Accounting Assignment Help » Financial Accounting Assignment Help » Connect Financial Accounting Chapter 3 Homework

Connect Financial Accounting Chapter 3 Homework

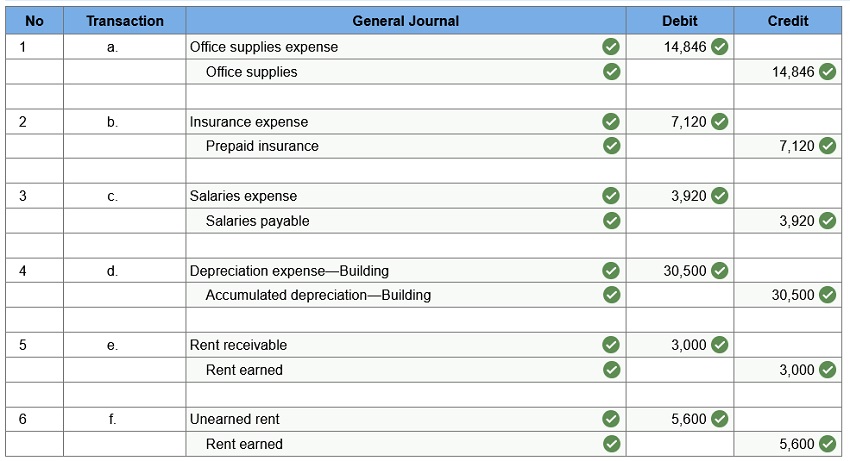

Q1. Arnez Company’s annual accounting period ends on December 31, 2019. The following information concerns the adjusting entries to be recorded as of that date.

a. The Office Supplies account started the year with a $4,000 balance. During 2019, the company purchased supplies for $13,400, which was added to the Office Supplies account. The inventory of supplies available at December 31, 2019, totaled $2,554.

b. An analysis of the company’s insurance policies provided the following facts.

| Policy | Date of Purchase | Months of Coverage | Cost |

| A | April 1, 2017 | 24 | $14,400 |

| B | April 1, 2018 | 36 | 12,960 |

| C | August 1, 2019 | 12 | 2,400 |

The total premium for each policy was paid in full (for all months) at the purchase date, and the Prepaid Insurance account was debited for the full cost. (Year-end adjusting entries for Prepaid Insurance were properly recorded in all prior years.)

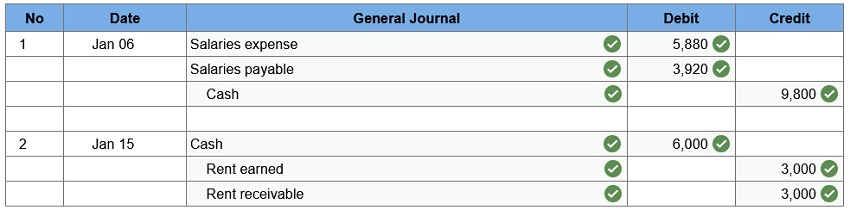

c. The company has 15 employees, who earn a total of $1,960 in salaries each working day. They are paid each Monday for their work in the five-day workweek ending on the previous Friday. Assume that December 31, 2019, is a Tuesday, and all 15 employees worked the first two days of that week. Because New Year’s Day is a paid holiday, they will be paid salaries for five full days on Monday, January 6, 2020.

d. The company purchased a building on January 1, 2019. It cost $960,000 and is expected to have a $45,000 salvage value at the end of its predicted 30-year life. Annual depreciation is $30,500.

e. Since the company is not large enough to occupy the entire building it owns, it rented space to a tenant at $3,000 per month, starting on November 1, 2019. The rent was paid on time on November 1, and the amount received was credited to the Rent Earned account. However, the tenant has not paid the December rent. The company has worked out an agreement with the tenant, who has promised to pay both December and January rent in full on January 15. The tenant has agreed not to fall behind again.

f. On November 1, the company rented space to another tenant for $2,800 per month. The tenant paid five months’ rent in advance on that date. The payment was recorded with a credit to the Unearned Rent account. Assume no other adjusting entries are made during the year.

Required:

Use the information to prepare adjusting entries as of December 31, 2019.

Prepare journal entries to record the first subsequent cash transaction in 2020 for parts c and e.

