Accounting Assignment Help » Managerial Accounting Assignment Help » Connect Managerial Accounting Chapter 5

Connect Managerial Accounting Chapter 5

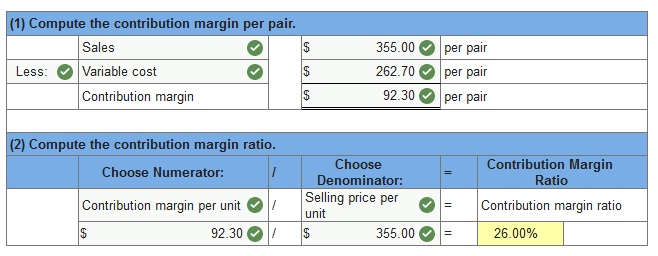

Q1. A jeans maker is designing a new line of jeans called Slims. The jeans will sell for $355 per pair and cost $262.70 per pair in variable costs to make. (Round your answers to 2 decimal places.)

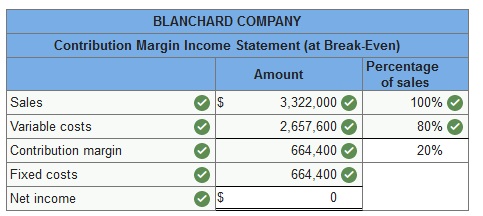

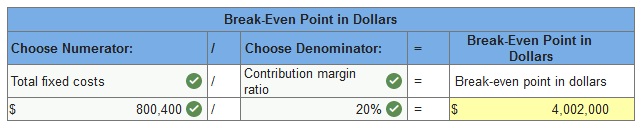

Q2. Blanchard Company manufactures a single product that sells for $220 per unit and whose total variable costs are $176 per unit. The company’s annual fixed costs are $664,400.

(1) Prepare a contribution margin income statement for Blanchard Company at the break-even point.

(2) Assume the company’s fixed costs increase by $136,000. What amount of sales (in dollars) is needed to break even?

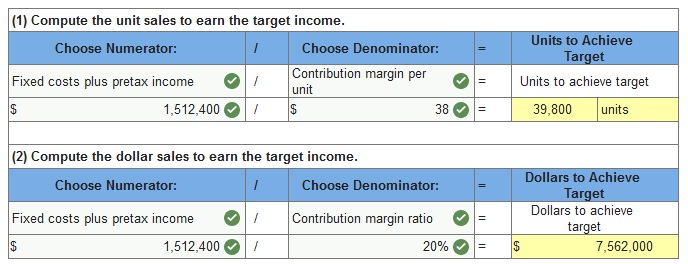

Q3. Blanchard Company manufactures a single product that sells for $190 per unit and whose total variable costs are $152 per unit. The company’s annual fixed costs are $562,400. Management targets an annual pretax income of $950,000. Assume that fixed costs remain at $562,400.

