Home » Accounting Assignment Help » Online Exam Help » Connect Financial Accounting Chapter 2

Connect Financial Accounting Chapter 2

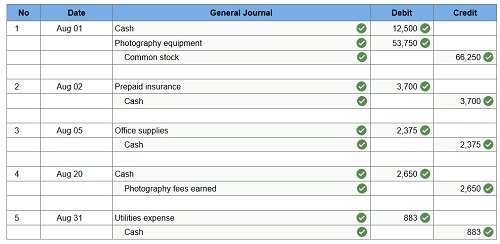

Q1. Following are the transactions of a new company called Pose-for-Pics.

- Aug 1 – Madison Harris, the owner, invested $12,500 cash and $53,750 of photography equipment in the company in exchange for common stock.

- Aug 2 – The company paid $3,700 cash for an insurance policy covering the next 24 months.

- Aug 5 – The company purchased office supplies for $2,375 cash.

- Aug 20 – The company received $2,650 cash in photography fees earned.

- Aug 31 – The company paid $883 cash for August utilities.

Prepare general journal entries for the above transactions.

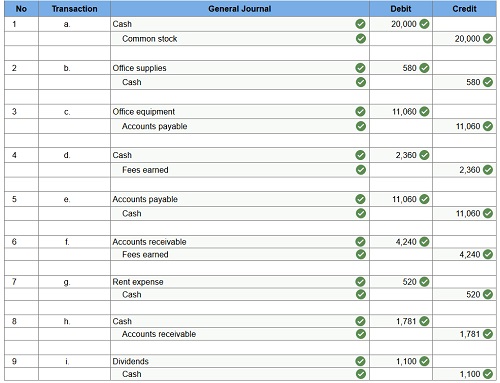

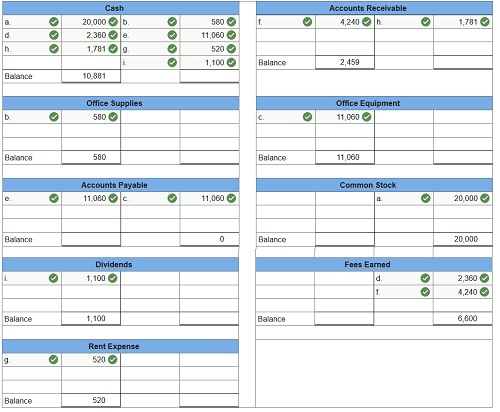

Q2. The transactions of Spade Company appear below.

- Kacy Spade, owner, invested $20,000 cash in the company in exchange for common stock.

- The company purchased office supplies for $580 cash.

- The company purchased $11,060 of office equipment on credit.

- The company received $2,360 cash as fees for services provided to a customer.

- The company paid $11,060 cash to settle the payable for the office equipment purchased in transaction c.

- The company billed a customer $4,240 as fees for services provided.

- The company paid $520 cash for the monthly rent.

- The company collected $1,781 cash as partial payment for the account receivable created in transaction f.

- The company paid $1,100 cash in dividends to the owner (sole shareholder).

Required:

1. Prepare general journal entries to record the transactions above for Spade Company by using the following accounts: Cash; Accounts Receivable; Office Supplies; Office Equipment; Accounts Payable; Common Stock; Dividends; Fees Earned; and Rent Expense. Use the letters beside each transaction to identify entries.

2. Post the above journal entries to T-accounts, which serve as the general ledger for this assignment.

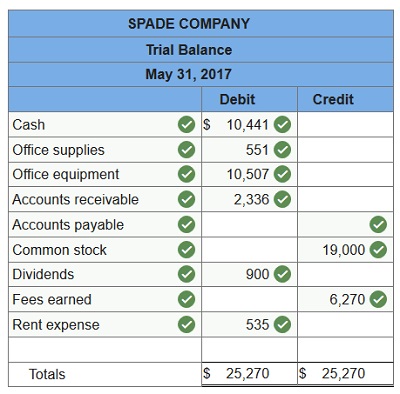

Q3. The transactions of Spade Company appear below.

