Accounting Assignment Help » Managerial Accounting Assignment Help » Connect Managerial Accounting Chapter 1

Connect Managerial Accounting Chapter 11

Q1. Mint Company is considering purchasing a machine with a cost of $10,000 and a useful life of 20 years. Mint expects the machine to produce net annual cash flows of $2,000 each year. What is the cash payback period of the machine?

- 2 years

- 5 years

- 10 years

- 0.20 years

Q2. Jelly Company is considering purchasing a machine with a cost of $20,000 and a useful life of 10 years. Mint expects the machine to produce net annual cash flows of $2,000 in year 1, $10,000 in year 2, $5,000 in year 3, $12,000 in year 4, and $8,000 in year 5. What is the cash payback period of the machine?

- 3 years

- 3.5 years

- 3.25 years

- 4.25 years

Q3. Chilly Company is considering investing $110,000 in a new refrigerator, designed to keep food extra crispy. The refrigerator will have a useful life of 10 years, a salvage value of $10,000, and is expected to generate an annual after-tax net income of $15,000 in each year of its useful life. Chilly Co. will use the straight-line method of depreciation. What is the annual average investment?

- $50,000

- $55,000

- $60,000

- $45,000

Q4. Chilly Company is considering investing $110,000 in a new refrigerator, designed to keep food extra crispy. The refrigerator will have a useful life of 10 years, a salvage value of $10,000, and is expected to generate an annual after tax net income of $15,000 in each year of its useful life. Chilly will use the straight-line method of depreciation. What is the accounting rate of return?

- 30%

- 13.64%

- 16.67%

- 25%

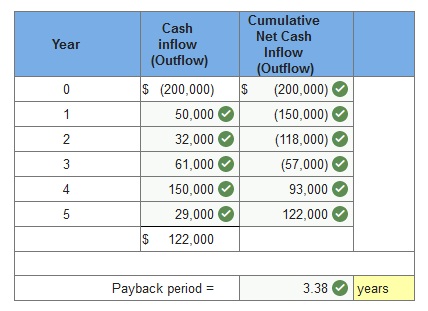

Q5. Beyer Company is considering the purchase of an asset for $200,000. It is expected to produce the following net cash flows. The cash flows occur evenly within each year.Compute the payback period for this investment. (Cumulative net cash outflows must be entered with a minus sign. Round your Payback Period answer to 2 decimal place.)

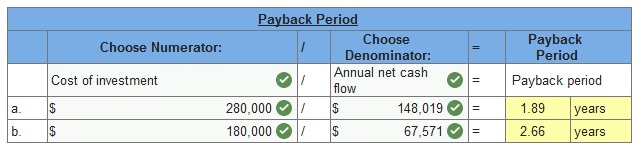

Compute the payback period for each of these two separate investments:

a. A new operating system for an existing machine is expected to cost $280,000 and have a useful life of four years. The system yields an incremental after-tax income of $80,769 each year after deducting its straight-line depreciation. The predicted salvage value of the system is $11,000.

b. A machine costs $180,000, has a $15,000 salvage value, is expected to last seven years, and will generate an after-tax income of $44,000 per year after straight-line depreciation.

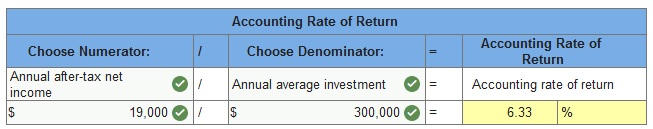

A machine costs $500,000 and is expected to yield an after-tax net income of $19,000 each year. Management predicts this machine has a 9-year service life and a $100,000 salvage value, and it uses straight-line depreciation. Compute this machine’s accounting rate of return.

