Home » Online Exam Help » Accounting Exam Help » Connect Financial Accounting Chapter 9

Connect Financial Accounting Chapter 9

Q1. Sylvestor Systems borrows $170,000 cash on May 15, 2017, by signing a 60-day, 7% note.

On what date does this note mature?

- July 13, 2017

- July 14, 2017

- July 15, 2017

- July 16, 2017

- July 17, 2017

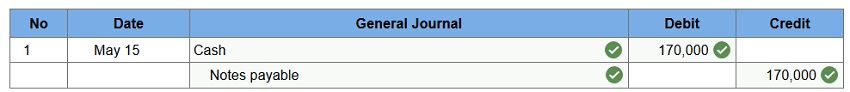

2. Assume the face value of the note equals $170,000, the principal of the loan.

Prepare the journal entry to record issuance of the note.

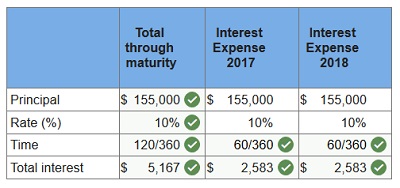

Q2. Keesha Co. borrows $155,000 cash on November 1, 2017, by signing a 120-day, 10% note with a face value of $155,000.

On what date does this note mature? (Assume that February has 28 days)

- March 27, 2018

- March 287, 2018

- March 29, 2018

- March 30, 2018

- March 01, 2018

2. & 3. What is the amount of interest expense in 2017 and 2018 from this note? (Use 360 days a year. Round final answers to the nearest whole dollar.)

4. Prepare journal entries to record (a) issuance of the note, (b) accrual of interest at the end of 2017, and (c) payment of the note at maturity. (Assume no reversing entries are made.) (Use 360 days a year. Do not round intermediate calculations.)

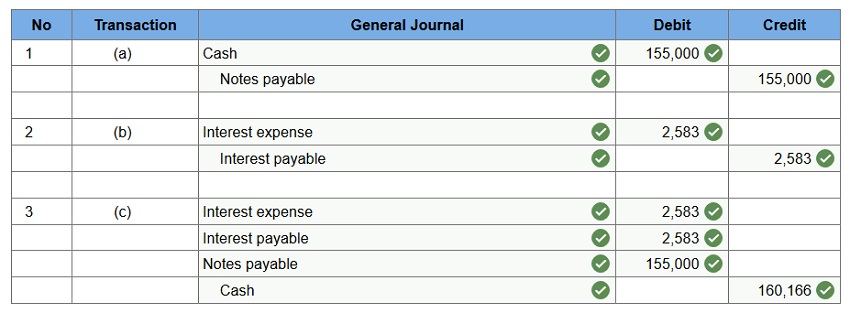

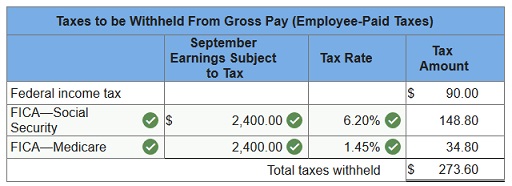

Q3. BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $118,500 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 2.9% of the first $7,000 paid to its employee.

| Gross Pay through August | Gross Pay for September | |||||||||

| a. | $ | 5,600 | $ | 1,500 | ||||||

| b. | 19,300 | 3,200 | ||||||||

| c. | 113,300 | 9,100 | ||||||||

Compute BMX’s amounts for each of these four taxes as applied to the employee’s gross earnings for September under each of three separate situations (a), (b), and (c). (Round your answers to 2 decimal places.)

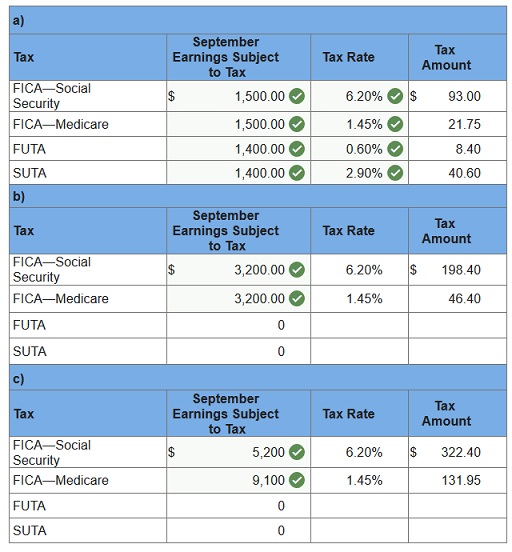

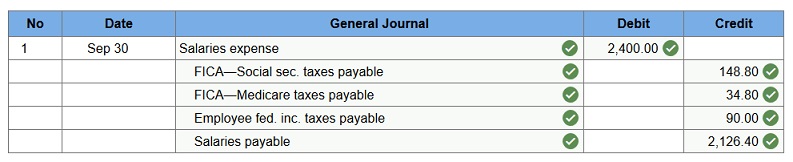

Q4. BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $118,500 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 2.9% of the first $7,000 paid to its employee.

| Gross Pay through August | Gross Pay for September | |||||||||

| a. | $ | 5,400 | $ | 2,400 | ||||||

| b. | 19,100 | 3,000 | ||||||||

| c. | 113,100 | 8,900 | ||||||||

Assuming situation a, prepare the employer’s September 30 journal entries to record salary expense and its related payroll liabilities for this employee. The employee’s federal income taxes withheld by the employer are $90 for this pay period. (Round your answers to 2 decimal places.)