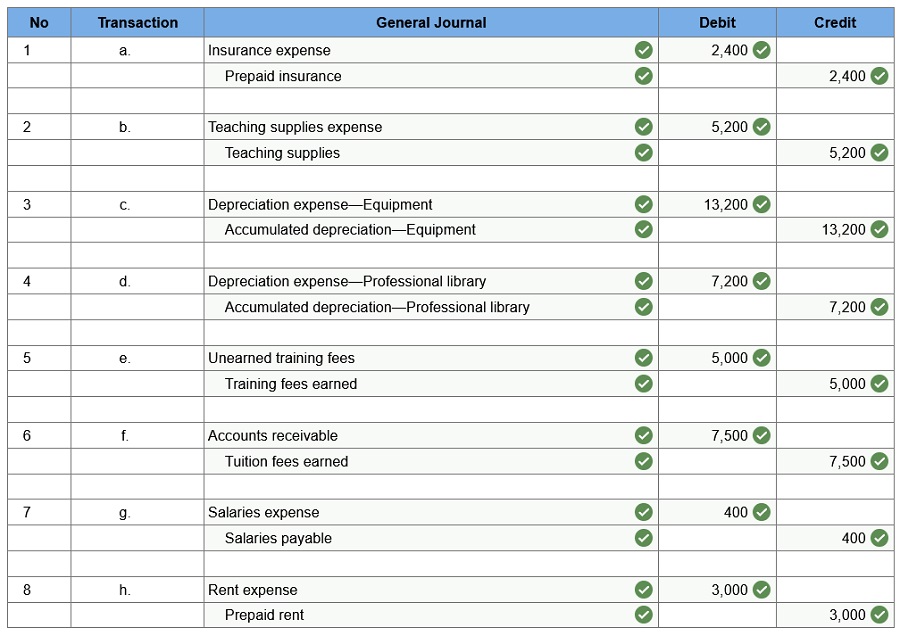

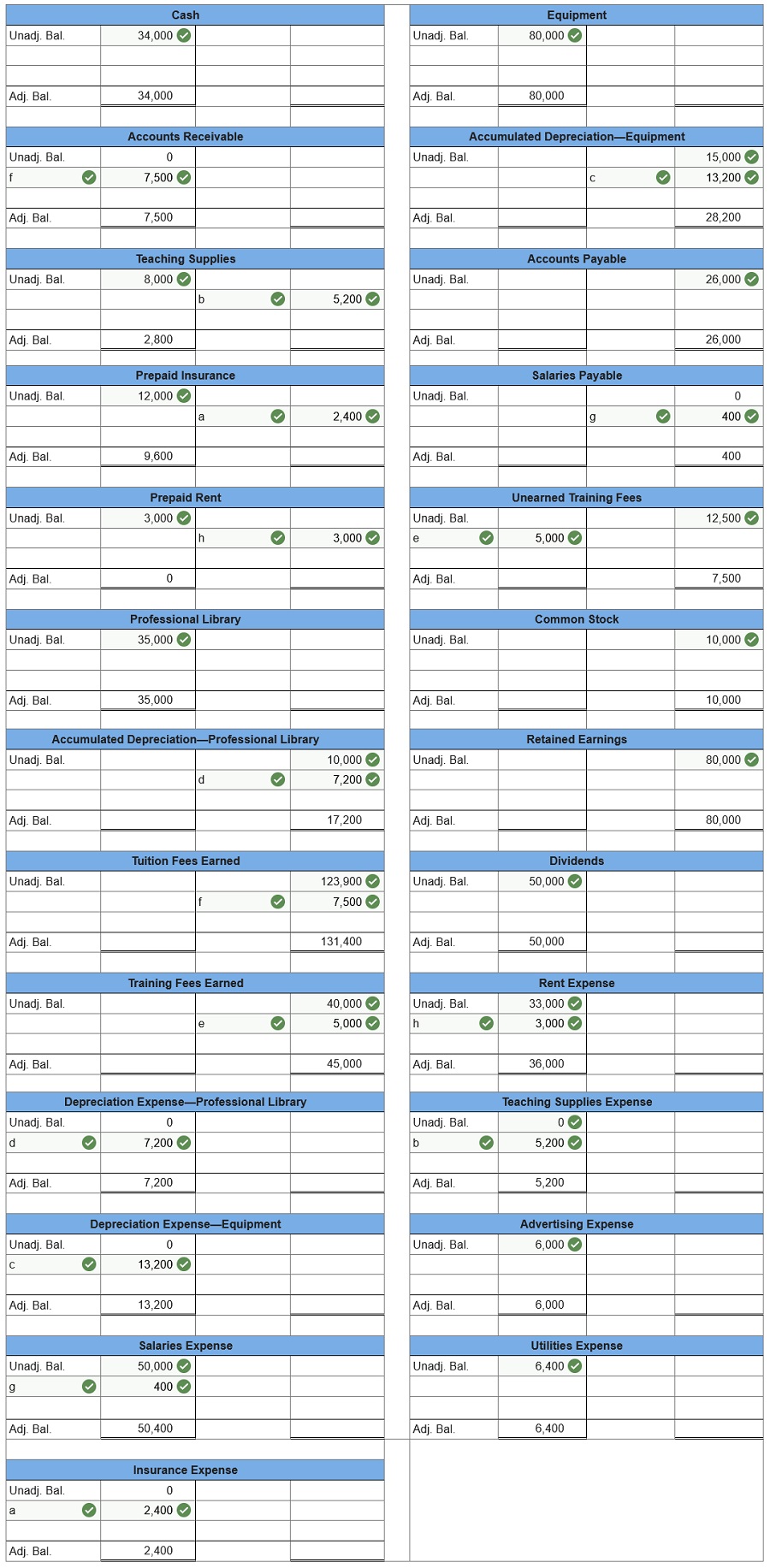

Q2. Wells Technical Institute (WTI), a school owned by Tristana Wells, provides training to individuals who pay tuition directly to the school. WTI also offers training to groups in off-site locations. WTI initially records prepaid expenses and unearned revenues in balance sheet accounts. Its unadjusted trial balance as of December 31 follows along with descriptions of items a through h that require adjusting entries on December 31.

Additional Information Items

- An analysis of WTI’s insurance policies shows that $2,400 of coverage has expired.

- An inventory count shows that teaching supplies costing $2,800 are available at year-end.

- Annual depreciation on the equipment is $13,200.

- Annual depreciation on the professional library is $7,200.

- On September 1, WTI agreed to do five courses for a client for $2,500 each. Two courses will start immediately and finish before the end of the year. Three courses will not begin until next year. The client paid $12,500 cash in advance for all five courses on September 1, and WTI credited Unearned Training Fees.

- On October 15, WTI agreed to teach a four-month class (beginning immediately) for an executive with payment due at the end of the class. At December 31, $7,500 of the tuition has been earned by WTI.

- WTI’s two employees are paid weekly. As of the end of the year, two days’ salaries have accrued at the rate of $100 per day for each employee.

