Home » Accounting Assignment Help » Online Exam Help » Connect Financial Accounting Chapter 3

Connect Financial Accounting Chapter 3

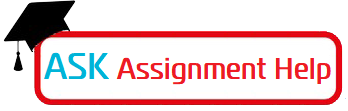

Q1. Pablo Management has two part-time employees, each of whom earns $110 per day. They are paid on Fridays for work completed Monday through Friday of the same week. Near year-end, the two employees worked Monday, December 31, and Wednesday through Friday, January 2, 3, and 4. New Year’s Day. (January 1) was an unpaid holiday.

- Prepare the year-end adjusting entry for wages expenses.

- Prepare the journal entry to record payment of the employees’ wages on Friday, January 4.

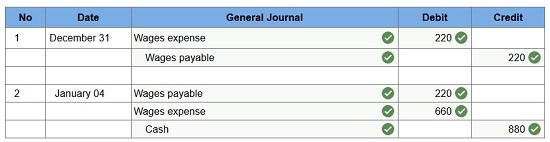

Q2. Exercise 3-3 Preparing adjusting entries LO P1

- Depreciation on the company’s equipment for 2017 is computed to be $11,000.

- The Prepaid Insurance account had a $7,000 debit balance at December 31, 2017, before adjusting for the costs of any expired coverage. An analysis of the company’s insurance policies showed that $1,220 of unexpired insurance coverage remains.

- The Office Supplies account had a $550 debit balance on December 31, 2016; and $2,680 of office supplies were purchased during the year. The December 31, 2017, physical count showed $649 of supplies available.

- One-third of the work related to $15,000 of cash received in advance was performed this period.

- The Prepaid Insurance account had a $5,600 debit balance at December 31, 2017, before adjusting for the costs of any expired coverage. An analysis of insurance policies showed that $4,380 of coverage had expired.

- Wage expenses of $1,000 have been incurred but are not paid as of December 31, 2017.

Prepare adjusting journal entries for the year ended (date of) December 31, 2017, for each of these separate situations.

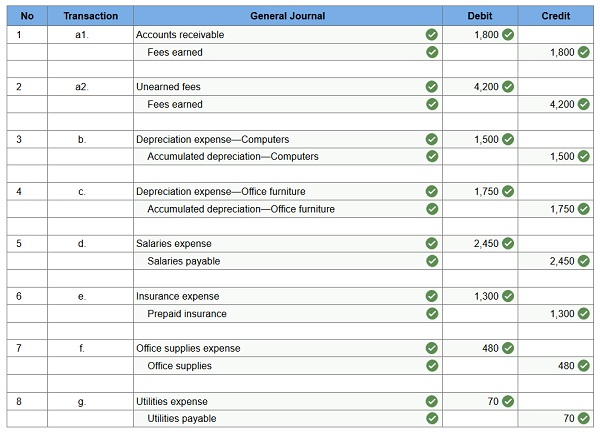

Q3. Following are two income statements for Alexis Co. for the year ended December 31. The left number column is prepared before any adjusting entries are recorded, and the right column includes the effects of adjusting entries. The company records cash receipts and payments related to unearned and prepaid items in balance sheet accounts. The middle column shows a blank space for each income statement effect of the eight adjusting entries a through g (the balance sheet part of the entries is not shown here).

| ALEXIS CO. Income Statements For Year Ended December 31 |

|||

| Unadjusted | Adjustments | Adjusted | |

| Revenues | |||

| Fees earned | $24,000 | a. | $30,000 |

| Commissions earned | 42,500 | 42,500 | |

| Total revenues | $66,500 | 72,500 | |

| Expenses | |||

| Depreciation expense—Computers | 0 | b. | 1,500 |

| Depreciation expense—Office furniture | 0 | c. | 1,750 |

| Salaries expense | 12,500 | d. | 14,950 |

| Insurance expense | 0 | e. | 1,300 |

| Rent expense | 4,500 | 4,500 | |

| Office supplies expense | 0 | f. | 480 |

| Advertising expense | 3,000 | 3,000 | |

| Utilities expense | 1,250 | g. | 1,320 |

| Total expenses | 21,250 | 28,800 | |

| Net income | $45,250 | $43,700 | |

Analyze the statements and prepare the eight adjusting entries a through g that likely were recorded. Note: Answer for a has two entries 30% of (i) the $6,000 adjustment for Fees Earned has been earned but not billed, and (ii) the other 70% has been earned by performing services that were paid for in advance.

