Accounting Assignment Help » Managerial Accounting Assignment Help » Online Exam Help » Managerial Accounting Final Exam

Master Course Managerial Accounting Final Exam

Q1. Schuepfer Inc. bases its selling and administrative expense budget on budgeted unit sales. The sales budget shows 1,900 units are planned to be sold in March. The variable selling and administrative expense is $4.80 per unit. The budgeted fixed selling and administrative expense is $35,690 per month, which includes depreciation of $3,400 per month. The remainder of the fixed selling and administrative expense represents current cash flows. The cash disbursements for selling and administrative expenses on the March selling and administrative expense budget should be:

Q1. Schuepfer Inc. bases its selling and administrative expense budget on budgeted unit sales. The sales budget shows 1,900 units are planned to be sold in March. The variable selling and administrative expense is $4.80 per unit. The budgeted fixed selling and administrative expense is $35,690 per month, which includes depreciation of $3,400 per month. The remainder of the fixed selling and administrative expense represents current cash flows. The cash disbursements for selling and administrative expenses on the March selling and administrative expense budget should be:

- $44,810

- $41,410

- $32,290

- $9,120

Q2. Helmers Corporation manufactures a single product. Variable costing net operating income last year was $95,000 and this year was $113,800. Last year, $35,400 in fixed manufacturing overhead costs were released from inventory under absorption costing. This year, $13,300 in fixed manufacturing overhead costs were deferred in inventory under absorption costing. What was the absorption costing net operating income last year?

- $59,600

- $130,400

- $100,500

- $95,000

Q3. Wimpy Inc. produces and sells a single product. The selling price of the product is $200.00 per unit and its variable cost is $60.00 per unit. The fixed expense is $407,820 per month. The break-even in monthly dollar sales is closest to: (Round your intermediate calculations to 2 decimal places.)

- $1,359,400

- $951,580

- $407,820

- $582,600

Q4. Eban Corporation uses the FIFO method in its process costing system. The first processing department, the Welding Department, started the month with 19,500 units in its beginning work in process inventory that were 50% complete with respect to conversion costs. The conversion cost in this beginning work in process inventory was $57,200. An additional 60,000 units were started into production during the month. There were 17,000 units in the ending work in process inventory of the Welding Department that were 20% complete with respect to conversion costs. A total of $294,160 in conversion costs were incurred in the department during the month. The cost per equivalent unit for conversion costs is closest to:

- $5.12

- $5.75

- $4.56

- $5.24

Q5. Jilk Inc.’s contribution margin ratio is 62% and its fixed monthly expenses are $46,500. Assuming that the fixed monthly expenses do not change, what is the best estimate of the company’s net operating income in a month when sales are $135,000?

- $88,500

- $83,700

- $4,800

- $37,200

Q6. Acheson Corporation, which applies manufacturing overhead on the basis of machine-hours, has provided the following data for its most recent year of operations.

| Estimated manufacturing overhead | $157,800 |

| Estimated machine-hours | 4,650 |

| Actual manufacturing overhead | $157,500 |

| Actual machine-hours | 4,880 |

The estimates of the manufacturing overhead and of machine-hours were made at the beginning of the year for the purpose of computing the company’s predetermined overhead rate for the year. The predetermined overhead rate is closest to:

- $33.94

- $32.27

- $33.87

- $42.62

Q7. Creswell Corporation’s fixed monthly expenses are $25,000 and its contribution margin ratio is 67%. Assuming that the fixed monthly expenses do not change, what is the best estimate of the company’s net operating income in a month when sales are $82,000?

