Accounting Assignment Help » Managerial Accounting Assignment Help » Connect Managerial Accounting Chapter 1

Connect Managerial Accounting Chapter 1

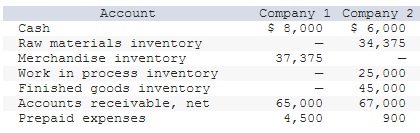

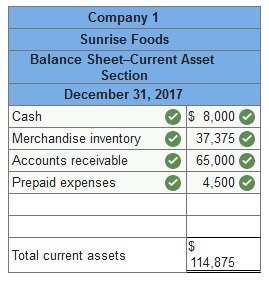

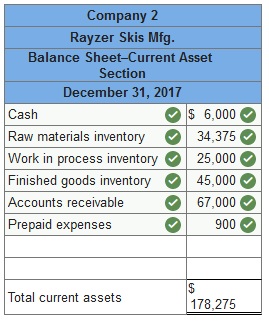

Current assets for two different companies at fiscal year-end 2017 are listed here. One is a manufacturer, Rayzer Skis Mfg., and the other, Sunrise Foods, is a grocery distribution company.

Required: Identify which set of numbers relates to the manufacturer and which to the merchandiser.

- Which of these company is manufacturer: Company 2

- Which of these company is merchandiser: Company 1

Prepare the current asset section for each company from this information.

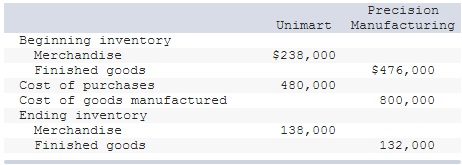

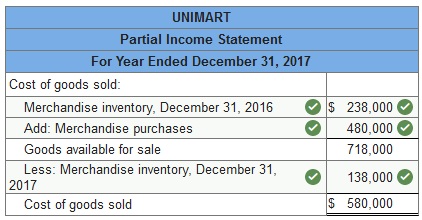

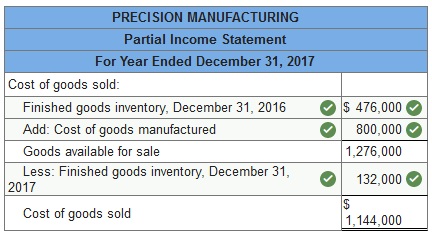

Compute cost of goods sold for each of these two companies for the year ended December 31, 2017..

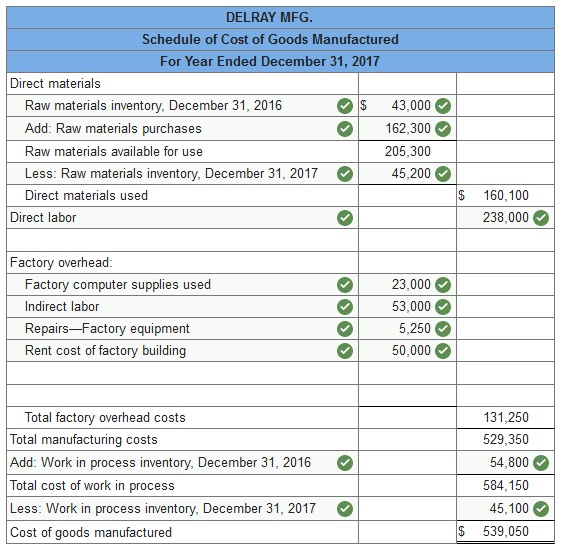

Prepare its schedule of cost of goods manufactured for the year ended December 31, 2017.

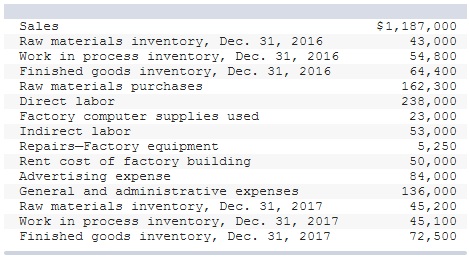

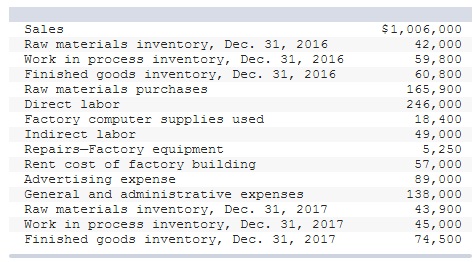

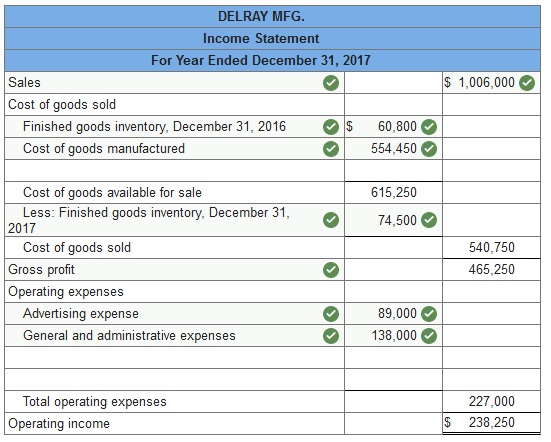

The following selected account balances are provided for Delray Mfg.

