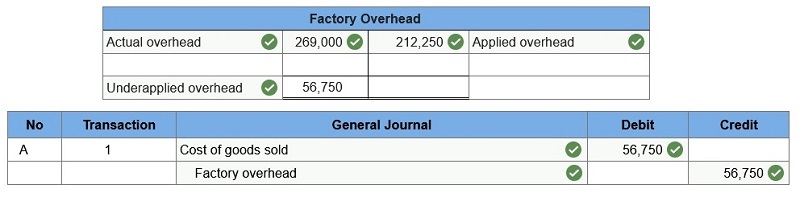

Q10. The following information is available for Lock-Tite Company, which produces special-order security products and uses a job order costing system.

| April 30 | May 31 | |

| Inventories | ||

| Raw materials | $52,000 | $70,000 |

| Work in process | 12,000 | 24,900 |

| Finished goods | 72,000 | 53,600 |

| Activities and information for May | ||

| Raw materials purchases (paid with cash) | 228,000 | |

| Factory payroll (paid with cash) | 381,000 | |

| Factory overhead | ||

| Indirect materials | 33,000 | |

| Indirect labor | 98,000 | |

| Other overhead costs | 138,000 | |

| Sales (received in cash) | 1,580,000 | |

| Predetermined overhead rate based on direct labor cost | 75% |

Determine whether there is over or underapplied overhead.

Prepare the journal entry to allocate (close) overapplied or underapplied overhead to Cost of Goods Sold.

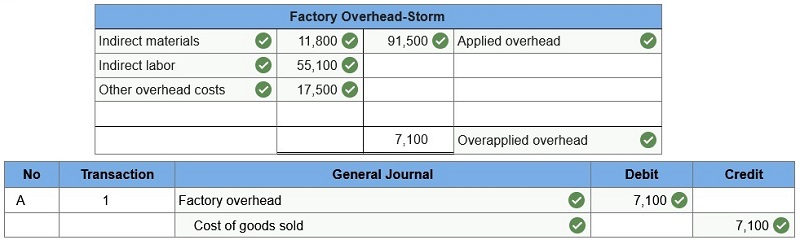

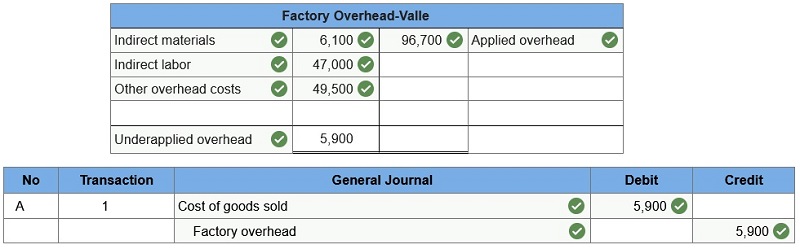

Q11.

| Storm Concert Promotions | Valle Home Builders | |

| Actual indirect materials costs | $11,800 | $6,100 |

| Actual indirect labor costs | 55,100 | 47,000 |

| Other overhead costs | 17,500 | 49,500 |

| Overhead applied | 91,500 | 96,700 |

Storm Concert Promotions

Determine whether overhead is overapplied or underapplied.

Prepare the journal entry to allocate (close) overapplied or underapplied overhead to Cost of Goods Sold.

Valle Home Builders

Determine whether overhead is overapplied or underapplied.

Prepare the journal entry to allocate (close) overapplied or underapplied overhead to Cost of Goods Sold.