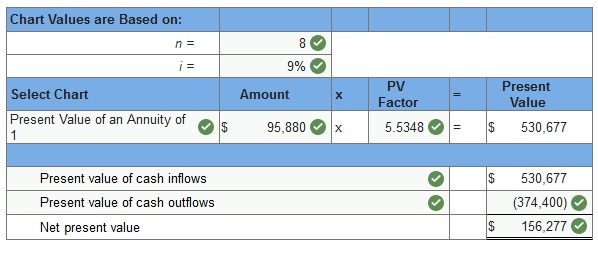

B2B Co. is considering the purchase of equipment that would allow the company to add a new product to its line. The equipment is expected to cost $374,400 with a 8-year life and no salvage value. It will be depreciated on a straight-line basis. The company expects to sell 149,760 units of the equipment’s product each year. The expected annual income related to this equipment follows.

| Sales | 234,000 |

| Costs | |

| Materials, labor, and overhead (except depreciation on new equipment) | 82,000 |

| Depreciation on new equipment | 46,800 |

| Selling and administrative expenses | 23,400 |

| Total costs and expenses | 152,200 |

| Pretax income | 81,800 |

| Income taxes (40%) | 32,720 |

| Net income | 49,080 |

If at least an 9% return on this investment must be earned, compute the net present value of this investment. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.)

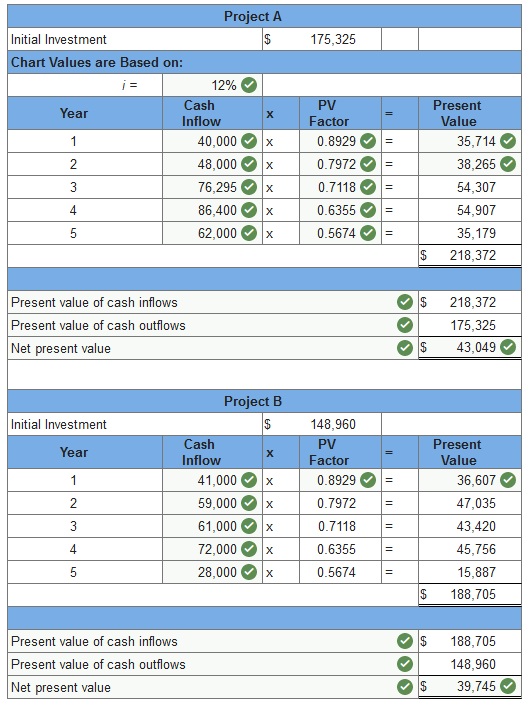

Following is information on two alternative investments being considered by Jolee Company. The company requires a 12% return from its investments. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.)

| Project A | Project B | |

| Initial investment | $(175,325) | $(148,960) |

| Expected net cash flows in year: | ||

| 1 | 40,000 | 41,000 |

| 2 | 48,000 | 59,000 |

| 3 | 76,295 | 61,000 |

| 4 | 86,400 | 72,000 |

| 5 | 62,000 | 28,000 |

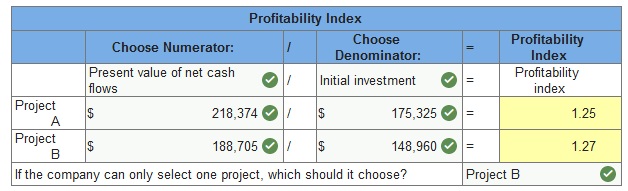

a. For each alternative project compute the net present value.

b. For each alternative project compute the profitability index. If the company can only select one project, which should it choose?

a. For each alternative project compute the net present value.

b. For each alternative project compute the profitability index. If the company can only select one project, which should it choose?

Connect Managerial Accounting Chapter 11 Quiz

Q1. Vextra Corporation is considering the purchase of new equipment costing $35,000. The projected annual cash inflow is $11,000, to be received at the end of each year. The machine has a useful life of 4 years and no salvage value. Vextra requires a 12% return on its investments. The present value of an annuity of $1 for different periods follows:

| Periods | 12% |

| 1 | 0.8929 |

| 2 | 1.6901 |

| 3 | 2.4018 |

| 4 | 3.0373 |

What is the net present value of the machine?

- $(33,410)

- $(3,100)

- $35,000

- $3,410

- $(1,590)

Q2. A disadvantage of using the payback period to compare investment alternatives is that:

- It ignores cash flows beyond the payback period.

