Accounting Assignment Help » Managerial Accounting Assignment Help » Connect Managerial Accounting Chapter 4

Connect Managerial Accounting Chapter 4

Q1. Huffington Company uses a plantwide overhead rate to apply overhead. The predetermined overhead rate is based on machine hours. At the beginning of the year, the company made the following estimates: direct labor hours of 16,000, direct labor cost of $200,000, machine hours of 5,000, and total overhead costs of $25,000. On a per machine hour basis, the company’s plantwide overhead rate is:

- $8

- $50

- $5

- $100

Q2. Benson, Inc., manufactures a single product. The company’s plantwide overhead rate is $25 per machine-hour (MH). Each unit of product requires 0.6 machine hours. The direct material cost per unit of product is estimated at $10.96 and direct labor cost is estimated at $3.84 per unit. The overhead cost per unit is expected to be:

- $15.00

- $16.30

- $25.00

- $41.67

Q3. Benson, Inc., manufactures a single product. The company’s plantwide overhead rate is $25 per machine-hour (MH). Each unit of product requires 0.6 machine hours. The direct material cost per unit of product is estimated at $10.96 and direct labor cost is estimated at $3.84 per unit. The total unit cost of its product is estimated to be:

- $1.50

- $16.30

- $25.00

- $29.80

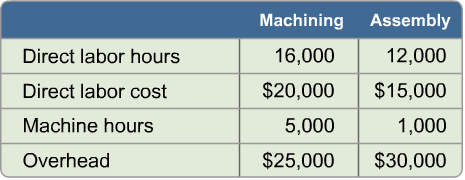

Q4. Assuming that overhead in the machining department is allocated on the basis of machine hours, and overhead in the assembly department is allocated on the basis of direct labor cost, the departmental overhead rates per unit of the related allocation bases in the Machining and Assembly Departments respectively will be:

- 110% and $15.00

- $5.00 and 50%

- $5.00 and 200%

- $8.00 and 50%

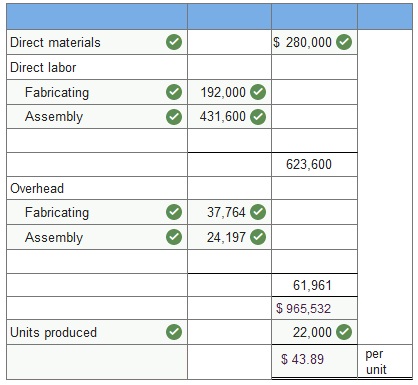

Q5. Laval produces lamps and home lighting fixtures. Its most popular product is a brushed aluminum desk lamp. This lamp is made from components shaped in the fabricating department and assembled in the assembly department. Information related to the 22,000 desk lamps produced annually follows.

| Direct materials | $280,000 |

| Direct labor | |

| Fabricating department (8,000 DLH × $24 per DLH) | $192,000 |

| Assembly department (16,600 DLH × $26 per DLH) | $431,600 |

| Machine hours | |

| Fabricating department | $15,200MH |

| Assembly department | $20,850MH |

Expected overhead cost and related data for the two production departments follow.

| Fabricating | Assembly | |

| Direct labor hours | 150,000DLH | 295,000DLH |

| Machine hours | 161,000MH | 128,000MH |

| Overhead cost | $400,000 | 430,000 |

Required

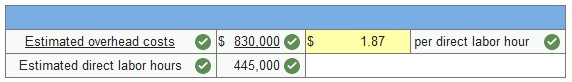

1. Determine the plantwide overhead rate for Laval using direct labor hours as a base.

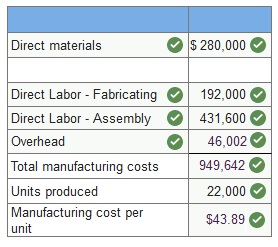

2. Determine the total manufacturing cost per unit for the aluminum desk lamp using the plantwide overhead rate.

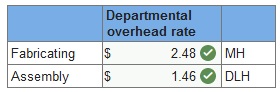

3. Compute departmental overhead rates based on machine hours in the fabricating department and direct labor hours in the assembly department.