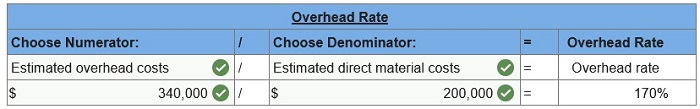

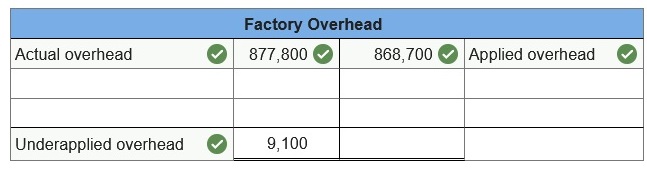

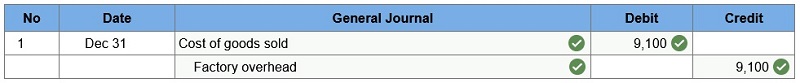

Q12. At the beginning of the year, Custom Mfg. established its predetermined overhead rate by using the following cost predictions: overhead costs, $340,000, and direct materials costs, $200,000. At year-end, the company’s records show that actual overhead costs for the year are $877,800. Actual direct materials cost had been assigned to jobs as follows.

| Jobs completed and sold | $390,000 |

| Jobs in finished goods inventory | 70,000 |

| Jobs in work in process inventory | 51,000 |

| Total actual direct materials cost | $511,000 |

1. Determine the predetermined overhead rate.

2&3. Enter the overhead costs incurred and the amounts applied to jobs during the year using the predetermined overhead rate and determine whether overhead is overapplied or underapplied.

4. Prepare the adjusting entry to allocate any over- or underapplied overhead to Cost of Goods Sold.

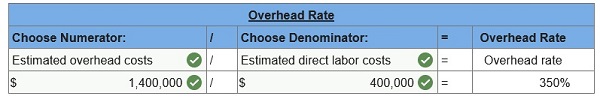

Q13. At the beginning of the year, Infodeo established its predetermined overhead rate for movies produced during the year by using the following cost predictions: overhead costs, $1,400,000,and direct labor costs, $400,000. At year-end, the company’s records show that actual overhead costs for the year are $1,900,700. Actual direct labor cost had been assigned to jobs as follows.

| Movies completed and released | $500,000 |

| Movies still in production | 46,000 |

| Total actual direct labor cost | $546,000 |

1. Determine the predetermined overhead rate for the year.

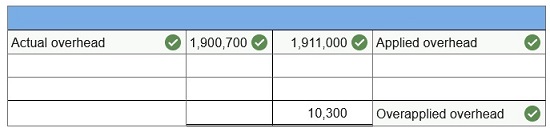

2&3. Enter the overhead costs incurred and the amounts applied to movies during the year using the predetermined overhead rate and determine whether overhead is overapplied or underapplied.

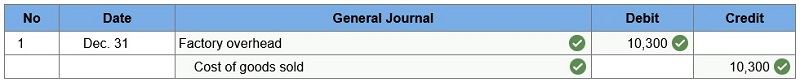

4. Prepare the adjusting entry to allocate any over- or underapplied overhead to Cost of Goods Sold.

Q14. Marcelino Co.’s March 31 inventory of raw materials is $82,000. Raw materials purchases in April are $530,000, and factory payroll cost in April is $380,000. Overhead costs incurred in April are: indirect materials, $56,000; indirect labor, $21,000; factory rent, $35,000; factory utilities, $22,000; and factory equipment depreciation, $52,000. The predetermined overhead rate is 50% of direct labor cost. Job 306 is sold for $640,000 cash in April. Costs of the three jobs worked on in April follow.

| Job 306 | Job 307 | Job 308 | |

| Balances on March 31 | |||

| Direct materials | $25,000 | $40,000 | |

| Direct labor | 23,000 | 15,000 | |

| Applied overhead | 11,500 | 7,500 | |

| Costs during April | |||

| Direct materials | 137,000 | 215,000 | $110,000 |

| Direct labor | 104,000 | 152,000 | 103,000 |

| Applied overhead | ? | ? | ? |

| Status on April 30 | Finished (sold) | Finished (unsold) | In process |

Required:

