Accounting Assignment Help » Managerial Accounting Assignment Help » Connect Managerial Accounting Chapter 10

Connect Managerial Accounting Chapter 10

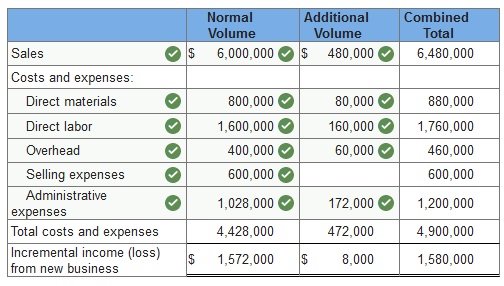

Q1. Farrow Co. expects to sell 400,000 units of its product in the next period with the following results.

| Sales (400,000 units) | $6,000,000 |

| Costs and expenses | |

| Direct materials | 800,000 |

| Direct labor | 1,600,000 |

| Overhead | 400,000 |

| Selling expenses | 600,000 |

| Administrative expenses | 1,028,000 |

| Total costs and expenses | 4,428,000 |

| Net income | $1,572,000 |

The company has an opportunity to sell 40,000 additional units at $12 per unit. The additional sales would not affect its current expected sales. Direct materials and labor costs per unit would be the same for the additional units as they are for the regular units. However, the additional volume would create the following incremental costs: (1) total overhead would increase by 15% and (2) administrative expenses would increase by $172,000.

Calculate the combined total net income if the company accepts the offer to sell additional units at the reduced price of $12 per unit.

Should the company accept or reject the offer?

- The company should reject the offer

- The company should accept the offer

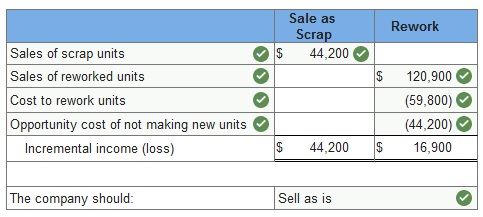

Q2. A company must decide between scrapping or reworking units that do not pass inspection. The company has 13,000 defective units that cost $5.90 per unit to manufacture. The units can be sold as is for $3.40 each, or they can be reworked for $4.60 each and then sold for the full price of $9.30 each. If the units are sold as is, the company will be able to build 13,000 replacement units at a cost of $5.90 each, and sell them at the full price of $9.30 each.

What is the incremental income from selling the units as scrap and reworking and selling the units? Should the company sell the units as scrap or rework them? (Enter costs and losses as negative values.)

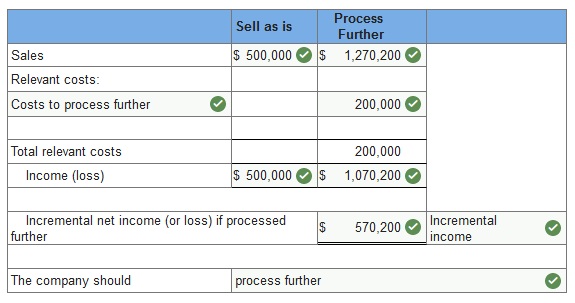

Q3. Cobe Company has already manufactured 20,000 units of Product A at a cost of $10 per unit. The 20,000 units can be sold at this stage for $500,000. Alternatively, the units can be further processed at a $200,000 total additional cost and be converted into 5,800 units of Product B and 11,900 units of Product C. Per unit selling price for Product B is $100 and for Product C is $58.

1. Prepare an analysis that shows whether the 20,000 units of Product A should be processed further or not.

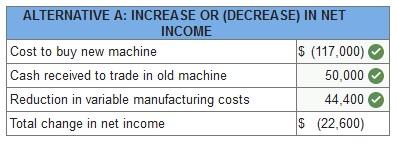

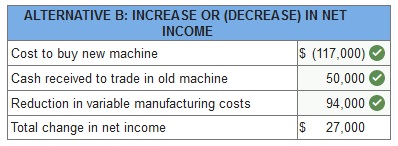

Q4. Xinhong Company is considering replacing one of its manufacturing machines. The machine has a book value of $40,000 and a remaining useful life of 4 years, at which time its salvage value will be zero. It has a current market value of $50,000. Variable manufacturing costs are $33,600 per year for this machine. Information on two alternative replacement machines follows.

| Alternative A | Alternative B | |

| Cost | $117,000 | $117,000 |

| Variable manufacturing costs per year | 22,500 | 10,100 |

Calculate the total change in net income if Alternative A, B is adopted. Should Xinhong keep or replace its manufacturing machine? If the machine should be replaced, which alternative new machine should Xinhong purchase?

