Home » Online Exam Help » Accounting Exam Help » Connect Financial Accounting Chapter 12

Connect Financial Accounting Chapter 12

Q1. The following income statement and information about changes in noncash current assets and current liabilities are reported.

| SONAD COMPANY Income Statement For Year Ended December 31, 2017 |

||||||

| Sales | $ | 2,323,000 | ||||

| Cost of goods sold | 1,138,270 | |||||

| Gross profit | 1,184,730 | |||||

| Operating expenses | ||||||

| Salaries expense | $ | 318,251 | ||||

| Depreciation expense | 55,752 | |||||

| Rent expense | 62,721 | |||||

| Amortization expenses–Patents | 6,969 | |||||

| Utilities expense | 25,553 | 469,246 | ||||

| 715,484 | ||||||

| Gain on sale of equipment | 9,292 | |||||

| Net income | $ | 724,776 | ||||

|

|

||||||

Changes in current asset and current liability accounts for the year that relate to operations follow.

| Accounts receivable | $ | 22,300 | increase | Accounts payable | $ | 10,025 | decrease | |||

| Inventory | 34,575 | increase | Salaries payable | 1,250 | decrease |

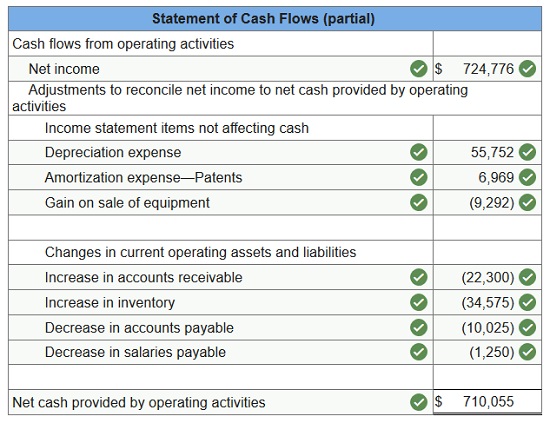

Prepare only the cash flows from operating activities section of the statement of cash flows using the indirect method. (Amounts to be deducted should be indicated with a minus sign.)

Q2. Equipment with a book value of $79,000 and an original cost of $168,000 was sold at a loss of $32,000.

- Paid $106,000 cash for a new truck.

- Sold land costing $315,000 for $405,000 cash, yielding a gain of $90,000.

- Long-term investments in stock were sold for $94,200 cash, yielding a gain of $16,250.

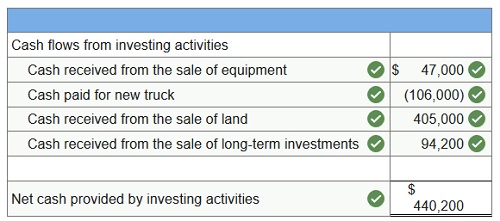

Use the above information to determine this company’s cash flows from investing activities. (Amounts to be deducted should be indicated with a minus sign.)

Q3.

- Net income was $479,000.

- Issued common stock for $72,000 cash.

- Paid cash dividend of $13,000.

- Paid $120,000 cash to settle a note payable at its $120,000 maturity value.

- Paid $119,000 cash to acquire its treasury stock.

- Purchased equipment for $85,000 cash.

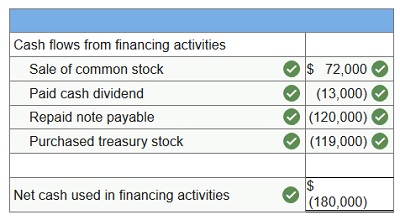

Use the above information to determine this company’s cash flows from financing activities. (Amounts to be deducted should be indicated with a minus sign.)

Q4. The following financial statements and additional information are reported.

| IKIBAN INC. Comparative Balance Sheets June 30, 2017 and 2016 |

||||||||

| 2017 | 2016 | |||||||

| Assets | ||||||||

| Cash | $ | 96,700 | $ | 62,000 | ||||

| Accounts receivable, net | 92,000 | 69,000 | ||||||

| Inventory | 81,800 | 113,500 | ||||||

| Prepaid expenses | 6,200 | 9,000 | ||||||

| Total current assets | 276,700 | 253,500 | ||||||

| Equipment | 142,000 | 133,000 | ||||||

| Accum. depreciation—Equipment | (36,000 | ) | (18,000 | ) | ||||

| Total assets | $ | 382,700 | $ | 368,500 | ||||

| Liabilities and Equity | ||||||||

| Accounts payable | $ | 43,000 | $ | 57,000 | ||||

| Wages payable | 7,800 | 18,600 | ||||||

| Income taxes payable | 5,200 | 7,400 | ||||||

| Total current liabilities | 56,000 | 83,000 | ||||||

| Notes payable (long term) | 48,000 | 78,000 | ||||||

| Total liabilities | 104,000 | 161,000 | ||||||

| Equity | ||||||||

| Common stock, $5 par value | 256,000 | 178,000 | ||||||

| Retained earnings | 22,700 | 29,500 | ||||||

| Total liabilities and equity | $ | 382,700 | $ | 368,500 | ||||

| IKIBAN INC. Income Statement For Year Ended June 30, 2017 |

||||||

| Sales | $ | 768,000 | ||||

| Cost of goods sold | 429,000 | |||||

| Gross profit | 339,000 | |||||

| Operating expenses | ||||||

| Depreciation expense | $ | 76,600 | ||||

| Other expenses | 85,000 | |||||

| Total operating expenses | 161,600 | |||||

| 177,400 | ||||||

| Other gains (losses) | ||||||

| Gain on sale of equipment | 3,800 | |||||

| Income before taxes | 181,200 | |||||

| Income taxes expense | 45,690 | |||||

| Net income | $ | 135,510 | ||||

Additional Information

- A $30,000 note payable is retired at its $30,000 carrying (book) value in exchange for cash.

