Home » Accounting Assignment Help » Financial Accounting Assignment Help » Connect Financial Accounting Chapter 5

Connect Financial Accounting Chapter 5

Q1. Walberg Associates, antique dealers, purchased the contents of an estate for $37,700. Terms of the purchase were FOB shipping point, and the cost of transporting the goods to Walberg Associates’s warehouse was $1,300. Walberg Associates insured the shipment at a cost of $170. Prior to putting the goods up for sale, they cleaned and refurbished them at a cost of $510.

Determine the cost of the inventory acquired from the estate.

Q2. Laker Company reported the following January purchases and sales data for its only product.

| Date | Activities | Units Acquired at Cost | Units sold at Retail | ||||||

| Jan 1 | Beginning inventory | 205 units | @ | $13.00 | = | $2,665 | |||

| Jan 10 | Sales | 165 units | @ | $22.00 | |||||

| Jan 20 | Purchase | 140 units | @ | $12.00 | = | 1,680 | |||

| Jan 25 | Sales | 145 units | @ | $22.00 | |||||

| Jan 30 | Purchase | 310 units | @ | $11.50 | = | 3,565 | |||

| Totals | 655 units | $7,910 | 310 units | ||||||

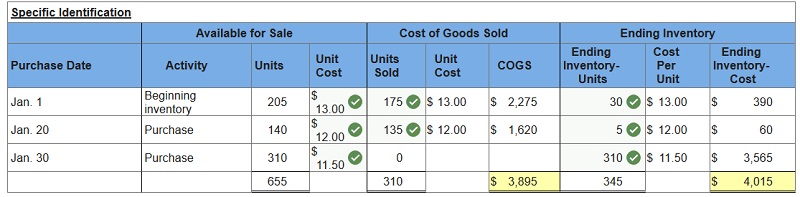

The Company uses a perpetual inventory system. For specific identification, ending inventory consists of 345 units, where 310 are from the January 30 purchase, 5 are from the January 20 purchase, and 30 are from beginning inventory.

1. Complete the table to determine the cost assigned to ending inventory and cost of goods sold using specific identification.

