Accounting Assignment Help » Managerial Accounting Assignment Help » Connect Managerial Accounting Chapter 7

Connect Managerial Accounting Chapter 7

Q1. Ruiz Co. provides the following sales forecast for the next four months:

| April | May | June | July | |

| Sales (units) | 580 | 660 | 610 | 700 |

The company wants to end each month with ending finished goods inventory equal to 30% of next month’s forecasted sales. Finished goods inventory on April 1 is 174 units. Assume July’s budgeted production is 610 units. In addition, each finished unit requires six pounds (lbs.) of raw materials and the company wants to end each month with raw materials inventory equal to 30% of next month’s production needs. Beginning raw materials inventory for April was 1,087 pounds. Assume direct materials cost $4 per pound.

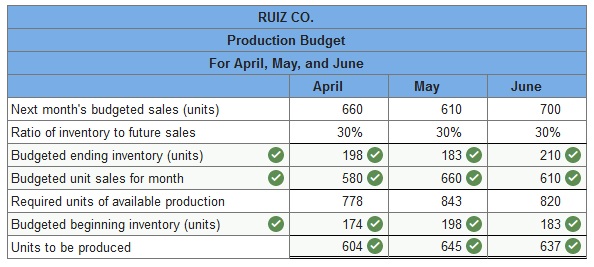

Prepare a production budget for the months of April, May, and June.

Q2. Ruiz Co. provides the following sales forecast for the next four months:

| April | May | June | July | |

| Sales (units) | 670 | 750 | 700 | 790 |

The company wants to end each month with ending finished goods inventory equal to 30% of next month’s forecasted sales. Finished goods inventory on April 1 is 201 units. Assume July’s budgeted production is 700 units. In addition, each finished unit requires four pounds (lbs.) of raw materials and the company wants to end each month with raw materials inventory equal to 30% of next month’s production needs. Beginning raw materials inventory for April was 833 pounds. Assume direct materials cost $5 per pound.

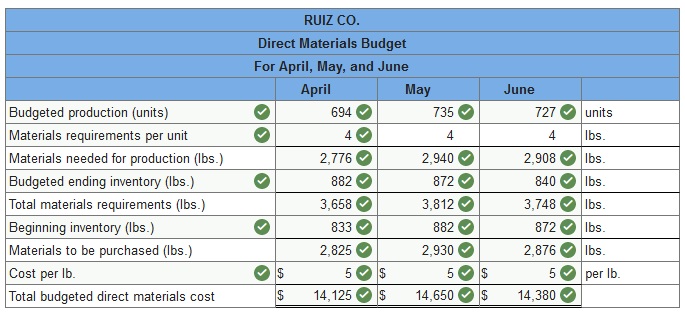

Prepare a direct materials budget for April, May, and June. (Round your intermediate calculations and final answers to the nearest whole dollar amount.)

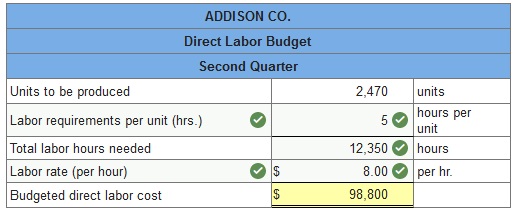

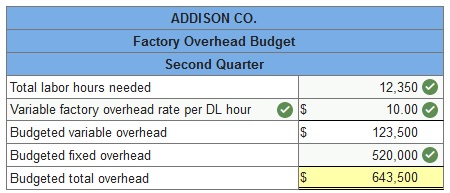

Addison Co. budgets production of 2,470 units during the second quarter. Other information is as follows:

| Direct labor | Each finished unit requires 5 direct labor hours, at a cost of $8 per hour. |

| Variable overhead | Applied at the rate of $10 per direct labor hour. |

| Fixed overhead | Budgeted at $520,000 per quarter. |

1. Prepare a direct labor budget.

2. Prepare a factory overhead budget.

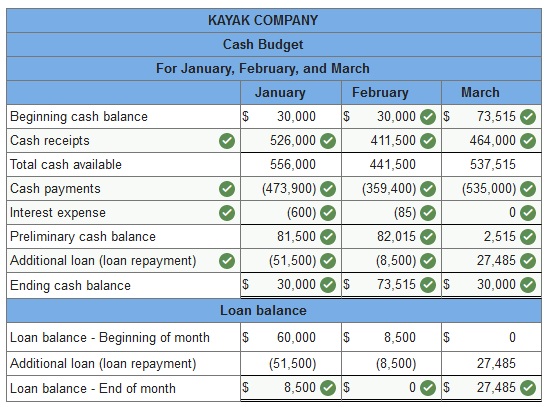

Q3. Kayak Co. budgeted the following cash receipts (excluding cash receipts from loans received) and cash payments (excluding cash payments for loan principal and interest payments) for the first three months of next year.

| Cash Receipts | Cash Payments | |

| January | $526,000 | $473,900 |

| February | 411,500 | 359,400 |

| March | 464,000 | 535,000 |

According to a credit agreement with the company’s bank, Kayak promises to have a minimum cash balance of $30,000 at each month-end. In return, the bank has agreed that the company can borrow up to $150,000 at a monthly interest rate of 1%, paid on the last day of each month. The interest is computed based on the beginning balance of the loan for the month. The company repays loan principal with any cash in excess of $30,000 on the last day of each month. The company has a cash balance of $30,000 and a loan balance of $60,000 at January 1.

