Online Exam Help » Finance Assignment Help » Corporate Finance Assignment Help » Harvard Corporate Finance Final Exam 1

Harvard Corporate Finance Final Exam 1

Q1. An optimal current ratio should be greater than 1.0.

Q1. An optimal current ratio should be greater than 1.0.

- True

- False

Q2. The cost of debt is generally lower than the cost of equity.

- True

- False

Q3. Which of the following are equivalent under M&M proposition I?

- Maximizing firm value and maximizing firm profit

- Maximizing firm value and minimizing the cost of capital

- Minimizing firm’s cost of capital and minimizing firm’s debt burden

- Maximizing profit and minimizing taxes

Q4. In general, an increase in a liability is a source of funds.

- True

- False

Q5. Which of the following expresses the value of a levered firm (VL) in the Static Tradeoff model of optimal capital structure? [Note: VU denotes the value of the unlevered firm; CFD denotes expected costs of financial distress; and PV denotes present value.]

- VL = PV(Tax Shield) – PV(CFD)

- VL = VU + PV(Tax Shield) / PV(CFD)

- VL = VU + PV(Tax Shield) – PV(CFD)

- VL = VU + PV(Tax Shield)

Q6. The beta for the market as a whole equals 1.0.

- True

- False

Q7. A company’s beta (from the CAPM) is affected by its capital structure.

- True

- False

Q8. Which of the following are sources of funds in a statement of sources and uses?

I. Collection of accounts receivables

II. Reduction of long-term debt

III. Payment of dividends

IV. Reduction in the cash account

- I only

- II and III

- III and IV

- I and IV

Q9. Share repurchases and dividend payouts are most likely to differ in their

- effects on a firm’s capital structure

- effects on corporate taxes.

- effects on corporate cash flow.

- effects on shareholders’ personal taxes

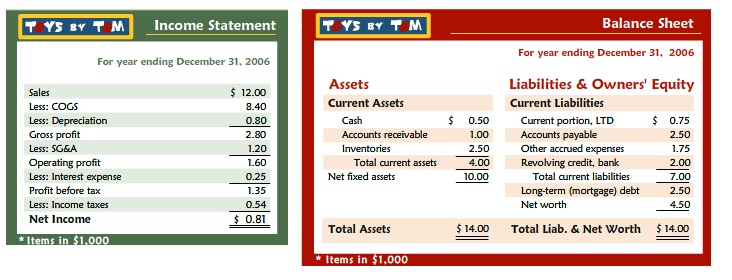

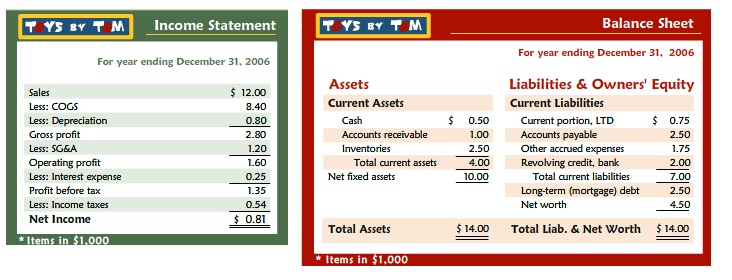

Q10. Analysis of a company’s financial statements: Below are simplified versions of the balance sheet and income statement for Toys by Tom, Inc. Use this information to answer the following question.

If sales in 2003 were $10,000, what is the compounded average growth rate?

- 8.6%

- 6.7%

- 6.3%

- Not enough information available

Q11. The cost of capital for an all-equity-financed company that pays no dividends is zero.

- True

- False

Q12. What is the expected return on a risky investment where

- the risk free rate is 5.1%;

- the investment’s beta is 1.4;

- the equity market risk premium is 5.0%; and

- the cost of debt is 4.5%.

Ans:

- 10.8%

- 9.6%

- 12.1%

- 9.2%

Q13. External funding needs are computed as:

- Projected total assets – (projected liabilities + projected net worth)

- Projected total assets – (actual liabilities + net worth)

- Projected current assets – (projected current liabilities + net worth)

- None of the above

Q14. Common-size financial statements are constructed in order to:

- Adjust for inflation and risk

- Facilitate comparisons of different-sized companies

- To comply with SEC requirements

- All of the above

Q15. “Real” activities create cash for a business, while “financial” activities distribute cash within the company.

- True

- False

Q16. A company has net income of $20,000 and a tax rate of 35 percent. Its total debt is $25,000, with principal payments of $5,000 due at the end of each year and an annual interest rate of 8%. What will be the company’s interest tax shield in the upcoming year?

- $8750

- $700

- $9450

- $2450

Q17. The Pecking Order Theory of capital structure rests on an assumption of

- agency costs.

- barriers to entry.

- asymmetric information.

- tax shields and cost of financial distress.

Q18. Which is a commonly used proxy for the “risk-free rate”?

- The average historical interest rate on long-term government bonds

- The current market rate interest rate on a government-insured savings account

- The current yield to maturity on a long-term government bond

- The rate of return on a low volatility stock

Q19. The sustainable growth rate is the maximum growth rate achievable over an extended period of time.

- True

- False

Q20. You are saving money for a down payment on a house. Suppose you want to have total savings of $20,000 in 10 years time and you have currently $5,000. What annual interest rate do you need to earn on your initial investment, assuming you contribute no additional savings?

- 10.0%

- 18.5%

- 12.5%

- 15.0%

Q21. Which of the following ratios appears on a common-size balance sheet?

I. Debt to asset ratio

II. Net working capital to total assets

III. Net profit margin

- I , II, III

- I only

- I and III

- III only

Q22. An increase in financial leverage generally results in a higher return on equity (ROE).

