Accounting Assignment Help » Managerial Accounting Assignment Help » Connect Managerial Accounting Chapter 6

Connect Managerial Accounting Chapter 6

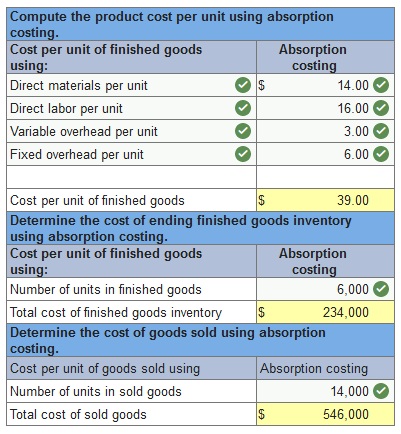

Q1. Trio Company reports the following information for the current year, which is its first year of operations.

| Direct materials | $14 | per unit |

| Direct labor | $16 | per unit |

| Overhead costs for the year | ||

| Variable overhead | $60,000 | per year |

| Fixed overhead | $120,000 | per year |

| Units produced this year | 20,000 | units |

| Units sold this year | 14,000 | units |

| Ending finished goods inventory in units | 6,000 | units |

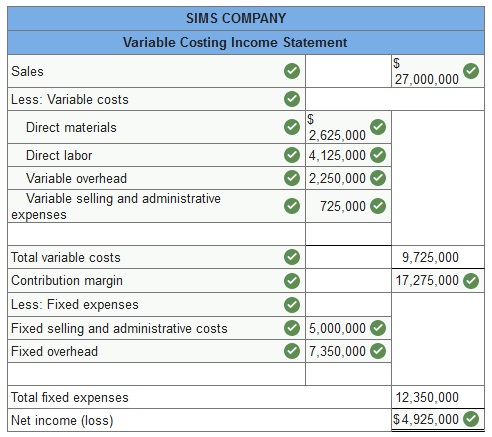

Q2. Sims Company, a manufacturer of tablet computers, began operations on January 1, 2017. Its cost and sales information for this year follows.

| Manufacturing costs | |

| Direct materials | $35 per unit |

| Direct labor | $55 per unit |

| Overhead costs for the year | |

| Variable overhead | $3,150,000 |

| Fixed overhead | $7,350,000 |

| Selling and administrative costs for the year | |

| Variable | $725,000 |

| Fixed | $5,000,000 |

| Production and sales for the year | |

| Units produced | 105,000 units |

| Units sold | 75,000 units |

| Sales price per unit | $360 per unit |

1. Prepare an income statement for the year using variable costing.

2. Prepare an income statement for the year using absorption costing.

3. Under what circumstance(s) is reported income identical under both absorption costing and variable costing?

![]()

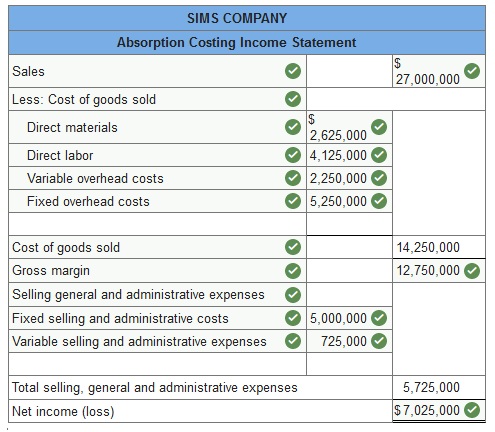

Q3. Kenzi Kayaking, a manufacturer of kayaks, began operations this year. During this first year, the company produced 1,000 kayaks and sold 750. at a price of $1,000 each. At this first year-end, the company reported the following income statement information using absorption costing.

| Sales (750 × $1,000) | $750,000 |

| Cost of goods sold (750 × $425) | 318,750 |

| Gross margin | 431,250 |

| Selling and administrative expenses | 240,000 |

| Net income | $191,250 |

Additional Information

- Product cost per kayak totals $425, which consists of $325 in variable production cost and $100 in fixed production cost—the latter amount is based on $100,000 of fixed production costs allocated to the 1,000 kayaks produced.

- The $240,000 in selling and administrative expense consists of $85,000 that is variable and $155,000 that is fixed.

1. Prepare an income statement for the current year under variable costing.

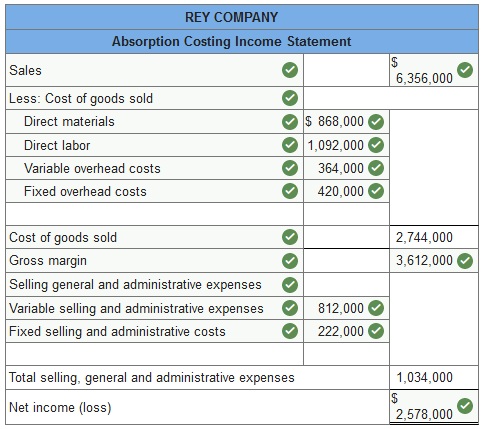

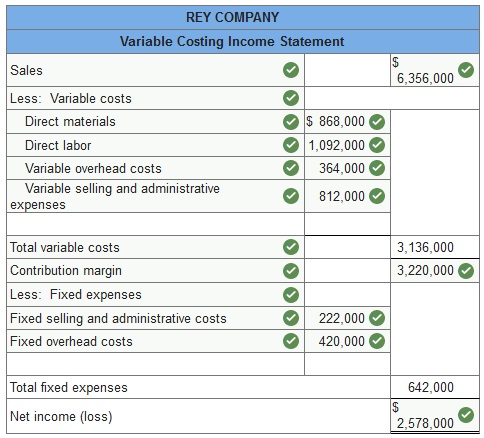

Q4. Rey Company’s single product sells at a price of $227 per unit. Data for its single product for its first year of operations follow.

