Accounting Assignment Help » Managerial Accounting Assignment Help » Connect Managerial Accounting Homework Chapter 4

Connect Managerial Accounting Homework Chapter 4

Q1. Laval produces lamps and home lighting fixtures. Its most popular product is a brushed aluminum desk lamp. This lamp is made from components shaped in the fabricating department and assembled in the assembly department. Information related to the 31,000 desk lamps produced annually follows.

| Direct materials | $280,000 |

| Direct labor | |

| Fabricating department (7,500 DLH × $24 per DLH) | $180,000 |

| Assembly department (15,600 DLH × $22 per DLH) | $343,200 |

| Machine hours | |

| Fabricating department | 14,800 MH |

| Assembly department | 20,150 MH |

Expected overhead cost and related data for the two production departments follow.

| Fabricating | Assembly | |

| Direct labor hours | 160,000 DLH | 270,000 DLH |

| Machine hours | 159,000 MH | 131,000 MH |

| Overhead cost | $380,000 | $435,000 |

Required

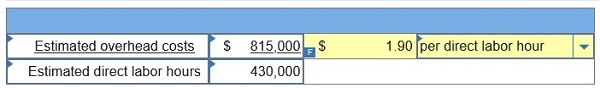

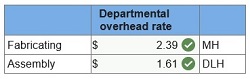

1. Determine the plantwide overhead rate for Laval using direct labor hours as a base.

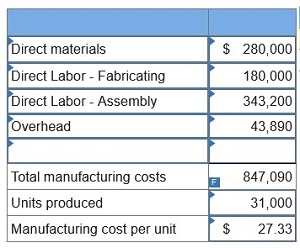

2. Determine the total manufacturing cost per unit for the aluminum desk lamp using the plantwide overhead rate.

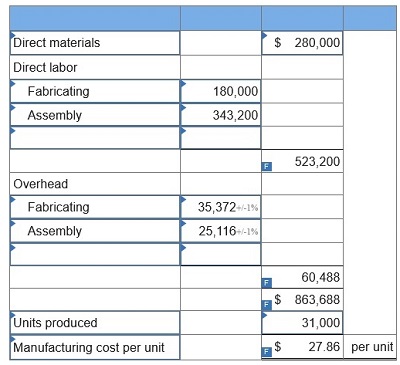

3. Compute departmental overhead rates based on machine hours in the fabricating department and direct labor hours in the assembly department.

4. Use departmental overhead rates from requirement 3 to determine the total manufacturing cost per unit for the aluminum desk lamps.

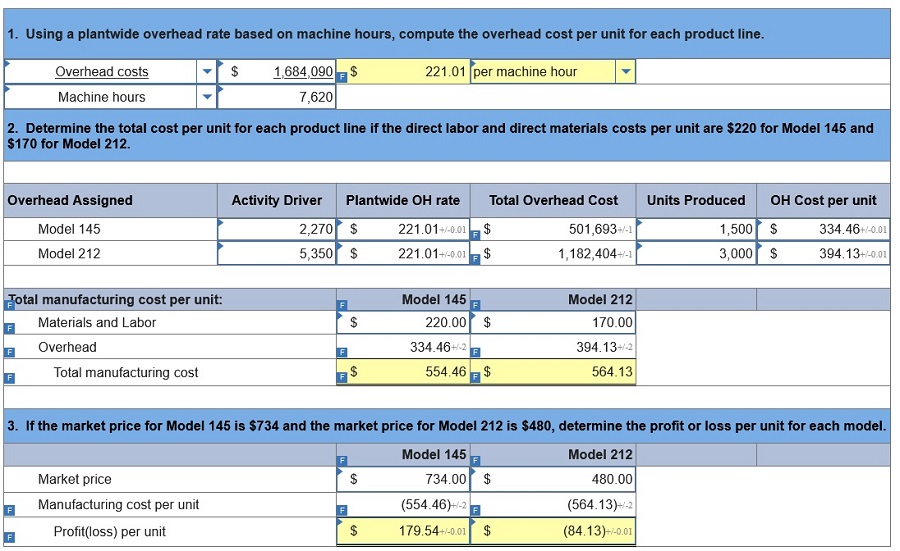

Q2. Way Cool produces two different models of air conditioners. The company produces the mechanical systems in its components department. The mechanical systems are combined with the housing assembly in its finishing department. The activities, costs, and drivers associated with these two manufacturing processes and the production support process follow. (Loss amounts should be indicated with a minus sign. Round your intermediate calculations and round “Cost per unit and OH rate” answers to 2 decimal places.)