- Kacy Spade, owner, invested $19,000 cash in the company in exchange for common stock.

- The company purchased office supplies for $551 cash.

- The company purchased $10,507 of office equipment on credit.

- The company received $2,242 cash as fees for services provided to a customer.

- The company paid $10,507 cash to settle the payable for the office equipment purchased in transaction c.

- The company billed a customer $4,028 as fees for services provided.

- The company paid $535 cash for the monthly rent.

- The company collected $1,692 cash as partial payment for the account receivable created in transaction f.

- The company paid $900 cash in dividends to the owner (sole shareholder).

Prepare the Trial Balance.

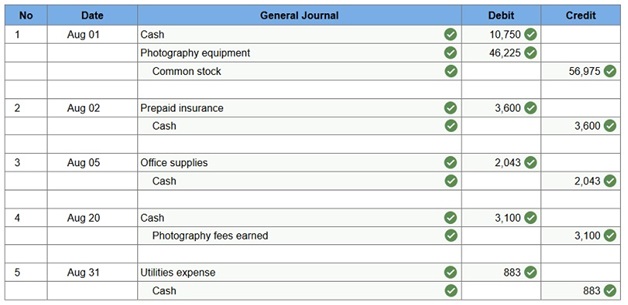

Q4. Following are the transactions of a new company called Pose-for-Pics.

| Aug. | 1 | Madison Harris, the owner, invested $10,750 cash and $46,225 of photography equipment in the company in exchange for common stock. |

| 2 | The company paid $3,600 cash for an insurance policy covering the next 24 months. | |

| 5 | The company purchased office supplies for $2,043 cash. | |

| 20 | The company received $3,100 cash in photography fees earned. | |

| 31 | The company paid $883 cash for August utilities. |

Prepare general journal entries for the above transactions.

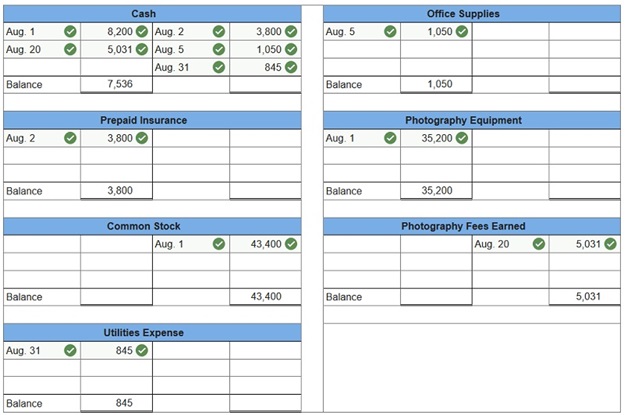

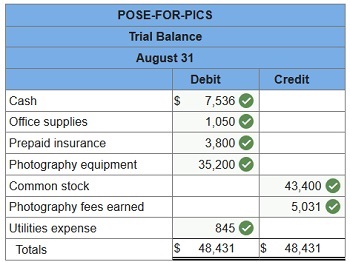

Q5. Following are the transactions of a new company called Pose-for-Pics.

| Aug. | 1 | Madison Harris, the owner, invested $8,200 cash and $35,200 of photography equipment in the company in exchange for common stock. |

| 2 | The company paid $3,800 cash for an insurance policy covering the next 24 months. | |

| 5 | The company purchased office supplies for $1,050 cash. | |

| 20 | The company received $5,031 cash in photography fees earned. | |

| 31 | The company paid $845 cash for August utilities. |

Required:

1. Post the transactions to the T-accounts.

2. Use the amounts from the T-accounts in Requirement (1) to prepare an August 31 trial balance for Pose-for-Pics.

Q6. The transactions of Spade Company appear below.

- Kacy Spade, owner, invested $18,750 cash in the company in exchange for common stock.

- The company purchased office supplies for $544 cash.

- The company purchased $10,369 of office equipment on credit.

- The company received $2,213 cash as fees for services provided to a customer.

- The company paid $10,369 cash to settle the payable for the office equipment purchased in transaction c.

