Accounting Assignment Help » Managerial Accounting Assignment Help » Connect Managerial Accounting Chapter 8

Connect Managerial Accounting Chapter 8

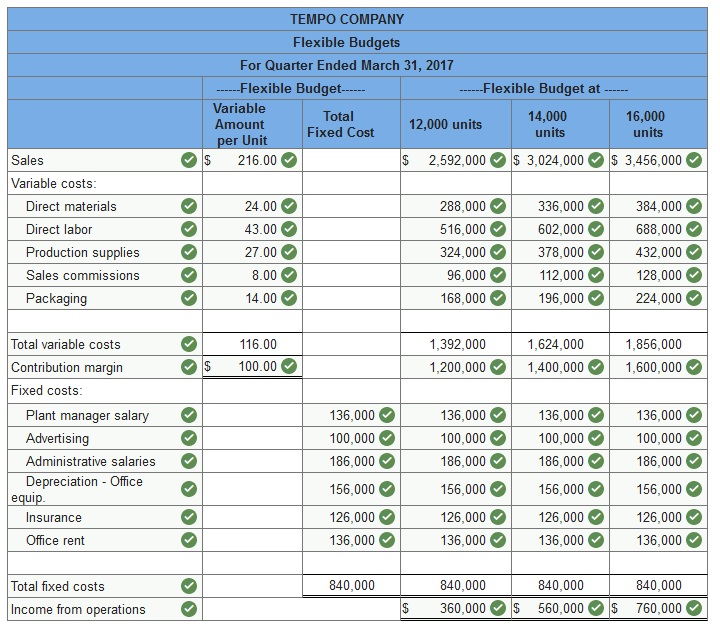

Q1. Tempo Company’s fixed budget (based on sales of 14,000 units) for the first quarter of calendar year 2017 reveals the following.

| Fixed Budget | ||

| Sales (14,000 units) | $3,024,000 | |

| Cost of goods sold | ||

| Direct materials | $336,000 | |

| Direct labor | 602,000 | |

| Production supplies | 378,000 | |

| Plant manager salary | 136,000 | 1,452,000 |

| Gross profit | 1,572,000 | |

| Selling expenses | ||

| Sales commissions | 112,000 | |

| Packaging | 196,000 | |

| Advertising | 100,000 | 408,000 |

| Administrative expenses | ||

| Administrative salaries | 186,000 | |

| Depreciation—office equip. | 156,000 | |

| Insurance | 126,000 | |

| Office rent | 136,000 | 604,000 |

| Income from operations | $560,000 | |

Complete the following flexible budgets for sales volumes of 12,000, 14,000, and 16,000 units. (Round cost per unit to 2 decimal places.)

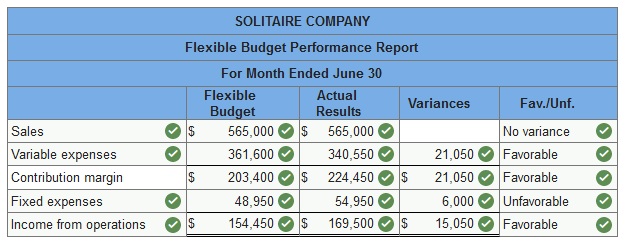

Q2. Solitaire Company’s fixed budget performance report for June follows. The $333,750 budgeted expenses include $284,800 variable expenses and $48,950 fixed expenses. Actual expenses include $54,950 fixed expenses.

| Fixed Budget | Actual Results | Variances | ||||||||

| Sales (in units) | 8,900 | 11,300 | ||||||||

| Sales (in dollars) | $ | 445,000 | $ | 565,000 | $ | 120,000 | F | |||

| Total expenses | 333,750 | 395,500 | 61,750 | U | ||||||

| Income from operations | $ | 111,250 | $ | 169,500 | $ | 58,250 | F | |||

Prepare a flexible budget performance report showing any variances between budgeted and actual results. List fixed and variable expenses separately.

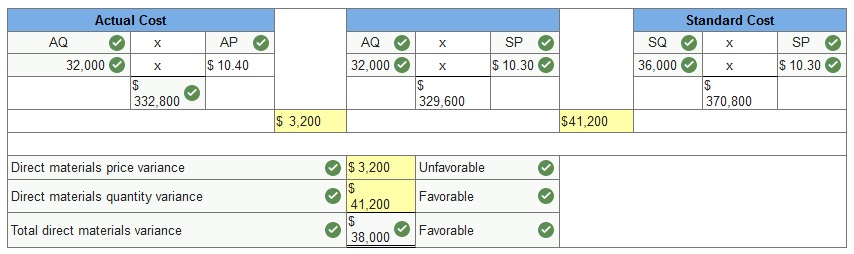

Hart Company made 3,600 bookshelves using 32,000 board feet of wood costing $332,800. The company’s direct materials standards for one bookshelf are 10 board feet of wood at $10.30 per board foot.

(1) Compute the direct materials price and quantity variances incurred in manufacturing these bookshelves.