| Process | Activity | Overhead Cost | Driver | Quantity |

| Components | Changeover | $452,000 | Number of batches | 870 |

| Machining | 300,800 | Machine hours | 7,620 | |

| Setups | 226,000 | Number of setups | 120 | |

| $978,800 | ||||

| Finishing | Welding | $181,800 | Welding hours | 4,800 |

| Inspecting | 234,000 | Number of inspections | 770 | |

| Rework | 61,000 | Rework orders | 250 | |

| $476,800 | ||||

| Support | Purchasing | $137,000 | Purchase orders | 488 |

| Providing space | 31,250 | Number of units | 4,500 | |

| Providing utilities | 60,240 | Number of units | 4,500 | |

| $228,490 |

Additional production information concerning its two product lines follows.

| Model 145 | Model 212 | |

| Units produced | 1,500 | 3,000 |

| Welding hours | 2,600 | 2,200 |

| Batches | 435 | 435 |

| Number of inspections | 460 | 310 |

| Machine hours | 2,270 | 5,350 |

| Setups | 60 | 60 |

| Rework orders | 160 | 90 |

| Purchase orders | 325 | 163 |

Required:

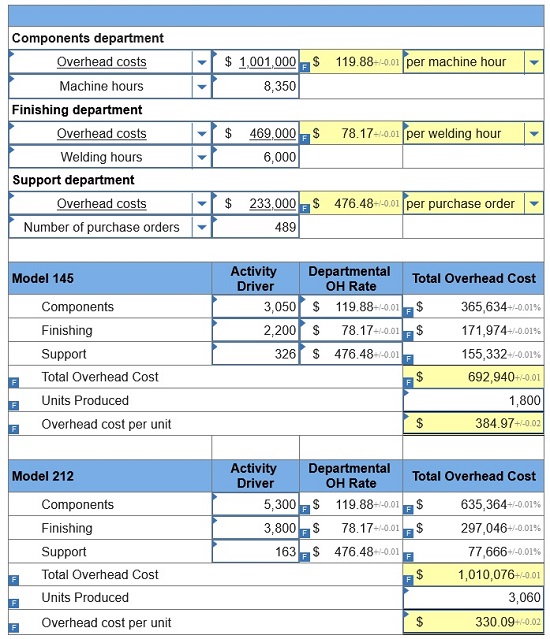

Q3. Way Cool produces two different models of air conditioners. The company produces the mechanical systems in its components department. The mechanical systems are combined with the housing assembly in its finishing department. The activities, costs, and drivers associated with these two manufacturing processes and the production support process follow.

| Process | Activity | Overhead Cost | Driver | Quantity |

| Components | Changeover | $464,000 | Number of batches | 730 |

| Machining | 308,000 | Machine hours | 8,350 | |

| Setups | 229,000 | Number of setups | 200 | |

| $1,001,000 | ||||

| Finishing | Welding | $186,000 | Welding hours | 6,000 |

| Inspecting | 222,000 | Number of inspections | 830 | |

| Rework | 61,000 | Rework orders | 240 | |

| $469,000 | ||||

| Support | Purchasing | $133,000 | Purchase orders | 489 |

| Providing space | 33,000 | Number of units | 4,860 | |

| Providing utilities | 67,000 | Number of units | 4,860 | |

| $233,000 |

Additional production information concerning its two product lines follows.

| Model 145 | Model 212 | |

| Units produced | 1,800 | 3,060 |

| Welding hours | 2,200 | 3,800 |

| Batches | 365 | 365 |

| Number of inspections | 460 | 370 |

| Machine hours | 3,050 | 5,300 |

| Setups | 100 | 100 |

| Rework orders | 140 | 100 |

| Purchase orders | 326 | 163 |

Required:

1. Determine departmental overhead rates and compute the overhead cost per unit for each product line. Base your overhead assignment for the components department on machine hours. Use welding hours to assign overhead costs to the finishing department. Assign costs to the support department based on number of purchase orders.

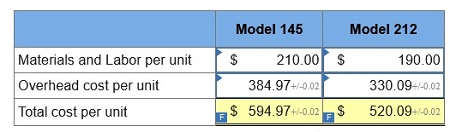

2. Determine the total cost per unit for each product line if the direct labor and direct materials costs per unit are $210 for Model 145 and $190 for Model 212.

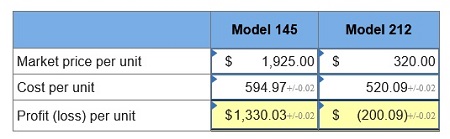

3. If the market price for Model 145 is $1,925 and the market price for Model 212 is $320, determine the profit or loss per unit for each model.

