Home » Online Exam Help » Accounting Exam Help » Connect Financial Accounting Chapter 8

Connect Financial Accounting Chapter 8

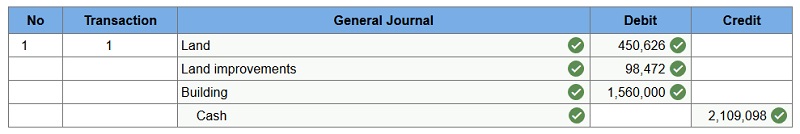

Q1. Cala Manufacturing purchases a large lot on which an old building is located as part of its plans to build a new plant. The negotiated purchase price is $228,000 for the lot plus $123,000 for the old building. The company pays $40,200 to tear down the old building and $59,426 to fill and level the lot. It also pays a total of $1,658,472 in construction costs—this amount consists of $1,560,000 for the new building and $98,472 for lighting and paving a parking area next to the building.

Prepare a single journal entry to record these costs incurred by Cala, all of which are paid in cash.

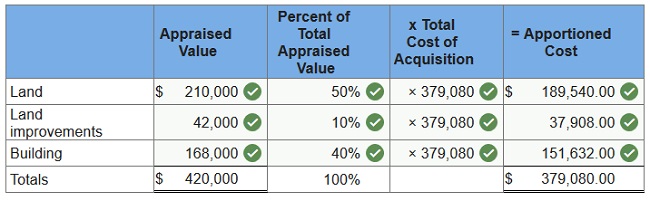

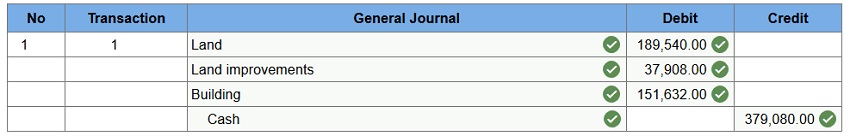

Q2. Rodriguez Company pays $360,000 for real estate plus $19,080 in closing costs. The real estate consists of land appraised at $210,000; land improvements appraised at $42,000; and a building appraised at $168,000.

Required:

1. Allocate the total cost among the three purchased assets.

2. Prepare the journal entry to record the purchase.

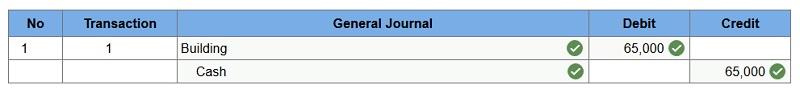

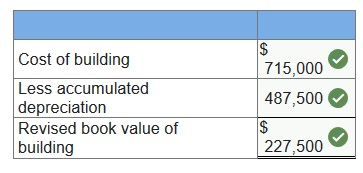

Q3. Martinez Company owns a building that appears on its prior year-end balance sheet at its original $650,000 cost less $487,500 accumulated depreciation. The building is depreciated on a straight-line basis assuming a 20-year life and no salvage value. During the first week in January of the current calendar year, major structural repairs are completed on the building at a $65,000 cost. The repairs extend its useful life for 5 years beyond the 20 years originally estimated.

1. Determine the building’s age (plant asset age) as of the prior year-end balance sheet date.

![]()

2. Prepare the entry to record the cost of the structural repairs that are paid in cash.

3. Determine the book value of the building immediately after the repairs are recorded.

4. Prepare the entry to record the current calendar year’s depreciation.

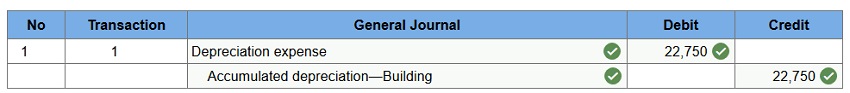

Q4. Diaz Company owns a milling machine that cost $126,600 and has accumulated depreciation of $90,100. Prepare the entry to record the disposal of the milling machine on January 3 under each of the following independent situations.

- The machine needed extensive repairs, and it was not worth repairing. Diaz disposed of the machine, receiving nothing in return.

- Diaz sold the machine for $16,700 cash.