- The company billed a customer $3,975 as fees for services provided.

- The company paid $530 cash for the monthly rent.

- The company collected $1,670 cash as partial payment for the account receivable created in transaction f.

- The company paid $1,000 cash in dividends to the owner (sole shareholder).

Prepare the Trial Balance.

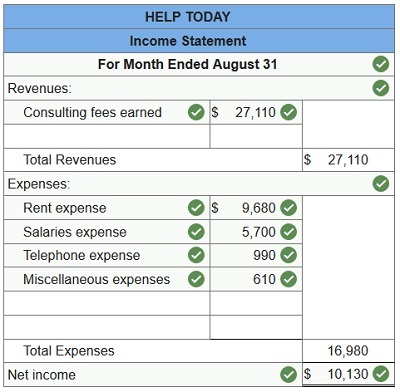

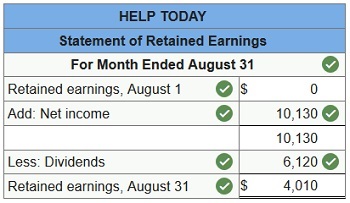

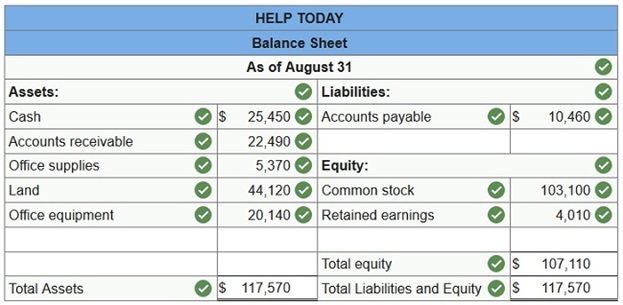

Q7. Carmen Camry operates a consulting firm called Help Today, which began operations on August 1. On August 31, the company’s records show the following accounts and amounts for the month of August.

| Cash | $25,450 | Consulting fees earned | $27,110 |

| Accounts receivable | 22,490 | Rent expense | 9,680 |

| Office supplies | 5,370 | Salaries expense | 5,700 |

| Land | 44,120 | Telephone expense | 990 |

| Office equipment | 20,140 | Miscellaneous expenses | 610 |

| Accounts payable | 10,460 | Common stock | 103,100 |

| Dividends | 6,120 |

Use the above information to prepare an August income statement for the business.

Q8. Use the above information to prepare an August statement of retained earnings for Help Today. (Hint: Net income for August is $10,130.)

Q9. Use the above information to prepare an August 31 balance sheet for Help Today. (Hint: The ending retained earnings account balance as of August 31 is $4,010.)

