Accounting Assignment Help » Managerial Accounting Assignment Help » Connect Managerial Accounting Chapter 3

Connect Managerial Accounting Chapter 3

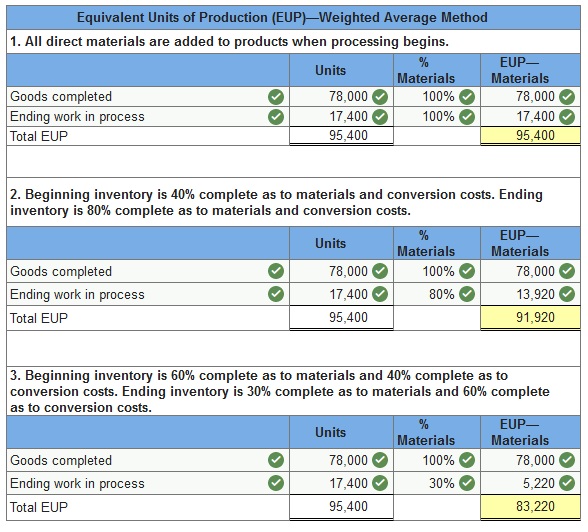

Q1. The production department in a process manufacturing system completed 78,000 units of product and transferred them to finished goods during a recent period. Of these units, 31,200 were in process at the beginning of the period. The other 46,800 units were started and completed during the period. At period-end, 17,400 units were in process.

Prepare the department’s equivalent units of production with respect to direct materials under each of three separate assumptions using the weighted-average method for process costing.

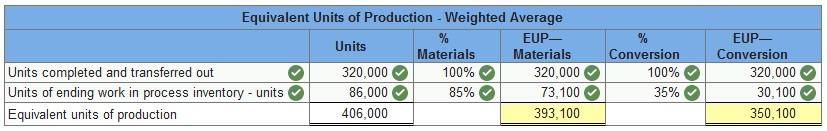

Q2. During April, the production department of a process manufacturing system completed a number of units of a product and transferred them to finished goods. Of these transferred units, 64,000 were in process in the production department at the beginning of April and 256,000 were started and completed in April. April’s beginning inventory units were 80% complete with respect to materials and 20% complete with respect to conversion. At the end of April, 86,000 additional units were in process in the production department and were 85% complete with respect to materials and 35% complete with respect to conversion.

1. Compute the number of units transferred to finished goods.

2. Compute the number of equivalent units with respect to both materials used and conversion used in the production department for April using the weighted-average method.

1. Compute the number of units transferred to finished goods.

![]()

2. Compute the number of equivalent units with respect to both materials used and conversion used in the production department for April using the weighted-average method.