- It includes the time value of money.

- It cannot be used when cash flows are not uniform.

- It cannot be used if a company records depreciation.

- It cannot be used to compare investments with different initial investments.

Q3. A company is considering a 5-year project. The company plans to invest $60,000 now and it forecasts cash flows for each year of $16,200. The company requires a hurdle rate of 12%. Calculate the internal rate of return to determine whether it should accept this project. Selected factors for a present value of an annuity of $1 for five years are shown below:

| Interest rate | Present value of an annuity of $1 factor for year 5 |

| 10% | 3.7908 |

| 12% | 3.6048 |

| 14% | 3.4331 |

- The project should be accepted.

- The project should be rejected because it earns less than 10%.

- The project earns more than 10% but less than 12%. At a hurdle rate of 12%, the project should be rejected.

- Only 9% is acceptable.

- Only 10% is acceptable.

Q4. A new manufacturing machine is expected to cost $278,000, have an eight-year life, and a $30,000 salvage value. The machine will yield an annual incremental after-tax income of $35,000 after deducting the straight-line depreciation. Compute the accounting rate of return for the investment.

- 22.7%

- 23.4%

- 46.9%

- 12.2%

- 24.5%

Q5. Capital budgeting decisions are risky because all of the following are true except:

- The outcome is uncertain.

- Large amounts of money are usually involved.

- The investment involves a long-term commitment.

- The decision could be difficult or impossible to reverse.

- They rarely produce net cash flows.

Q6. Watson Corporation is considering buying a machine for $25,000. Its estimated useful life is 5 years, with no salvage value. Watson anticipates annual net income after taxes of $1,500 from the new machine. What is the accounting rate of return assuming that Watson uses straight-line depreciation and that income is earned uniformly throughout each year?

- 6.0%

- 8.0%

- 8.5%

- 10.0%

- 12.0%

Q7. Carmel Corporation is considering the purchase of a machine costing $36,000 with a 6-year useful life and no salvage value. Carmel uses straight-line depreciation and assumes that the annual cash inflow from the machine will be received uniformly throughout each year. In calculating the accounting rate of return, what is Carmel’s average investment?

- $6,000

- $7,000

- $18,000

- $21,000

- $36,000

Q8. The time value of money concept:

- Means that a dollar today is worth less than a dollar tomorrow.

- Means that a dollar tomorrow is worth more than a dollar today.

- Means that a dollar today is worth more than a dollar tomorrow.

- Means that “Time is money.”

- Does not involve the concept of compound interest.

Q9. Porter Co. is analyzing two projects for the future. Assume that only one project can be selected.

| Project X | Project Y | |

| Cost of machine | $68,000 | $60,000 |

| Net cash flow: | ||

| Year 1 | 24,000 | 4,000 |

| Year 2 | 24,000 | 26,000 |

| Year 3 | 24,000 | 26,000 |

| Year 4 | 0 | 20,000 |

If the company is using the payback period method and it requires a payback of three years or less, which project should be selected?

- Project Y

- Project X

- Both X and Y are acceptable projects.

- Neither X nor Y is an acceptable project.

- Project Y because it has a lower initial investment.

Q10. Poe Company is considering the purchase of new equipment costing $80,000. The projected annual cash inflows are $30,200, to be received at the end of each year. The machine has a useful life of 4 years and no salvage value. Poe requires a 10% return on its investments. The present value of $1 and present value of an annuity of $1 for different periods is presented below. Compute the net present value of the machine.

| Periods | Present Value of $1 at 10% | Present Value of an Annuity of $1 at 10% |

| 1 | 0.9091 | 0.9091 |

| 2 | 0.8264 | 1.7355 |

| 3 | 0.7514 | 2.4869 |

| 4 | 0.6830 | 3.1699 |

- $(15,731)

- $(4,896)

- $15,731

- $4,896

- $32,334

Please contact us via live chat if you face difficulty in any of the question or exercise.