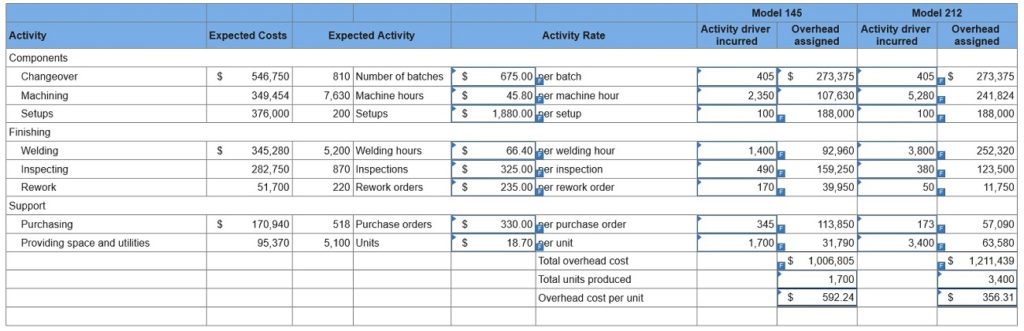

Q4. Way Cool produces two different models of air conditioners. The company produces the mechanical systems in its components department. The mechanical systems are combined with the housing assembly in its finishing department. The activities, costs, and drivers associated with these two manufacturing processes and the production support process follow.

| Process | Activity | Overhead Cost | Driver | Quantity |

| Components | Changeover | $546,750 | Number of batches | 810 |

| Machining | 349,454 | Machine hours | 7,630 | |

| Setups | 376,000 | Number of setups | 200 | |

| $1,272,204 | ||||

| Finishing | Welding | $345,280 | Welding hours | 5,200 |

| Inspecting | 282,750 | Number of inspections | 870 | |

| Rework | 51,700 | Rework orders | 220 | |

| $679,730 | ||||

| Support | Purchasing | $170,940 | Purchase orders | 518 |

| Providing space | 32,000 | Number of units | 5,100 | |

| Providing utilities | 63,370 | Number of units | 5,100 | |

| $266,310 |

Additional production information concerning its two product lines follows.

| Model 145 | Model 212 | |

| Units produced | 1,700 | 3,400 |

| Welding hours | 1,400 | 3,800 |

| Batches | 405 | 405 |

| Number of inspections | 490 | 380 |

| Machine hours | 2,350 | 5,280 |

| Setups | 100 | 100 |

| Rework orders | 170 | 50 |

| Purchase orders | 345 | 173 |

Required:

1. Using ABC, compute the overhead cost per unit for each product line.

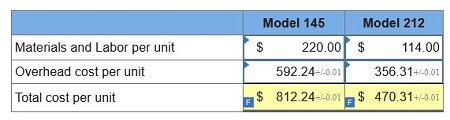

2. Determine the total cost per unit for each product line if the direct labor and direct materials costs per unit are $220 for Model 145 and $114 for Model 212.

3. If the market price for Model 145 is $812.90 and the market price for Model 212 is $470.67, determine the profit or loss per unit for each model.