- The balance in the Prepaid Rent account represents rent for December.

| WELLS TECHNICAL INSTITUTE Unadjusted Trial Balance December 31 |

|||||||||

| Debit | Credit | ||||||||

| Cash | $34,000 | ||||||||

| Accounts receivable | 0 | ||||||||

| Teaching supplies | 8,000 | ||||||||

| Prepaid insurance | 12,000 | ||||||||

| Prepaid rent | 3,000 | ||||||||

| Professional library | 35,000 | ||||||||

| Accumulated depreciation—Professional library | $10,000 | ||||||||

| Equipment | 80,000 | ||||||||

| Accumulated depreciation—Equipment | 15,000 | ||||||||

| Accounts payable | 26,000 | ||||||||

| Salaries payable | 0 | ||||||||

| Unearned training fees | 12,500 | ||||||||

| Common stock | 10,000 | ||||||||

| Retained earnings | 80,000 | ||||||||

| Dividends | 50,000 | ||||||||

| Tuition fees earned | 123,900 | ||||||||

| Training fees earned | 40,000 | ||||||||

| Depreciation expense—Professional library | 0 | ||||||||

| Depreciation expense—Equipment | 0 | ||||||||

| Salaries expense | 50,000 | ||||||||

| Insurance expense | 0 | ||||||||

| Rent expense | 33,000 | ||||||||

| Teaching supplies expense | 0 | ||||||||

| Advertising expense | 6,000 | ||||||||

| Utilities expense | 6,400 | ||||||||

| Totals | $317,400 | $317,400 | |||||||

1 Prepare the necessary adjusting journal entries for items a through h. Assume that adjusting entries are made only at year-end.

2a Post the balance from the unadjusted trial balance and the adjusting entries in to the T-accounts.

