Accounting Assignment Help » Financial Accounting Assignment Help » Connect Financial Accounting Chapter 1

Connect Financial Accounting Chapter 1

Q1. Determine the missing amount from each of the separate situations given below.

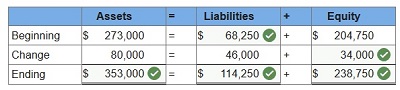

Q2. Answer the following questions. (Hint: Use the accounting equation.)At the beginning of the year, Addison Company’s assets are

a. $273,000 and its equity is $204,750. During the year, assets increase $80,000 and liabilities increase $46,000. What is the equity at year-end?

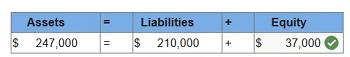

b. Office Store has assets equal to $247,000 and liabilities equal to $210,000 at year-end. What is the equity for Office Store at year-end?

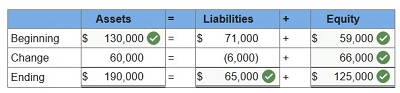

c. At the beginning of the year, Quaker Company’s liabilities equal $71,000. During the year, assets increase by $60,000, and at year-end assets equal $190,000. Liabilities decrease $6,000 during the year. What are the beginning and ending amounts of equity?

Q3. On October 1, Ebony Ernst organized Ernst Consulting; on October 3, the owner contributed $83,110 in assets in exchange for its common stock to launch the business. On October 31, the company’s records show the following items and amounts.

| Cash | $ | 14,550 | Cash dividends | $ | 1,120 | |

| Accounts receivable | 11,500 | Consulting revenue | 11,500 | |||

| Office supplies | 2,400 | Rent expense | 2,640 | |||

| Land | 45,860 | Salaries expense | 5,920 | |||

| Office equipment | 17,020 | Telephone expense | 800 | |||

| Accounts payable | 7,820 | Miscellaneous expenses | 620 | |||

| Common Stock | 83,110 | |||||

|

|

||||||

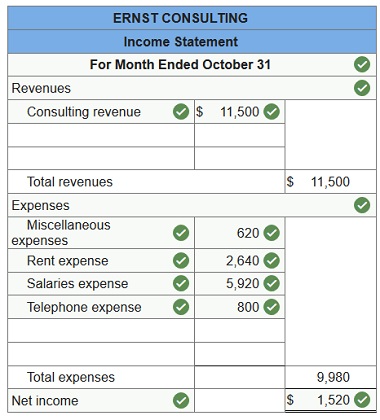

Using the above information prepare an October income statement for the business.

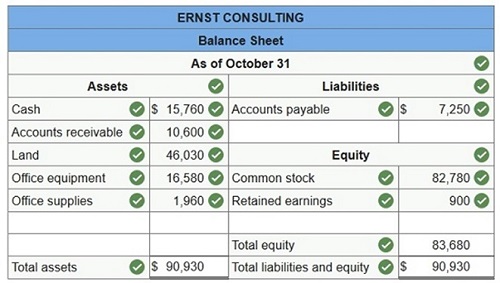

Q4. On October 1, Ebony Ernst organized Ernst Consulting; on October 3, the owner contributed $82,780 in assets in exchange for its common stock to launch the business. On October 31, the company’s records show the following items and amounts.

| Cash | $ | 15,760 | Cash dividends | $ | 640 | |

| Accounts receivable | 10,600 | Consulting revenue | 10,600 | |||

| Office supplies | 1,960 | Rent expense | 2,270 | |||

| Land | 46,030 | Salaries expense | 5,450 | |||

| Office equipment | 16,580 | Telephone expense | 760 | |||

| Accounts payable | 7,250 | Miscellaneous expenses | 580 | |||

| Common Stock | 82,780 | |||||

|

|

||||||

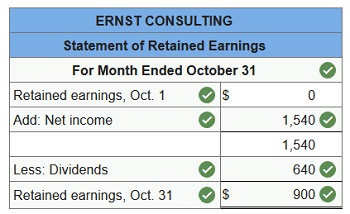

Using the above information prepare an October statement of retained earnings for Ernst Consulting.

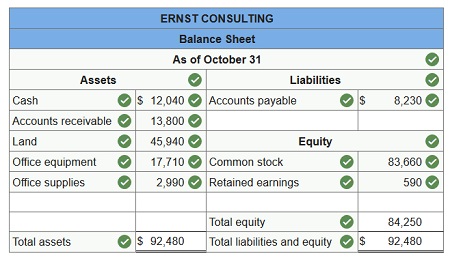

Q5. On October 1, Ebony Ernst organized Ernst Consulting; on October 3, the owner contributed $83,660 in assets in exchange for its common stock to launch the business. On October 31, the company’s records show the following items and amounts.

| Cash | $ | 12,040 | Cash dividends | $ | 1,760 | |

| Accounts receivable | 13,800 | Consulting revenue | 13,800 | |||

| Office supplies | 2,990 | Rent expense | 3,210 | |||

| Land | 45,940 | Salaries expense | 6,690 | |||

| Office equipment | 17,710 | Telephone expense | 870 | |||

| Accounts payable | 8,230 | Miscellaneous expenses | 680 | |||

| Common Stock | 83,660 | |||||

Using the above information prepare an October 31 balance sheet for Ernst Consulting.