Prepare monthly cash budgets for January, February, and March. (Negative balances and Loan repayment amounts (if any) should be indicated with minus sign.)

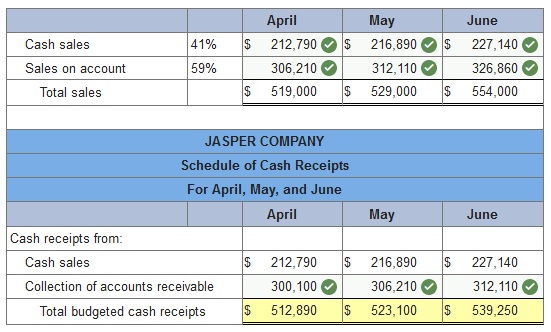

Q4. Jasper Company has sales on account and for cash. Specifically, 59% of its sales are on account and 41% are for cash. Credit sales are collected in full in the month following the sale. The company forecasts sales of $519,000 for April, $529,000 for May, and $554,000 for June. The beginning balance of Accounts Receivable is $300,100 on April 1.

Prepare a schedule of budgeted cash receipts for April, May, and June

Connect Managerial Accounting Chapter 7 Quiz

Q1. Zhang Industries sells a product for $700. Unit sales for May were 400 and each month’s sales are expected to exceed the prior month’s results by 3%. Compute the total sales dollars to be reported on the sales budget for month ended June 30.

- $280,000

- $297,000

- $271,600

- $288,400

- $364,000

Q2. To determine the production budget for an accounting period, consideration is given to all of the following except:

- Budgeted ending inventory.

- Budgeted beginning inventory.

- Budgeted sales.

- Budgeted overhead.

- Ratio of inventory to future sales.

Q3. Zhang Industries is preparing a cash budget for June. The company has $25,000 cash at the beginning of June and anticipates $95,000 in cash receipts and $111,290 in cash disbursements during June. The company has no loans outstanding on June 1. Compute the amount the company must borrow, if any, to maintain a $20,000 cash balance.

- $28,710

- $12,290

- $16,290

- $11,290

- $6,290

Q4. Which of the following budgets is not a budget that a manufacturer would include in its master budget?

- Sales budget.

- Direct materials budget.

- Production budget.

- Merchandise purchases budget.

- Cash budget.

Q5. Frankie’s Chocolate Co. reports the following information from its sales budget:

| Expected Sales: | July | $90,000 |

| August | 104,000 | |

| September | 120,000 |

Cash sales are normally 25% of total sales and all credit sales are expected to be collected in the month following the date of sale. The total amount of cash expected to be received from customers in September is:

- $30,000

- $78,000

- $108,000

- $120,000

- $130,500

Q6. Junior Snacks reports the following information from its sales budget:

| Expected Sales: | October | $143,000 |

| November | 151,000 | |

| December | 187,000 |

All sales are on credit and are expected to be collected 40% in the month of sale and 60% in the month following sale. The total amount of cash expected to be received from customers in November is:

- $146,200

- $85,800

- $151,000

- $236,800

- $60,400

Q7. Flagstaff Company has budgeted production units for July of 7,900 units. Variable factory overhead is $1.20 per unit. Budgeted fixed factory overhead is $19,000, which includes $3,000 of factory equipment depreciation. Compute the total budgeted overhead to be reported on the factory overhead budget for the month.

- $25,480

- $19,000

- $23,900

- $28,480

- $9,480

Q8. Boulware Company’s budgeted production calls for 5,000 units in October and 8,000 units in November. Each unit requires 8 pounds (lbs.) of raw material A. Each month’s ending inventory of raw materials should equal 20% of the following month’s budgeted materials requirements. The October 1 inventory for this material is 8,000 pounds. What is the budgeted materials purchases for this key material in pounds for October?

- 40,000 lbs

- 44,800 lbs

- 52,800 lbs

- 60,800 lbs

- 35,200 lbs

Q9. Ratchet Manufacturing anticipates total sales for August, September, and October of $200,000, $210,000, and $220,500 respectively. Cash sales are normally 25% of total sales and the remaining sales are on credit. All credit sales are collected in the first month after the sale. Compute the amount of accounts receivable to be reported on the company’s budgeted balance sheet for August.

- $150,000

- $50,000

- $157,500

- $52,500

- $200,000

Q10. Fortune Company’s direct materials budget shows the following cost of materials to be purchased for the coming three months:

| January | February | March | |

| Material purchases | $12,040 | $14,150 | $10,970 |

Payments for purchases are expected to be made 50% in the month of purchase and 50% in the month following purchase. The December Accounts Payable balance is $6,500. The budgeted cash payments for materials in January are:

- $6,500

- $9,270

- $12,520

- $13,095

- $18,540

Please contact us via live chat if you face difficulty in any of the question or exercise.