- Diaz sold the machine for $36,500 cash.

- Diaz sold the machine for $40,800 cash.

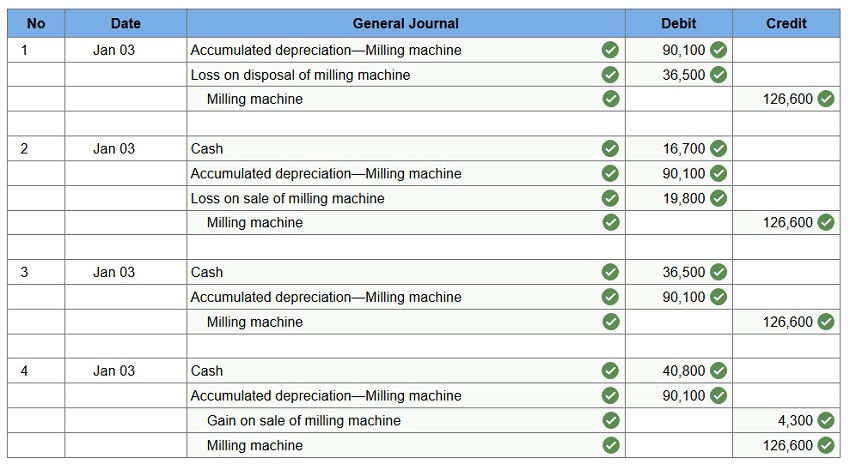

Q5. On April 2, 2017, Montana Mining Co. pays $4,248,270 for an ore deposit containing 1,598,000 tons. The company installs machinery in the mine costing $238,000, with an estimated seven-year life and no salvage value. The machinery will be abandoned when the ore is completely mined. Montana begins mining on May 1, 2017, and mines and sells 142,700 tons of ore during the remaining eight months of 2017.

Prepare the December 31, 2017, entries to record both the ore deposit depletion and the mining machinery depreciation. Mining machinery depreciation should be in proportion to the mine’s depletion. (Do not round intermediate calculations. Round your final answers to the nearest whole number.)

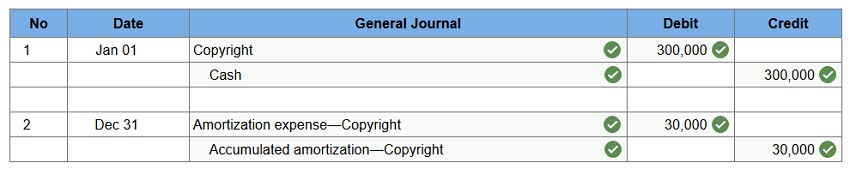

Q6. Milano Gallery purchases the copyright on an oil painting for $300,000 on January 1, 2017. The copyright legally protects its owner for 10 more years. The company plans to market and sell prints of the original for 19 years.

Prepare entries to record the purchase of the copyright on January 1, 2017, and its annual amortization on December 31, 2017.

Q7. On January 1, 2017, Robinson Company purchased Franklin Company at a price of $3,900,000. The fair market value of the net assets purchased equals $2,750,000.

1. What is the amount of goodwill that Robinson records at the purchase date?

![]()

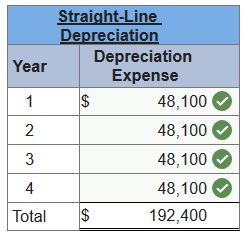

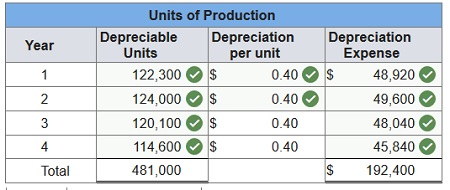

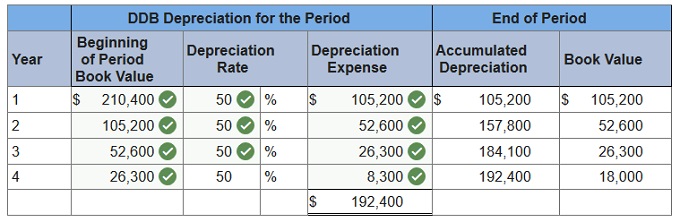

Q8. A machine costing $210,400 with a four-year life and an estimated $18,000 salvage value is installed in Luther Company’s factory on January 1. The factory manager estimates the machine will produce 481,000 units of product during its life. It actually produces the following units: 122,300 in 1st year, 124,000 in 2nd year, 120,100 in 3rd year, 124,600 in 4th year. The total number of units produced by the end of year 4 exceeds the original estimate—this difference was not predicted. (The machine must not be depreciated below its estimated salvage value.)