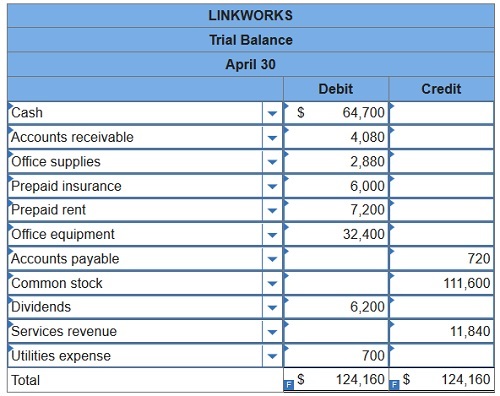

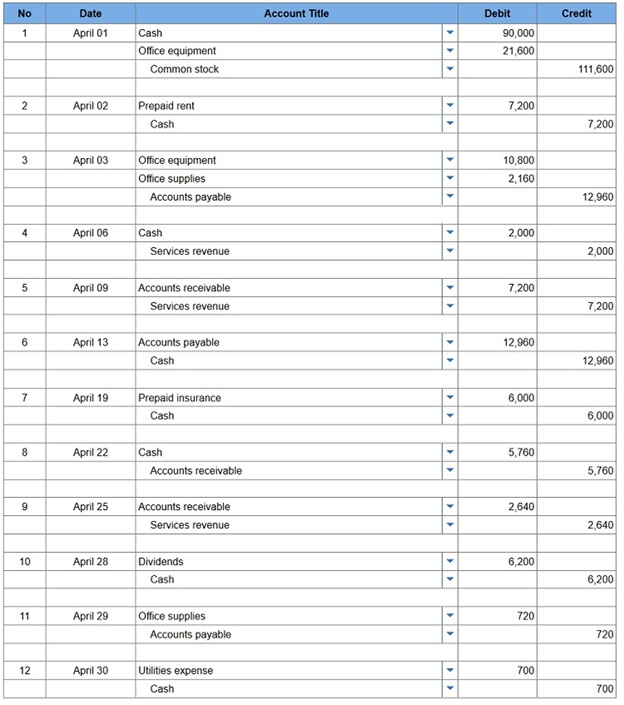

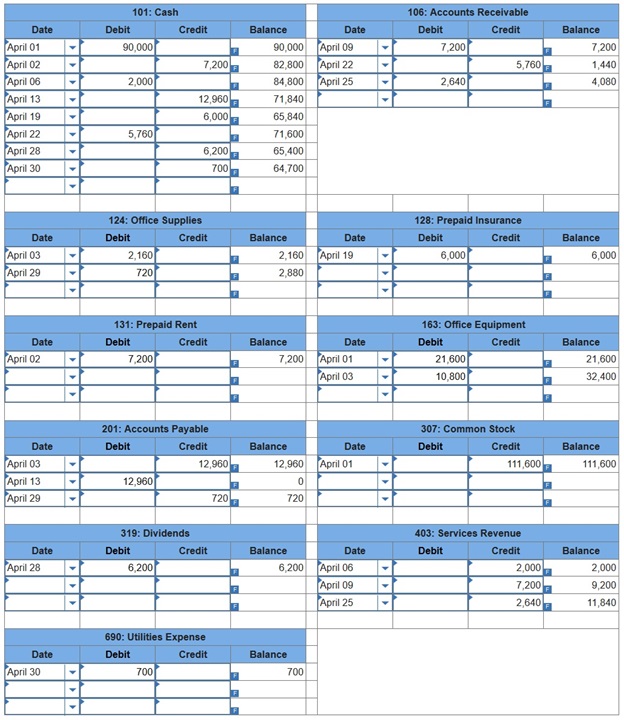

Q10. Karla Tanner opens a Web consulting business called Linkworks and completes the following transactions in its first month of operations.

| April | 1 | Tanner invested $90,000 cash along with office equipment valued at $21,600 n the company in exchange for common stock. |

| 2 | The company prepaid $7,200 cash for 12 months’ rent for office space. (Hint: Debit Prepaid Rent for $7,200.) | |

| 3 | The company made credit purchases for $10,800 in office equipment and $2,160 in office supplies. Payment is due within 10 days. | |

| 6 | The company completed services for a client and immediately received $2,000 cash. | |

| 9 | The company completed a $7,200 project for a client, who must pay within 30 days. | |

| 13 | The company paid $12,960 cash to settle the account payable created on April 3. | |

| 19 | The company paid $6,000 cash for the premium on a 12-month insurance policy. (Hint: Debit Prepaid Insurance for $6,000.) | |

| 22 | The company received $5,760 cash as partial payment for the work completed on April 9. | |

| 25 | The company completed work for another client for $2,640 on credit. | |

| 28 | The company paid $6,200 cash in dividends. | |

| 29 | The company purchased $720 of additional office supplies on credit. | |

| 30 | The company paid $700 cash for this month’s utility bill. |

Required:

1. Prepare general journal entries to record these transactions using the following titles: Cash (101); Accounts Receivable (106); Office Supplies (124); Prepaid Insurance (128); Prepaid Rent (131); Office Equipment (163); Accounts Payable (201); Common Stock (307); Dividends (319); Services Revenue (403); and Utilities Expense (690).

2. Post the journal entries from part 1 to the ledger accounts.

3. Prepare a trial balance as of April 30.