Connect Managerial Accounting Chapter 10 Quiz

Q1. Granfield Company has a piece of manufacturing equipment with a book value of $40,000 and a remaining useful life of four years. At the end of the four years the equipment will have a zero salvage value. The market value of the equipment is currently $22,000. Granfield can purchase a new machine for $120,000 and receive $22,000 in return for trading in its old machine. The new machine will reduce variable manufacturing costs by $19,000 per year over the four-year life of the new machine. The total increase or decrease in net income by replacing the current machine with the new machine (ignoring the time value of money) is:

- $22,000 decrease

- $76,000 increase

- $18,000 decrease

- $52,000 increase

- $22,000 increase

Q2. Markson Company had the following results of operations for the past year:

| Sales (8,000 units at $20) | $160,000 | |

| Variable manufacturing costs | $86,000 | |

| Fixed manufacturing costs | 15,000 | |

| Variable selling and administrative expenses | 12,000 | |

| Fixed selling and administrative expenses | 20,000 | (133,000) |

| Operating income | $27,000 |

A foreign company whose sales will not affect Markson’s market offers to buy 2,000 units at $14 per unit. In addition to variable manufacturing costs, selling these units would increase fixed overhead by $1,600 for the purchase of special tools. Markson’s annual productive capacity is 12,000 units. If Markson accepts this additional business, its profits will:

- Increase by $3,500.

- Decrease by $5,650.

- Decrease by $1,600.

- Increase by $1,900.

- Decrease by $5,100.

Q3. What decision rule should be followed when deciding if a business segment should be eliminated?

- Segments generating a net loss should always be eliminated.

- Segments with revenues that are more than avoidable expenses should be considered for elimination.

- Segments with revenues that are more than unavoidable expenses should be considered for elimination.

- Segments with revenues that are less than avoidable expenses should be considered for elimination.

- Segments with revenues that are less than unavoidable expenses should be considered for elimination.

Q4. A company paid $200,000 ten years ago for a specialized machine that has no salvage value and is being depreciated at the rate of $10,000 per year. The company is considering using the machine in a new project that will have incremental revenues of $28,000 per year and annual cash expenses of $20,000. In analyzing the new project, the $200,000 original cost of the machine is an example of a(n):

- Incremental cost.

- Opportunity cost.

- Variable cost.

- Sunk cost.

- Out-of-pocket cost.

Q5. Assume markup percentage equals desired profit divided by total costs. What is the correct calculation to determine the dollar amount of the markup per unit?

- Total cost times markup percentage.

- Total cost per unit times markup percentage per unit.

- Total cost per unit divided by markup percentage per unit.

- Markup percentage per unit divided by total cost per unit.

- Markup percentage divided by total cost.

Q6. Ahngram Corp. has 1,000 defective units of a product that cost $3 per unit in direct costs and $6.50 per unit in indirect cost when produced last year. The units can be sold as scrap for $4 per unit or reworked at an additional cost of $2.50 and sold at full price of $12. The incremental net income (loss) from the choice of reworking the units would be:

- $5,500

- $0

- ($2,500)

- $9,500

- $2,500

Q7. Bluebird Mfg. has received a special one-time order for 15,000 bird feeders at $3 per unit. Bluebird currently produces and sells 75,000 units at $7.00 each. This level represents 80% of its capacity. These bird feeders would be marketed under the wholesaler’s name and would not affect Bluebird’s sales through its normal channels. Production costs for these units are $3.50 per unit, which includes $2.25 variable cost and $1.25 fixed cost. If Bluebird accepts this additional business, the effect on net income will be:

- $45,000 increase.

- $11,250 increase

- $33,750 increase

- $7,500 decrease

- $33,750 decrease

Q8. Granfield Company is considering eliminating its backpack division, which reported an operating loss for the recent year of $42,000. The division sales for the year were $960,000 and the variable costs were $475,000. The fixed costs of the division were $527,000. If the backpack division is dropped, 40% of the fixed costs allocated to that division could be eliminated. The impact on Granfield’s operating income for eliminating this business segment would be:

- $485,000 decrease

- $210,800 increase

- $274,200 decrease

- $485,000 increase

- $274,200 increase

Q9. Paxton Company can produce a component of its product that incurs the following costs per unit: direct materials, $10; direct labor, $14, variable overhead $3 and fixed overhead, $8. An outside supplier has offered to sell the product to Paxton for $32. Compute the net incremental cost or savings of buying the component.

- $5.00 savings per unit.

- $3.00 cost per unit

- $0 cost or savings per unit

- $5.00 cost per unit

- $3.00 savings per unit

Q10. Chang Industries has 2,000 defective units of product that have already cost $14 each to produce. A salvage company will purchase the defective units as they are for $5 each. Chang’s production manager reports that the defects can be corrected for $6 per unit, enabling them to be sold at their regular market price of $21. Chang should:

- Throw the units away.

- Sell the units to the salvage company for $5 per unit.

- Sell the units as they are because repairing them will cause their total cost to exceed their selling price.

- Sell 1,000 units to the salvage company and repair the remainder.

- Correct the defects and sell the units at the regular price.

Please contact us via live chat if you face difficulty in any of the question or exercise.