4. Use departmental overhead rates from requirement 3 to determine the total manufacturing cost per unit for the aluminum desk lamps.

1. Determine the plantwide overhead rate for Laval using direct labor hours as a base.

2. Determine the total manufacturing cost per unit for the aluminum desk lamp using the plantwide overhead rate.

3. Compute departmental overhead rates based on machine hours in the fabricating department and direct labor hours in the assembly department.

4. Use departmental overhead rates from requirement 3 to determine the total manufacturing cost per unit for the aluminum desk lamps.

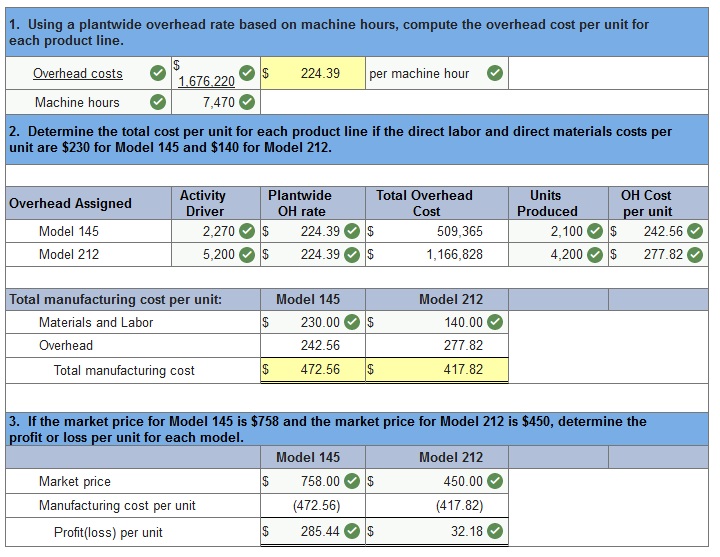

Q6. Way Cool produces two different models of air conditioners. The company produces the mechanical systems in their components department. The mechanical systems are combined with the housing assembly in its finishing department. The activities, costs, and drivers associated with these two manufacturing processes and the production support process follow. (Loss amounts should be indicated with a minus sign. Round your intermediate calculations and round “Cost per unit and OH rate” answers to 2 decimal places.)

| Process | Activity | Overhead Cost | Driver | Quantity |

| Components | Changeover | $459,000 | Number of batches | 910 |

| Machining | 301,200 | Machine hours | 7,470 | |

| Setups | 228,500 | Number of setups | 180 | |

| $988,700 | ||||

| Finishing | Welding | $180,400 | Welding hours | 3,700 |

| Inspecting | 222,000 | Number of inspections | 755 | |

| Rework | 60,450 | Rework orders | 250 | |

| $462,850 | ||||

| Support | Purchasing | $134,500 | Purchase orders | 548 |

| Providing space | 30,150 | Number of units | 6,300 | |

| Providing utilities | 60,020 | Number of units | 6,300 | |

| $224,670 |

Additional production information concerning its two product lines follows.