- $2,060

- $54,940

- $57,000

- $29,940

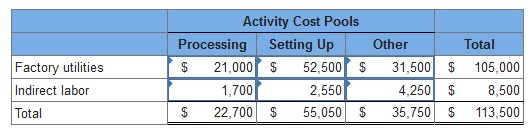

Q8. Hagy Corporation has an activity-based costing system with three activity cost pools–Processing, Setting Up, and Other. The company’s overhead costs, which consist of factory utilities and indirect labor, are allocated to the cost pools in proportion to the activity cost pools’ consumption of resources. Data concerning the company’s costs and activity-based costing system appear below:

| Factory utilities (total) | $105,000 |

| Indirect labor (total) | $8,500 |

Distribution of Resource Consumption Across Activity Cost Pools

| Processing | Setting Up | Other | |

| Factory utilities | 0.20 | 0.50 | 0.30 |

| Indirect labor | 0.20 | 0.30 | 0.50 |

Required: Assign overhead costs to activity cost pools using activity-based costing.

Q9. Mahon Corporation has two production departments, Casting and Customizing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Casting Department’s predetermined overhead rate is based on machine-hours and the Customizing Department’s predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:

| Casting | Customizing | |

| Machine-hours | 19,400 | 15,400 |

| Direct labor-hours | 6,500 | 7,700 |

| Total fixed manufacturing overhead cost | $120,280 | $81,620 |

| Variable manufacturing overhead per machine-hour | $1.80 | |

| Variable manufacturing overhead per direct labor-hour | $3.50 |

During the current month the company started and finished Job T138. The following data were recorded for this job:

| Job T138: | Casting | Customizing |

| Machine-hours | 80 | 60 |

| Direct labor-hours | 15 | 80 |

The amount of overhead applied in the Customizing Department to Job T138 is closest to: (Round your intermediate calculations to 2 decimal places.)

- $1,056

- $528

- $1,128

- $108,570

Q10. Lupo Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on the following data:

| Total machine-hours | 30,300 | |

| Total fixed manufacturing overhead cost | $575,700 | |

| Variable manufacturing overhead per machine-hour | $4 |

Recently, Job T687 was completed with the following characteristics:

| Number of units in the job | 10 |

| Total machine-hours | 30 |

| Direct materials | $730 |

| Direct labor cost | $1,460 |

The amount of overhead applied to Job T687 is closest to: (Round your intermediate calculations to 2 decimal places.)

- $690.00

- $805.20

- $575.70

- $138.00

Q11. Tabet Corporation uses the FIFO method in its process costing system. Operating data for the Curing Department for the month of March appear below:

| Units | Percent Complete with Respect to Conversion | |

| Beginning work in process inventory | 6,400 | 70% |

| Transferred in from the prior department during March | 57,700 | |

| Completed and transferred to the next department during March | 59,400 | |

| Ending work in process inventory | 4,700 | 90% |

According to the company’s records, the conversion cost in beginning work in process inventory was $21,049 at the beginning of March. The cost per equivalent unit for conversion costs for March was $5.70. How much conversion cost would be assigned to the units completed and transferred out of the department during March?

- $333,694

- $334,093

- $322,100

- $313,044

Q12. Mirabile Corporation uses activity-based costing to compute product margins. Overhead costs have already been allocated to the company’s three activity cost pools–Processing, Supervising, and Other. The costs in those activity cost pools appear below:

| Processing | $7,020 |

| Supervising | $41,040 |

| Other | $12,400 |

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:

| MHs (Processing) |

Batches (Supervising) |

|

| Product M0 | 12,825 | 950 |

| Product M5 | 675 | 950 |

| Total | 13,500 | 1,900 |

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

| Product M0 | Product M5 | |||

| Sales (total) | $88,700 | $99,900 | ||

| Direct materials (total) | $30,500 | $33,400 | ||

| Direct labor (total) | $29,800 | $43,700 |

What is the overhead cost assigned to Product M5 under activity-based costing?

- $36,880

- $20,871

- $41,000

- $24,400

Q13. The following standards for variable manufacturing overhead have been established for a company that makes only one product:

| Standard hours per unit of output | 8.0 hours |

| Standard variable overhead rate | $14.40 per hour |

The following data pertain to operations for the last month:

| Actual hours | 2,850 hours |

| Actual total variable manufacturing overhead cost | $41,770 |

| Actual output | 200 units |

What is the variable overhead efficiency variance for the month?