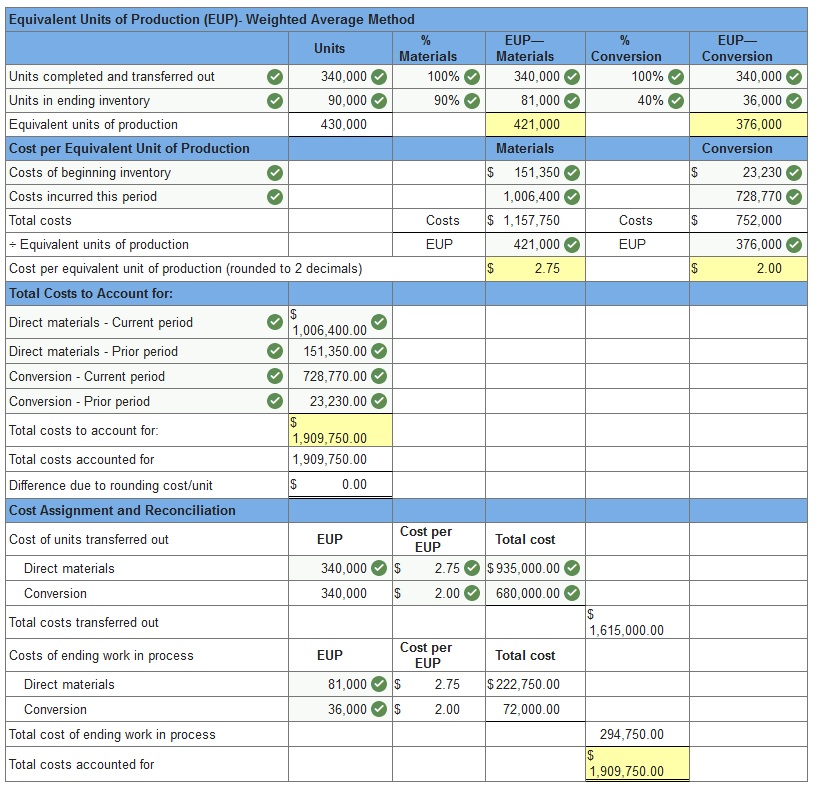

Q3. During April, the production department of a process manufacturing system completed a number of units of a product and transferred them to finished goods. Of these transferred units, 68,000 were in process in the production department at the beginning of April and 272,000 were started and completed in April. April’s beginning inventory units were 75% complete with respect to materials and 25% complete with respect to conversion. At the end of April, 90,000 additional units were in process in the production department and were 90% complete with respect to materials and 40% complete with respect to conversion.

The production department had $1,006,400 of direct materials and $728,770 of conversion costs charged to it during April. Also, its beginning inventory of $174,580 consists of $151,350 of direct materials cost and $23,230 of conversion costs.

1&2. Using the weighted-average method, compute the direct materials cost and the conversion cost per equivalent unit and assign April’s costs to the department’s output. (Round “Cost per EUP” to 2 decimal places.)

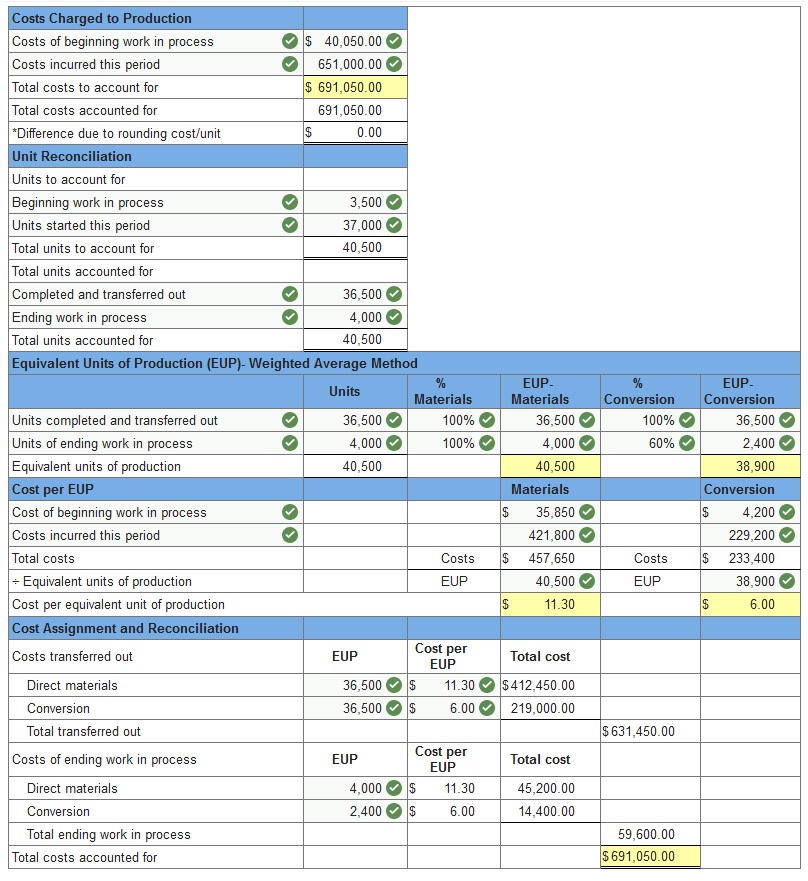

Q4. The following partially completed process cost summary describes the July production activities of Ashad Company. Its production output is sent to its warehouse for shipping. All direct materials are added to products when processing begins. Beginning work in process inventory is 20% complete with respect to conversion.