Required: Compute depreciation for each year (and total depreciation of all years combined) for the machine under each depreciation method.

Connect Financial Accounting Chapter 8 Quiz

Q1. Which of the following would be classified as a natural resource?

- Patent on an oil extraction process.

- Land held as an investment.

- Timber purchased by a lumber yard.

- Diamond mine.

Q2. A company purchased a mineral deposit for $800,000. It expects this property to produce 120,000 tons of minerals and to have a salvage value of $50,000. In the current year, the company mined and sold 9,000 tons of minerals. Its depletion expense for the current period equals:

- $15,000

- $60,000

- $150,000

- $56,250

- $139,500

Q3. The straight-line depreciation method and the double-declining-balance depreciation method:

- Produce the same total depreciation over an asset’s useful life.

- Produce the same depreciation expense each year.

- Produce the same book value each year.

- Are acceptable for tax purposes only.

- Are the only acceptable methods of depreciation for financial reporting.

Q4. Mohr Company purchases a machine at the beginning of the year at a cost of $24,000. The machine is depreciated using the straight-line method. The machine’s useful life is estimated to be 5 years with a $4,000 salvage value. Depreciation expense in year 2 is:

- $4,800

- $4,000

- $9,600

- $20,000

- $0

Q5. Bering Rock acquires a granite quarry at a cost of $590,000, which is estimated to contain 200,000 tons of granite and is expected to take 6 years to remove. Compute the depletion expense for the first year assuming 38,000 tons were removed and sold.

- $98,333

- $93,158

- $38,000

- $12,881

- $112,100

Q6. Minor Company installs a machine in its factory at the beginning of the year at a cost of $135,000. The machine’s useful life is estimated to be 5 years, or 300,000 units of product, with a $15,000 salvage value. During its first year, the machine produces 64,500 units of product. Determine the machines’ first year depreciation under the double-declining-balance method.

- $66,000

- $54,000

- $24,000

- $25,800

- $48,000

Q7. Bering Rock acquires a granite quarry at a cost of $590,000, which is estimated to contain 200,000 tons of granite and is expected to take 6 years to remove. What journal entry would be needed to record the expense for the first year assuming 38,000 tons were removed and sold?

- Debit Depletion Expense $112,100; credit Accumulated Depletion $112,100.

- Debit Amortization Expense $112,100; credit Natural Resources $112,100.

- Debit Depreciation Expense $93,158; credit Accumulated Depreciation $93,158.

- Debit Depletion Expense $93,158; credit Accumulated Depletion $93,158.

- Debit Depreciation Expense $98,333; credit Accumulated Depreciation $98,333.

Q8. A company purchased a tract of land for its natural resources at a cost of $1,500,000. It expects to mine 2,000,000 tons of ore from this land. The salvage value of the land is expected to be $250,000. The depletion expense per ton of ore is:

- $0.75

- $0.625

- $0.875

- $6.00

- $8.00

Q9. Marlow Company purchased a point of sale system on January 1 for $3,400. This system has a useful life of 10 years and a salvage value of $400. What would be the depreciation expense for the first year of its useful life using the double-declining-balance method?

- $680

- $2,320

- $2,720

- $600

- $300

Q10. Total asset turnover is used to evaluate:

- The efficient use of assets to generate sales.

- The necessity for asset replacement.

- The number of times operating assets were sold during the year.

- The cash flows used to acquire assets.

- The relation between asset cost and book value.

If the digits in your course is different, you can connect with us via live chat or you can submit your assignment details using the Submit Requirements form given in the right sidebar. We will get back to you soon.