- The only changes affecting retained earnings are net income and cash dividends paid.

- New equipment is acquired for $75,600 cash.

- Received cash for the sale of equipment that had cost $66,600, yielding a $3,800 gain.

- Prepaid Expenses and Wages Payable relate to Other Expenses on the income statement.

- All purchases and sales of inventory are on credit.

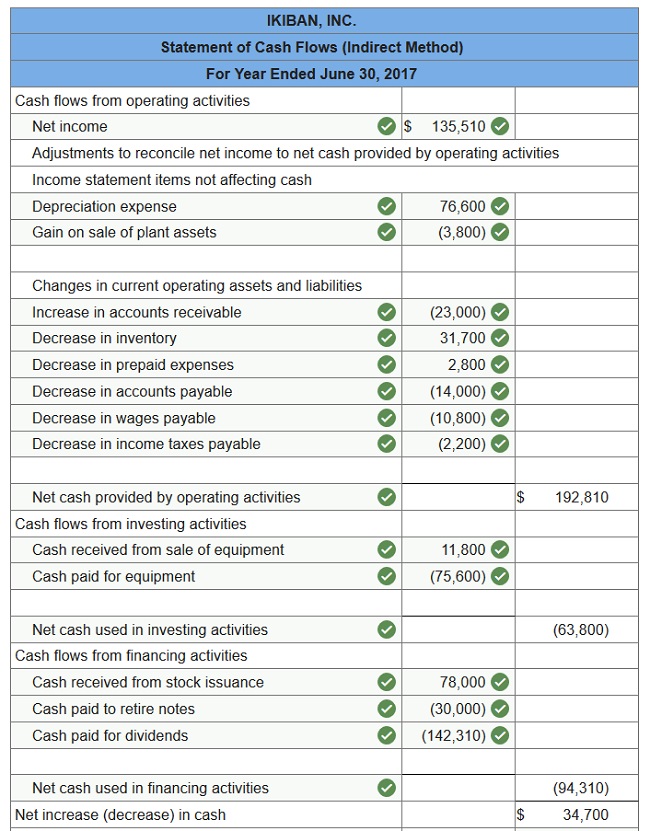

(1) Prepare a statement of cash flows for the year ended June 30, 2017, using the indirect method. (Amounts to be deducted should be indicated with a minus sign.)

Connect Financial Accounting Chapter 12 Quiz

Q1. The purchase of long-term assets by issuing a note payable for the entire amount is reported on the statement of cash flows in the:

- Operating activities.

- Financing activities.

- Investing activities.

- Schedule of noncash financing and investing activities.

- Reconciliation of cash balance.

Q2. The appropriate section in the statement of cash flows for reporting the purchase of land in exchange for common stock is:

- Operating activities.

- Financing activities.

- Investing activities.

- Schedule of noncash investing or financing activity.

- Reconciliation of cash balance.

Q3. In preparing Marjorie Company’s statement of cash flows for the most recent year, the following information is available:

| Purchase of equipment | $ | 260,000 |

| Proceeds from the sale of equipment | 87,000 | |

| Purchase of land | 91,000 |

- $438,000 of net cash used.

- $438,000 of net cash provided.

- $264,000 of net cash used.

- $351,000 of net cash used.

- $264,000 of net cash provided.

Q4. Use the following information to calculate cash received from dividends:

| Dividends revenue | $ | 29,800 |

| Dividends receivable, January 1 | 2,600 | |

| Dividends receivable, December 31 | 3,400 |

- $26,400

- $29,000

- $29,800

- $30,600

- $32,400

Q5. The statement of cash flows helps analysts evaluate all but which of the following?

- Ability of the company to generate profit.

- Source of cash used for plant expansion.

- Differences between net income and net operating cash flow.

- Source of cash used to finance investing activities.

- Source of cash used for debt repayments.

Q6. The first line item in the operating activities section of a spreadsheet for a statement of cash flows prepared using the indirect method is:

- Cash

- Cash received from customers.

- Increase (decrease) in accounts receivable.

- Net income (loss).

- Adjustments to net income.

Q7. A machine with a cost of $130,000 and accumulated depreciation of $85,000 is sold for $50,000 cash. The amount that should be reported in the operating activities section reported under the direct method is:

- $50,000

- $5,000

- $45,000

- Zero. This is an investing activity.

- Zero. This is a financing activity

Q8. When using the indirect method to calculate and report the net cash provided or used by operating activities, net income is adjusted for all but which of the following?

- Gains and losses from nonoperating items.

- Revenues and expenses that did not provide or use cash.

- Changes in noncurrent assets and noncurrent liabilities.

- Changes in current liabilities related to operating activities.

- Depreciation and amortization expense.

Q9. A company had net cash flows from operations of $341,000, net income of $286,000 and average total assets of $1,850,000. The cash flow on total assets ratio equals:

- 83.9

- 542.5

- 15.5

- 18.4

- 646.9

Q10. In preparing a company’s statement of cash flows for the most recent year using the indirect method, the following information is available:

| Net income for the year was | $ | 52,000 | |

| Accounts payable increased by | 18,000 | ||

| Accounts receivable decreased by | 25,000 | ||

| Inventories increased by | 5,000 | ||

| Depreciation expense was | 30,000 |

Net cash provided by operating activities was:

- $120,000

- $60,000

- $70,000

- $80,000

- $130,000