| Equivalent Units of Production | Direct Materials | Conversion |

| Units transferred out | 36,500 EUP | 36,500 EUP |

| Units of ending work in process | 4,000 EUP | 2,400 EUP |

| Equivalent units of production | 40,500 EUP | 38,900 EUP |

| Costs per EUP | Direct Materials | Conversion |

| Costs of beginning work in process | $35,850 | $4,200 |

| Costs incurred this period | 421,800 | 229,200 |

| Total costs | $457,650 | $233,400 |

| Units in beginning work in process (all completed during July) | 3,500 |

| Units started this period | 37,000 |

| Units completed and transferred out | 36,500 |

| Units in ending work in process | 4,000 |

Prepare its process cost summary using the weighted-average method. (Round “Cost per EUP” to 2 decimal places.)

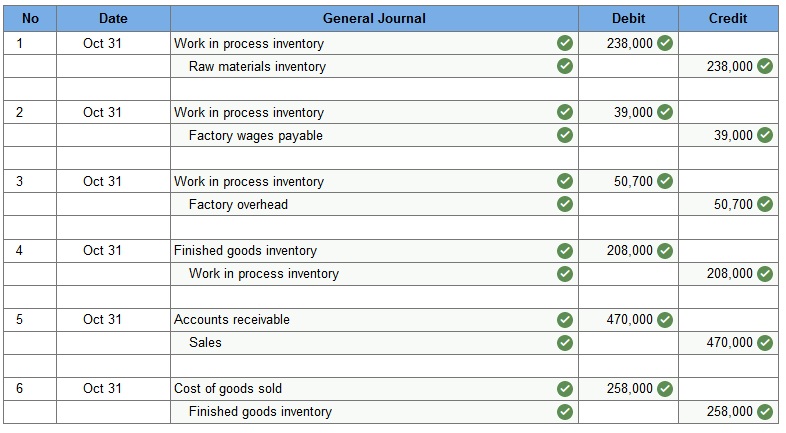

Q5. Laffer Lumber produces bagged bark for use in landscaping. Production involves packaging bark chips in plastic bags in a bagging department. The following information describes production operations for October.

| Bagging Department |

|

| Direct materials used | $238,000 |

| Direct labor used | $39,000 |

| Predetermined overhead rate (based on direct labor) | 130% |

| Goods transferred from bagging to finished goods | $(208,000) |

The company’s revenue for the month totaled $470,000 from credit sales, and its cost of goods sold for the month is $258,000.

Prepare summary journal entries dated October 31 to record its October production activities for (1) direct materials usage, (2) direct labor incurred (3) overhead allocation, (4) goods transfer from production to finished goods, and (5) credit sales.

Connect Managerial Accounting Chapter 3 Quiz

Q1. A company uses the weighted-average method for inventory costing. At the end of the period, 22,000 units were in the ending Work in Process inventory and are 100% complete for materials and 75% complete for conversion. The equivalent costs per unit are materials, $2.65 and conversion $5.35. Compute the cost that would be assigned to the ending Work in Process inventory for the period.

- $146,575

- $176,000

- $87,725

- $93,775

- $132,000

Q2. Which of the following is not one of the four steps in accounting for production activity and assigning costs during a period under a process cost system?

- Determine over or underapplied overhead.

- Determine the physical flow of units.

- Compute the equivalent units of production.

- Compute the cost per equivalent unit of production.

- Assign and reconcile costs.

Q3. Wilturner Company incurs $74,000 of labor related directly to the product in the Assembly Department, $23,000 of labor not directly related to the product but related to the Assembly Department as a whole, and $10,000 of labor for services that help production in both the Assembly and Finishing departments. The journal entries to record the labor would include:

- Debit Work in Process Inventory $74,000; debit Factory Overhead $33,000.

- Debit Work in Process Inventory $74,000; debit Wages Expense $33,000.

