Home » Online Class Help » Accounting Assignment Help » Accounting Exam Help »

Connect Intermediate Accounting Chapter 14

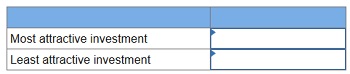

Q1. Your investment department has researched possible investments in corporate debt securities. Among the available investments are the following $100 million bond issues, each dated January 1, 2018. Prices were determined by underwriters at different times during the last few weeks. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.)

| Company | Bond Price | Stated Rate | |||

| 1. | BB Corp. | $ | 109 million | 11 | % |

| 2. | DD Corp. | $ | 100 million | 10 | % |

| 3. | GG Corp. | $ | 91 million | 9 | % |

Each of the bond issues matures on December 31, 2037, and pays interest semiannually on June 30 and December 31. For bonds of similar risk and maturity, the market yield at January 1, 2018, is 10%.

Required:

Other things being equal, which of the bond issues offers the most attractive investment opportunity if it can be purchased at the prices stated? The least attractive?

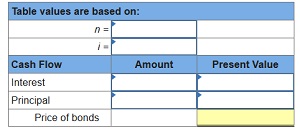

Q2. Complete the below table to calculate the price of a $1 million bond issue under each of the following independent assumptions (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.):

Maturity 10 years, interest paid annually, stated rate 10%, effective (market) rate 12%

2. Maturity 10 years, interest paid semiannually, stated rate 10%, effective (market) rate 12%

3. Maturity 10 years, interest paid semiannually, stated rate 12%, effective (market) rate 10%

4. Maturity 20 years, interest paid semiannually, stated rate 12%, effective (market) rate 10%

5. Maturity 20 years, interest paid semiannually, stated rate 12%, effective (market) rate 12%

Q3. The Bradford Company issued 10% bonds, dated January 1, with a face amount of $80 million on January 1, 2018. The bonds mature on December 31, 2027 (10 years). For bonds of similar risk and maturity, the market yield is 12%. Interest is paid semiannually on June 30 and December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.)

Required:

1. Determine the price of the bonds at January 1, 2018.

2. to 4. Prepare the journal entry to record their issuance by The Bradford Company on January 1, 2018, interest on June 30, 2018 and interest on December 31, 2018 (at the effective rate).

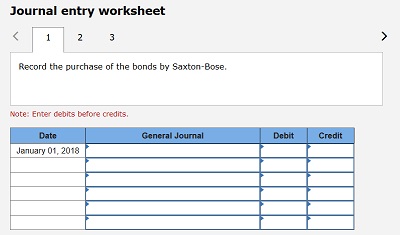

Q4. The Bradford Company issued 10% bonds, dated January 1, with a face amount of $80 million on January 1, 2018 to Saxton-Bose Corporation. The bonds mature on December 31, 2027 (10 years). For bonds of similar risk and maturity, the market yield is 12%. Interest is paid semiannually on June 30 and December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.)

Required:

1. to 3. Prepare the journal entry to record the purchase of the bonds by Saxton-Bose on January 1, 2018, interest revenue on June 30, 2018 and interest revenue on December 31, 2018 (at the effective rate). (Enter your answers in whole dollars. Round your answers to the nearest whole dollar. If no entry is required for a transaction/event, select “No journal entry required” in the first account field.)

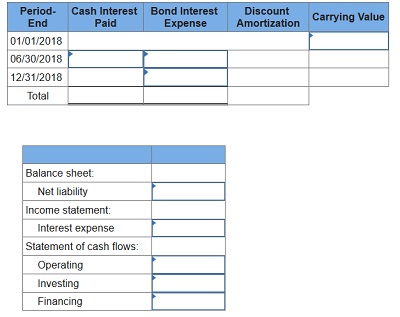

Q5. Myriad Solutions, Inc., issued 10% bonds, dated January 1, with a face amount of $320 million on January 1, 2018, for $283,294,720. The bonds mature on December 31, 2027 (10 years). For bonds of similar risk and maturity the market yield is 12%. Interest is paid semiannually on June 30 and December 31.

Required:

Complete the table below to calculate the amounts related to the bonds that Myriad would report in its financial statements.

Indicate the amounts reported on the financial statements below for the year ending December 31, 2018.