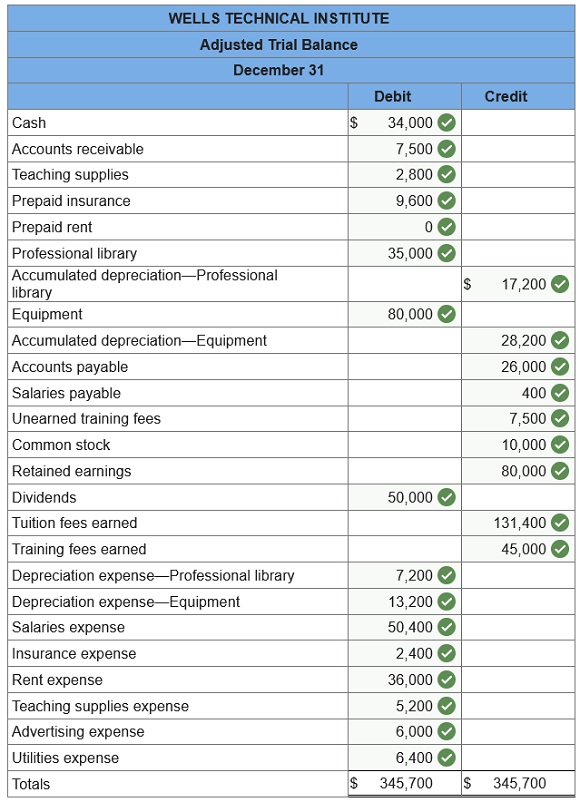

2b Prepare an adjusted trial balance.

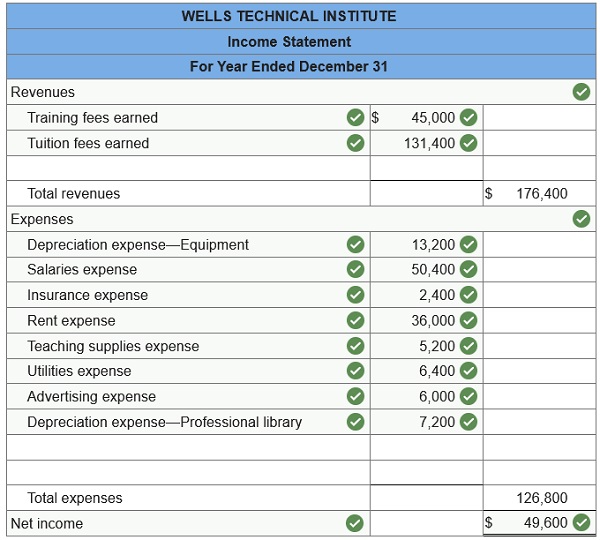

3a Prepare Wells Technical Institute’s income statement for the year.

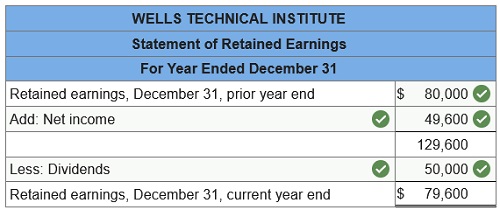

3b Prepare Wells Technical Institute’s statement of retained earnings for the year. The Retained Earnings account balance was $80,000 on December 31 of the prior year.

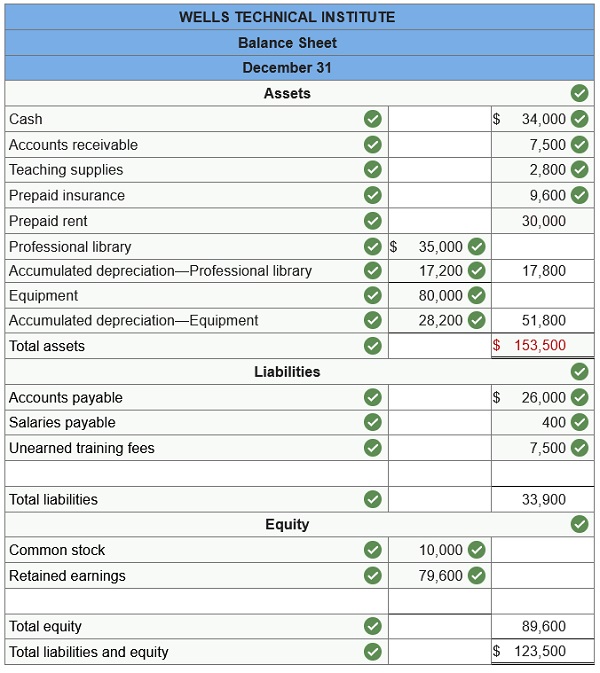

3c Prepare Wells Technical Institute’s balance sheet as of December 31.