- True

- False

Q23. Which of the following is commonly forecasted as a percent of sales:

- Common stock

- Gross profit

- Long-term debt

- Revolving credit

Q24. Which of the following actions, all else being equal, will increase the sustainable growth rate?

- Increasing asset turnover

- Reducing dividend payout

- Increasing leverage

- All of the above

Q25. A company’s return on assets should be greater than its return on equity.

- True

- False

Q26. The item that roughly divides “real” from “financial” activities on an income statement is:

- EBIT

- Interest Expense

- SG&A Expense

- None of the above

Q27. In the CAPM, what does the parameter beta measure?

- Non-systematic (diversifiable) risk

- Systematic (non-diversifiable) risk

- Total risk

- Risk-adjusted stock returns

Q28. The higher the opportunity cost of capital the higher the NPV.

- True

- False

Q29. What is the present value of a growing perpetuity that makes a payment of $100 in the first year, which thereafter grows at 3% per year? Apply a discount rate of 7%.

- $2000

- $3500

- $2500

- $4000

Q30. The owners of a firm facing a high probability of bankruptcy prefer to invest in ____ projects, because ______.

- safer; riskier projects make bankruptcy more likely

- no new; the firm is likely to go bankrupt anyway

- risky; the shareholders have little to lose and might win if successful

- risky; creditors prefer taking a gamble rather than having the company default

Q31. GoodTimes, Inc. has asset turnover of 0.5 times, a net profit margin of 10% and average total assets of $100, what is its net income (assuming no unusual items)?

- $50

- $500

- $5

- The answer cannot be determined with the information provided.

Q32. Analysis of a company’s financial statements: Below are simplified versions of the balance sheet and income statement for Toys by Tom, Inc. Use this information to answer the following question.

A 15% increase in inventory turns for Toys by Tom, Inc. would bring this ratio to ____, suggesting ________ in ________.

- 109 days; a deterioration; profitability

- 3.9 days; a deterioration; profitability

- 4.8 times; an improvement; efficiency

- 3.9 times; an improvement; efficiency

Q33. Biases can and should always be eliminated in financial forecasts.

- True

- False

Q34. The cash conversion cycle is calculated as:

- Days in Inventory + Collection Period

- Days in Inventory – Payables Period

- Days in Inventory + Collection Period – Payables Period

- None of the above

Q35. Enterprise Free Cash Flows should include which of the following:

I. Capital expenditures

II. Financing costs

III. Taxes

IV. Working capital requirements

- I and IV

- I, II and IV

- I , III and IV

- I, II, III, IV

Q36. Which of the following is correct?

I. Tax shields make debt financing more attractive, all else equal.

II. A firm’s debt ratio falls when it uses excess cash to pay dividends.

III. The cost of equity is low for firms that pay no dividends, all else equal.

IV. Bankruptcy costs decrease the benefits of debt financing all else equal.

- I and IV

- I, II and IV

- I, III and IV

- I, II, III and IV

Q37. If you invest $2,000 today for three years at 5% interest paid annually, you will earn a total of $_____ in interest. Assume you re-invest all interest.

- 205.00

- 300.00

- 315.25

- 500.00

Q38. A share repurchase is financially equivalent to a dividend.

- True

- False

Q39. A project with an internal rate of return greater than the cost of capital should always be accepted.

- True

- False

Q40. You are trying to decide whether to accept or reject a one-year project. The project is estimated to generate $5,000 in incremental gross profit, which includes $200 in depreciation. Incremental SG&A expense is $400. At a 35% tax rate, the after-tax incremental cash flow is:

- $2990

- $3190

- $3250

- $3510

Q41. The Pecking Order Theory of capital structure implies a unique optimum capital structure.

- True

- False

Q42. A perpetuity is a stream of cash flows that lasts forever.

- True

- False

Q43. Grandma’s Applesauce, Inc. has a 0.60 probability of a good year with operating cash flow of $50,000; and 0.40 probability of a bad year with operating cash flow of $30,000. The company has a debt of $35,000 with 8 percent interest due next year. Assuming the company has no means of servicing its debt other than operations, and a 0% tax rate, which of the following is true?

- Shareholders expected claim is $12,200

- Creditors expected claim is $37,800

- Creditors expected claim is $34,680

- None of the above

Q44. What is the risk premium for a stock where

- the risk free rate is 5.1%;

- the equity market risk premium is 5.0%; and

- the beta of the stock is 1.2.

Ans:

- 11.1%

- 6.1%

- 6.0%

- 12.1%

Q45. A company builds a new plant and finances its construction by issuing stock. Which ratio is least likely to be affected, all else being equal?

- Current ratio

- Debt to equity ratio

- Debt to asset ratio

- Net fixed assets to total assets

Q46. A company has net working capital of $0, current liabilities of $25 and total assets equal to $100. What is its current ratio?

- 0.0

- 1.0

- 0.5

- 4.0

Q47. The Static Tradeoff theory of capital structure implies that firms with higher business risk should have lower leverage.

- True

- False

Q48. A firm is all equity financed, with 10,000 outstanding shares with a market value of $20 each. Its net income was $30,000, and it decides to pay a cash dividend of $2,000. Calculate the value of each share after the dividend payout.

- $22.8

- $20.0

- $19.8

- Not enough information

Q49. The phenomenon of compounding connotes which of the following?

- Investment of principal for a prolonged period

- Interest earned over a prolonged period

- Earning income on previously earned income

- Rising interest rates over time

Q50. The cash cycle measures the days required to produce finished goods or delivered services.

- True

- False

Please click on Make Payment to get all correct answers at $60 (No Hidden Charges or any Sign Up Fee). In description, please don’t forget to mention the exam name – Harvard Corporate Finance Final Exam Help 1. You will receive the answers at your email id in the next 30 minutes.