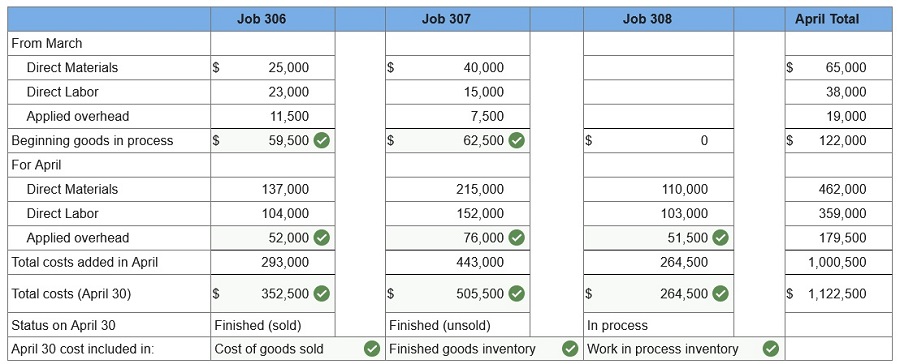

1. Determine the total of each production cost incurred for April (direct labor, direct materials, and applied overhead), and the total cost assigned to each job (including the balances from March 31).

Q15. Marcelino Co.’s March 31 inventory of raw materials is $82,000. Raw materials purchases in April are $530,000, and factory payroll cost in April is $380,000. Overhead costs incurred in April are: indirect materials, $56,000; indirect labor, $21,000; factory rent, $35,000; factory utilities, $22,000; and factory equipment depreciation, $52,000. The predetermined overhead rate is 50% of direct labor cost. Job 306 is sold for $640,000 cash in April. Costs of the three jobs worked on in April follow.

| Job 306 | Job 307 | Job 308 | |

| Balances on March 31 | |||

| Direct materials | $25,000 | $40,000 | |

| Direct labor | 23,000 | 15,000 | |

| Applied overhead | 11,500 | 7,500 | |

| Costs during April | |||

| Direct materials | 137,000 | 215,000 | $110,000 |

| Direct labor | 104,000 | 152,000 | 103,000 |

| Applied overhead | ? | ? | ? |

| Status on April 30 | Finished (sold) | Finished (unsold) | In process |

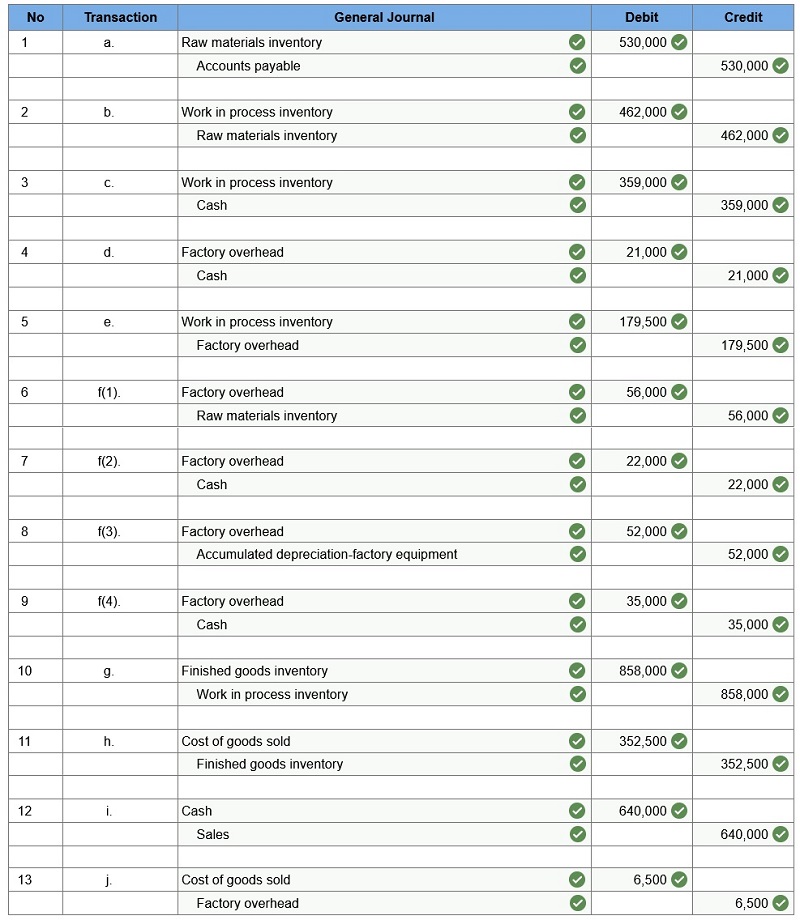

- Materials purchases (on credit).