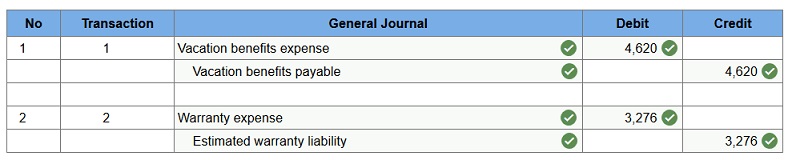

Q5. Listed below are a few transactions and events of Maxum Company.

- Employees earn vacation pay at a rate of one day per month. During December, 22 employees qualify for one vacation day each. Their average daily wage is $210 per employee.

- During December, Maxum Company sold 3,900 units of a product that carries a 60-day warranty. December sales for this product total $130,000. The company expects 7% of the units to need warranty repairs, and it estimates the average repair cost per unit will be $12.

Prepare any necessary adjusting entries at December 31, 2017, for Maxum Company’s year-end financial statements for each of the above separate transactions and events.

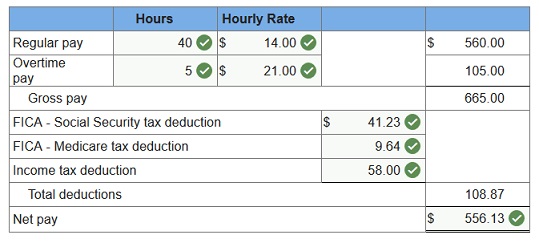

Q6. Lenny Florita, an unmarried employee, works 45 hours in the week ended January 12. His pay rate is $14 per hour, and his wages are subject to no deductions other than FICA Social Security, FICA Medicare, and federal income taxes. He claims three withholding allowances. Compute his regular pay, overtime pay (for this company, workers earn 150% of their regular rate for hours in excess of 40 per week), and gross pay. Then compute his FICA tax deduction (use 6.2% for the Social Security portion and 1.45% for the Medicare portion), income tax deduction (use the wage bracket withholding table from Exhibit 11A.6.), total deductions, and net pay. (Round your intermediate calculations and final answers to 2 decimal places.)

Connect Financial Accounting Chapter 9 Quiz

Q1. An employee earned $62,500 during the year working for an employer. The FICA tax rate for Social Security is 6.2% of the first $118,500 of employee earnings per calendar year and the FICA tax rate for Medicare is 1.45% of all earnings. The current FUTA tax rate is 0.6%, and the SUTA tax rate is 5.4%. Both unemployment taxes are applied to the first $7,000 of an employee’s pay. What is the amount of total unemployment taxes the employee must pay?

- $101.50

- $56.00

- $378.00

- $434.00

- $0.00

Q2. If a company has advance ticket sales totaling $2,000,000 for the upcoming football season, the receipt of cash would be journalized as:

- Debit Sales, credit Unearned Revenue.

- Debit Unearned Revenue, credit Sales.

- Debit Cash, credit Unearned Revenue.

- Debit Unearned Revenue, credit Cash.

- Debit Cash, credit Ticket sales payable.

Q3. All of the following statements regarding liabilities are true except:

- A liability is a probable future payment of assets or services.

- Unearned future wages to be paid to employees should be recorded as liabilities.

- For a liability to be reported, it must be a present obligation that results from a past transaction or event, and requires a future payment of assets or services.

- Information about liabilities is more useful when the balance sheet identifies them as either current or long term.

- Liabilities can involve uncertainty in whom to pay.

Q4. Contingent liabilities must be recorded if:

- The future event is probable and the amount owed can be reasonably estimated.

- The future event is remote.

- The future event is reasonably possible but not estimable.

- The amount owed cannot be reasonably estimated.

- The future event is probable but not estimable.

Q5. If the times interest earned ratio:

- Increases, then risk increases.

- Increases, then risk decreases.

- Is greater than 1.5, the company is in default.

- Is less than 1.5, the company is carrying too little debt.

- Is greater than 3.0, the company is likely carrying too much debt.

Q6. All of the following statements regarding FICA taxes are true except:

- FICA taxes are deducted from the employee.

- Employers must pay withheld FICA taxes to the IRS.

- The amount of FICA deducted from the employee is credited to a liability account.

- A self-employed person is exempt from FICA taxes.

- An employer must pay FICA taxes equal to the amount withheld from the employee.

Q7. Athena Company provides employee health insurance that costs $5,000 per month. In addition, the company contributes an amount equal to 5% of the employees’ $120,000 gross salary to a retirement program. The entry to record the accrued benefits for the month would include a:

- Debit to Medical Insurance Payable $5,000.

- Debit to Employee Retirement Program Payable $6,000.

- Debit to Employee Benefits Expense $11,000.

- Credit to Employee Benefits Expense $11,000.

- Debit to Payroll Taxes Expense $11,000.

Q8. Interest expense is not:

- Incurred on current liabilities.

- Likely to stay the same when sales change.

- A fixed expense.

- Likely to fluctuate when sales change.

- A factor in determining a company’s borrowing risk.

Q9. The deferred income tax liability:

- Results from the income tax expense reported on the income statement differing from the amount of income taxes payable to the government.

- Is a contingent liability.

- Can result in a deferred income tax asset.

- Is never recorded.

- Is recorded whether or not the difference between taxable income and financial accounting income is permanent or temporary.

Q10. Furniture World is required by law to collect and remit sales taxes to the state. If Furniture World has $78,000 of cash sales that are subject to a 6% sales tax, what is the journal entry to record the cash sales?

- Debit Cash $82,680; credit Sales $78,000; credit Sales Taxes Payable $4,680.

- Debit Sales Taxes Payable $4,680; debit Cash $73,220; credit Sales $78,000.

- Debit Cash $78,000; credit Sales $78,000; and record the taxes when paid.

- Debit Cash $78,000; credit Sales $73,320; credit Sales Taxes Payable $4,680.

- Debit Accounts Receivable $82,680; credit Sales $78,000; credit Sales Taxes Payable $4,680.