| Model 145 | Model 212 | |

| Units produced | 2,100 | 4,200 |

| Welding hours | 1,000 | 2,700 |

| Batches | 455 | 455 |

| Number of inspections | 470 | 285 |

| Machine hours | 2,270 | 5,200 |

| Setups | 90 | 90 |

| Rework orders | 140 | 110 |

| Purchase orders | 365 | 183 |

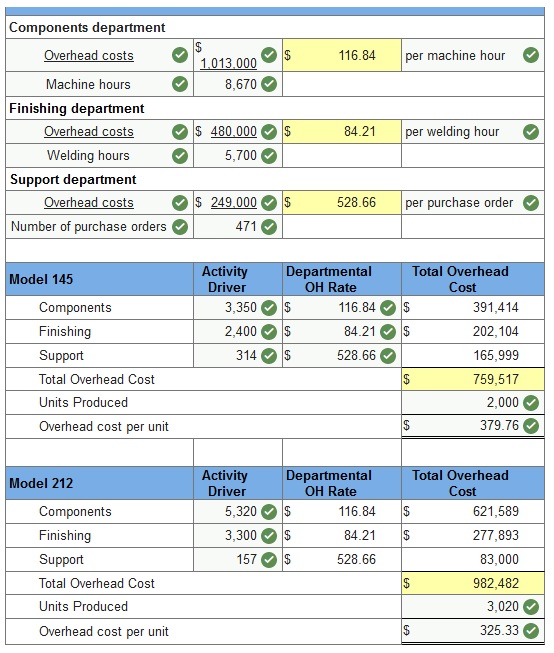

Q7. Way Cool produces two different models of air conditioners. The company produces the mechanical systems in their components department. The mechanical systems are combined with the housing assembly in its finishing department. The activities, costs, and drivers associated with these two manufacturing processes and the production support process follow.

| Process | Activity | Overhead Cost | Driver | Quantity |

| Components | Changeover | $474,000 | Number of batches | 870 |

| Machining | 307,000 | Machine hours | 8,670 | |

| Setups | 232,000 | Number of setups | 180 | |

| $1,013,000 | ||||

| Finishing | Welding | $184,000 | Welding hours | 5,700 |

| Inspecting | 234,000 | Number of inspections | 805 | |

| Rework | 62,000 | Rework orders | 250 | |

| $480,000 | ||||

| Support | Purchasing | $147,000 | Purchase orders | 471 |

| Providing space | 38,000 | Number of units | 5,020 | |

| Providing utilities | 64,000 | Number of units | 5,020 | |

| $249,000 |

Additional production information concerning its two product lines follows.

| Model 145 | Model 212 | |

| Units produced | 2,000 | 3020 |

| Welding hours | 2400 | 3300 |

| Batches | 435 | 435 |

| Number of inspections | 475 | 330 |

| Machine hours | 3350 | 5320 |

| Setups | 90 | 90 |

| Rework orders | 140 | 110 |

| Purchase orders | 314 | 157 |

Required:

1. Determine departmental overhead rates and compute the overhead cost per unit for each product line. Base your overhead assignment for the components department on machine hours. Use welding hours to assign overhead costs to the finishing department. Assign costs to the support department based on number of purchase orders.

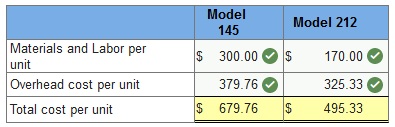

2. Determine the total cost per unit for each product line if the direct labor and direct materials costs per unit are $300 for Model 145 and $170 for Model 212.

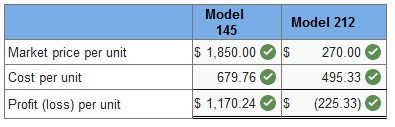

3. If the market price for Model 145 is $1,850 and the market price for Model 212 is $270, determine the profit or loss per unit for each model.

1. Determine departmental overhead rates and compute the overhead cost per unit for each product line. Base your overhead assignment for the components department on machine hours. Use welding hours to assign overhead costs to the finishing department. Assign costs to the support department based on number of purchase orders.

2. Determine the total cost per unit for each product line if the direct labor and direct materials costs per unit are $300 for Model 145 and $170 for Model 212.

3. If the market price for Model 145 is $1,850 and the market price for Model 212 is $270, determine the profit or loss per unit for each model.