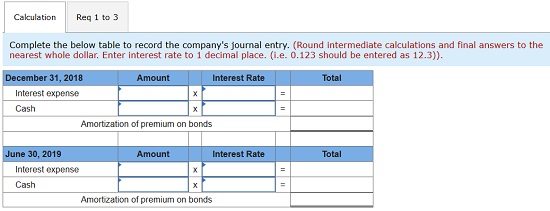

Q6. The Gorman Group issued $900,000 of 13% bonds on June 30, 2018, for $967,707. The bonds were dated on June 30 and mature on June 30, 2038 (20 years). The market yield for bonds of similar risk and maturity is 12%. Interest is paid semiannually on December 31 and June 30.

Required:

Complete the below table to record the company’s journal entry.

1. to 3. Prepare the journal entry to record their issuance by The Gorman Group on June 30, 2018, interest on December 31, 2018 and interest on June 30, 2019 (at the effective rate).

Q7. Universal Foods issued 10% bonds, dated January 1, with a face amount of $150 million on January 1, 2018. The bonds mature on December 31, 2032 (15 years). The market rate of interest for similar issues was 12%. Interest is paid semiannually on June 30 and December 31. Universal uses the straight-line method. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.)

Required:

1. Determine the price of the bonds at January 1, 2018.

2. to 4. Prepare the journal entry to record their issuance by Universal Foods on January 1, 2018, interest on June 30, 2018 and interest on December 31, 2025.

Q8. Universal Foods issued 10% bonds, dated January 1, with a face amount of $150 million on January 1, 2018 to Wang Communications. The bonds mature on December 31, 2032 (15 years). The market rate of interest for similar issues was 12%. Interest is paid semiannually on June 30 and December 31. Universal uses the straight-line method. Universal Foods sold the entire bond issue to Wang Communications. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.)

Required:

1-3. Prepare the journal entry to record the purchase of the bonds by Wang Communications on January 1, 2018, interest revenue on June 30, 2018 and interest revenue on December 31, 2025. (Round final answers to the nearest whole dollars. If no entry is required for a transaction/event, select “No journal entry required” in the first account field.)

Q9. When Patey Pontoons issued 6% bonds on January 1, 2018, with a face amount of $600,000, the market yield for bonds of similar risk and maturity was 7%. The bonds mature December 31, 2021 (4 years). Interest is paid semiannually on June 30 and December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.)

Required:

1. Determine the price of the bonds at January 1, 2018.

2. Prepare the journal entry to record their issuance by Patey on January 1, 2018.

3. Prepare an amortization schedule that determines interest at the effective rate each period.

4. Prepare the journal entry to record interest on June 30, 2018.

5. What is the amount related to the bonds that Patey will report in its balance sheet at December 31, 2018?

6. What is the amount related to the bonds that Patey will report in its income statement for the year ended December 31, 2018? (Ignore income taxes.)

7. Prepare the appropriate journal entries at maturity on December 31, 2021.

Q10. National Orthopedics Co. issued 9% bonds, dated January 1, with a face amount of $500,000 on January 1, 2018. The bonds mature on December 31, 2021 (4 years). For bonds of similar risk and maturity the market yield was 10%. Interest is paid semiannually on June 30 and December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.)

Required:

1. Determine the price of the bonds at January 1, 2018.

2. Prepare the journal entry to record their issuance by National on January 1, 2018.

3. Prepare an amortization schedule that determines interest at the effective rate each period.

4. Prepare the journal entry to record interest on June 30, 2018.

5. Prepare the appropriate journal entries at maturity on December 31, 2021.

Q11. On February 1, 2018, Strauss-Lombardi issued 9% bonds, dated February 1, with a face amount of $800,000. The bonds sold for $731,364 and mature on January 31, 2038 (20 years). The market yield for bonds of similar risk and maturity was 10%. Interest is paid semiannually on July 31 and January 31. Strauss-Lombardi’s fiscal year ends December 31.

Required:

1. to 4. Prepare the journal entry to record their issuance by Strauss-Lombardi on February 1, 2018, interest on July 31, 2018 (at the effective rate), adjusting entry to accrue interest on December 31, 2018 and interest on January 31, 2019. (Do not round your intermediate and round your final answers to nearest whole dollar. If no entry is required for a transaction/event, select “No journal entry required” in the first account field.)