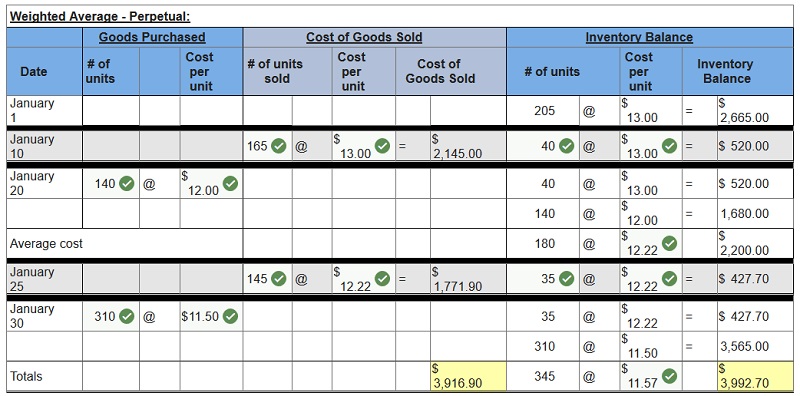

2. Determine the cost assigned to ending inventory and to cost of goods sold using weighted average.

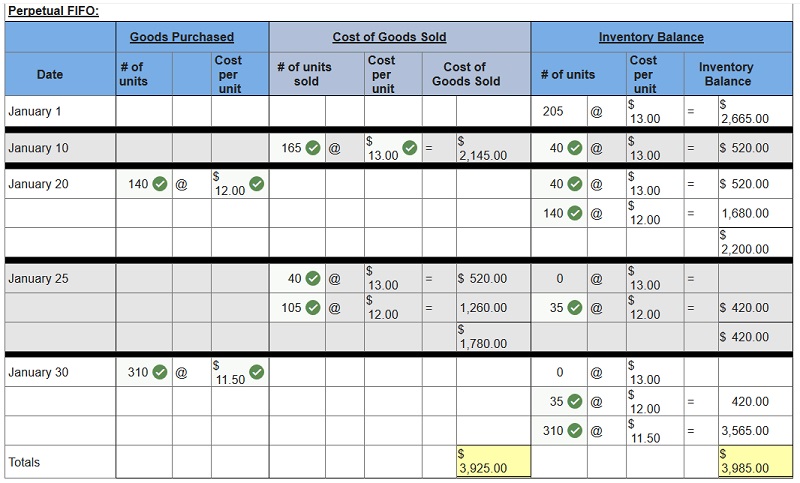

3. Determine the cost assigned to ending inventory and to cost of goods sold using FIFO.

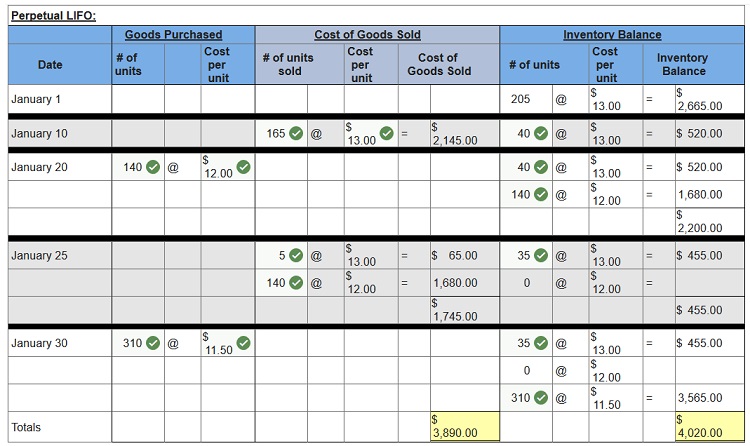

4. Determine the cost assigned to ending inventory and to cost of goods sold using LIFO.

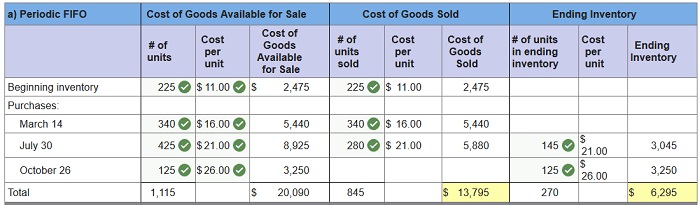

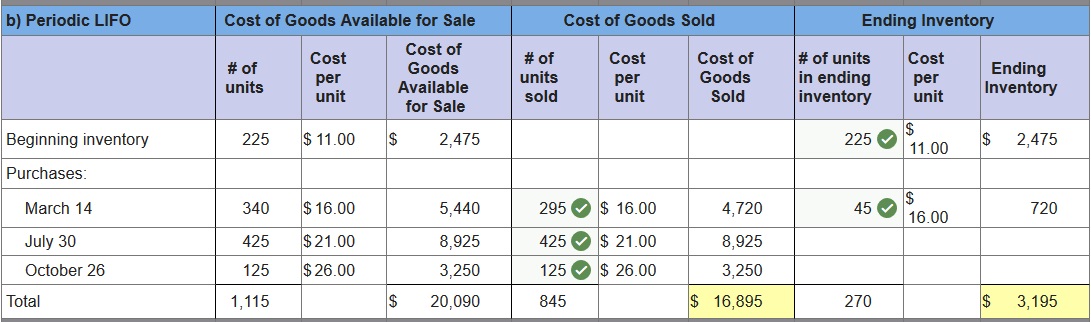

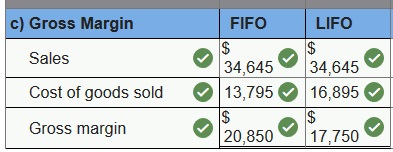

Q3. Hemming Co. reported the following current-year purchases and sales for its only product.

| Date | Activities | Units Acquired at Cost | Units sold at Retail | ||||||

| Jan 1 | Beginning inventory | 225 units | @ | $11.00 | = | $2,475 | |||

| Jan 10 | Sales | 150 units | @ | $41.00 | |||||

| Mar 14 | Purchase | 340 units | @ | $16.00 | = | 5,440 | |||

| Mar 15 | Sales | 300 units | @ | $41.00 | |||||

| July 30 | Purchase | 425 units | @ | $21.00 | = | 8,925 | |||

| Oct 5 | Sales | 390 units | $41.00 | ||||||

| Oct 26 | Purchase | 125 units | @ | $26.00 | = | 3,250 | |||

| Totals | 1,115 units | $20,090 | 845 units | ||||||

Hemming uses a periodic inventory system.

a. Determine the costs assigned to ending inventory and to cost of goods sold using FIFO.

b. Determine the costs assigned to ending inventory and to cost of goods sold using LIFO.

c. Compute the gross margin for each method.