Q8. Way Cool produces two different models of air conditioners. The company produces the mechanical systems in their components department. The mechanical systems are combined with the housing assembly in its finishing department. The activities, costs, and drivers associated with these two manufacturing processes and the production support process follow.

| Process | Activity | Overhead Cost | Driver | Quantity | |

| Components | Changeover | $453,750 | Number of batches | 750 | |

| Machining | 371,790 | Machine hours | 8,100 | ||

| Setups | 361,000 | Number of setups | 200 | ||

| $1,186,540 | |||||

| Finishing | Welding | $256,800 | 4,800 | ||

| Inspecting | 323,025 | Number of inspections | 885 | ||

| Rework | 63,000 | Rework orders | 210 | ||

| $642,825 | |||||

| Support | Purchasing | $205,205 | Purchase orders | 533 | |

| Providing space | 30,600 | Number of units | 5,700 | ||

| Providing utilities | 75,990 | Number of units | 5,700 | ||

| $311,795 |

Connect Managerial Accounting Chapter 4 Quiz

Q1. ABC assumes all costs are ________ because over the long run the company can adjust the amount of assets utilized.

- variable

- fixed

- direct

- committed

- nondiscritionary

Q2. Put the following ABC implementation steps in order ________.

- D Identify the activities and the overhead costs they cause.

- C Trace overhead costs to cost pools.

- B Compute the allocation rates.

- A Use the activity overhead rates to assign overhead costs to cost objects.

Q3. Which types of overhead allocation methods result in the use of more than one overhead rate during the same time period?

- Plantwide overhead rate method and departmental overhead rate method.

- Cost pool overhead rate method and plantwide overhead rate method.

- Departmental overhead rate method and activity-based costing.

- Activity-based costing and plantwide overhead rate method.

- Departmental overhead rate method and cost pool overhead rate method.

Q4. What are three advantages of activity-based costing over traditional volume-based allocation methods?

- Ease of use, more accurate product costing, and more effective cost control.

- Fewer allocation bases, ease of use, and a direct correlation to production volume.

- More accurate product costing, more effective cost control, and better focus on the relevant factors for decision making.

- More accurate product costing, fewer cost objects, and a direct correlation to production volume.

- More accurate product costing, ease of use, less costly to implement.

Q5. Which of the following is a disadvantage of the departmental overhead rate method?

- The departmental overhead rate method assigns overhead on the basis of volume-related measures.

- The departmental overhead rate method is more refined than the plantwide overhead rate method.

- The departmental overhead rate method does not assign overhead on the basis of volume-related measures.

- The departmental overhead rate method is simpler and less costly to implement than the plantwide rate method.

- There are no disadvantages of the departmental overhead rate method.

Q6. ABC costing might lead to:

- increasing the sales price of low-volume products.

- increasing the sales price of high-volume products.

- increasing low-volume products that appear to be profitable.

- decreasing high-volume products that appear to be unprofitable.

Q7.The cost object(s) of the activity-based costing method is(are):

- The unit of product.

- The production departments of the company.

- The production activities of the company.

- The production activities in the first stage and the unit of product in the second stage.

- The unit of product in the first stage and the production activities in the second stage.

Q8. What are the main advantages of volume-based allocation methods compared to activity-based costing?

- Volume-based methods are easier to use and less costly to implement and maintain.

- Volume-based methods are more accurate and allowed by GAAP

- Volume-based methods are less accurate and easier to use.

- Volume-based methods are harder to use and more costly to implement and maintain.

- There are no advantages to using volume-based methods.

Q9. Peterson Company estimates that overhead costs for the next year will be $6,520,000 for indirect labor and $550,000 for factory utilities. The company uses machine hours as its overhead allocation base. If 140,000 machine hours are planned for this next year, what is the company’s plantwide overhead rate? (Round your answer to two decimal places.)

- $0.02 per machine hour.

- $50.50 per machine hour.

- $45.75 per machine hour.

- $3.93 per machine hour.

- $0.25 per machine hour.

Q10. Which of the following statements is true with regard to the departmental overhead rate method?

- It is logical to use this method when overhead resources are consumed by various products in substantially the same way throughout multiple departments.

- It is logical to use this method when overhead resources are consumed by various products in substantially different ways throughout multiple departments.

- Each department has the same rate for the same activity pool.

- It requires one overhead cost pool and one rate.

- It is synonymous with activity-based costing.

Please contact us via live chat if you face difficulty in any of the question or exercise.