- Direct materials used in production.

- Direct labor paid and assigned to Work in Process Inventory.

- Indirect labor paid and assigned to Factory Overhead.

- Overhead costs applied to Work in Process Inventory.

- Actual overhead costs incurred, including indirect materials. (Factory rent and utilities are paid in cash.)

- Transfer of Jobs 306 and 307 to Finished Goods Inventory.

- Cost of goods sold for Job 306.

- Revenue from the sale of Job 306.

- Assignment of any underapplied or overapplied overhead to the Cost of Goods Sold account. (The amount is not material.)

2. Prepare journal entries for the month of April to record the above transactions.

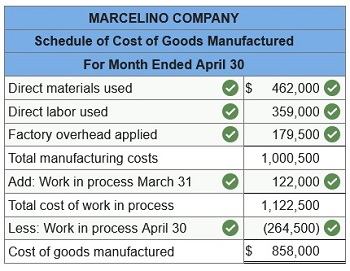

Q16. Marcelino Co.’s March 31 inventory of raw materials is $82,000. Raw materials purchases in April are $530,000, and factory payroll cost in April is $380,000. Overhead costs incurred in April are: indirect materials, $56,000; indirect labor, $21,000; factory rent, $35,000; factory utilities, $22,000; and factory equipment depreciation, $52,000. The predetermined overhead rate is 50% of direct labor cost. Job 306 is sold for $640,000 cash in April. Costs of the three jobs worked on in April follow.

| Job 306 | Job 307 | Job 308 | |

| Balances on March 31 | |||

| Direct materials | $25,000 | $40,000 | |

| Direct labor | 23,000 | 15,000 | |

| Applied overhead | 11,500 | 7,500 | |

| Costs during April | |||

| Direct materials | 137,000 | 215,000 | $110,000 |

| Direct labor | 104,000 | 152,000 | 103,000 |

| Applied overhead | ? | ? | ? |

| Status on April 30 | Finished (sold) | Finished (unsold) | In process |

3. Prepare a schedule of cost of goods manufactured.

Q17. Marcelino Co.’s March 31 inventory of raw materials is $82,000. Raw materials purchases in April are $530,000, and factory payroll cost in April is $380,000. Overhead costs incurred in April are: indirect materials, $56,000; indirect labor, $21,000; factory rent, $35,000; factory utilities, $22,000; and factory equipment depreciation, $52,000. The predetermined overhead rate is 50% of direct labor cost. Job 306 is sold for $640,000 cash in April. Costs of the three jobs worked on in April follow.

| Job 306 | Job 307 | Job 308 | |

| Balances on March 31 | |||

| Direct materials | $25,000 | $40,000 | |

| Direct labor | 23,000 | 15,000 | |

| Applied overhead | 11,500 | 7,500 | |

| Costs during April | |||

| Direct materials | 137,000 | 215,000 | $110,000 |

| Direct labor | 104,000 | 152,000 | 103,000 |

| Applied overhead | ? | ? | ? |

| Status on April 30 | Finished (sold) | Finished (unsold) | In process |

4-a. Compute gross profit for April.

4-b. Show how to present the inventories on the April 30 balance sheet.

Please click on Pay Now to get explanations to all answers at $40 (No Hidden Charges or any Sign Up Fee). In description, please don’t forget to mention the exam name – Connect Managerial Accounting Homework Chapter 2. We will send the explanation at your email id instantly. If you are looking for accounting class help for other fields then also you can connect with us anytime. We will provide high quality and accurate accounting assignment help for all questions…