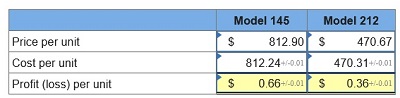

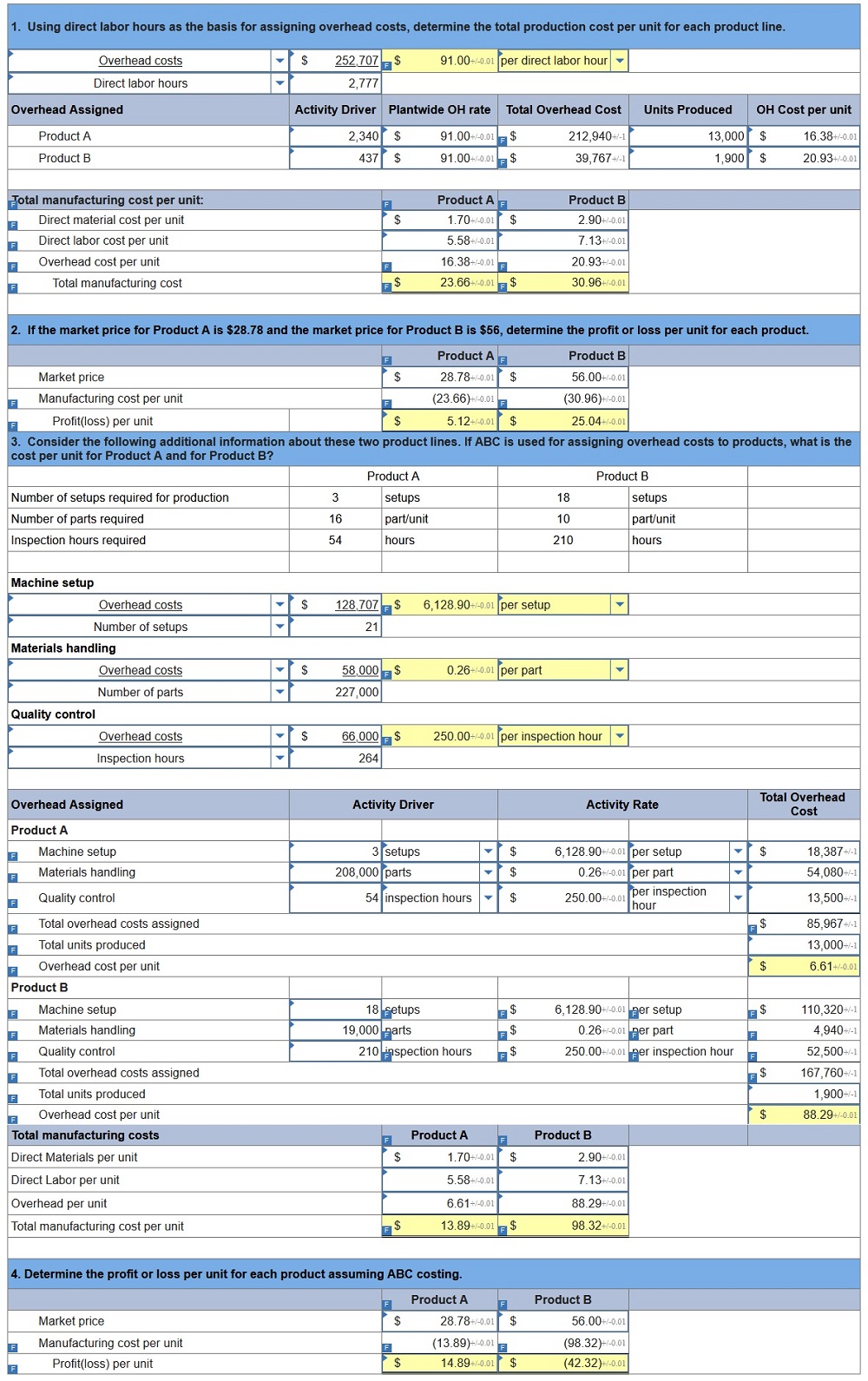

Q5. Consider the following data for two products of Gitano Manufacturing. (Loss amounts should be indicated with a minus sign. Round your intermediate calculations and “OH rate and cost per unit” answers to 2 decimal places.)

| Product A | Product B | |

| Number of units produced | 13,000 units | 1,900 units |

| Direct labor cost (@ $31 per DLH) | 0.18 DLH per unit | 0.23 DLH per unit |

| Direct materials cost | $ 1.70 per unit | $ 2.90 per unit |

| Activity | Overhead costs |

| Machine setup | $128,707 |

| Materials handling | 58,000 |

| Quality control inspections | 66,000 |

| $252,707 |

Based on your results in part 4, should the profit or loss per unit for each product influence company strategy? Yes

Required:

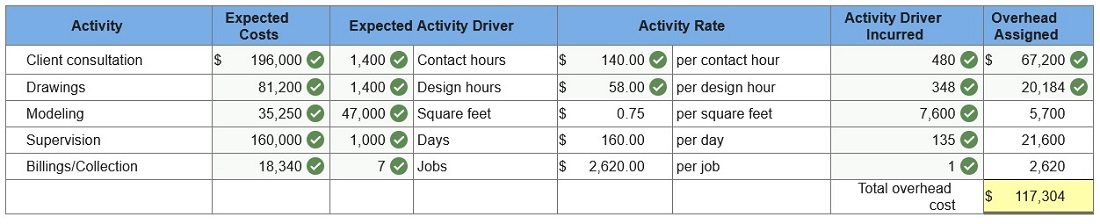

Q6. Cardiff and Delp is an architectural firm that provides services for residential construction projects. The following data pertain to a recent reporting period.

| Activities | Costs | |

| Design department | ||

| Client consultation | 1,400 contact hours | $196,000 |

| Drawings | 1,400 design hours | 81,200 |

| Modeling | 47,000 square feet | 35,250 |

| Project management department | ||

| Supervision | 1,000 days | $160,000 |

| Billings | 7 jobs | 8,000 |

| Collections | 7 jobs | 10,340 |

Required:

1. & 2. Using ABC, compute the firm’s activity overhead rates. Form activity cost pools where appropriate. Assign costs to a 7,600-square-foot job that requires 480 contact hours, 348 design hours, and 135 days to complete. (Round activity rate answers to 2 decimal places.)