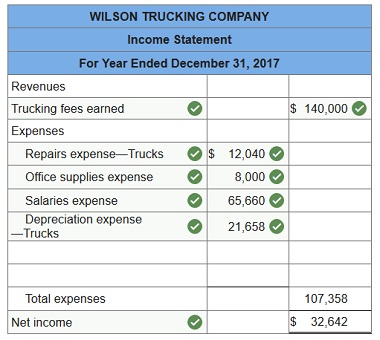

Q4. The following is the adjusted trial balance of Wilson Trucking Company.

| Account Title | Debit | Credit |

| Cash | $8,800 | |

| Accounts receivable | 16,500 | |

| Office supplies | 2,000 | |

| Trucks | 163,000 | |

| Accumulated depreciation—Trucks | $33,578 | |

| Land | 75,000 | |

| Accounts payable | 12,800 | |

| Interest payable | 3,000 | |

| Long-term notes payable | 52,000 | |

| Common stock | 20,000 | |

| Retained earnings | 130,280 | |

| Dividends | 19,000 | |

| Trucking fees earned | 140,000 | |

| Depreciation expense—Trucks | 21,658 | |

| Salaries expense | 65,660 | |

| Office supplies expense | 8,000 | |

| Repairs expense—Trucks | 12,040 | |

| Totals | $391,658 | $391,658 |

The Retained Earnings account balance is $130,280 at December 31, 2016.

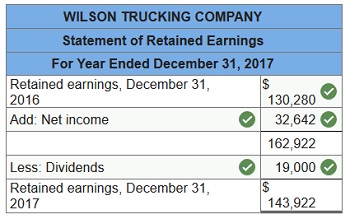

Prepare the income statement for the year ended December 31, 2017.

Prepare the statement of retained earnings for the year ended December 31, 2017.

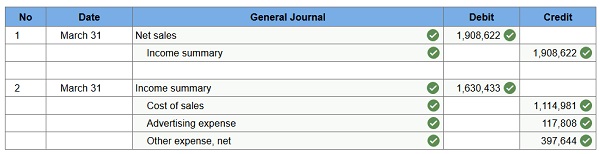

Q5. Following are Nintendo’s revenue and expense accounts for a recent March 31 fiscal year-end (yen in millions). (Enter answers in millions.)

| Net sales | ¥1,908,622 |

| Cost of sales | 1,114,981 |

| Advertising expense | 117,808 |

| Other expense, net | 397,644 |

Prepare the company’s closing entries for its revenues and its expenses.

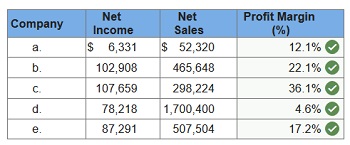

Q6. Use the following information to compute profit margin for each separate company a through e. (Round your answers to 1 decimal place.)

Which of the five companies is the most profitable according to the profit margin ratio? Company C

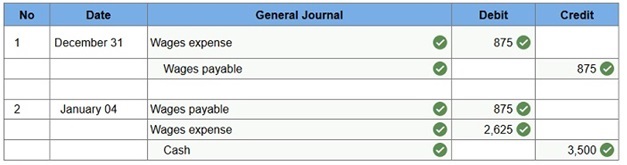

Q7. Pablo Management has seven part-time employees, each of whom earns $125 per day. They are paid on Fridays for work completed Monday through Friday of the same week. Near year-end, the seven employees worked Monday, December 31, and Wednesday through Friday, January 2, 3, and 4. New Year’s Day. (January 1) was an unpaid holiday.

- Prepare the year-end adjusting entry for wages expenses.

- Prepare the journal entry to record payment of the employees’ wages on Friday, January 4.

Q8.

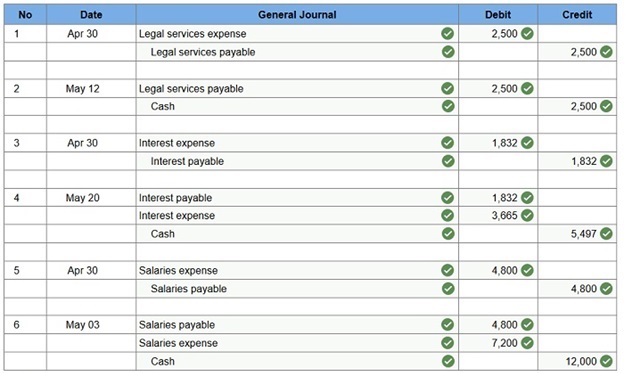

- On April 1, the company retained an attorney for a flat monthly fee of $2,500. Payment for April legal services was made by the company on May 12.