- $23,040 F

- $18,730 U

- $18,000 U

- $730 U

Q14. Tubaugh Corporation has two major business segments–East and West. In December, the East business segment had sales revenues of $280,000, variable expenses of $155,000, and traceable fixed expenses of $35,000. During the same month, the West business segment had sales revenues of $950,000, variable expenses of $496,000, and traceable fixed expenses of $181,000. The common fixed expenses totaled $270,000 and were allocated as follows: $135,000 to the East business segment and $135,000 to the West business segment. The contribution margin of the West business segment is:

- $585,000

- $(33,000)

- $90,000

- $454,000

Q15. Ibarra Corporation uses the FIFO method in its process costing system. The first processing department, the Forming Department, started the month with 16,400 units in its beginning work in process inventory that were 20% complete with respect to conversion costs. The conversion cost in this beginning work in process inventory was $23,250. An additional 101,000 units were started into production during the month and 104,000 units were completed and transferred to the next processing department. There were 13,400 units in the ending work in process inventory of the Forming Department that were 30% complete with respect to conversion costs. A total of $597,123 in conversion costs were incurred in the department during the month. The cost per equivalent unit for conversion costs for the month is closest to:

- $5.92

- $5.22

- $5.90

- $5.70

Q16. Sorin Inc., a company that produces and sells a single product, has provided its contribution format income statement for January.

| Sales (4,300 units) | $94,600 |

| Variable expenses | 47,300 |

| Contribution margin | 47,300 |

| Fixed expenses | 35,000 |

| Net operating income | $12,300 |

If the company sells 4,900 units, its total contribution margin should be closest to: (Do not round intermediate calculations.)

- $53,900

- $14,016

- $71,000

- $47,300

Q17. Bade Midwifery’s cost formula for its wages and salaries is $1,350 per month plus $232 per birth. For the month of October, the company planned for activity of 115 births, but the actual level of activity was 111 births. The actual wages and salaries for the month was $28,065. The activity variance for wages and salaries in October would be closest to:

- $928 U

- $928 F

- $35 U

- $35 F

Q18. Laurant Corporation uses the FIFO method in its process costing system. Department A is the first stage of the company’s production process. The following information is available for conversion costs for the month of May for Department A:

| Units | |

| Work in process, beginning (40% complete with respect to conversion costs) | 5,700 |

| Started in May | 49,000 |

| Completed in May and transferred to Department B | 44,000 |

| Work in process, ending (30% complete with respect to conversion costs) | 8,700 |

The equivalent units of production for conversion costs for the month is closest to:

- 40,580 units

- 40,910 units

- 41,720 units

- 44,330 units

Q19. During June, Buttrey Corporation incurred $79,000 of direct labor costs and $19,000 of indirect labor costs. The journal entry to record the accrual of these wages would include a:

- debit to Work in Process of $98,000.

- credit to Work in Process of $79,000.

- credit to Work in Process of $98,000.

- debit to Work in Process of $79,000.

Q20. On November 1, Arvelo Corporation had $33,500 of raw materials on hand. During the month, the company purchased an additional $76,500 of raw materials. During November, $92,000 of raw materials were requisitioned from the storeroom for use in production. These raw materials included both direct and indirect materials. The indirect materials totaled $3,300. Prepare journal entries to record these events. Use those journal entries to answer the following questions:

The credits to the Raw Materials account for the month of November total:

- $33,500

- $92,000

- $76,500

- $110,000

Q21. The following data have been recorded for recently completed Job 450 on its job cost sheet. Direct materials cost was $2,132. A total of 40 direct labor-hours and 238 machine-hours were worked on the job. The direct labor wage rate is $17 per labor-hour. The Corporation applies manufacturing overhead on the basis of machine-hours. The predetermined overhead rate is $23 per machine-hour. The total cost for the job on its job cost sheet would be:

- $8,286

- $10,431

- $5,661

- $5,242

Q22. The following materials standards have been established for a particular product:

| Standard quantity per unit of output | 5.5 meters |

| Standard price | $19.10 per meter |

The following data pertain to operations concerning the product for the last month:

| Actual materials purchased | 9,100 meters |

| Actual cost of materials purchased | $182,700 |

| Actual materials used in production | 8,600 meters |

| Actual output | 1,540 units |

What is the materials price variance for the month?