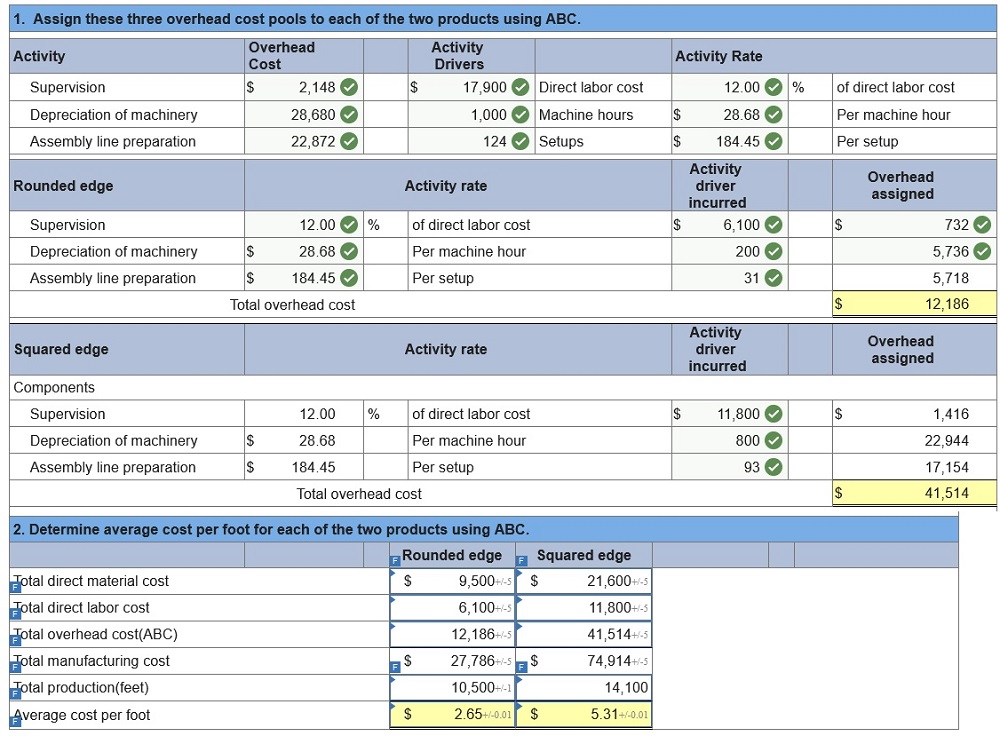

Q7. Glassworks Inc. produces two types of glass shelving, rounded edge and squared edge, on the same production line. For the current period, the company reports the following data.

| Rounded Edge | Squared Edge | Total | |

| Direct materials | $9,500 | $21,600 | $31,100 |

| Direct labor | 6,100 | 11,800 | 17,900 |

| Overhead (300% of direct labor cost) | 18,300 | 35,400 | 53,700 |

| Total cost | $33,900 | $68,800 | $102,700 |

| Quantity produced | 10,500 ft. | 14,100 ft. | |

| Average cost per ft. (rounded) | $3.23 | $4.88 |

Glassworks’s controller wishes to apply activity-based costing (ABC) to allocate the $53,700 of overhead costs incurred by the two product lines to see whether cost per foot would change markedly from that reported above. She has collected the following information.

| Overhead Cost Category (Activity Cost Pool) |

Cost |

| Supervision | $2,148 |

| Depreciation of machinery | 28,680 |

| Assembly line preparation | 22,872 |

| Total overhead | $53,700 |

She has also collected the following information about the cost drivers for each category (cost pool) and the amount of each driver used by the two product lines. (Round activity rate and cost per unit answers to 2 decimal places.)

| Usage | ||||

| Overhead Cost Category (Activity Cost Pool) |

Driver | Rounded Edge | Squared Edge | Total |

| Supervision | Direct labor cost ($) | $6,100 | $11,800 | $17,900 |

| Depreciation of machinery | Machine hours | 200 hours | 800 hours | 1,000 hours |

| Assembly line preparation | Setups (number) | 31 times | 93 times | 124 times |

Required:

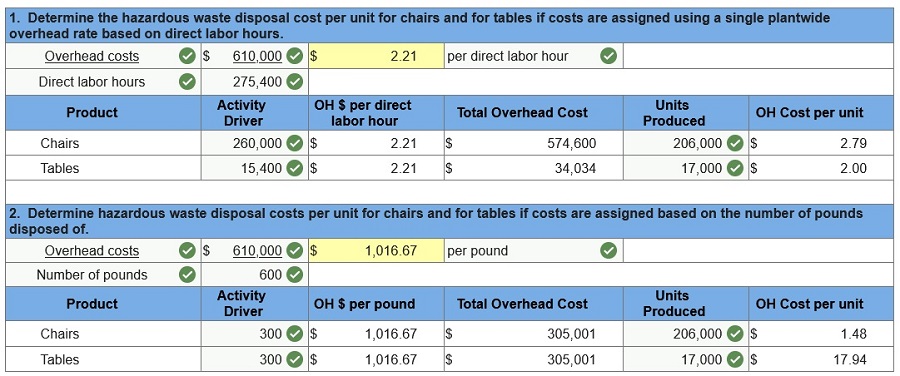

Q8. Smythe Co. makes furniture. The following data are taken from its production plans for the year.

