Accounting Assignment Help » Managerial Accounting Assignment Help » Connect Managerial Accounting Chapter 2

Connect Managerial Accounting Chapter 2

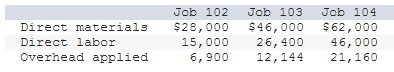

Q1. As of the end of June, the job cost sheets at Racing Wheels, Inc., show the following total costs accumulated on three custom jobs.

Job 102 was started in production in May and the following costs were assigned to it in May: direct materials, $14,000; direct labor, $3,800; and overhead, $1,748. Jobs 103 and 104 were started in June. Overhead cost is applied with a predetermined rate based on direct labor cost. Jobs 102 and 103 were finished in June, and Job 104 is expected to be finished in July. No raw materials were used indirectly in June. Using this information, answer the following questions. (Assume this company’s predetermined overhead rate did not change across these months.)

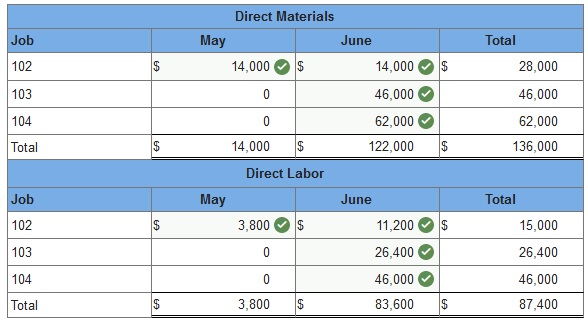

1&2. Complete the table below to calculate the cost of the raw materials requisitioned and direct labor cost incurred during June for each of the three jobs?

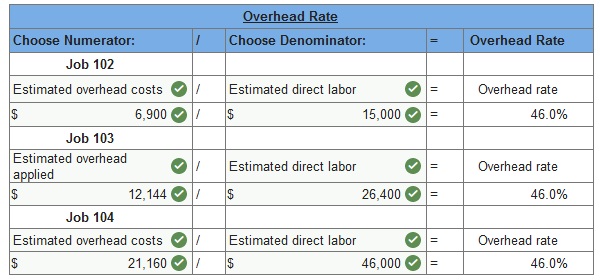

3. Using the accumulated costs of the jobs, what predetermined overhead rate is used?

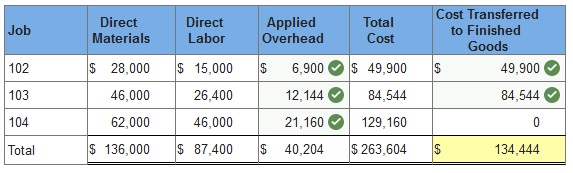

4. How much total cost is transferred to finished goods during June?

1&2. Complete the table below to calculate the cost of the raw materials requisitioned and direct labor cost incurred during June for each of the three jobs?

3. Using the accumulated costs of the jobs, what predetermined overhead rate is used?

4. How much total cost is transferred to finished goods during June?

Q2. Starr Company reports the following information for August.

| Raw materials purchased on account | $88,200 | |

| Direct materials used in production | $54,600 | |

| Factory wages earned (direct labor) | $17,750 | |

| Overhead rate | 120 | % of direct labor cost |

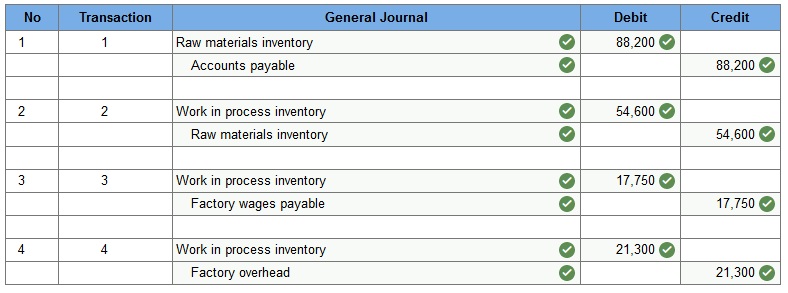

Prepare journal entries to record the following events.

1. Raw materials purchased.

2. Direct materials used in production.

3. Direct labor used in production.

4. Applied overhead.

Q3. In December 2016, Custom Mfg. established its predetermined overhead rate for jobs produced during 2017 by using the following cost predictions: overhead costs, $700,000, and direct materials costs, $500,000. At year-end 2017, the company’s records show that actual overhead costs for the year are $785,900. Actual direct material cost had been assigned to jobs as follows.

| Jobs completed and sold | $420,000 | |

| Jobs in finished goods inventory | 78,000 | |

| Jobs in work in process inventory | 57,000 | |

| Total actual direct materials cost | $555,000 |

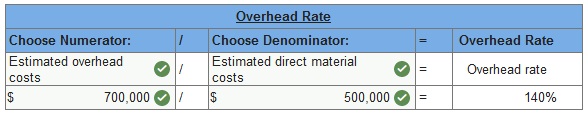

1. Determine the predetermined overhead rate for 2017.

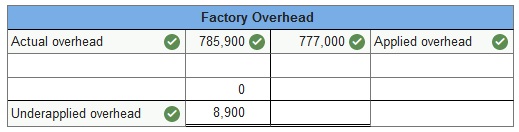

2&3. Enter the overhead costs incurred and the amounts applied during the year using the predetermined overhead rate and determine whether overhead is overapplied or underapplied.