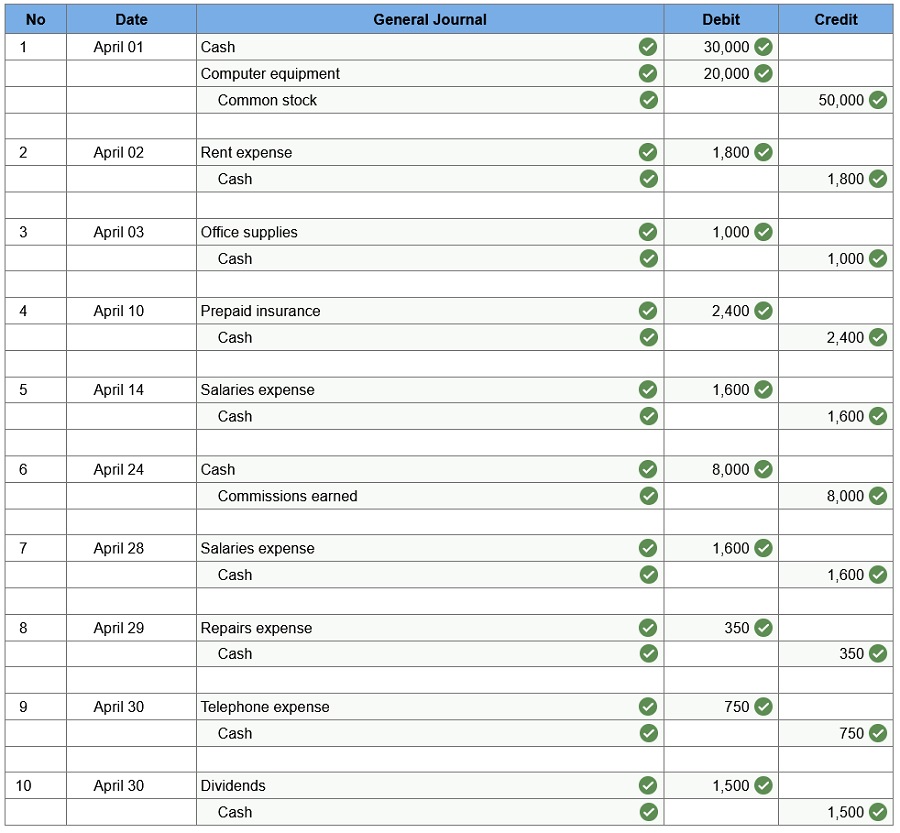

Q3. On April 1, Jiro Nozomi created a new travel agency, Adventure Travel. The following transactions occurred during the company’s first month.

| April 1 | Nozomi invested $30,000 cash and computer equipment worth $20,000 in the company in exchange for common stock. |

| April 2 | The company rented furnished office space by paying $1,800 cash for the first month’s (April) rent. |

| April 3 | The company purchased $1,000 of office supplies for cash. |

| April 10 | The company paid $2,400 cash for the premium on a 12-month insurance policy. Coverage begins on April 11. |

| April 14 | The company paid $1,600 cash for two weeks’ salaries earned by employees. |

| April 24 | The company collected $8,000 cash for commissions earned. |

| April 28 | The company paid $1,600 cash for two weeks’ salaries earned by employees. |

| April 29 | The company paid $350 cash for minor repairs to the company’s computer. |

| April 30 | The company paid $750 cash for this month’s telephone bill. |

| April 30 | The company paid $1,500 cash in dividends. |

The company’s chart of accounts follows.

| 101 | Cash | 405 | Commissions Earned |

| 106 | Accounts Receivable | 612 | Depreciation Expense—Computer Equip. |

| 124 | Office Supplies | 622 | Salaries Expense |

| 128 | Prepaid Insurance | 637 | Insurance Expense |

| 167 | Computer Equipment | 640 | Rent Expense |

| 168 | Accumulated Depreciation—Computer Equip. | 650 | Office Supplies Expense |

| 209 | Salaries Payable | 684 | Repairs Expense |

| 307 | Common Stock | 688 | Telephone Expense |

| 318 | Retained Earnings | 901 | Income Summary |

| 319 | Dividends | ||

Use the following information:

- Prepaid insurance of $133 has expired this month.

- At the end of the month, $600 of office supplies are still available.

- This month’s depreciation on the computer equipment is $500.