| Direct labor costs | $5,440,000 | ||

| Hazardous waste disposal costs | 610,000 | ||

|

|

|||

| Chairs | Tables | |||

| Expected production | 206,000 | units | 17,000 | units |

| Direct labor hours required | 260,000 | DLH | 15,400 | DLH |

| Hazardous waste disposed | 300 | pounds | 300 | pounds |

|

|

||||

Required:

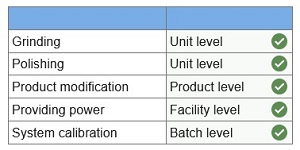

Q9. Craft Pro Machining produces machine tools for the construction industry. The following details about overhead costs were taken from its company records.

| Production Activity | Indirect Labor | Indirect Materials | Other Overhead | ||||||||

| Grinding | $ | 400,000 | |||||||||

| Polishing | $ | 145,000 | |||||||||

| Product modification | 450,000 | ||||||||||

| Providing power | $ | 200,000 | |||||||||

| System calibration | 500,000 | ||||||||||

|

|

|||||||||||

Additional information on the drivers for its production activities follows.

| Grinding | 19,000 | machine hours |

| Polishing | 19,000 | machine hours |

| Product modification | 1,800 | engineering hours |

| Providing power | 14,000 | direct labor hours |

| System calibration | 1,050 | batches |

|

|

||

| Job 3175 | Job 4286 | |||

| Number of units | 220 | units | 2,750 | units |

| Machine hours | 300 | MH | 3,000 | MH |

| Engineering hours | 35 | eng. hours | 24 | eng. hours |

| Batches | 15 | batches | 45 | batches |

| Direct labor hours | 490 | DLH | 4,410 | DLH |

|

|

||||

Required:

1. Classify each activity as unit level, batch level, product level, or facility level.

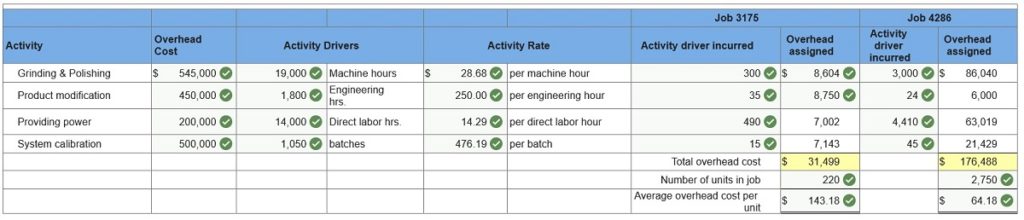

Q10. Craft Pro Machining produces machine tools for the construction industry. The following details about overhead costs were taken from its company records.

| Production Activity | Indirect Labor | Indirect Materials | Other Overhead | ||||||||

| Grinding | $ | 400,000 | |||||||||

| Polishing | $ | 145,000 | |||||||||

| Product modification | 450,000 | ||||||||||

| Providing power | $ | 200,000 | |||||||||

| System calibration | 500,000 | ||||||||||

|

|

|||||||||||

Additional information on the drivers for its production activities follows.

| Grinding | 19,000 | machine hours |

| Polishing | 19,000 | machine hours |

| Product modification | 1,800 | engineering hours |

| Providing power | 14,000 | direct labor hours |

| System calibration | 1,050 | batches |

|

|

||

| Job 3175 | Job 4286 | |||

| Number of units | 220 | units | 2,750 | units |

| Machine hours | 300 | MH | 3,000 | MH |

| Engineering hours | 35 | eng. hours | 24 | eng. hours |

| Batches | 15 | batches | 45 | batches |

| Direct labor hours | 490 | DLH | 4,410 | DLH |

|

|

||||

Required:

2, 3 & 4. Compute the activity overhead rates using ABC. Combine the grinding and polishing activities into a single cost pool. Determine overhead costs to assign to the above jobs using ABC. What is the overhead cost per unit for Job 3175? What is the overhead cost per unit for Job 4286? (Round your activity rate and average overhead cost per unit to 2 decimal places. Round “overhead assigned” to the nearest whole dollar.)