AQ = Actual Quantity

SQ = Standard Quantity

AP = Actual Price

SP = Standard Price

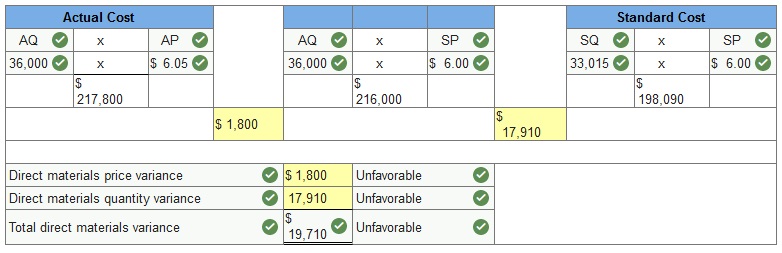

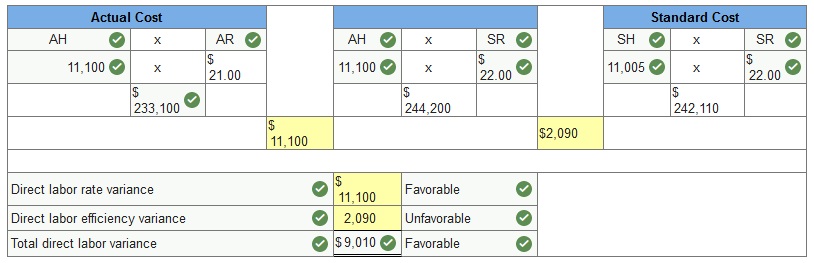

The following information describes production activities of Mercer Manufacturing for the year.

| Actual direct materials used | 36,000 lbs. at $6.05 per lb. |

| Actual direct labor used | 11,100 hours for a total of $233,100 |

| Actual units produced | 66,030 |

Budgeted standards for each unit produced are 0.50 pounds of direct material at $6.00 per pound and 10 minutes of direct labor at $22.00 per hour.

AQ = Actual Quantity

SQ = Standard Quantity

AP = Actual Price

SP = Standard Price

AH = Actual Hours

SH = Standard Hours

AR = Actual Rate

SR = Standard Rate

(1) Compute the direct materials price and quantity variances.

(2) Compute the direct labor rate and efficiency variances. Indicate whether each variance is favorable or unfavorable.

Connect Managerial Accounting Chapter 8 Quiz

Q1. Summerlin Company budgeted 4,000 pounds of material costing $5.00 per pound to produce 2,000 units. The company actually used 4,500 pounds that cost $5.10 per pound to produce 2,000 units. What is the direct materials quantity variance?

- $400 unfavorable

- $450 unfavorable

- $2,500 unfavorable

- $2,550 unfavorable

- $2,950 unfavorable

Q2. Use the following data to find the total direct labor cost variance if the company produced 3,500 units during the period.

| Direct labor standard (4 hrs. @ $7/hr.) | $28 per unit |

| Actual hours worked | 12,250 |

| Actual rate per hour | $7.50 |

- $6,125 unfavorable

- $7,000 unfavorable

- $7,000 favorable

- $12,250 favorable

- $6,125 favorable

Q3. The following information relating to a company’s overhead costs is available.

| Actual total variable overhead | $73,000 |

| Actual total fixed overhead | $17,000 |

| Budgeted variable overhead rate per machine hour | $2.50 |

| Budgeted total fixed overhead | $15,000 |

| Budgeted machine hours allowed for actual output | 30,000 |

Based on this information, the total variable overhead variance is:

- $2,000 favorable

- $6,000 favorable

- $2,000 unfavorable

- $6,000 unfavorable

- $1,000 favorable

Q4. Overhead cost variance is:

- The difference between the overhead costs actually incurred and the overhead budgeted at the actual operating level.

- The difference between the actual overhead incurred during a period and the standard overhead applied.

- The difference between actual and budgeted cost caused by the difference between the actual price per unit and the budgeted price per unit.

- The costs that should be incurred under normal conditions to produce a specific product (or component) or to perform a specific service.

- The difference between the total overhead cost that would have been expected if the actual operating volume had been accurately predicted and the amount of overhead cost that was allocated to products using the standard overhead rate.

Q5. A flexible budget performance report compares the differences between:

- Actual performance and budgeted performance based on actual sales volume.

- Actual performance over several periods.

- Budgeted performance over several periods.

- Actual performance and budgeted performance based on budgeted sales volume.

- Actual performance and standard costs at the budgeted sales volume.

Q6. Fletcher Company collected the following data regarding production of one of its products. Compute the standard quantity allowed for the actual output.

| Direct materials standard (6 lbs. @ $2/lb.) | $12 per finished unit |

| Actual direct materials used | 243,000 lbs. |

| Actual finished units produced | 40,000 units |

| Actual cost of direct materials used | $483,570 |

- 243,000 pounds.

- 240,000 pounds.

- 40,000 pounds

- 480,000 pounds.

- 80,000 pounds.

Q7. Claremont Company specializes in selling refurbished copiers. During the month, the company sold 180 copiers for total sales of $540,000. The budget for the month was to sell 175 copiers at an average price of $3,200. The sales price variance for the month was:

- $20,000 unfavorable

- $20,000 favorable

- $36,000 unfavorable

- $32,000 unfavorable

- $36,000 favorable

Q8. A company provided the following direct materials cost information. Compute the total direct materials cost variance.

| Standard costs assigned: | |

| Direct materials standard cost (405,000 units @ $2.00/unit) | $810,000 |

| Actual costs: | |

| Direct Materials costs incurred (403,750 units @ $2.20/unit) | $888,250 |

- $2,500 Favorable

- $78,250 Favorable

- $78,250 Unfavorable

- $80,750 Favorable

- $80,750 Unfavorable

Q9. Claremont Company specializes in selling refurbished copiers. During the month, the company sold 180 copiers at an average price of $3,000 each. The budget for the month was to sell 175 copiers at an average price of $3,200. The expected total sales for 180 copiers were:

- $540,000

- $576,000

- $525,000

- $560,000

- $550,000

Q10. When recording the journal entry for labor, the Work in Process Inventory account is

- Debited for standard labor cost.

- Debited for actual labor cost.

- Credited for standard labor cost.

- Credited for actual labor cost.

- Not used.

Please contact us via live chat if you face difficulty in any of the question or exercise.