- A $680,000 note payable requires 9.7% annual interest, or $5,497, to be paid at the 20th day of each month. The interest was last paid on April 20, and the next payment is due on May 20. As of April 30, $1,832 of interest expense has accrued.

- Total weekly salaries expense for all employees is $12,000. This amount is paid at the end of the day on Friday of each five-day workweek. April 30 falls on a Tuesday, which means that the employees had worked two days since the last payday. The next payday is May 3.

The above three separate situations require adjusting journal entries to prepare financial statements as of April 30. For each situation, present both:

- The April 30 adjusting entry.

- The subsequent entry during May to record payment of the accrued expenses.

Q9.

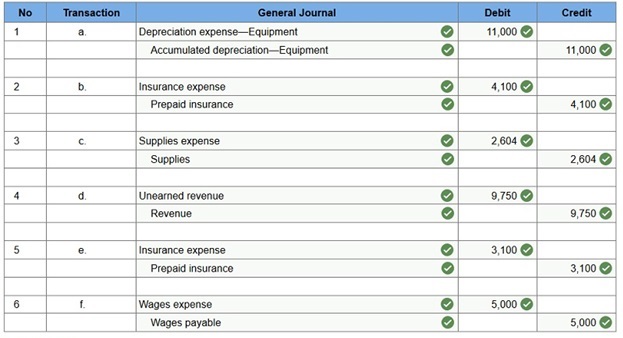

- Depreciation on the company’s equipment for 2017 is computed to be $11,000.

- The Prepaid Insurance account had a $6,000 debit balance at December 31, 2017, before adjusting for the costs of any expired coverage. An analysis of the company’s insurance policies showed that $1,900 of unexpired insurance coverage remains.

- The Office Supplies account had a $420 debit balance on December 31, 2016; and $2,680 of office supplies were purchased during the year. The December 31, 2017, physical count showed $496 of supplies available.

- Three-fourths of the work related to $13,000 of cash received in advance was performed this period.

- The Prepaid Insurance account had a $5,000 debit balance at December 31, 2017, before adjusting for the costs of any expired coverage. An analysis of insurance policies showed that $3,100 of coverage had expired.

- Wage expenses of $5,000 have been incurred but are not paid as of December 31, 2017.

Prepare adjusting journal entries for the year ended (date of) December 31, 2017, for each of these separate situations.

Q10.

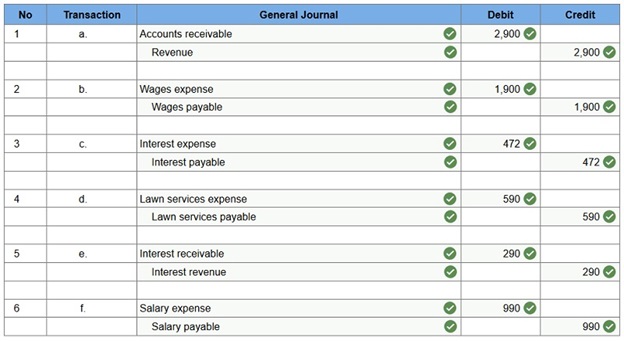

- M&R company provided $2,900 in services to customers that are expected to pay the company sometime in January following the company’s year-end.

- Wage expenses of $1,900 have been incurred but are not paid as of December 31.

- M&R company has a $5,900 bank loan and has incurred (but not recorded) 8% interest expense of $472 for the year ended December 31. The company will pay the $472 interest in cash on January 2 following the company’s year-end.

- M&R Company hired a firm to provide lawn services at a monthly fee of $590 with payment occurring on the 15th of the following month. Payment for December services will occur on January 15 following the company’s year-end.

- M&R company has earned $290 in interest revenue from investments for the year ended December 31. The interest revenue will be received on January 15 following the company’s year-end.

- Salary expenses of $990 have been earned by supervisors but not paid as of December 31.

Prepare year-end adjusting journal entries for M&R Company as of December 31, 2017, for each of the above separate cases.