Connect Financial Accounting Chapter 5 Quiz

Q1. Use the following information for Davis Company to compute inventory turnover for Year 2.

| Year 2 | Year 1 | |

| Cost of goods sold | 279,500 | 291,800 |

| Ending inventory | 47,700 | 49,350 |

- 5.86

- 5.76

- 5.67

- 11.77

- 5.89

Q2. Eastview Company uses a perpetual LIFO inventory system, and has the following purchases and sales:

| January 1 | 150 units were purchased at $9 per unit. |

| January 17 | 120 units were sold. |

| January 20 | 160 units were purchased at $11 per unit. |

| January 29 | 150 units were sold. |

What is the value of ending inventory?

- $2,730

- $2,750

- $2,670

- $440

- $380

Q3. Acceptable methods of assigning specific costs to inventory and cost of goods sold include all of the following except:

- LIFO method.

- FIFO method.

- Specific identification method.

- Weighted average method.

- Retail method.

Q4. Hull Company reported the following income statement information for the current year:

| Sales | $410,000 |

| Cost of goods sold: | |

| Beginning inventory | $132,000 |

| Cost of goods purchased | 273,000 |

| Cost of goods available for sale | 405,000 |

| Ending inventory | 144,000 |

| Cost of goods sold | 261,000 |

| Gross profit | $149,000 |

The beginning inventory balance is correct. However, the ending inventory figure was overstated by $20,000. Given this information, the correct gross profit would be:

- $149,000

- $169,000

- $129,000

- $142,000

- $112,000

Q5. The understatement of the ending inventory balance causes:

- Cost of goods sold to be overstated and net income to be understated.

- Cost of goods sold to be overstated and net income to be overstated.

- Cost of goods sold to be understated and net income to be understated.

- Cost of goods sold to be understated and net income to be overstated.

- Cost of goods sold to be overstated and net income to be correct.

Q6. Monarch Company uses a weighted-average perpetual inventory system, and has the following purchases and sales:

| January 1 | 20 units were purchased at $10 per unit. |

| January 12 | 12 units were sold. |

| January 20 | 18 units were purchased at $11 per unit. |

What is the value of ending inventory? (Round average cost per unit to 2 decimal places.)

- $278

- $272

- $126

- $398

- $120

Q7. Grays Company has inventory of 10 units at a cost of $10 each on August 1. On August 3, it purchased 20 units at $12 each. 12 units are sold on August 6. Using the FIFO perpetual inventory method, what amount will be reported as cost of goods sold for the 12 units that were sold?

- $120

- $124

- $128

- $130

- $140

Q8. A company had the following purchases and sales during its first year of operations:

| Purchases | Sales | |

| January: | 10 units at $120 | 6 units |

| February: | 20 units at $125 | 5 units |

| May: | 15 units at $130 | 9 units |

| September: | 12 units at $135 | 8 units |

| November: | 10 units at $140 | 13 units |

On December 31, there were 26 units remaining in ending inventory. Using the Periodic FIFO inventory valuation method, what is the cost of the ending inventory? (Assume all sales were made on the last day of the month.)

- $3,405

- $3,200

- $3,445

- $3,540

- $3,270

Q9. If a period-end inventory amount is reported in error, it can cause a misstatement in all of the following except:

- Cost of goods sold.

- Gross profit.

- Net sales.

- Current assets.

- Net income.

Q10. Salmone Company reported the following purchases and sales of its only product. Salmone uses a perpetual inventory system. Determine the cost assigned to cost of goods sold using FIFO.

| Date | Activities | Units Acquired at Cost | Units Sold at Retail |

| May 1 | Beginning Inventory | 150 units @ $10.00 | |

| 5 | Purchase | 220 units @ $12.00 | |

| 10 | Sales | 140 units @ $20.00 | |

| 15 | Purchase | 100 units @ $13.00 | |

| 24 | Sales | 90 units @ $21.00 |

- $2,980

- $2,460

- $2,850

- $2,590

- $5,440

Please contact us via live chat if you face difficulty in any of the question or exercise.