Accounting Assignment Help » Managerial Accounting Assignment Help » Connect Managerial Accounting Chapter 9

Connect Managerial Accounting Chapter 9

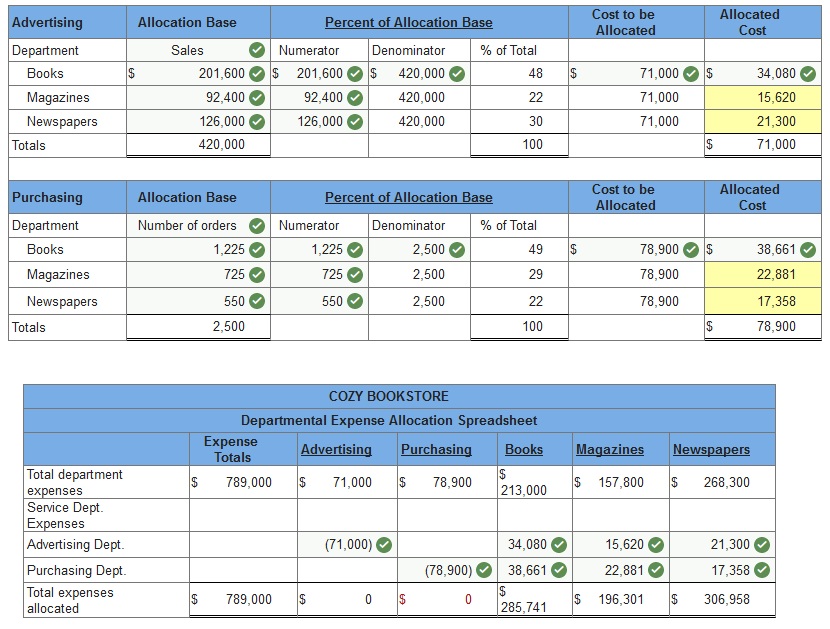

Q1. Advertising department expenses of $71,000 and purchasing department expenses of $78,900 of Cozy Bookstore are allocated to operating departments on the basis of dollar sales and purchase orders, respectively. Information about the allocation bases for the three operating departments follows.

| Department | Sales | Purchase Orders |

| Books | $201,600 | 1,225 |

| Magazines | 92,400 | 725 |

| Newspapers | 126,000 | 550 |

| Total | $420,000 | 2,500 |

Complete the following table by allocating the expenses of the two service departments (advertising and purchasing) to the three operating departments.

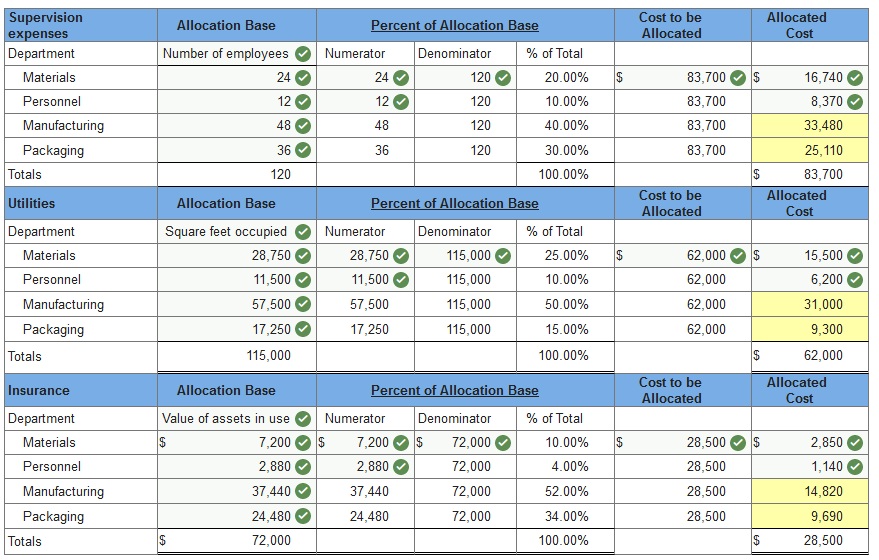

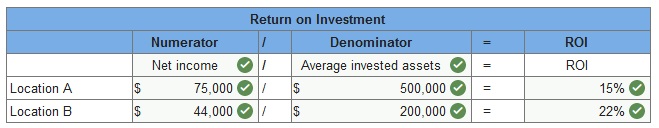

Q2. Woh Che Co. has four departments: materials, personnel, manufacturing, and packaging. In a recent month, the four departments incurred three shared indirect expenses. The amounts of these indirect expenses and the bases used to allocate them follow.

| Indirect Expense | Cost | Allocation Base |

| Supervision | $83,700 | Number of employees |

| Utilities | 62,000 | Square feet occupied |

| Insurance | 28,500 | Value of assets in use |

| Total | $174,200 |

Departmental data for the company’s recent reporting period follow.

