Home » Accounting Assignment Help » Financial Accounting Assignment Help » Connect Financial Accounting Chapter 4

Connect Financial Accounting Chapter 4

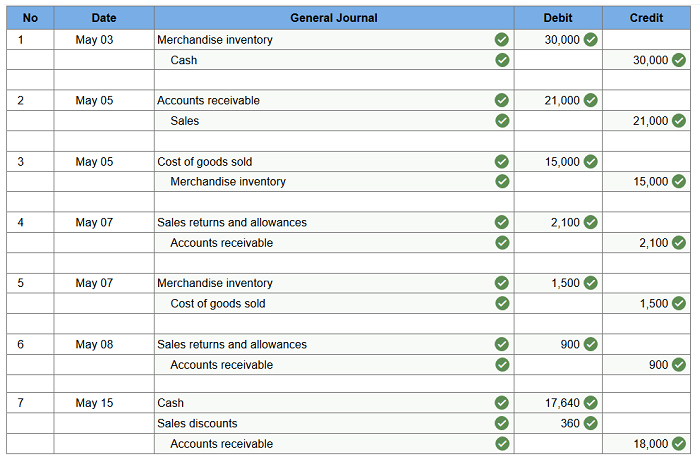

Q1. Allied Merchandisers was organized on May 1. Macy Co. is a major customer (buyer) of Allied (seller) products.

- May 3 – Allied made its first and only purchase of inventory for the period on May 3 for 3,000 units at a price of $10 cash per unit (for a total cost of $30,000).

- May 5 – Allied sold 1,500 of the units in inventory for $14 per unit (invoice total: $21,000) to Macy Co. under credit terms 2/10, n/60. The goods cost Allied $15,000.

- May 7 – Macy returns 150 units because they did not fit the customer’s needs (invoice amount: $2,100). Allied restores the units, which cost $1,500, to its inventory.

- May 8 – Macy discovers that 150 units are scuffed but are still of use and, therefore, keeps the units. Allied sends Macy a credit memorandum for $900 toward the original invoice amount to compensate for the damage.

- May 15 – Allied receives payment from Macy for the amount owed on the May 5 purchase; payment is net of returns, allowances, and any cash discount.

Prepare journal entries to record the following transactions for Allied assuming it uses a perpetual inventory system and the gross method. (Allied estimates returns using an adjusting entry at each year-end.)

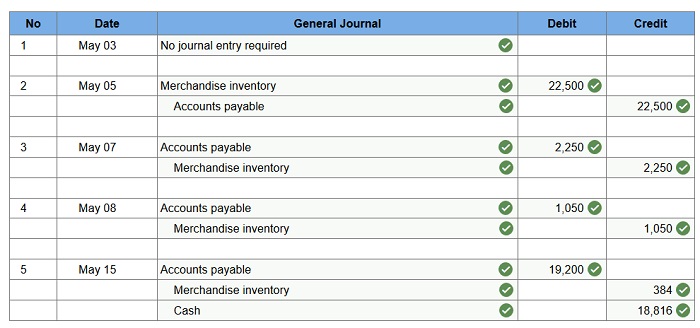

Q2. Allied Merchandisers was organized on May 1. Macy Co. is a major customer (buyer) of Allied (seller) products.

- May 3 – Allied made its first and only purchase of inventory for the period on May 3 for 3,000 units at a price of $11 cash per unit (for a total cost of $33,000).

- May 5 – Allied sold 1,500 of the units in inventory for $15 per unit (invoice total: $22,500) to Macy Co. under credit terms 2/10, n/60. The goods cost Allied $16,500.

- May 7 – Macy returns 150 units because they did not fit the customer’s needs (invoice amount: $2,250). Allied restores the units, which cost $1,650, to its inventory.

- May 8 – Macy discovers that 150 units are scuffed but are still of use and, therefore, keeps the units. Allied sends Macy a credit memorandum for $1,050 toward the original invoice amount to compensate for the damage.

- May 15 – Allied receives payment from Macy for the amount owed on the May 5 purchase; payment is net of returns, allowances, and any cash discount.

Prepare the appropriate journal entries for Macy Co. to record each of the May transactions. Macy is a retailer that uses the gross method and a perpetual inventory system, and purchases these units for resale. (If no entry is required for a transaction/event, select “No journal entry required” in the first account field.)

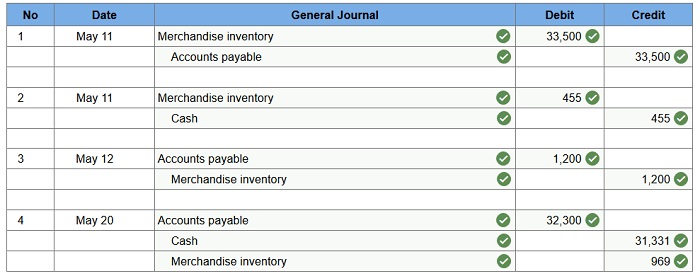

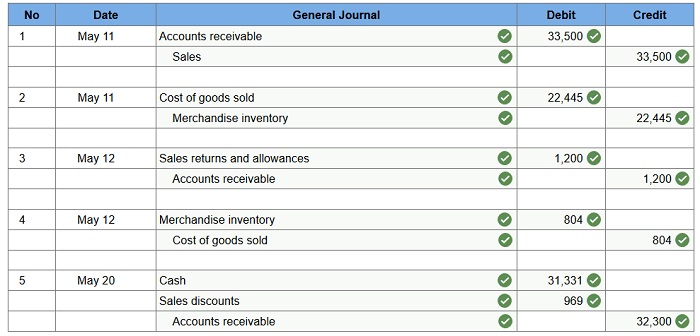

Q3. Sydney Retailing (buyer) and Troy Wholesalers (seller) enter into the following transactions.