Prepare an income statement for Delray Mfg. (a manufacturer).

Connect Managerial Accounting Chapter 1 Quiz

Q1. Which of the following accounts would appear on a schedule of cost of goods manufactured?

- Raw materials, factory insurance expired, indirect labor.

- Raw materials, work in process, finished goods.

- Direct labor, delivery equipment, and depreciation on factory equipment.

- Direct materials, indirect labor, sales salaries.

- Direct labor, factory repairs and maintenance, wages payable.

Q2. The following information relates to the manufacturing operations of the Abbra Publishing Company for the year:

| Beginning | Ending | |

|---|---|---|

| Raw Materials Inventory | $547,000 | $610,000 |

The raw materials used in manufacturing during the year totaled $1,018,000. Raw materials purchased during the year amount to:

- $955,000

- $892,000

- $1,565,000

- $408,000

- $1,081,000

Beginning Raw Materials + Purchases – Ending Raw Materials = Raw Materials Used

$547,000 + Purchases – $610,000 = $1,018,000;

Purchases = $1,018,000 + $610,000 – $547,000 = $1,081,000

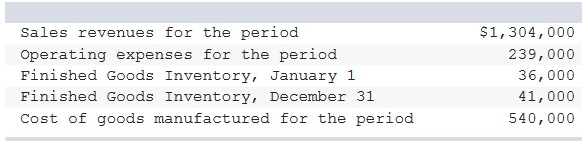

Q3. Using the information below, calculate cost of goods sold for the period:

- $774,000

- $769,000

- $530,000

- $535,000

- $448,000

Beginning Finished Goods Inventory + Cost of goods manufactured – Ending Finished Goods Inventory = Cost of goods sold. $36,000 + 540,000 – 41,000 = $535,000.

Q4. Flexibility of practice when applied to managerial accounting means that:

- The information must be presented in electronic format so that it is easily changed.

- Managers must be willing to accept the information as the accountants present it to them, rather than in the format they ask for.

- The managerial accountants need to be on call twenty-four hours a day.

- Managerial accounting system differ across companies depending on the nature of the business and the arrangement of its internal operations.

- Managers must be flexible with information provided in varying forms and using inconsistent measures.

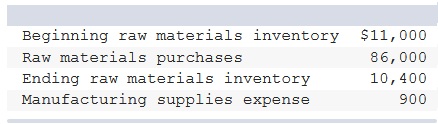

Q5. The following information is available for the year ended December 31:

- $87,500

- $85,700

- $86,900

- $85,400

- $86,600

Beginning Raw Materials + Purchases – Ending Raw Materials = Raw Materials Used

$11,000 + $86,000 – $10,400 = $86,600

Q6. All of the following statements regarding manufacturing costs are true except:

- Direct material costs that increase in total with volume of production are called variable costs.

- The reporting of fixed and variable costs separately is not helpful to managers in analyzing cost behavior.

- When overhead costs vary with production, they are called variable overhead.

- When overhead costs don’t vary with production, they are called fixed overhead.

- Overhead can be both variable and fixed.

Q7. Which of the following is not part of the sales activity in the flow of manufacturing activities?

- Beginning Finished Goods Inventory.

- Cost of Goods Manufactured.

- Total Finished Goods available for sale.

- Ending Work in Process Inventory.

- Cost of Goods Sold.

Beginning Finished Goods Inventory + Cost of Goods Manufactured = Finished Goods Available for Sale. Finished Goods Available for Sale – Ending Finished Goods Inventory = Cost of Goods Sold.

Q8. A direct cost is a cost that is:

- Identifiable as controllable.

- Traceable to the company as a whole.

- Does not change with the volume of activity.

- Traceable to a single cost object.

- Traceable to multiple cost objects.

Q9. Total manufacturing costs incurred during the year do not include:

- Direct materials used.

- Factory supplies used.

- Work in Process inventory, beginning balance.

- Direct labor.

- Depreciation of factory machinery.

Q10. Managerial accounting is different from financial accounting in that:

- Managerial accounting is more focused on the organization as a whole and financial accounting is more focused on subdivisions of the organization.

- Managerial accounting never includes nonmonetary information.

- Managerial accounting includes many projections and estimates whereas financial accounting has a minimum of predictions.

- Managerial accounting is used extensively by investors, whereas financial accounting is used only by creditors.

- Managerial accounting is mainly used to set stock prices.

Please contact us via live chat if you face difficulty in any of the question or exercise.