| Department | Employees | Square Feet | Asset Values |

| Materials | 24 | 28,750 | $7,200 |

| Personnel | 12 | 11,500 | 2,880 |

| Manufacturing | 48 | 57,500 | 37,440 |

| Packaging | 36 | 17,250 | 24,480 |

| Total | 120 | 115,000 | $72,000 |

1. Use this information to allocate each of the three indirect expenses across the four departments.

2. Prepare a summary table that reports the indirect expenses assigned to each of the four departments.

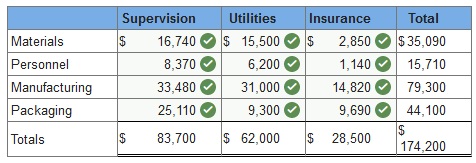

You must prepare a return on investment analysis for the regional manager of Fast & Great Burgers. This growing chain is trying to decide which outlet of two alternatives to open. The first location (A) requires a $500,000 investment and is expected to yield annual net income of $75,000. The second location (B) requires a $200,000 investment and is expected to yield annual net income of $44,000.

Compute the return on investment for each Fast & Great Burgers alternative.

Using return on investment as your only criterion, recommend which of the locations to open

- Location A

- Location B

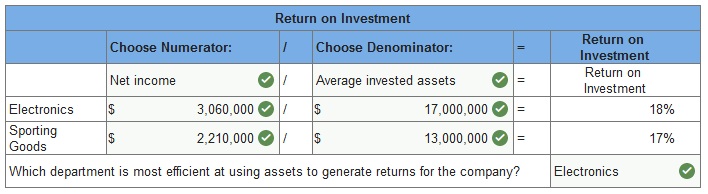

Megamart, a retailer of consumer goods, provides the following information on two of its departments (each considered an investment center).

| Investment Center | Sales | Income | Average Invested Assets |

| Electronics | $40,800,000 | $3,060,000 | $17,000,000 |

| Sporting goods | 17,680,000 | 2,210,000 | 13,000,000 |

- Compute return on investment for each department. Using return on investment, which department is most efficient at using assets to generate returns for the company?

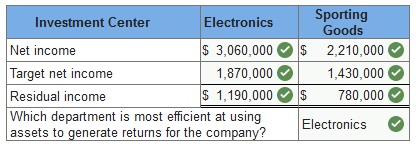

- Assume a target income level of 11% of average invested assets. Compute residual income for each department. Which department generated the most residual income for the company?

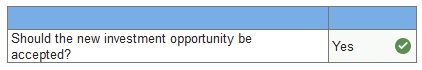

- Assume the Electronics department is presented with a new investment opportunity that will yield a 15% return on investment. Should the new investment opportunity be accepted?

1. Compute return on investment for each department. Using return on investment, which department is most efficient at using assets to generate returns for the company?

2. Assume a target income level of 11% of average invested assets. Compute residual income for each department. Which department generated the most residual income for the company?

3. Assume the Electronics department is presented with a new investment opportunity that will yield a 15% return on investment. Should the new investment opportunity be accepted?

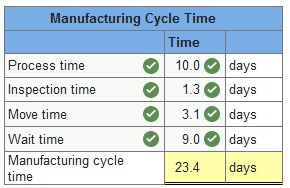

Oakwood Company produces maple bookcases to customer order. The following information is available for the production of the bookcases.

| Process time | 10.0 days |

| Inspection time | 1.3 days |

| Move time | 3.1 days |

| Wait time | 9.0 days |

Required:

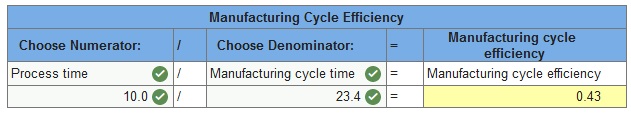

1. Compute the company’s manufacturing cycle time.

2. Compute the company’s manufacturing cycle efficiency.

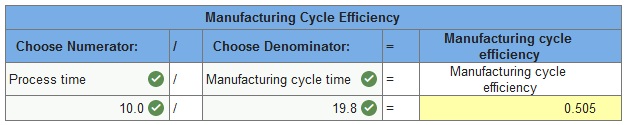

3. Management believes it can reduce move time by 1.10 days and wait time by 2.50 days by adopting lean manufacturing techniques. Compute the company’s manufacturing cycle efficiency assuming the company’s predictions are correct.

1. Compute the company’s manufacturing cycle time.

2. Compute the company’s manufacturing cycle efficiency.

3. Management believes it can reduce move time by 1.10 days and wait time by 2.50 days by adopting lean manufacturing techniques. Compute the company’s manufacturing cycle efficiency assuming the company’s predictions are correct.