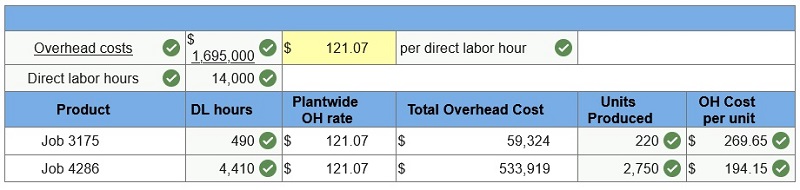

Q11. Craft Pro Machining produces machine tools for the construction industry. The following details about overhead costs were taken from its company records.

| Production Activity | Indirect Labor | Indirect Materials | Other Overhead | ||||||||

| Grinding | $ | 400,000 | |||||||||

| Polishing | $ | 145,000 | |||||||||

| Product modification | 450,000 | ||||||||||

| Providing power | $ | 200,000 | |||||||||

| System calibration | 500,000 | ||||||||||

|

|

|||||||||||

Additional information on the drivers for its production activities follows.

| Grinding | 19,000 | machine hours |

| Polishing | 19,000 | machine hours |

| Product modification | 1,800 | engineering hours |

| Providing power | 14,000 | direct labor hours |

| System calibration | 1,050 | batches |

|

|

||

| Job 3175 | Job 4286 | |||

| Number of units | 220 | units | 2,750 | units |

| Machine hours | 300 | MH | 3,000 | MH |

| Engineering hours | 35 | eng. hours | 24 | eng. hours |

| Batches | 15 | batches | 45 | batches |

| Direct labor hours | 490 | DLH | 4,410 | DLH |

|

|

||||

Required:

5. If the company uses a plantwide overhead rate based on direct labor hours, what is the overhead cost for each unit of Job 3175? Of Job 4286? (Do not round intermediate calculations. Round “OH Cost per unit” answers to 2 decimal places.)

Q12. Sara’s Salsa Company produces its condiments in two types: Extra Fine for restaurant customers and Family Style for home use. Salsa is prepared in department 1 and packaged in department 2. The activities, overhead costs, and drivers associated with these two manufacturing processes and the company’s production support activities follow.

| Process | Activity | Overhead cost | Driver | Quantity | ||

| Department 1 | Mixing | $ | 5,300 | Machine hours | 1,700 | |

| Cooking | 10,000 | Machine hours | 1,700 | |||

| Product testing | 113,300 | Batches | 550 | |||

| $ | 128,600 | |||||

| Department 2 | Machine calibration | $ | 290,000 | Production runs | 800 | |

| Labeling | 16,000 | Cases of output | 130,000 | |||

| Defects | 10,000 | Cases of output | 130,000 | |||

| $ | 316,000 | |||||

| Support | Recipe formulation | $ | 98,000 | Focus groups | 50 | |

| Heat, lights, and water | 34,000 | Machine hours | 1,700 | |||

| Materials handling | 73,000 | Container types | 10 | |||

| $ | 205,000 | |||||

|

|

||||||

Additional production information about its two product lines follows.

| Extra Fine | Family Style | |||

| Units produced | 28,000 | cases | 102,000 | cases |

| Batches | 280 | batches | 270 | batches |

| Machine hours | 650 | MH | 1,050 | MH |

| Focus groups | 20 | groups | 30 | groups |

| Container types | 7 | containers | 3 | containers |

| Production runs | 280 | runs | 520 | runs |

|

|

||||

Required:

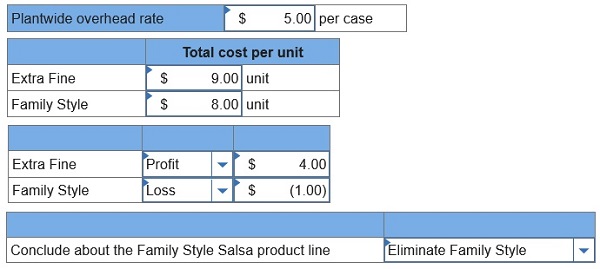

1. Using a plantwide overhead rate based on cases, compute the overhead cost that is assigned to each case of Extra Fine Salsa and each case of Family Style Salsa.

2. Using the plantwide overhead rate, determine the total cost per case for the two products if the direct materials and direct labor cost is $4 per case of Extra Fine and $3 per case of Family Style.

3.a. If the market price of Extra Fine Salsa is $13 per case and the market price of Family Style Salsa is $7 per case, determine the gross profit per case for each product.

3.b. What might management conclude about the Family Style Salsa product line?