- May 11 – Sydney accepts delivery of $33,500 of merchandise it purchases for resale from Troy: invoice dated May 11; terms 3/10, n/90; FOB shipping point. The goods cost Troy $22,445. Sydney pays $455 cash to Express Shipping for delivery charges on the merchandise

- May 12 – Sydney returns $1,200 of the $33,500 of goods to Troy, who receives them the same day and restores them to its inventory. The returned goods had cost Troy $804.

- May 20 – Sydney pays Troy for the amount owed. Troy receives the cash immediately.

(Both Sydney and Troy use a perpetual inventory system and the gross method.)

1. Prepare journal entries that Sydney Retailing (buyer) records for these three transactions.

2. Prepare journal entries that Troy Wholesalers (seller) records for these three transactions.

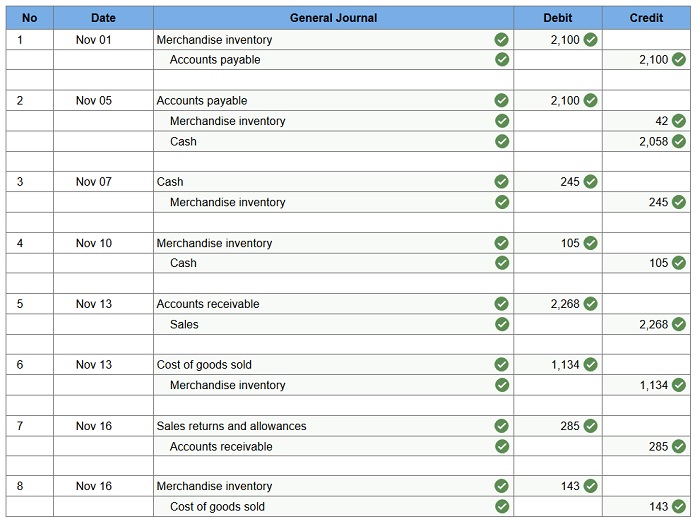

Q4. Following are the merchandising transactions for Dollar Store.

- Nov 1 – Dollar Store purchases merchandise for $2,100 on terms of 2/5, n/30, FOB shipping point, invoice dated November 1.

- Nov 5 – Dollar Store pays cash for the November 1 purchase.

- Nov 7 – Dollar Store discovers and returns $250 of defective merchandise purchased on November 1, and paid for on November 5, for a cash refund.

- Nov 10 – Dollar Store pays $105 cash for transportation costs for the November 1 purchase.

- Nov 13 – Dollar Store sells merchandise for $2,268 with terms n/30. The cost of the merchandise is $1,134.

- Nov 16 – Merchandise is returned to the Dollar Store from the November 13 transaction. The returned items are priced at $285 and cost $143; the items were not damaged and were returned to inventory.

Journalize the above merchandising transactions for the Dollar Store assuming it uses a perpetual inventory system and the gross method.

Connect Financial Accounting Chapter 4 Quiz

Q1. Multiple-step income statements:

- Are required by the FASB and IASB.

- Contain more detail than a simple listing of revenues and expenses.

- Are required for the periodic inventory system.

- List cost of goods sold as an operating expense.

- Are only used in perpetual inventory systems.

Q2. All of the following statements regarding sales returns and allowances are true except:

- A reduction in the selling price because of damaged merchandise is included in sales returns and allowances.

- There is no relationship between sales returns and allowances and the possibility of lost future sales.

- Sales returns and allowances are recorded in a separate contra-revenue account.

- Sales returns and allowances are rarely disclosed in published financial statements.

- Sales returns and allowances are closed to the Income Summary account.

Q3. All of the following statements related to U.S. GAAP and IFRS are true except:

- Accounting for basic inventory transactions is the same under the two systems.

- The closing process for merchandisers is the same under both systems.

- U.S. GAAP offers little guidance about the presentation order of expenses.

- Neither system requires separate disclosure of items when their size, nature, or frequency are important.

- Neither system defines operating income.

Q4. Liquidity problems are likely to exist when a company’s acid-test ratio:

- Is less than the current ratio.

- Equals 1.

- Is higher than 1.

- Is substantially lower than 1.

- Is higher than the current ratio.

Q5. A company purchased $1,800 of merchandise on July 5 with terms 2/10, n/30. On July 7, it returned $200 worth of merchandise. On July 12, it paid the full amount due. Assuming the company uses a perpetual inventory system, and records purchases using the gross method, the correct journal entry to record the payment on July 12 is:

- Debit Merchandise Inventory $1,600; credit Cash $1,600.

- Debit Cash $1,600; credit Accounts Payable $1,600.

- Debit Accounts Payable $1,600; credit Merchandise Inventory $32; credit Cash $1,568.

- Debit Accounts Payable $1,800; credit Cash $1,800.

- Debit Accounts Payable $1,600; credit Cash $1,600.

Q6. A company purchases merchandise with a catalog price of $20,000. The company receives a 35% trade discount from the seller. The seller also offers credit terms of 2/10, n/30. Assuming no returns were made and that payment was made within the discount period, what is the net cost of the merchandise?

- $13,720.

- $19,600.

- $6,860.

- $13,000.

- $12,740.

Q7. The amount recorded for merchandise inventory includes all of the following except:

- Purchase discounts.

- Returns and allowances.

- Freight costs paid by the buyer.

- Freight costs paid by the seller.

- Trade discounts.

Please contact us via live chat if you face difficulty in any of the question or exercise.