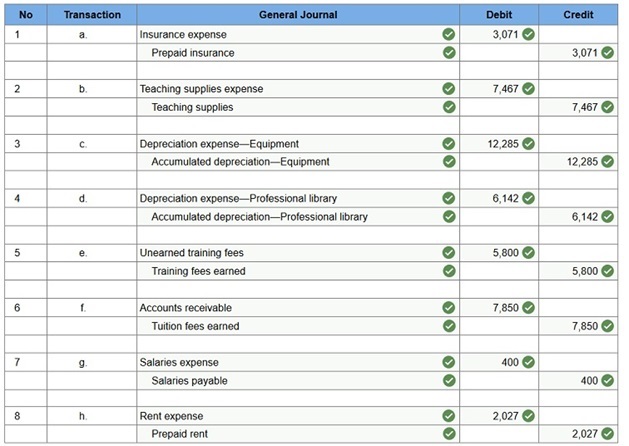

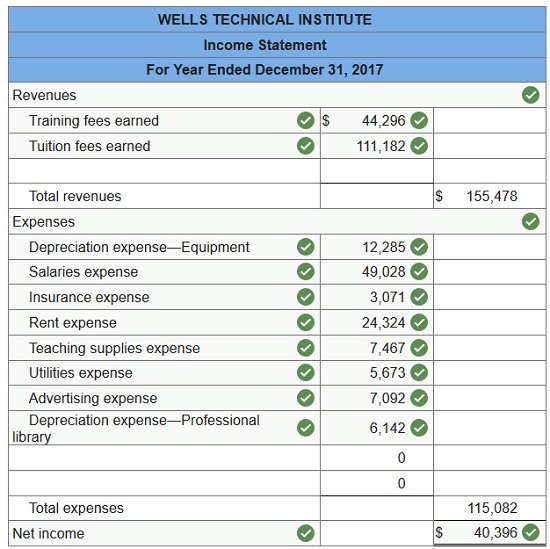

Q11. Wells Technical Institute (WTI), a school owned by Tristana Wells, provides training to individuals who pay tuition directly to the school. WTI also offers training to groups in off-site locations. Its unadjusted trial balance as of December 31, 2017, follows. WTI initially records prepaid expenses and unearned revenues in balance sheet accounts. Descriptions of items a through h that require adjusting entries on December 31, 2017, follow.

Additional Information Items

- An analysis of WTI’s insurance policies shows that $3,071 of coverage has expired.

- An inventory count shows that teaching supplies costing $2,662 are available at year-end 2017.

- Annual depreciation on the equipment is $12,285.

- Annual depreciation on the professional library is $6,142.

- On November 1, WTI agreed to do a special six-month course (starting immediately) for a client. The contract calls for a monthly fee of $2,900, and the client paid the first five months’ fees in advance. When the cash was received, the Unearned Training Fees account was credited. The fee for the sixth month will be recorded when it is collected in 2018.

- On October 15, WTI agreed to teach a four-month class (beginning immediately) for an individual for $3,140 tuition per month payable at the end of the class. The class started on October 15, but no payment has yet been received. (WTI’s accruals are applied to the nearest half-month; for example, October recognizes one-half month accrual.)

- WTI’s two employees are paid weekly. As of the end of the year, two days’ salaries have accrued at the rate of $100 per day for each employee.

- The balance in the Prepaid Rent account represents rent for December.

| WELLS TECHNICAL INSTITUTE Unadjusted Trial Balance December 31, 2017 |

|||||

| Debit | Credit | ||||

| Cash | $ | 26,340 | |||

| Accounts receivable | 0 | ||||

| Teaching supplies | 10,129 | ||||

| Prepaid insurance | 15,197 | ||||

| Prepaid rent | 2,027 | ||||

| Professional library | 30,391 | ||||

| Accumulated depreciation—Professional library | $ | 9,119 | |||

| Equipment | 70,903 | ||||

| Accumulated depreciation—Equipment | 16,210 | ||||

| Accounts payable | 33,112 | ||||

| Salaries payable | 0 | ||||

| Unearned training fees | 14,500 | ||||

| Common stock | 12,000 | ||||

| Retained earnings | 52,431 | ||||

| Dividends | 40,523 | ||||

| Tuition fees earned | 103,332 | ||||

| Training fees earned | 38,496 | ||||

| Depreciation expense—Professional library | 0 | ||||

| Depreciation expense—Equipment | 0 | ||||

| Salaries expense | 48,628 | ||||

| Insurance expense | 0 | ||||

| Rent expense | 22,297 | ||||

| Teaching supplies expense | 0 | ||||

| Advertising expense | 7,092 | ||||

| Utilities expense | 5,673 | ||||

| Totals | $ | 279,200 | $ | 279,200 | |

Required:

1. Prepare the necessary adjusting journal entries for items a through h. Assume that adjusting entries are made only at year-end.