Q12. On March 1, 2018, Stratford Lighting issued 14% bonds, dated March 1, with a face amount of $300,000. The bonds sold for $294,000 and mature on February 28, 2038 (20 years). Interest is paid semiannually on August 31 and February 28. Stratford uses the straight-line method and its fiscal year ends December 31.

Required:

1. to 4. Prepare the journal entry to record the issuance of the bonds by Stratford Lighting on March 1, 2018, interest on August 31, 2018, interest on December 31, 2018 and interest on February 28, 2019. (Do not round intermediate calculations. If no entry is required for a transaction/event, select “No journal entry required” in the first account field.)

Q13. Federal Semiconductors issued 11% bonds, dated January 1, with a face amount of $800 million on January 1, 2018. The bonds sold for $739,814,813 and mature on December 31, 2037 (20 years). For bonds of similar risk and maturity the market yield was 12%. Interest is paid semiannually on June 30 and December 31.

Required:

1. to 3. Prepare the journal entry to record their issuance by Federal on January 1, 2018, interest on June 30, 2018 (at the effective rate) and interest on December 31, 2018 (at the effective rate).

4. At what amount will Federal report the bonds among its liabilities in the December 31, 2018, balance sheet?

Q14. When companies offer new debt security issues, they publicize the offerings in the financial press and on Internet sites. Assume the following were among the debt offerings reported in December 2018:

| New Securities Issues |

| Corporate |

| National Equipment Transfer Corporation —$200 million bonds via lead managers Second Tennessee Bank N.A. and Morgan, Dunavant & Co., according to a syndicate official. Terms: maturity, Dec. 15, 2024; coupon 7.46%; issue price, par; yield, 7.46%; noncallable, debt ratings: Ba-1 (Moody’s Investors Service, Inc.), BBB + (Standard & Poor’s). |

| IgWig Inc. —$350 million of notes via lead manager Stanley Brothers, Inc., according to a syndicate official. Terms: maturity, Dec. 1, 2026; coupon, 6.46%; Issue price, 99; yield, 6.56%; call date, NC; debt ratings: Baa-1 (Moody’s Investors Service, Inc.), A (Standard & Poor’s). |

Required:

1. Prepare the appropriate journal entries to record the sale of both issues to underwriters. Ignore share issue costs and assume no accrued interest.

2. Prepare the appropriate journal entries to record the first semiannual interest payment for both issues.

Q15. At the end of 2017, Majors Furniture Company failed to accrue $61,000 of interest expense that accrued during the last five months of 2017 on bonds payable. The bonds mature in 2031. The discount on the bonds is amortized by the straight-line method. The following entry was recorded on February 1, 2018, when the semiannual interest was paid:

| Interest expense | 73,200 | |

| Discount on bonds payable | 1,200 | |

| Cash | 72,000 |

Required:

Prepare any journal entry necessary to correct the errors as of February 2, 2018, when the errors were discovered. Also, prepare any adjusting entry at December 31, 2018, related to the situation described. (Ignore income taxes.) (Do not round your intermediate calculations. If no entry is required for a transaction/event, select “No journal entry required” in the first account field.)

Q16. Wilkins Food Products, Inc., acquired a packaging machine from Lawrence Specialists Corporation. Lawrence completed construction of the machine on January 1, 2016. In payment for the machine Wilkins issued a three-year installment note to be paid in three equal payments at the end of each year. The payments include interest at the rate of 10%.

Lawrence made a conceptual error in preparing the amortization schedule, which Wilkins failed to discover until 2018. The error had caused Wilkins to understate interest expense by $45,000 in 2016 and $40,000 in 2017.

Required:

1. Determine which accounts are incorrect as a result of these errors at January 1, 2018, before any adjustments. (Ignore income taxes) (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.)

2. Prepare a journal entry to correct the error. (If no entry is required for a transaction/event, select “No journal entry required” in the first account field.)

Please click on Pay Now to get all correct answers at $50 (No Hidden Charges or any Sign Up Fee). In description, please don’t forget to mention the exam name – Connect Intermediate Accounting Chapter 14. We will send the answers to your email id instantly.