- $2,610 U

- $16,450 U

- $8,890 U

- $9,600 U

Q23. Gullett Corporation had $44,000 of raw materials on hand on November 1. During the month, the Corporation purchased an additional $93,000 of raw materials. The journal entry to record the purchase of raw materials would include a:

- credit to Raw Materials of $93,000

- debit to Raw Materials of $137,000

- debit to Raw Materials of $93,000

- credit to Raw Materials of $137,000

Q24. Wetherald Products, Inc., has a Pump Division that manufactures and sells a number of products, including a standard pump that could be used by another division in the company, the Pool Products Division, in one of its products. Data concerning that pump appear below:

| Capacity in units | 59,500 |

| Selling price to outside customers | $100 |

| Variable cost per unit | $62 |

| Fixed cost per unit (based on capacity) | $20 |

The Pool Products Division is currently purchasing 4,900 of these pumps per year from an overseas supplier at a cost of $83 per pump. Assume that the Pump Division is selling all of the pumps it can produce to outside customers. What should be the minimum acceptable transfer price for the pumps from the standpoint of the Pump Division?

- $82 per unit

- $62 per unit

- $83 per unit

- $100 per unit

Q25. Kerekes Manufacturing Corporation has prepared the following overhead budget for next month.

| Activity level | 2,400 machine hours |

| Variable overhead costs: | |

| Supplies | $10,560 |

| Indirect labor | 19,920 |

| Fixed overhead costs: | |

| Supervision | 15,600 |

| Utilities | 5,800 |

| Depreciation | 6,800 |

| Total overhead cost | $58,680 |

The company’s variable overhead costs are driven by machine-hours. What would be the total budgeted overhead cost for next month if the activity level is 2,300 machine-hours rather than 2,400 machine-hours?

- $56,235

- $58,680

- $57,410

- $56,830

Q26. Depasquale Corporation is working on its direct labor budget for the next two months. Each unit of output requires 0.41 direct labor-hours. The direct labor rate is $9.00 per direct labor-hour. The production budget calls for producing 5,900 units in May and 6,300 units in June. If the direct labor work force is fully adjusted to the total direct labor-hours needed each month, what would be the total combined direct labor cost for the two months?

- $21,771.00

- $23,247.00

- $45,018.00

- $22,509.00

Q27. Eisentrout Corporation has two production departments, Machining and Customizing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Machining Department’s predetermined overhead rate is based on machine-hours and the Customizing Department’s predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:

| Machining | Customizing | |

| Machine-hours | 28,000 | 11,000 |

| Direct labor-hours | 4,000 | 3,000 |

| Total fixed manufacturing overhead cost | $86,800 | $12,000 |

| Variable manufacturing overhead per machine-hour | $1.50 | |

| Variable manufacturing overhead per direct labor-hour | $4.70 |

During the current month the company started and finished Job T272. The following data were recorded for this job:

| Job T272: | Machining | Customizing |

| Machine-hours | 70 | 20 |

| Direct labor-hours | 20 | 30 |

The estimated total manufacturing overhead for the Machining Department is closest to:

- $86,800

- $128,800

- $42,000

- $103,300

Q28. A manufacturing company that produces a single product has provided the following data concerning its most recent month of operations:

| Selling price | $160 |

| Units in beginning inventory | 100 |

| Units produced | 16,000 |

| Units sold | 15,800 |

| Units in ending inventory | 300 |

| Variable costs per unit: | |

| Direct materials | $51 |

| Direct labor | $46 |

| Variable manufacturing overhead | $8 |

| Variable selling and administrative expense | $5 |

| Fixed costs: | |

| Fixed manufacturing overhead | $560,000 |

| Fixed selling and administrative expense | $173,800 |

What is the total period cost for the month under variable costing?