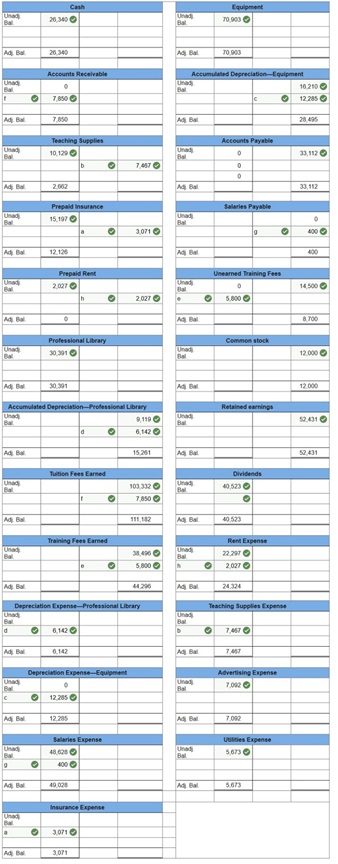

Q12. a. Post the balance from the unadjusted trial balance and the adjusting entries in to the T-accounts.

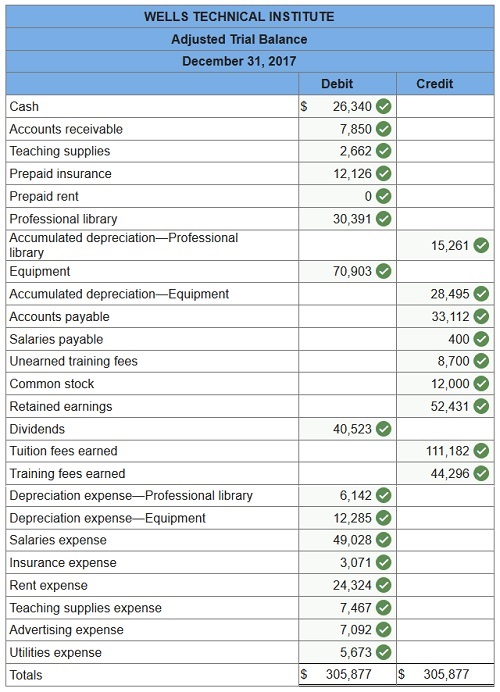

b. Prepare an adjusted trial balance.

Q13. Prepare Wells Technical Institute’s income statement for the year 2017.

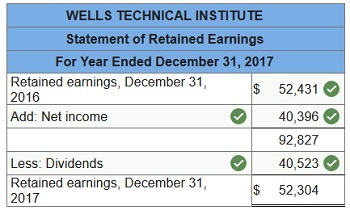

b. Prepare Wells Technical Institute’s statement of owner’s equity for the year 2017.

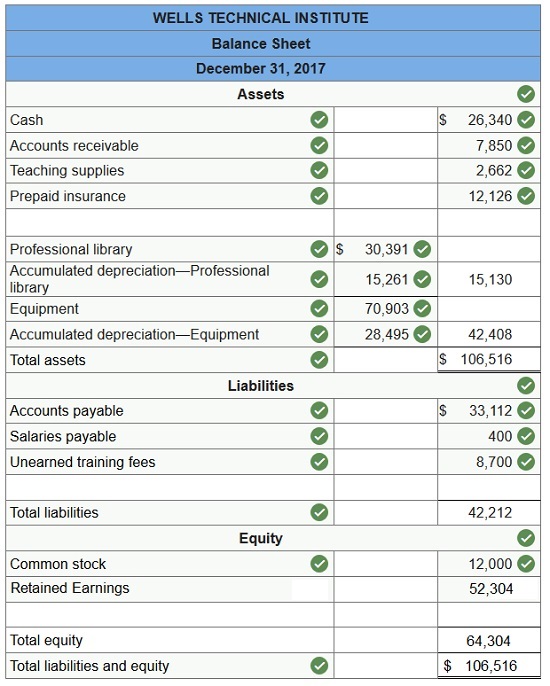

c. Prepare Wells Technical Institute’s balance sheet as of December 31, 2017.