Long Term Financial Planning Problems

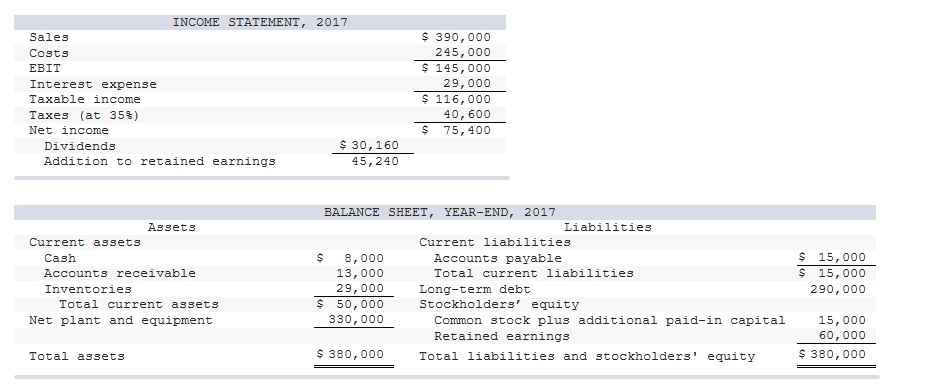

Q1. The 2017 financial statements for Growth Industries are presented below.

Sales and costs are projected to grow at 30% a year for at least the next 4 years. Both current assets and accounts payable are projected to rise in proportion to sales. The firm is currently operating at 75% capacity, so it plans to increase fixed assets in proportion to sales. Interest expense will equal 10% of long-term debt outstanding at the start of the year. The firm will maintain a dividend payout ratio of 0.40.

What is the required external financing over the next year? (Enter excess cash as a negative number with a minus sign.)

External Financing -$51,500

Q2. Plank’s Plants had net income of $6,000 on sales of $90,000 last year. The firm paid a dividend of $2,100. Total assets were $500,000, of which $350,000 was financed by debt.

a. What is the firm’s sustainable growth rate? (Do not round intermediate calculations. Enter your answer as a percent rounded to 1 decimal place.)

Sustainable Growth Rate 2.6%

b. If the firm grows at its sustainable growth rate, how much debt will be issued next year? (Do not round intermediate calculations.)

New Debt $9100

c. What would be the maximum possible growth rate if the firm did not issue any debt next year? (Do not round intermediate calculations. Enter your answer as a percent rounded to 1 decimal place.)

Maximum Growth Rate 0.8%

Q3. An all-equity-financed firm plans to grow at an annual rate of at least 12%. Its return on equity is 20%. What is the maximum possible dividend payout rate the firm can maintain without resorting to additional equity issues? (Do not round intermediate calculations. Enter your answer as a percent rounded to 1 decimal place.)

Maximum Dividend Payout Ratio 40.0%