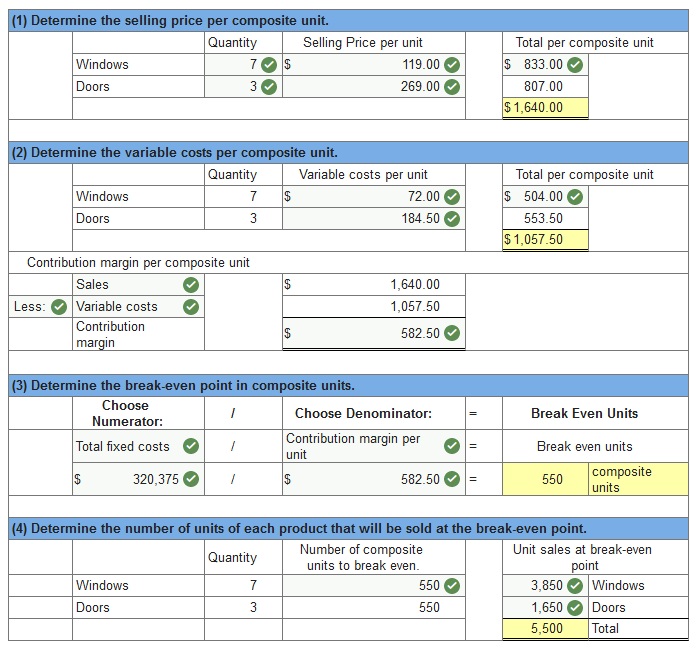

Q4. Handy Home sells windows and doors in the ratio of 7:3 (windows:doors). The selling price of each window is $119 and of each door is $269. The variable cost of a window is $72.00 and of a door is $184.50. Fixed costs are $320,375. (Enter your “per unit” values in two decimal places.)

Connect Managerial Accounting Chapter 5 Quiz

Q1. Use the following information to determine the contribution margin ratio:

| Unit sales | 50,000 Units |

| Unit selling price | $14.50 |

| Unit variable cost | $7.50 |

| Fixed costs | $204,000 |

- 6.9%

- 48.3%

- 24.5%

- 34.1%

Q2. An important tool in predicting the volume of activity, the costs to be incurred, the sales to be made, and the profit to be earned is:

- Target income analysis.

- Cost-volume-profit analysis.

- Least-squares regression analysis.

- Variance analysis.

- Process costing

Q3. A firm expects to sell 25,000 units of its product at $11 per unit and to incur variable costs per unit of $6. Total fixed costs are $70,000. The pretax net income is:

- $55,000

- $90,000

- $125,000

- $150,000

- $380,000

Q4. Use the following information to determine the break-even point in units (rounded to the nearest whole unit):

| Unit sales | 50,000 Units |

| Unit selling price | $14.50 |

| Unit variable cost | $7.50 |

| Fixed costs | $186,000 |

- 12,828

- 26,571

- 8,455

- 46,667

- 24,800

Q5. Maroon Company’s contribution margin ratio is 24%. Total fixed costs are $84,000. What is Maroon’s break-even point in sales dollars?

- $20,160

- $110,526

- $350,000

- $240,000

- $84,000

Q6. During its most recent fiscal year, Raphael Enterprises sold 200,000 electric screwdrivers at a price of $15 each. Fixed costs amounted to $400,000 and pretax income was $600,000. What amount should have been reported as variable costs in the company’s contribution margin income statement for the year in question?

- $2,400,000.

- $1,600,000.

- $3,000,000.

- $2,000,000.

- $1,000,000.

Q7. The following information is available for a company’s cost of sales over the last five months.

| Month | Units sold | Cost of sales |

| January | 400 | $31,000 |

| February | 800 | $37,000 |

| March | 1,600 | $49,000 |

| April | 2,400 | $61,000 |

Using the high-low method, the estimated total fixed cost is:

- $25,000

- $30,000

- $13,692

- $100,000

- $50,000

Q8. A manufacturer reports the following costs to produce 10,000 units in its first year of operations: Direct materials, $10 per unit, Direct labor, $6 per unit, Variable overhead, $70,000, and Fixed overhead, $120,000. Of the 10,000 units produced, 9,200 were sold, and 800 remain in inventory at year-end. Under absorption costing, the value of the inventory is:

- $12,800

- $18,400

- $28,000

- $22,400

- $13,600

Q9. Flannigan Company manufactures and sells a single product that sells for $450 per unit; variable costs are $270. Annual fixed costs are $800,000. Current sales volume is $4,200,000. Compute the break-even point in units.

- 5,500

- 1,933

- 4,444

- 2,900

- 1,160

Q10. During its most recent fiscal year, Dover, Inc. had total sales of $3,200,000. Contribution margin amounted to $1,500,000 and pretax income was $400,000. What amount should have been reported as fixed costs in the company’s contribution margin income statement for the year in question?

- $1,900,000.

- $2,800,000.

- $1,300,000.

- $1,100,000.

- $1,700,000.

Please contact us via live chat if you face difficulty in any of the question or exercise.