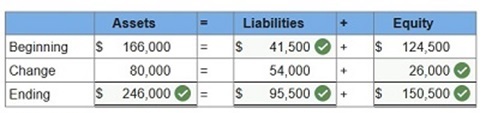

Q6. At the beginning of the year, Addison Company’s assets are $166,000 and its equity is $124,500. During the year, assets increase $80,000 and liabilities increase $54,000. What is the equity at year-end?

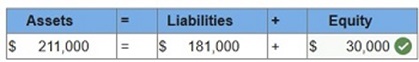

Q7. Office Store has assets equal to $211,000 and liabilities equal to $181,000 at year-end. What is the equity for Office Store at year-end?

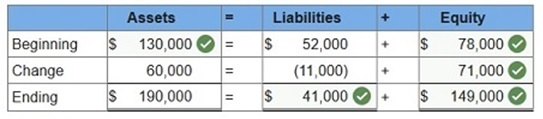

Q8. At the beginning of the year, Quaker Company’s liabilities equal $52,000. During the year, assets increase by $60,000, and at year-end assets equal $190,000. Liabilities decrease $11,000 during the year. What are the beginning and ending amounts of equity?

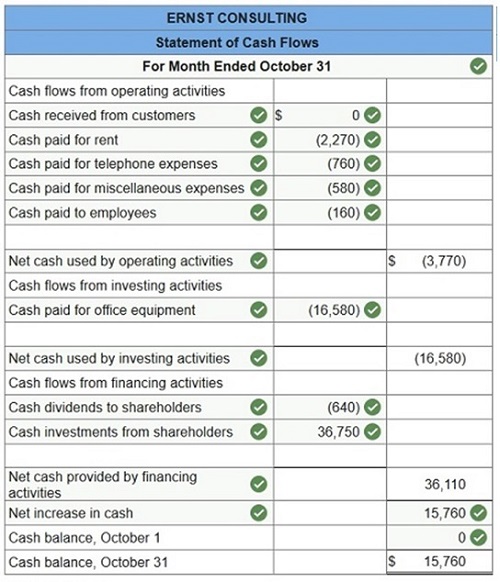

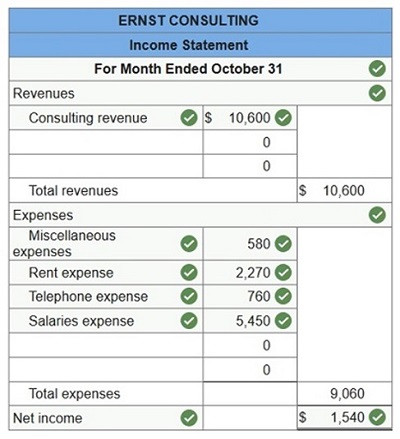

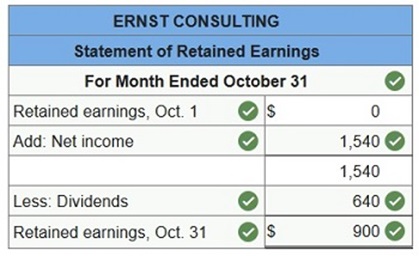

Q9. On October 1, Ebony Ernst organized Ernst Consulting; on October 3, the owner contributed $82,780 in assets in exchange for its common stock to launch the business. On October 31, the company’s records show the following items and amounts.

| Cash | $15,760 | Cash dividends | $640 |

| Accounts receivable | 10,600 | Consulting revenue | 10,600 |

| Office supplies | 1,960 | Rent expense | 2,270 |

| Land | 46,030 | Salaries expense | 5,450 |

| Office equipment | 16,580 | Telephone expense | 760 |

| Accounts payable | 7,250 | Miscellaneous expenses | 580 |

| Common Stock | 82,780 | ||

Using the above information prepare an October income statement for the business.

Q10. Using the above information prepare an October statement of retained earnings for Ernst Consulting.

Q11. Using the above information prepare an October 31 balance sheet for Ernst Consulting.

Q12. Also assume the following:

- The owner’s initial investment consists of $36,750 cash and $46,030 in land in exchange for its common stock..

- The company’s $16,580 equipment purchase is paid in cash.

- The accounts payable balance of $7,250 consists of the $1,960 office supplies purchase and $5,290 in employee salaries yet to be paid.

- The company’s rent, telephone, and miscellaneous expenses are paid in cash.

- No cash has been collected on the $10,600 consulting fees earned.

Using the above information prepare an October 31 statement of cash flows for Ernst Consulting. (Cash outflows should be indicated by a minus sign.)