- $560,000

- $812,800

- $733,800

- $252,800

Q29. The BRS Corporation makes collections on sales according to the following schedule:

40% in month of sale

55% in month following sale

5% in second month following sale

The following sales have been budgeted:

| Sales | |

| April | $110,000 |

| May | $120,000 |

| June | $110,000 |

Budgeted cash collections in June would be:

- $112,000

- $110,550

- $115,500

- $110,000

Q30. Lusk Corporation produces and sells 14,100 units of Product X each month. The selling price of Product X is $23 per unit, and variable expenses are $17 per unit. A study has been made concerning whether Product X should be discontinued. The study shows that $74,000 of the $104,000 in monthly fixed expenses charged to Product X would not be avoidable even if the product was discontinued. If Product X is discontinued, the annual financial advantage (disadvantage) for the company of eliminating this product should be:

- ($54,600)

- $49,400

- $19,400

- ($49,400)

Q31. Haylock Inc. bases its manufacturing overhead budget on budgeted direct labor-hours. The direct labor budget indicates that 7,800 direct labor-hours will be required in August. The variable overhead rate is $1.20 per direct labor-hour. The company’s budgeted fixed manufacturing overhead is $100,560 per month, which includes depreciation of $8,790. All other fixed manufacturing overhead costs represent current cash flows. The August cash disbursements for manufacturing overhead on the manufacturing overhead budget should be:

- $109,920

- $9,360

- $91,770

- $101,130

Q32. Gaba Corporation uses the FIFO method in its process costing system. The Grinding Department started the month with 18,700 units in its beginning work in process inventory that were 60% complete with respect to conversion costs. An additional 77,000 units were transferred in from the prior department during the month to begin processing in the Grinding Department. During the month 87,000 units were completed in the Grinding Department and transferred to the next processing department. There were 8,700 units in the ending work in process inventory of the Grinding Department that were 10% complete with respect to conversion costs. What were the equivalent units of production for conversion costs in the Grinding Department for the month?

- 87,000

- 67,000

- 87,870

- 76,650

Q33. Data concerning three of the activity cost pools of Salcido LLC, a legal firm, have been provided below:

| Activity Cost Pool | Total Cost | Total Activity |

| Researching legal issues | $23,180 | 820 research hours |

| Meeting with clients | $1,347,501 | 7,613 meeting hours |

| Preparing documents | $94,540 | 5,920 documents |

The activity rate for the “meeting with clients” activity cost pool is closest to:

- $100 per meeting hour

- $177 per meeting hour

- $77 per meeting hour

- $1,347,501 per meeting hour

Q34. Wedd Corporation uses activity-based costing to assign overhead costs to products. Overhead costs have already been allocated to the company’s three activity cost pools as follows: Processing, $50,300; Supervising, $33,100; and Other, $25,200. Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:

| MHs (Processing) | Batches (Supervising) | |

| Product O6 | 9,900 | 1,580 |

| Product D7 | 820 | 1,000 |

| Total | 10,720 | 2,580 |

The activity rate for the Processing activity cost pool under activity-based costing is closest to:

- $4.69 per MH

- $4.99 per MH

- $9.12 per MH

- $4.37 per MH

Q35. Beamish Inc., which produces a single product, has provided the following data for its most recent month of operations:

| Number of units produced | 6,900 |

| Variable costs per unit: | |

| Direct materials | $139 |

| Direct labor | $126 |

| Variable manufacturing overhead | $7 |

| Variable selling and administrative expense | $12 |

| Fixed costs: | |

| Fixed manufacturing overhead | $248,400 |

| Fixed selling and administrative expense | $538,200 |

There were no beginning or ending inventories. The absorption costing unit product cost was:

- $308 per unit

- $272 per unit

- $265 per unit

- $398 per unit