Connect Managerial Accounting Chapter 9 Quiz

Q1. Marks Corporation has two operating departments, Drilling and Grinding, and an office. The three categories of office expenses are allocated to the two departments using different allocation bases. The following information is available for the current period:

| Office Expenses | Total | Allocation Basis |

| Salaries | $30,000 | Number of employees |

| Depreciation | 20,000 | Cost of goods sold |

| Advertising | 40,000 | Net sales |

| Item | Drilling | Grinding | Total | |

| Number of employees | 1,000 | 1,500 | 2,500 | |

| Net sales | $325,000 | $475,000 | $800,000 | |

| Cost of goods sold | $75,000 | $125,000 | $200,000 |

The amount of salaries that should be allocated to Drilling for the current period is:

- $30,000

- $18,000

- $15,000

- $10,000

- $12,000

Q2. Brownley Company has two service departments and two operating (production) departments. The Payroll Department services all three of the other departments in proportion to the number of employees in each. The Maintenance Department costs are allocated to the two operating departments in proportion to the floor space used by each. Listed below are the operating data for the current period:

| Service Depts. | Production Depts. | |||

| Payroll | Maintenance | Cutting | Assembly | |

| Direct costs | $20,400 | $25,500 | $76,500 | $105,400 |

| No. of personnel | 15 | 15 | 45 | |

| Sq. ft. of space | 10,000 | 15,000 | ||

The total cost of operating the Maintenance Department for the current period is:

- $14,280

- $15,912

- $25,500

- $29,580

- $22,412

Q3. The Dark Chocolate Division of Yummy Snacks, Inc. had the following operating results last year:

| Sales (150,000 pounds of chocolate) | $60,000 | ||

| Variable expenses | 37,500 | ||

| Contribution margin | 22,500 | ||

| Fixed expenses | 12,000 | ||

| Profit | $10,500 |

Assume that the Dark Chocolate Division is currently operating at its capacity of 200,000 pounds of chocolate. Also assume again that the Peanut Butter Division wants to purchase an additional 20,000 pounds of chocolate from Dark Chocolate. Under these conditions, what amount per pound of chocolate would Dark Chocolate have to charge Peanut Butter in order to maintain its current profit?

- $0.40 per pound

- $0.08 per pound

- $0.15 per pound

- $0.25 per pound

- $0.30 per pound

Q4. Calculating return on investment for an investment center is defined by the following formula:

- Contribution margin/Ending assets.

- Gross profit/Ending assets.

- Net income/Ending assets.

- Income/Average invested assets.

- Contribution margin/Average invested assets.

Q5. In regard to joint cost allocation, the “split-off point” is:

- A physical basis method to allocate costs based on ratio of some physical characteristic.

- The difference between the actual and market value of joint costs.

- The point at which some products are sold and some remain in inventory.

- The point at which separate products can be identified.

- Not acceptable when using the value basis for allocating joint costs.

Q6. The amount by which a department’s sales exceed its direct expenses is:

- Net sales.

- Gross profit.

- Departmental profit.

- Contribution margin.

- Departmental contribution to overhead.

Q7. Two investment centers at Marshman Corporation have the following current-year income and asset data:

| Investment Center A | Investment Center B | |||||

| Investment center income | $415,000 | $525,000 | ||||

| Investment center average invested assets | $2,400,000 | $1,950,000 | ||||

The return on investment (ROI) for Investment Center A is:

- 578.3%

- 24.1%

- 17.3%

- 39.2%

- 19.1%

Q8. Within an organizational structure, the person most likely to be evaluated in terms of controllable costs would be:

- A payroll clerk.

- A cost center manager.

- A production line worker.

- A maintenance worker.

- A sales representative.

Q9. Part 7B costs the Midwest Division of Frackle Corporation $30 to make, of which $21 is variable. Midwest Division sells Part 7B to other companies for $47. The Northern Division of Frackle Corporation can use Part 7B in one of its products. The Midwest Division has enough idle capacity to produce all of the units of Part 7B that the Northern Division would require. What is the lowest transfer price at which the Midwest Division should be willing to sell Part 7B to the Northern Division?

- $30

- $21

- $47

- $17

- $20

Q10. Marks Corporation has two operating departments, Drilling and Grinding, and an office. The three categories of office expenses are allocated to the two departments using different allocation bases. The following information is available for the current period:

| Office Expenses | Total | Allocation Basis | |||||||

| Salaries | $30,000 | Number of employees | |||||||

| Depreciation | 20,000 | Cost of goods sold | |||||||

| Advertising | 40,000 | Net sales | |||||||

| Item | Drilling | Grinding | Total |

| Number of employees</td? | 1,000 | 1,500 | 2,500 |

| Net sales | $325,000 | $475,000 | $800,000 |

| Cost of goods sold | $75,000 | $125,000 | $200,000 |

The amount of depreciation that should be allocated to Grinding for the current period is:

- $20,000

- $25,000

- $7,500

- $12,500

- $40,000

Please contact us via live chat if you face difficulty in any of the question or exercise.