Q13. Sara’s Salsa Company produces its condiments in two types: Extra Fine for restaurant customers and Family Style for home use. Salsa is prepared in department 1 and packaged in department 2. The activities, overhead costs, and drivers associated with these two manufacturing processes and the company’s production support activities follow.

| Process | Activity | Overhead cost | Driver | Quantity | ||

| Department 1 | Mixing | $ | 5,300 | Machine hours | 1,700 | |

| Cooking | 10,000 | Machine hours | 1,700 | |||

| Product testing | 113,300 | Batches | 550 | |||

| $ | 128,600 | |||||

| Department 2 | Machine calibration | $ | 290,000 | Production runs | 800 | |

| Labeling | 16,000 | Cases of output | 130,000 | |||

| Defects | 10,000 | Cases of output | 130,000 | |||

| $ | 316,000 | |||||

| Support | Recipe formulation | $ | 98,000 | Focus groups | 50 | |

| Heat, lights, and water | 34,000 | Machine hours | 1,700 | |||

| Materials handling | 73,000 | Container types | 10 | |||

| $ | 205,000 | |||||

|

|

||||||

Additional production information about its two product lines follows.

| Extra Fine | Family Style | |||

| Units produced | 28,000 | cases | 102,000 | cases |

| Batches | 280 | batches | 270 | batches |

| Machine hours | 650 | MH | 1,050 | MH |

| Focus groups | 20 | groups | 30 | groups |

| Container types | 7 | containers | 3 | containers |

| Production runs | 280 | runs | 520 | runs |

|

|

||||

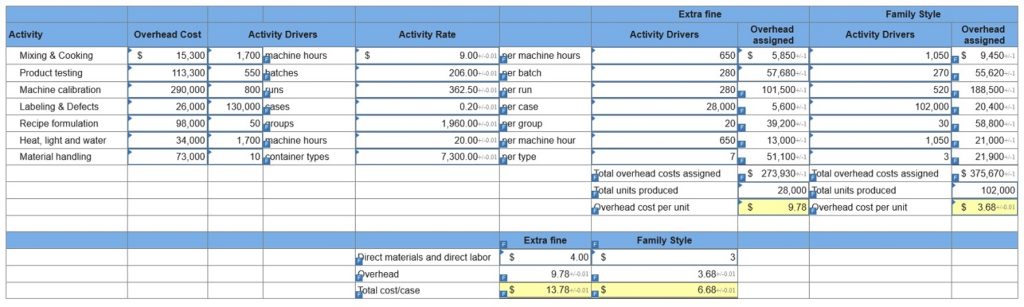

4. Using ABC, compute the total cost per case for each product type if the direct labor and direct materials cost is $4 per case of Extra Fine and $3 per case of Family Style. (Round your intermediate calculations to 2 decimal places. Round “Activity Rate” and “Overhead cost per unit” answers to 2 decimal places.)

Q14. Sara’s Salsa Company produces its condiments in two types: Extra Fine for restaurant customers and Family Style for home use. Salsa is prepared in department 1 and packaged in department 2. The activities, overhead costs, and drivers associated with these two manufacturing processes and the company’s production support activities follow.

| Process | Activity | Overhead cost | Driver | Quantity | ||

| Department 1 | Mixing | $ | 5,300 | Machine hours | 1,700 | |

| Cooking | 10,000 | Machine hours | 1,700 | |||

| Product testing | 113,300 | Batches | 550 | |||

| $ | 128,600 | |||||

| Department 2 | Machine calibration | $ | 290,000 | Production runs | 800 | |

| Labeling | 16,000 | Cases of output | 130,000 | |||

| Defects | 10,000 | Cases of output | 130,000 | |||

| $ | 316,000 | |||||

| Support | Recipe formulation | $ | 98,000 | Focus groups | 50 | |

| Heat, lights, and water | 34,000 | Machine hours | 1,700 | |||

| Materials handling | 73,000 | Container types | 10 | |||

| $ | 205,000 | |||||

|

|

||||||

Additional production information about its two product lines follows.

| Extra Fine | Family Style | |||

| Units produced | 28,000 | cases | 102,000 | cases |

| Batches | 280 | batches | 270 | batches |

| Machine hours | 650 | MH | 1,050 | MH |

| Focus groups | 20 | groups | 30 | groups |

| Container types | 7 | containers | 3 | containers |

| Production runs | 280 | runs | 520 | runs |

|

|

||||

5. If the market price is $13 per case of Extra Fine and $7 per case of Family Style, determine the gross profit per case for each product. (Round your intermediate calculations and final answers to 2 decimal places.)

Please click on Pay Now to get explanations to all answers at $40 (No Hidden Charges or any Sign Up Fee). In description, please don’t forget to mention the exam name – Connect Managerial Accounting Homework Chapter 4. We will send the explanation at your email id instantly. If you are looking for accounting class help for other fields then also you can connect with us anytime. We will provide high quality and accurate accounting assignment help for all questions…