- Debit Work in Process Inventory $97,000; debit Wages Expense $10,000.

- Debit Work in Process Inventory $107,000.

- Debit Work in Process Inventory $97,000; debit Factory Overhead $10,000.

Q4. During December, the production department of a process operations system completed and transferred to finished goods a total of 65,000 units of product. At the end of March, 15,000 additional units were in process in the production department and were 80% complete with respect to materials. The beginning inventory included materials cost of $57,500 and the production department incurred direct materials cost of $183,000 during December. Compute the direct materials cost per equivalent unit for the department using the weighted-average method.

- $3.70

- $2.38

- $2.82

- $3.12

- $4.79

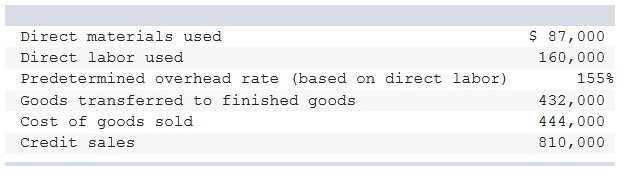

Q5. Dazzle, Inc. produces beads for jewelry making use. The following information summarizes production operations for June. The journal entry to record June production activities for direct labor usage is:

- Debit Factory Payroll Payable $160,000; credit Cash $160,000.

- Debit Work in Process Inventory $160,000; credit Factory Payroll Payable $160,000.

- Debit Cost of Goods Sold $160,000; credit Factory Payroll Payable $160,000.

- Debit Work in Process Inventory $160,000; credit Raw Materials Inventory $160,000.

- Debit Work in Process Inventory $160,000; credit Cash $160,000.

Q6. When raw materials are purchased on account for use in a process costing system, the corresponding journal entry that should be recorded will include:

- A debit to Work in Process Inventory.

- A debit to Accounts Payable.

- A credit to Cash.

- A debit to Raw Materials Inventory.

- A credit to Raw Materials Inventory.

Q7. Which of the following is the best explanation for why it is necessary to calculate equivalent units of production in a process costing environment?

- In most manufacturing environments, it is not possible to conduct a physical count of units.

- Companies often use a combination of a process costing and job order costing systems.

- In most process costing systems, direct materials are added at the beginning of the process while conversion costs are added evenly throughout the manufacturing process.

- All of the work to make a unit 100% complete and ready to move to the next stage of production or to finished goods inventory may not have been completed in a single time period.

- In most cases, there is no difference between physical units and equivalent units of production.

Q8. A company uses a process costing system. Its Welding Department completed and transferred out 100,000 units during the current period. The ending inventory in the Welding Department consists of 30,000 units (75% complete with respect to direct materials and 40% complete with respect to conversion costs).

Determine the equivalent units of production for the Welding Department for direct materials and conversion costs assuming the weighted average method.

- 130,000 materials; 130,000 conversion.

- 130,000 materials; 112,000 conversion.

- 107,500 materials; 118,000 conversion.

- 122,500 materials; 112,000 conversion.

- 112,500 materials; 130,000 conversion.

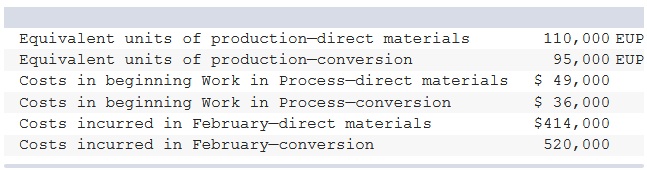

Q9. Andrews Corporation uses the weighted-average method of process costing. The following information is available for February in its Polishing Department:

- $9.26

- $4.21

- $5.85

- $5.05

- $4.97

Cost of beginning WIP $36,000 + costs incurred in February $520,000 = $556,000

Total cost $556,000/Equivalent units of production 95,000 = $5.85 cost per equivalent unit of production.

Q10. Which of the following products is most likely to be produced in a process operations system?

- Airplanes

- Cereal

- Bridges

- Designer bridal gowns

- Custom cabinets

Please contact us via live chat if you face difficulty in any of the question or exercise.