Accounting Coursework Help » Accounting Assignment Help » Journal Entry Assignment Help

Journal Entry Assignment Help

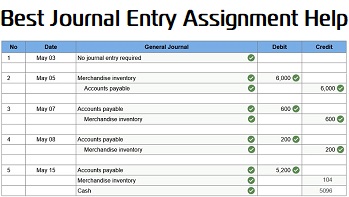

A journal entry is a task that is done in order to record the business transactions that are required for the accounting of the business. After the records are taken, the information is advanced in order to issue financial statements needed for the business. Are you finding journal entry assignments tough? We will ensure that no student will be misguided and all their queries are answered. Our experts provide high eminent journal entry assignment help. The journal entry helps the companies to record their progress and the transactions they did for the business. The journal entry is the most crucial task to be maintained by an organization as it contains all the necessary details needed for the movement of the company. Therefore, it is necessary to follow the proper structure, while doing a journal entry.

A journal entry is a task that is done in order to record the business transactions that are required for the accounting of the business. After the records are taken, the information is advanced in order to issue financial statements needed for the business. Are you finding journal entry assignments tough? We will ensure that no student will be misguided and all their queries are answered. Our experts provide high eminent journal entry assignment help. The journal entry helps the companies to record their progress and the transactions they did for the business. The journal entry is the most crucial task to be maintained by an organization as it contains all the necessary details needed for the movement of the company. Therefore, it is necessary to follow the proper structure, while doing a journal entry.

The structure that is required to be followed at the time of entering the data in a journal is as follows: There should be header line that would include the entry number of the journal along with the date of the entry. In the first column, account name and the account number is put. The entry is recorded in this column. In the second column, the amount that has been debited would be entered. There would be another column that would include the amount credited. There would be a footer that can be included as the column containing brief information regarding the reason the journal entry. You can contact the experts during any point of time which will provide you peace of mind. Our accounting experts will assist you with their advanced knowledge.

Types Of Journal Entries

There are different types of journal entries. They are adjusting entry, compound entry and reversing entry. The adjusting entry is usually done at the end of the month in order to change the financial statements so that they could align them with the accounting frameworks. For instance, if the company is on an accrual basis of accounting, the can accrue the wages that are not yet being paid. Another type, that is, the compound entry is used to include the information in the entry that has more than double lines to be fulfilled. This entry is often used for complex transactions or to record several entries altogether. The reversing entry contains the altered entry that is required to be changed for the different accrued expense. The journal entries are usually done in order to record the billings of the customers or the invoice of the suppliers. These are done with the help of software, which automatically creates the record once the entries are given. These entries can be used for many years and as long there is no audit required for the companies. We solely believe that the pricing of any journal entry assignment help should not create any breakage in your banks.

Easy Questions Of Journal Entry Assignments

Q1. Epic Inc. has 11,000 shares of $2 par value common stock outstanding. Epic declares a 15% stock dividend on July 1 when the stock’s market value is $18 per share. The stock dividend is distributed on July 20. Prepare journal entries for (a) declaration and (b) distribution of the stock dividend.

| No | Date | General Journal | Debit | Credit |

| 1 | July 01 | Retained earnings | 29,700 | |

| Common stock dividend distributable | 3,300 | |||

| Paid-in Capital in excess of par value, common stock | 26,400 | |||

| 2 | July 20 | Common stock dividend distributable | 3,300 | |

| Common stock, $2 par value | 3,300 |

Q2. Hillside issues $2,100,000 of 5%, 15-year bonds dated January 1, 2019, that pay interest semiannually on June 30 and December 31. The bonds are issued at a price of $2,570,390. Prepare the January 1 journal entry to record the bonds’ issuance

| No | Date | General Journal | Debit | Credit |

| 1 | January 01 | Cash | 2,570,390 | |

| Discount on bonds payable | 470,390 | |||

| Bonds payable | 2,100,100 |

Q3. Hotwax completed products costing $345,000 and transferred them to finished goods. Prepare its journal entry to record the transfer of units from Shaping to finished goods inventory.

| No | Transaction | General Journal | Debit | Credit |

| 1 | 1 | Finished goods inventory | 345,000 | |

| Work in process inventory – Shaping | 345,000 |

Difficult Questions Covered With Our Journal Entry Assignment Help

Q1. On January 8, the end of the first weekly pay period of the year, Regis Company’s employees earned $20,760 of office salaries and $70,840 of sales salaries. Withholdings from the employees’ salaries include FICA Social Security taxes at the rate of 6.2%, FICA Medicare taxes at the rate of 1.45%, $13,460 of federal income taxes, $1,410 of medical insurance deductions, and $860 of union dues. No employee earned more than $7,000 in this first period. Prepare the journal entry to record Regis Company’s January 8 employee payroll expenses and liabilities.

| No | Date | General Journal | Debit | Credit |

| 1 | Jan 08 | Office salaries expense | 20,760.00 | |

| Sales salaries expense | 70,840.00 | |||

| FICA – Social sec. taxes payable | 5,679.20 | |||

| FICA – Medicare taxes payable | 1,328.20 | |||

| Employee fed inc. taxes payable | 13,460.00 | |||

| Employee medical insurance payable | 1,410.00 | |||

| Employee union dues payable | 860.00 | |||

| Salaries payable | 68,862.60 |

Q2. Hart Company made 3,380 bookshelves using 22,380 board feet of wood costing $313,320. The company’s direct materials standards for one bookshelf are 8 board feet of wood at $13.90 per board foot. Hart Company uses a standard costing system.

Prepare the journal entry to charge direct materials costs to Work in Process Inventory and record the materials variances.

| No | Transaction | General Journal | Debit | Credit |

| A | 1 | Work in process inventory | 375,856 | |

| Direct materials price variance | 2,238 | |||

| Direct materials quantity variance | 64,774 | |||

| Raw materials inventory | 313,320 |

Assume that Hart’s materials variances are the only variances accumulated in the accounting period and that they are immaterial. Prepare the adjusting journal entry to close the variance accounts at period-end.

| No | Transaction | General Journal | Debit | Credit |

| A | 1 | Direct materials quantity variance | 64,774 | |

| Direct materials price variance | 2,238 | |||

| Cost of goods sold | 62,536 |

Online Journal Entry Homework Help

There are rules that need to be followed, when a journal entry is being done. A journal entry must have at least two columns, in which the information would be entered. After this, the person responsible for the entry should be careful of the fact that the total amount entered in the debit column and the total amount entered in the credit column must be equal to each other. The journal entries are usually kept stored after they are being printed. Our experts have turned out to be a boon for students with our online journal entry homework help.

These entries are also kept with the backup materials, which would later help to identify the reasons of the transactions. The journal entries by an organization are, often times, checked by external auditors to get the year-end information of the companies and their financial statements. We have taken the responsibility to bring up the next generation with latest information and experienced guides. We assure you that the experts associated with us have a strong academic record as well. You can ask for our journal entry assignment help or urgent assignment help for any other subject, you will get immediate assistance by our side.urgent