| Direct materials | $31 per unit |

| Direct labor | $39 per unit |

| Overhead costs | |

| Variable overhead | $13 per unit |

| Fixed overhead per year | $420,000 per year |

| Selling and administrative expenses | |

| Variable | $29 per unit |

| Fixed | $222,000 per year |

| Units produced and sold | 28,000 units |

1. Prepare an income statement for the year using absorption costing

2. Prepare an income statement for the year using variable costing.

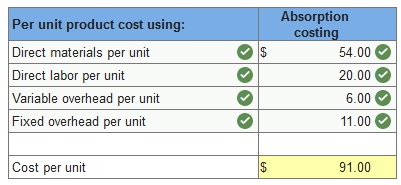

Q5. Cool Sky reports the following costing data on its product for its first year of operations. During this first year, the company produced 46,000 units and sold 38,000 units at a price of $130 per unit.

| Manufacturing costs | |

| Direct materials per unit | $54 |

| Direct labor per unit | $20 |

| Variable overhead per unit | $6 |

| Fixed overhead for the year | $506,000 |

| Selling and administrative costs | |

| Variable selling and administrative cost per unit | $11 |

| Fixed selling and administrative cost per year | $115,000 |

1a. Assume the company uses absorption costing. Determine its product cost per unit.

Connect Managerial Accounting Chapter 6 Quiz

Q1. Which of the following costing methods charges all manufacturing costs to its products?

- Direct costing

- ABC costing

- Variable costing

- Absorption costing

Q2. Which of the following statements is true regarding absorption costing?

- It is not the traditional costing approach.

- It is not permitted to be used for financial reporting.

- It is not permitted to be used for tax reporting.

- It assigns all manufacturing costs to products.

- It requires only variable costs to be treated as product costs.

Q3. Using absorption costing, which of the following manufacturing costs are assigned to products?

- Direct materials and direct labor.

- Direct labor and variable manufacturing overhead.

- Fixed manufacturing overhead, direct materials, and direct labor.

- Variable manufacturing overhead, direct materials, and direct labor.

- Variable manufacturing overhead, direct materials, direct labor, and fixed manufacturing overhead.

Q4. Income __________ when there is zero beginning inventory and all inventory units produced are sold.

- Will be lower under variable costing than absorption costing

- Will be the same under both variable and absorption costing

- Will be higher under variable costing than absorption costing

- Will be higher than gross margin under variable costing

Q5. Which of the following would be a line item for a variable costing income statement?

- Gross margin

- Cost of goods available for sale

- Total cost of goods sold

- Contribution margin

- Work-in-process inventory

Q6. When evaluating a special order, management should:

- Only accept the order if the incremental revenue exceeds all product costs.

- Only accept the order if the incremental revenue exceeds fixed product costs.

- Only accept the order if the incremental revenue exceeds total variable product costs.

- Only accept the order if the incremental revenue exceeds full absorption product costs.

- Only accept the order if the incremental revenue exceeds regular sales revenue.

Q7. Alexis Co. reported the following information for May:

| Units sold | 5,000 units |

| Selling price per unit | $800 |

| Variable manufacturing cost per unit | 520 |

| Sales commission per unit – Part A | 80 |

What is the manufacturing margin for Part A?

- $1,000,000

- $1,400,000

- $3,600,000

- $2,600,000

Q8. Geneva Co. reports the following information for July:

| Sales | $750,000 |

| Variable costs | 225,000 |

| Fixed costs | 100,000 |

Calculate the contribution margin for July.

- $525,000

- $425,000

- $650,000

- $750,000

Q9. Geneva Company manufactures dolls that are sold to various customers. The company works at full capacity for half the year to meet peak demand, and operates at 80% capacity for the other half of the year. The following information is provided:

| Units produced and sold | 600,000 | units | |

| Selling price | $35 | / | unit |

| Variable manufacturing costs | $20 | / | unit |

| Fixed manufacturing costs | $1,200,000 | / | yr. |

| Variable selling and administrative costs | $6 | / | unit |

| Fixed selling and administrative costs | $950,000 | / | yr. |

Geneva receives a purchase order to make 5,000 dolls as a one-time event. The good news is that this order is during a period when Geneva does have excess capacity. What is the lowest selling price Geneva should accept for this purchase order?

- $35.00

- $26.00

- $29.50

- $23.50

Q10. Swisher, Incorporated reports the following annual cost data for its single product:

| Normal production level | 30,000 | units |

| Direct materials | $6.40 | per unit |

| Direct labor | $3.93 | per unit |

| Variable overhead | $5.80 | per unit |

| Fixed overhead | $150,000 | in total |

This product is normally sold for $48 per unit. If Swisher increases its production to 50,000 units, while sales remain at the current 30,000 unit level, by how much would the company’s income increase or decrease under variable costing?

- $60,000 decrease

- $90,000 decrease

- There is no change in income

- $90,000 increase

- $60,000 increase

Please contact us via live chat if you face difficulty in any of the question or exercise.