Home » Urgent Assignment Help » Finance Assignment Help » Connect Finance Week 5 Homework Assignment

Connect Finance Week 5 Homework Assignment

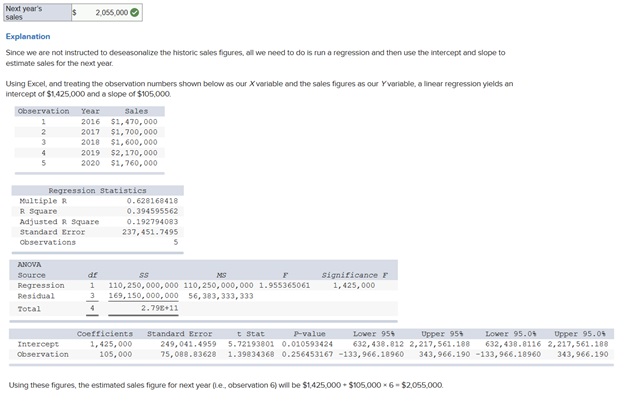

Q1. JohnBoy Industries has a cash balance of $44,000, accounts payable of $124,000, inventory of $174,000, accounts receivable of $209,000, notes payable of $119,000, and accrued wages and taxes of $36,500. How much net working capital does the firm need to fund?

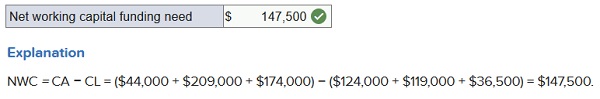

Q2. Dabble, Inc. has sales of $976,000 and cost of goods sold of $511,000. The firm had an average inventory of $44,000. What is the length of the days’ sales in inventory? (Use 365 days a year. Round your answer to 2 decimal places.)

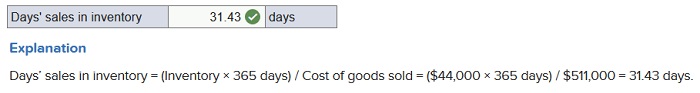

Q3. Suppose that Dunn Industries has annual sales of $4.05 million, cost of goods sold of $1,560,000, average inventories of $1,026,000, and average accounts receivable of $660,000. Assume that all of Dunn’s sales are on credit. What will be the firm’s operating cycle? (Use 365 days a year. Do not round intermediate calculations. Round your final answer to 2 decimal places.)

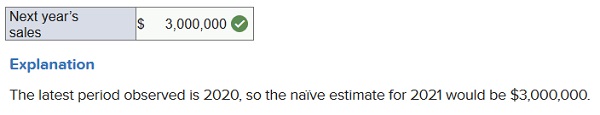

Q4. Suppose a firm has had the following historic sales figures.

| Year: | 2016 | 2017 | 2018 | 2019 | 2020 |

| Sales | $2,900,000 | $4,150,000 | $2,800,000 | $2,400,000 | $3,000,000 |

What would be the forecast for next year’s sales using the naïve approach?

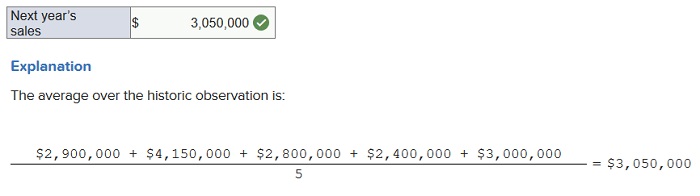

Q5. Suppose a firm has had the following historic sales figures.

| Year: | 2016 | 2017 | 2018 | 2019 | 2020 |

| Sales | $2,900,000 | $4,150,000 | $2,800,000 | $2,400,000 | $3,000,000 |

What would be the forecast for next year’s sales using the average approach?

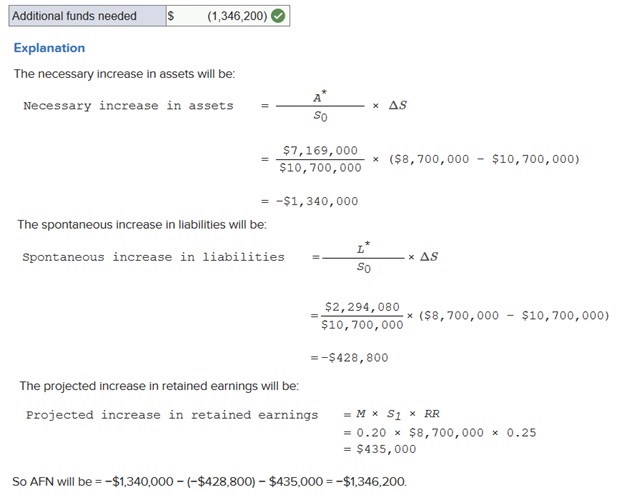

Q6. Suppose that Gyp Sum Industries currently has the balance sheet shown below, and that sales for the year just ended were $10.7 million. The firm also has a profit margin of 20 percent, a retention ratio of 25 percent, and expects sales of $8.7 million next year.

| Assets | Liabilities and Equity | ||||||

| Current assets | $ | 2,469,000 | Current liabilities | $ | 2,294,080 | ||

| Fixed assets | 4,700,000 | Long-term debt | 1,850,000 | ||||

| Equity | 3,024,920 | ||||||

| Total assets | $ | 7,169,000 | Total liabilities and equity | $ | 7,169,000 | ||

If all assets and current liabilities are expected to shrink with sales, what amount of additional funds will Gyp Sum need from external sources to fund the expected growth? (Enter your answer in dollars not in millions. Negative amount should be indicated by a minus sign.)

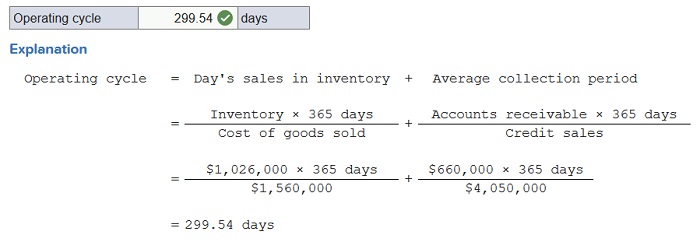

Q7. Suppose a firm has had the following historic sales figures.

| Year: | 2016 | 2017 | 2018 | 2019 | 2020 |

| Sales | $1,470,000 | $1,700,000 | $1,600,000 | $2,170,000 | $1,760,000 |

What would be the forecast for next year’s sales using regression to estimate a trend?