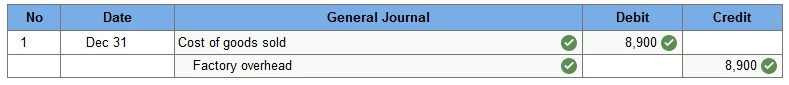

4. Prepare the adjusting entry to allocate any over- or underapplied overhead to Cost of Goods Sold.

1. Determine the predetermined overhead rate for 2017.

2&3. Enter the overhead costs incurred and the amounts applied during the year using the predetermined overhead rate and determine whether overhead is overapplied or underapplied.

4. Prepare the adjusting entry to allocate any over- or underapplied overhead to Cost of Goods Sold.

Connect Managerial Accounting Chapter 2 Quiz

Q1. Kayak Company uses a job order costing system and allocates its overhead on the basis of direct labor costs. Kayak Company’s production costs for the year were: direct labor, $30,000; direct materials, $50,000; and factory overhead applied $6,000. The overhead application rate was:

- 5.0%

- 12.0%

- 20.0%

- 500.0%

- 16.7%

OH rate = OH applied/Direct Labor Costs = $6,000/$30,000 = 20%

Q2. An example of direct labor cost is:

- Supervisor salary

- Maintenance worker wages

- Janitor wages

- Product assembler wages

- Accountant salary

Q3. Copy Center pays an average wage of $12 per hour to employees for printing and copying jobs, and allocates $18 of overhead for each employee hour worked. Materials are assigned to each job according to actual cost. Jobs are marked up 20% above cost to determine the selling price. If Job M-47 used $350 of materials and took 20 hours of labor to complete, what is the selling price of the job?

- $852

- $1,140

- $456

- $720

- $708

Direct materials $350 + Direct labor ($12 * 20) + Factory overhead ($18 * 20) = $350 + $240 + $360 = $950 Total cost

$950 * 120% = $1,140

Q4. The balance in the Work in Process Inventory at any point in time is equal to:

- The costs for jobs finished during the period but not yet sold.

- The cost of jobs ordered but not yet started into production.

- The sum of the costs for all jobs in process but not yet completed.

- The costs of all jobs started during the period, completed or not.

- The sum of the materials, labor and overhead costs paid during the period.

Q5. Lowden Company has an overhead application rate of 160% and allocates overhead based on direct material cost. During the current period, direct labor cost is $50,000 and direct materials used cost $80,000. Determine the amount of overhead Lowden Company should record in the current period.

- $31,250

- $50,000

- $80,000

- $128,000

- $208,000

$80,000 direct materials * 1.60 = $128,000

Q6. Portside Watercraft uses a job order costing system. During one month Portside purchased $173,000 of raw materials on credit; issued materials to production of $164,000 of which $24,000 were indirect. Portside incurred a factory payroll of $95,000, of which $25,000 was indirect labor. Portside uses a predetermined overhead rate of 170% of direct labor cost. The journal entry to record the issuance of materials to production is:

- Debit Raw Materials Inventory $153,000; credit Accounts Payable $153,000.

- Debit Work in Process Inventory $140,000; debit Factory Overhead $24,000; credit Raw Materials Inventory $164,000.

- Debit Raw Materials Inventory $195,000; credit Work in Process Inventory $195,000.

- Debit Work in Process Inventory $140,000; debit Raw Materials Inventory $24,000; credit Materials Inventory $164,000.

- Debit Finished Goods Inventory $140,000; credit Raw Materials Inventory $140,000.

Q7. A company has an overhead application rate of 125% of direct labor costs. How much overhead would be allocated to a job if it required total labor costing $20,000?

- $5,000

- $16,000

- $25,000

- $125,000

- $250,000

$20,000 * 1.25 = $25,000

Q8. A job order costing system would best fit the needs of a company that makes:

- Shoes and apparel.

- Paint

- Cement

- Custom machinery.

- Pencils and erasers.

Q9. A job cost sheet includes:

- Direct materials, direct labor, operating costs.

- Direct materials, estimated overhead, administrative costs.

- Direct labor, actual overhead, selling costs.

- Direct material, direct labor, applied overhead.

- Direct materials, direct labor, selling costs.

Q10. At the current year-end, Simply Company found that its overhead was underapplied by $2,500, and this amount was not considered material. Based on this information, Simply should:

- Close the $2,500 to Cost of Goods Sold.

- Close the $2,500 to Finished Goods Inventory.

- Do nothing about the $2,500, since it is not material, and it is likely that overhead will be overapplied by the same amount next year.

- Carry the $2,500 to the income statement as “Other Expense”.

- Carry the $2,500 to the next period.

Please contact us via live chat if you face difficulty in any of the question or exercise.