- Employees earned $420 of unpaid and unrecorded salaries as of month-end.

- The company earned $1,750 of commissions that are not yet billed at month-end.

Required:

1. & 2. Prepare journal entries to record the transactions for April and post them to the ledger accounts in Requirement 6b. The company records prepaid and unearned items in balance sheet accounts.

3. Using account balances from Requirement 6b, prepare an unadjusted trial balance as of April 30.

4. Journalize the adjusting entries for the month and prepare the adjusted trial balance.

5a. Prepare the income statement for the month of April 30.

5b. Prepare the statement of retained earnings for the month of April 30.

5c. Prepare the balance sheet at April 30.

6a. Prepare journal entries to close the temporary accounts and then post to Requirement 6b.

6b. Post the journal entries to the ledger.

7. Prepare a post-closing trial balance.

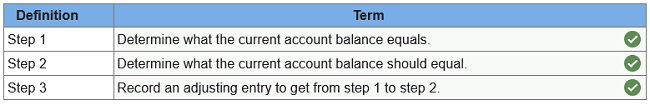

Q4. Place the steps in the three-step adjusting process in the correct order:

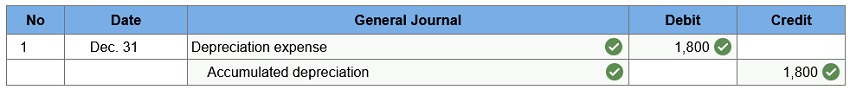

Q5. On January 1, the company purchased equipment that cost $10,000. The equipment is expected to be worth about (or has a salvage value of) $1,000 at the end of its useful life in five years. The company uses straight-line depreciation. It has not recorded any adjustments relating to this equipment during the current year. Complete the necessary December 31 journal entry by selecting the account names from the pull-down menus and entering dollar amounts in the debit and credit columns.

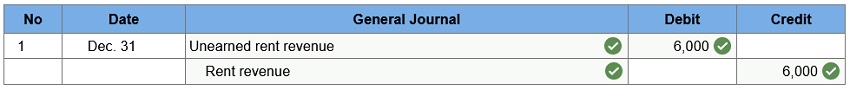

Q6. On November 1, the company rented space to another tenant. A check in the amount of $9,000, representing three months’ rent in advance, was received from the tenant on that date. The payment was recorded with a credit to the Unearned Rent Revenue account. Complete the necessary December 31 adjusting journal entry by selecting the account names from the pull-down menus and entering dollar amounts in the debit and credit columns.

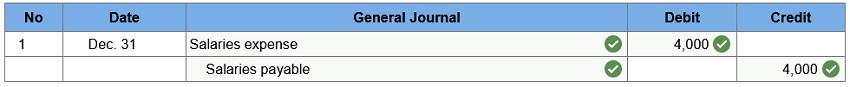

Q7. The company employs a single employee who works all five weekdays and is paid on the following Monday. The employee works the entire week ending on Friday, December 30. The employee earns $800 per day. Complete the necessary December 31 journal entry by selecting the account names from the pull-down menus and entering dollar amounts in the debit and credit columns.

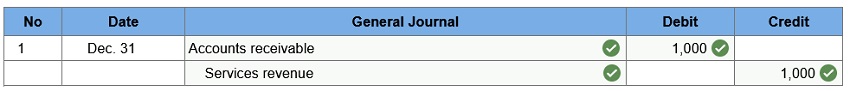

Q8. On Saturday, December 31, the company’s owner provided ten hours of service to a customer. The company bills $100 per hour for services provided on weekends. Payment has not yet been received. The owner did not stop in the office on Saturday; as such, on December 31, the services were unbilled and unrecorded. Complete the necessary December 31 journal entry by selecting the account names from the pull-down menus and entering dollar amounts in the debit and credit columns.

Q9. Before the adjusting entry for a deferral of an expense, the expenses will be _____ and the assets will be _____.

- Understated; overstated

- Overstated; understated

- Understated; understated

- Overstated; overstated

Q10. Assume that the Accumulated Depreciation account has an unadjusted normal balance of $120,000. The company’s list of adjusting entries includes one that debits Depreciation Expense and credits the Accumulated Depreciation account for $20,000. The adjusted balance in the Accumulated Depreciation account is a:

- credit balance of $140,000

- debit balance of $120,000

- credit balance of $120,000

- debit balance of $140,000

To get rest of the solutions, please connect with us via live chat or via WhatsApp at +44 7448-027841